The 24th meeting of the FP&A board discussed driver-based planning and predictive analytics in modern FP&A. The meeting was held on the 12th of September 2019, at IWG’s offices near Trafalgar Square. It was sponsored by Anaplan, IWG and Michael Page.

The 24th meeting of the FP&A board discussed driver-based planning and predictive analytics in modern FP&A. The meeting was held on the 12th of September 2019, at IWG’s offices near Trafalgar Square. It was sponsored by Anaplan, IWG and Michael Page.

Introduction

I’ve been in the midst of the planning process for over the last 18 years, either doing it myself in FP&A roles or telling others how to do it in my life as a management consultant. Modelling drivers to create output for forecasts was always the primary method of deriving the budget. In my mind, the method hasn’t really moved on much from when I first started. The importance of understanding the causal relationships and how to model them to create an output are the same today as they were 18 years ago.

Of course, what has changed is that we can do so much more - and faster. We have technology that allows us to perform the processes at scale and therefore, connect large parts of the organisation. More importantly, in the past, advanced analytics was left to the math geeks with operations research PhDs, who focused on specific tasks, rather than an end-to-end budget process - now, the skills required are increasing available to the finance department.

This is why a discussion of driver-based and predictive FP&A is so important. The 24th London FP&A Board was devoted to this subject. I was looking forward to learning from colleagues and pioneers in this topic.

We started with a poll of the room - as per previously surveyed results, the majority of the room had partially driver-based planning processes, with a few outliers being fully driver-based or not driver-based at all. Interestingly, we heard that the west coast of the US has a higher proportion of fully driver-based organisations, with Germany among the lowest.

The biggest changes facing FP&A today…

- How to use the growing volumes of both internal and external data? Our colleague from a telemarketing company talked about how they have an ongoing collection and cataloguing of data, with a continual review of what is useful and how they can apply it

- How to uncover the key drivers? We discussed the fact that marketing teams have taken the lead in this area, and have use cases such as analysing the drivers of churn and conversation rates

- How to discover hidden patterns for FP&A with predictive analytics?

- How to use AI/ ML for FP&A?

Following an exploration of what driver-based planning actually involves (i.e. inputs-model-outputs), we explored why driver-based planning matters to the modern FP&A teams. We discussed speed, increased efficiency through automation, better resource analysis, supporting integrated planning and allowing us to talk to the business. However, the point that resonated with me the most was debiasing decisions, as we have facts and their causal relationships. In my view this is crucial to improving forecast accuracy - a person’s intuition is merely a data science algorithm in their mind!

Allow flexibility in the models - Our colleague from a consultancy organisation described how they moved towards a formal driver-based model. This allowed iterations to be much faster than their old spreadsheets. The challenge they faced was that the disparate nature of their business units meant that it was hard to map common revenue drivers. Therefore, they needed the flexibility to allow business units to ‘overwrite’ part of the plan. Each year, they have a planning workshop to fine-tune and improve the process. At the moment, they are looking to work with their treasury team to automate hedges for currencies.

Consider the human aspect to build trust in the numbers - We also heard from a colleague in the publishing sector, whose organisation has achieved a fully automated forecast. They use behavioral data to define the propensity to renew and therefore forecast revenues. They had to face the question of ‘how can I be responsible for a machine-generated forecast?’. To address this, they had to perform ‘retro-testing’ to demonstrate this method was more accurate than the previous models.

Focus on the few drivers that have the greatest impact - To model every driver, for every part of the planning process will be time-consuming and difficult to maintain. In the past, I have talked about defining a ‘forecast value chain’ and prioritising areas to build models where they will have the greatest impact. Larysa talked about a far simpler approach, using the Pareto principle, focus on the 20% of the drivers that explain 80% of the numbers.

What is predictive analytics? How does it add value to the forecasting process?

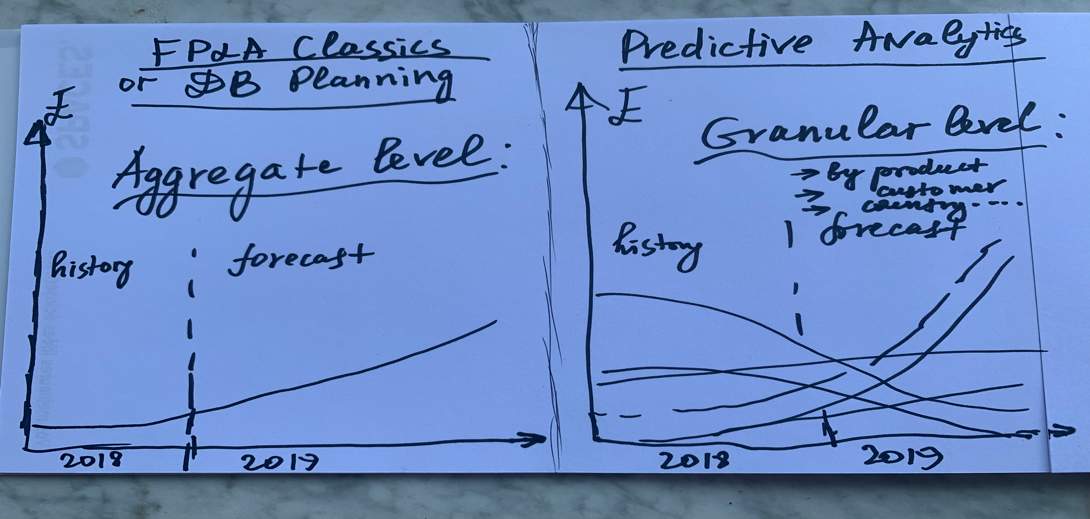

Predictive analytics utilises advanced analytics and statistical methods to identify patterns and relationships within data sets. I consider this to be an evolution of the driver-based modelling method. Whilst the latter works with aggregated data sets, predictive analytics requires data at a very granular level, spanning multiple dimensions. Larysa showed us a sketch from a previous FP&A board participant, which explains evolution…

Our colleague from the publishing company went on to describe how they use this to analyse the likelihood of customer subscription renewals. They have data scientists embedded into the team, and this has allowed them to predict churn and alter their approach to customer pricing.

The group also discussed the fact that in the past, predictive analytics was performed within a particular product – often in silos. Now, the trend is for this to be driven by head office / global corporate centres.

The real-world examples discussed included Swiss RE’s 500 million investment in this area, which will enable them to forecast down as far as contract levels.

Case study – Alkermes

Owen Tiernan talked about the journey of Alkermes, a bio-pharma organisation, with Irish roots. Alkermes grew from an organisation producing drugs on behalf of other organisations, to developing their own pipeline. This meant that the organisation had to renew its KPIs and drivers to adapt to the new business model.

Owen discussed the importance of driver-based planning to Alkermes – demystifying the process, connecting the process with the plan owners, enabling business ownership and simplifying scenario management.

Owen mentioned the key learnings from this journey… drivers are complex, you need to continuously review them. He cited the example of the success of a drug in Ohio. They missed the fact that local funding was driving revenue, and therefore the success in Ohio was not replicated in other states

Additionally, he described how forecasting had moved from being done in a spreadsheet in a locked room to a process where there is greater ownership across the business.

The next steps for them is to continue to link the models to strategy, simplify, automate and incorporate AI and ML.

Case study – driver-based cost engine at Orange Business Services

Lakhbir Sumra, now at Capita, described the journey at Orange Business Services. About ten years ago, they had implemented an ABC reporting tool. Following on from this, they wanted to understand the drivers of cost – in this matrix organisation, where service engineers were supporting multiple divisions and product lines. They correlated central resources consumed with revenues which were driving consumption. This provided greater visibility into performance to the leadership.

This deployment helped the FP&A team to expand their influence within the sales teams, help turnaround areas/ accounts which were not performing, identify productivity and most importantly, utilise post-mortems to ensure that the performance issues did not appear in subsequent tenders

Group discussions

We split into three groups to discuss the cultural requirements, implementation approaches and process of delivering driver-based planning

Group 1 – Cultural aspects of driver-based planning

A few themes emerged – when you gain more trust, you get more collaboration and the business folks will come to you with suggestions of KPIs. Finance need to know when to challenge and when to keep their distance. Credibility takes a while to build but can disappear quickly

Group 2 – System and analytical aspects of driver-based planning

The main requirements are to reduce the dependence on IT for building models, finance need to be able to self-serve. Other issues discussed included providing a data hub as a single source of truth, providing curated data so that teams do not create their own, and ensuring data governance. This group also discussed how to build a data science team within finance, and how to clarify their goals

Group 3 – What the driver-based planning process looks like

It is important to define the current strategic objectives, this forms the basis of selecting the most appropriate drivers. We then review the drivers and refine the assumptions and calculations. The critical next step is to assign business accountability to each driver, and then start the cycle of understanding the gap between top-down targets and bottom-up forecasts

Conclusions and recommendations

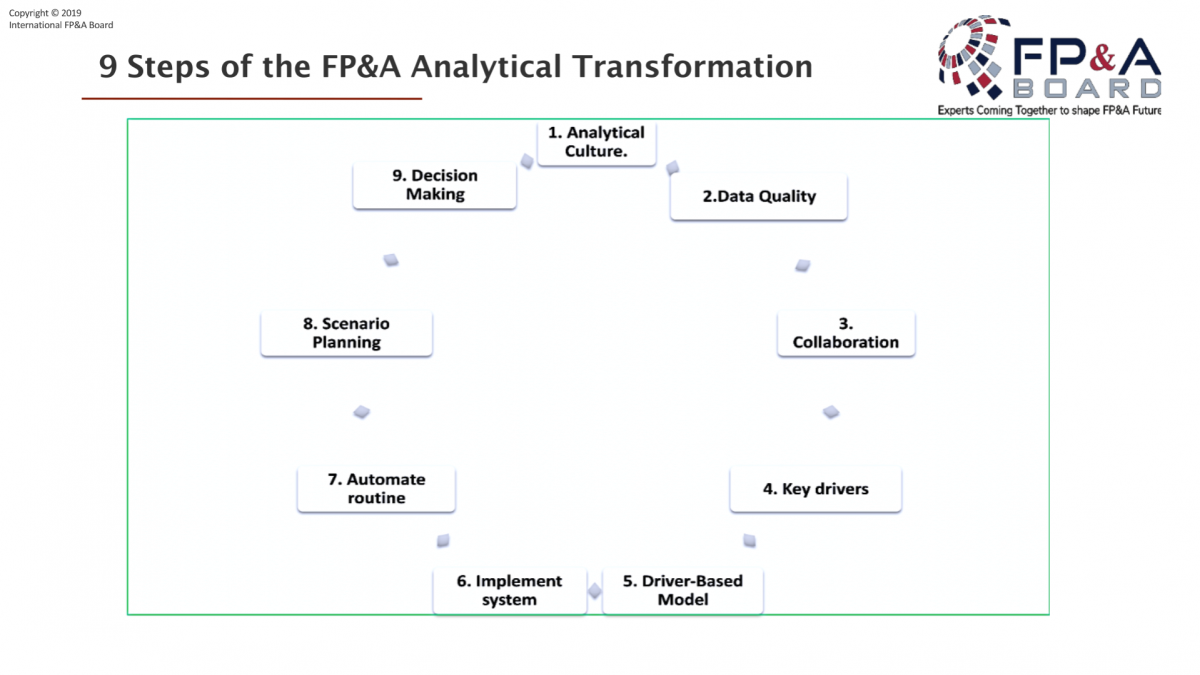

We finished with a discussion on the 9-step FP&A framework

A couple of comments to bring out here…

- Culture – best projects are driven by incredible CFOs (e.g. from Swiss RE and Nielsen), this sets the tone amongst the team

- 95% of organisations cite data quality as a barrier

- Key drivers – find 20% of drivers that explain 80% of the results

- Driver-based model – know what to implement, before building the system, and make it flexible

- FP&A architect is an emerging role that bridges the gap between finance and data science (McKinsey refer to these folks as ‘translators’). An increasing number of CFOs are enrolling on data science courses

- Bring in big data, and analyse using AI and ML – but you need to understand the drivers yourself

The topic at the next meeting is storytelling with data. This is a topic that I am passionate about, as this is an art that allows finance to drive engagement with the rest of the business.