The International FP&A Board held its third FP&A Board meeting in Boston on the 12 June. It was another interesting FP&A Business Partnering (BP) debate with 25 senior finance practitioners sharing their professional experience with each other.

The International FP&A Board held its third FP&A Board meeting in Boston on the 12 June. It was another interesting FP&A Business Partnering (BP) debate with 25 senior finance practitioners sharing their professional experience with each other.

Agenda

1. What is FP&A Business Partnering and why is it important?

2. What are the most critical attributes of an FP&A business partner?

3. Mini-cases from the field:

- "Organizational Transformation Through Pricing Analytics." Presentation by Matthew Hagen, VP Finance / Global Pricing at Monster.com.

- "Driving Success through Business Partnering". Presentation by Jessica Allen, Director, Financial Planning and Analysis at Verizon Connect.

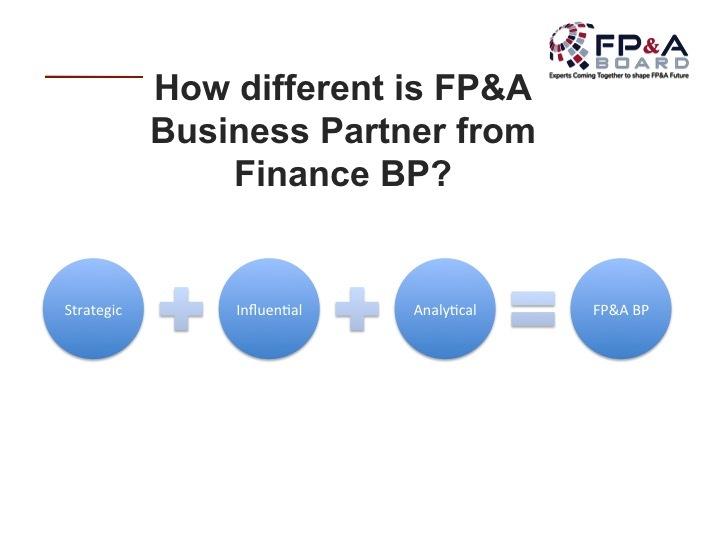

Before starting the discussion, the Board raised an important question about the difference between FP&A BP and Finance BP. When it comes to this comparison, there are two keywords that can describe modern FP&A Business Partner, namely, Strategic and Influential. He/she plays a key role between operations and the board, allowing for the harmonized decision-making process that is quick, flexible and analytical.

The Board also discussed critical attributes of an FP&A Business Partner. The role has two high-level objectives:

- Providing commercial finance support

- Challenging the status quo of the business with an emphasis on shaping the future strategic direction

During the discussion, the Board members came to a conclusion that FP&A BP is not just a role, it is a mindset. To understand its true value, it is important to ask about how useful innovative analytical exercise can be if it is not shared with business. The planning model that does not take into consideration assumptions from different business stakeholders cannot be very helpful either.

Our Sponsors and Speakers

We are very grateful to our speakers Jessica Allen and Matthew H Hagen for sharing their case studies with the Boston Board.

We are also grateful to our global sponsors CCH® Tagetik and Regus / Spaces for their great support in Boston.