On 17 October 2019, I had the pleasure of facilitating, the 2nd Paris FP&A Board. The board meeting was sponsored by Apliqo and Michael Page and attended by over 30 FP&A specialists. The main subject of discussion was “Rolling forecast – the key success factors”

On 17 October 2019, I had the pleasure of facilitating, the 2nd Paris FP&A Board. The board meeting was sponsored by Apliqo and Michael Page and attended by over 30 FP&A specialists. The main subject of discussion was “Rolling forecast – the key success factors”

We started the meeting with a general introduction in which the participants shared their own personal experiences with Rolling Forecasts.

We also carried out a poll of who currently uses Rolling Forecast and how successful and satisfied were they with the process. The results summarized below resonates very closely to all the polls we have done around the world in other FP&A board meetings:

Implemented and Use Rolling Forecast 30%

No / limited use of Rolling Forecast 70%

Use rolling forecast & satisfied (of the 30%) 5%

We then went on to discuss the following:

Definitions of Rolling Forecast (RF)

It is important not to confuse RF with Plan / Budget / Target

Plan – what does the future look like

Forecast – what does the future most likely look like

Target – an expression of intent and desire

Budget – allocation of resources

Benefits of Rolling Forecast:

- better accuracy

- more flexibility

- quicker decision-making

- improved corporate vision / direction

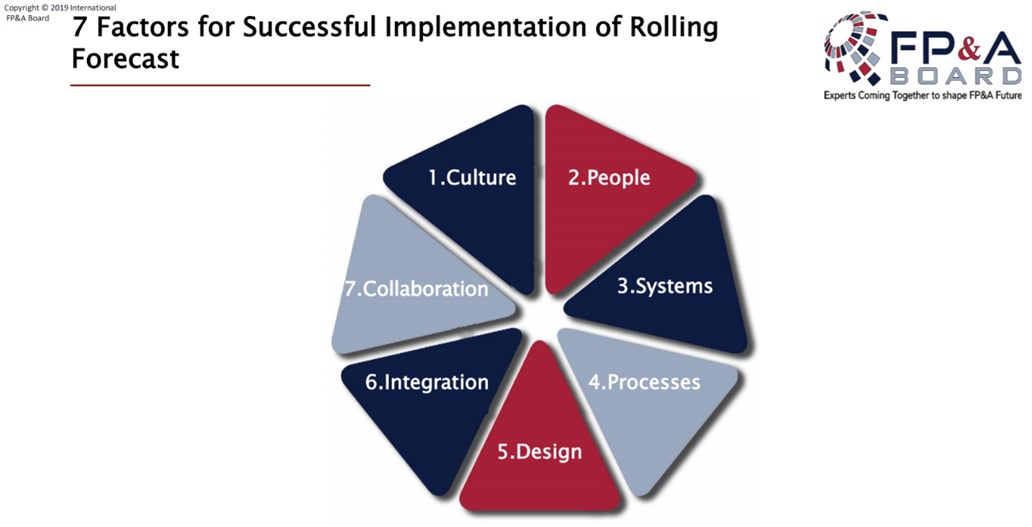

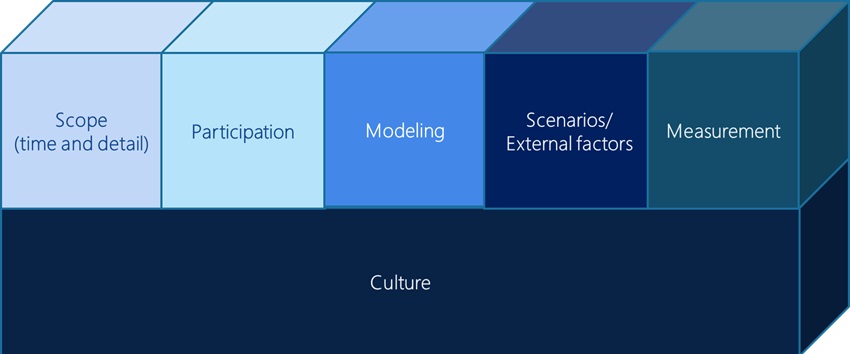

7 Key factors for successful implementation of Rolling Forecast

We then went on to look at the different factors for a successful implementation. These can be summarised as follows:

Details of each of the 7 factors can be found from this link.

Case Study Presentations: Practical Experience on Rolling Forecast

Case Study 1: Olivier Goetschy

Olivier, Chief Financial Officer at Gewiss France, shared withus his experience working with a rolling forecast.

Oliver took us through who the RF is directed at, why we should be doing a rolling forecast and, according to his experience the limits of RF. He also shared with us the Grand Paris Project 2024, where Gewiss is one of the key suppliers of electrical components and how he has had to adapt and extend his RF looking forward to 5 years.

According to Oliver the key take from his experience is the utmost importance of Communication with operations and their involvement in the whole process. This also includes feedback to them. He highlighted that excel is still being used, which is one of the limitations until he can move away from it.

Case study 2: Stephanie Didier

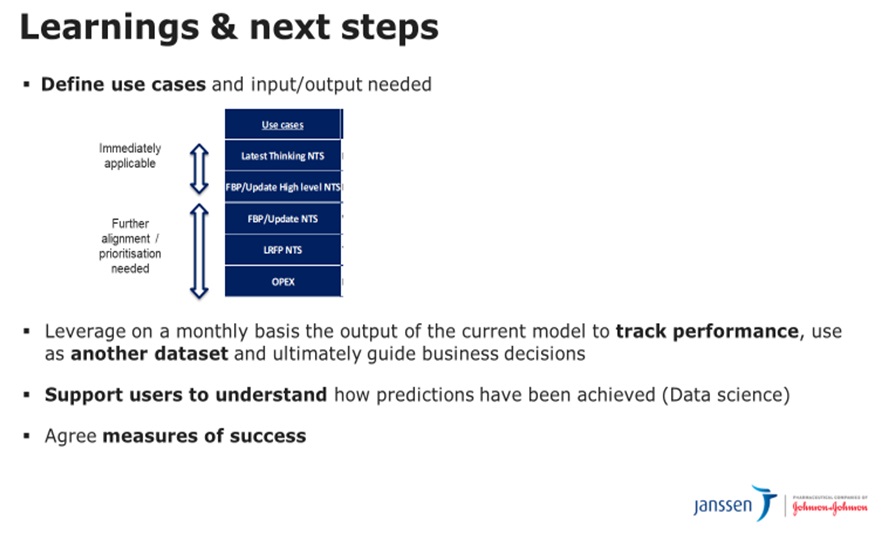

Stephanie, Finance Director France at Janssen EMEA, shared with us how she is using Rolling Forecast in her current role and more importantly how she is using and implementing AI to improve the forecasting process.

According to Stephanie the key factors in a successful rolling forecast are:

- High performing & collaborative team

- Digitalisation

- Agility

- Simplicity

She also shared with us how the Predictive Sales forecasting model tested in APAC is now being rolled out in EMEA to the relevant portfolios to leverage where results are satisfying and identify levers to improve the model.

- Outputs from the models: a monthly forecast for the next 18 months

- Predicting each relevant individual brand and country

- Start with historical financial information

- Restated from exceptional events

The leanings and next steps are best described in the slide below:

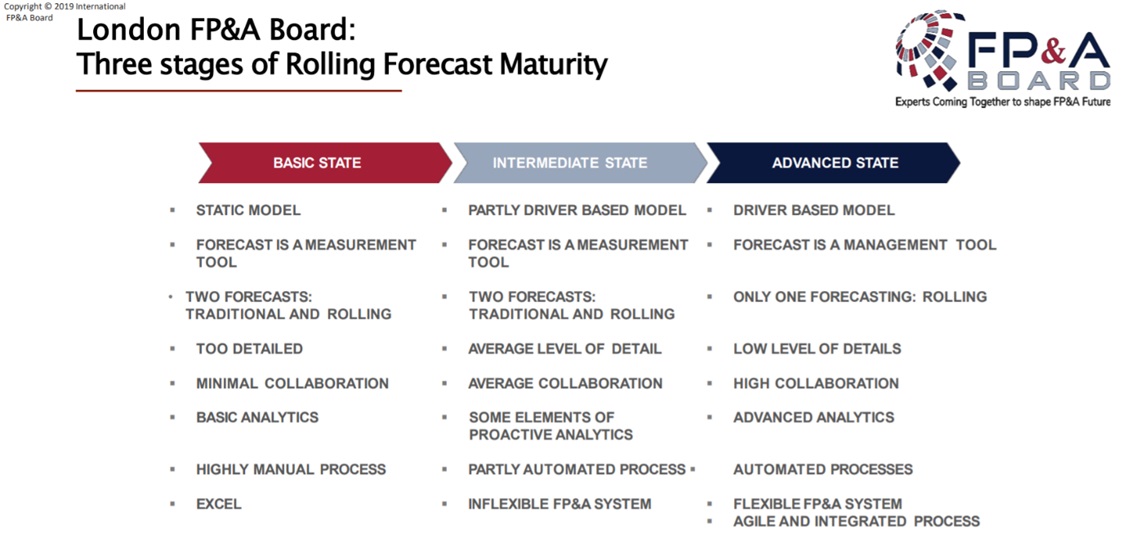

Rolling Forecast Maturity Model

We then looked at the Rolling Forecast Maturity model developed by the London FP&A board. The three states of where a company is currently positioned within the Maturity model is very important in determining the next steps and what in what order we implement these so we can move from one state to the next.

We then went on to the Group exercise whereby the members were divided into two groups with each group taking one question from below: -

Group 1 : Analytical Aspect of the Rolling Forecast: what is needed for the leading process

Group 2: Human and Cultural Aspect of the Rolling Forecast: what is needed for the leading process

Key factors needed from an analytical aspect for a successful rolling forecast process

- Having the bigger picture, strategic goals in mind

- Access to data beyond finance (internal and external)

- Understand and challenge the key drivers

- Smooth access & collaboration with various business experts

- Ensure and maintain data quality and integrity

- Adaptability of time frame and detail level

Key factors needed from human & cultural aspect for a successful rolling forecast process

People doing the RFC

- Ability to explain why the process

- Working fast

- Deadline focus

- Pressure

- Business oriented

People feeding the RFC

- Measurement - understanding objectives

- Understanding that process is not just finance

Summary of discussion: in order to achieve a leading state in rolling forecast process, a company needs to develop an organisation and culture where there is a shared ownership of the Rolling forecast process objectives (between finance and the other functions). It includes:

- Ensuring the quality and integrity of the internal and external data gathering, analysis and communication

- Good inter-function collaboration top to bottom and across

- Common understanding of the company strategic objectives and business key drivers and evolution

- Respect of the deliverables, time table and deadlines from all parties in the process,

- Agility and adaptability in the process

Conclusion

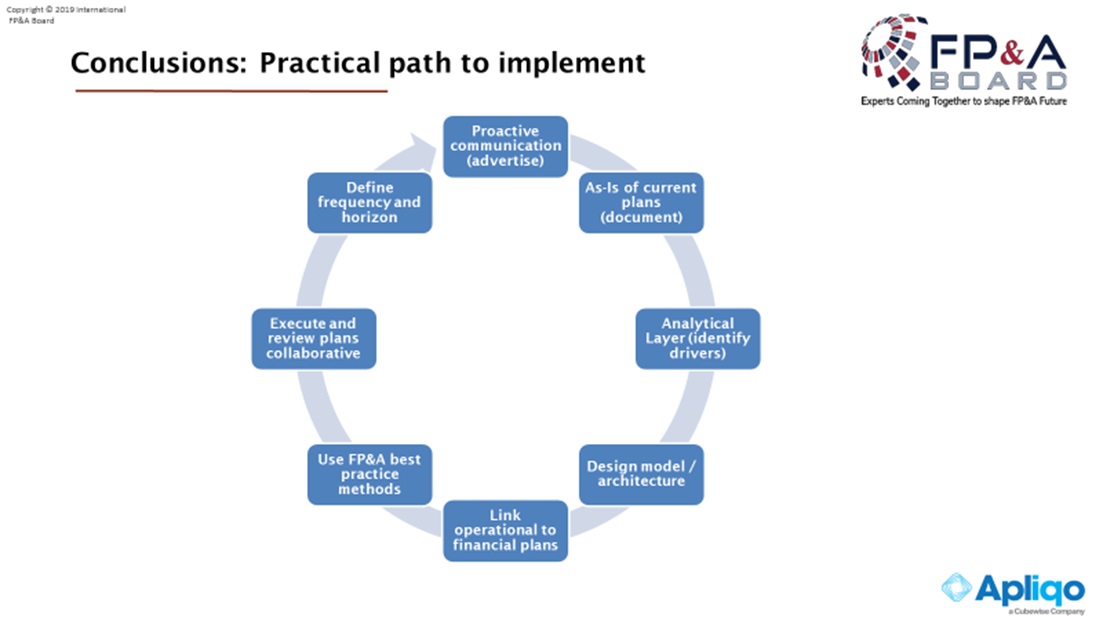

To conclude the meeting Martin Winkler of Apliqo shared their experience and tips on the practical way of implementing Rolling Forecast.

Finally, I summarised the findings and conclusion of our discussion as per below:

- Traditional Forecasting Process has many limitations

- Rolling Forecasts is better alternative as it gives better perspective and flexibility

- However, the adaptation process of RF is slow. The success stories are rare.

- There are seven factors of successful implementation and these need to be adhered to.

- Best way to implement a successful Rolling Forecast is as per below:

That concluded our 2nd Paris FP&A Board meeting. Next board meeting to be scheduled early 2020 with key potential subject for discussion being FP&A Team Building / Zero Base Budgeting – A new Era.

The board members, sponsors and helpers were then invited to network, for around an hour, with a glass of wine and some lovely food provided by our Michael Page.

I would like to take this opportunity to thank our sponsors Michael Page and Apliqo, our two presenters Mr Olivier Goestchy and Stephanie Didier for their case study, the board members for their participation and valuable input and Christian Fournier for his help on summarising the group discussion.

Look forward to the next meeting in early 2020.