I had the pleasure of attending the 7th London FP&A circle. The Circle is the educational branch of the International FP&A Board which shares the latest professional trends and developments with the UK FP&A community. It is open to both senior and mid-level finance practitioners.

I had the pleasure of attending the 7th London FP&A circle. The Circle is the educational branch of the International FP&A Board which shares the latest professional trends and developments with the UK FP&A community. It is open to both senior and mid-level finance practitioners.

On the 4th October in Central London, a series of presentations showed me that, done properly, FP&A can become that analytical powerhouse advising the business. Here, setting up the FP&A function properly can allow the us to harness the historical data and the commercial expertise of our stakeholders to give the story behind the numbers, allow us to leverage the drivers behind the business and provide a basis for leaders to act with confidence.

Colm Quinn, who attended the Toronto FP&A board, gives an eminently well-summarised look at many of the topics which were also discussed in London, which you can read here.

Therefore, I wish to focus on the three guest presentations at the event.

Delivering Real FP&A Transformation in uncertain times

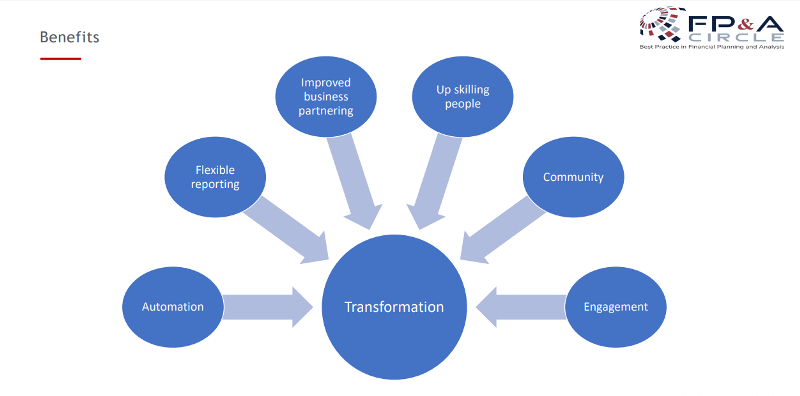

Finance Director at Interserve Support Services, Sile Lillis, discussed the company’s challenges towards, and enablers of, FP&A transformation. She took us on the company’s journey and where they have seen the benefits of FP&A transformation despite a challenging backdrop.

Sile explained that, coupled with the broader internal challenges of a new senior management team and the need for transformation, the following were seen as barriers to an effective FP&A process:

- Systems: Basic tools coupled with;

- Process: leading to frustration and suboptimal;

- Behaviour: frustration within the business leading to an inconsistent process and frustration with the systems.

These are also areas of opportunity, and Sile outlined the steps of transforming her function.

Transformation

From this position, implicitly highlighting elements of Kotter’s 8 step change model, the company saw the introduction of more advanced budgeting tools and standardised processes that have laid the foundation for, amongst others:

- Strong business partnering;

- What if analysis; and

- Generating plans within weeks, not months.

The future

From here, the next stage to become a leading FP&A function for that company are:

- Real-time forecasts;

- Scenario Analysis;

- Long-Term Cash Flow planning, linked with Treasury

Sile emphasised the drivers of change with good communication, cheerleaders, getting a project sponsor, and being strict about scope creep. Sile was also clear that money, and training, are critical to ensuring that the transformation not only introduces positive change; but beds it in.

Seven analytical models that every FP&A department should have

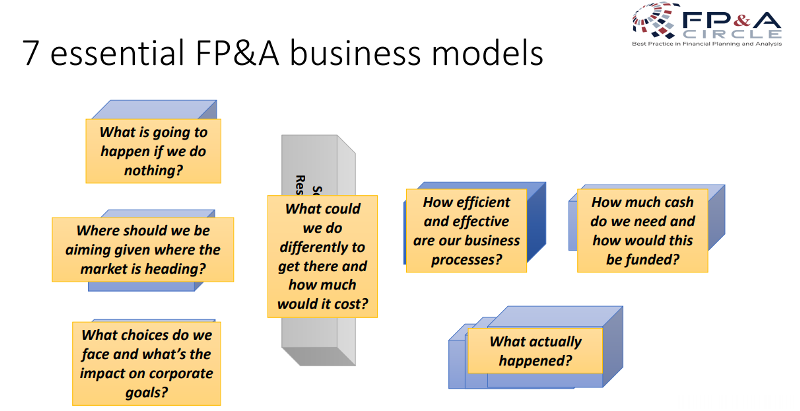

The first question to consider is what are you trying to achieve? Is the objective clear from those who contribute to them and does it differentiate on those elements that are controllable?

From there, Michael Coveney, analytics thought leader and author, outlined that businesses can control three things:

- Arrangement of business processes;

- Resources; and

- Work carried out in these processes.

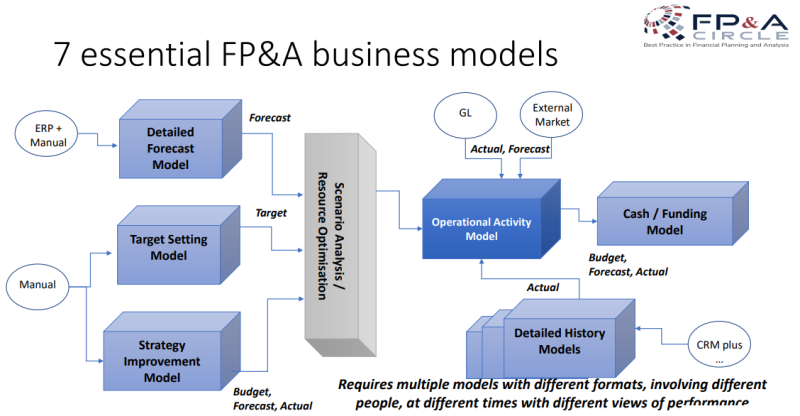

Therefore, planning is about adjusting these processes in an uncertain world. There are 7 essential FP&A business models, that look at the key business questions.

The Operational Activity Model which looks at how efficient and effective the business processes are, setting out the relationship between resources, workload and outputs.

The Cash and Funding Model looks at forecasting cash requirements and determining funding costs.

The Detailed History Model looks at “what actually happened” with a focus on multi-dimensional analysis.

The Target Setting Model is a driver based model between goals, resources and outcomes.

The Detailed Forecast Model is a bottom-up forecast that looks at forecast against targets/plan, showing what happens if the organisation continues as present without change.

The Strategy Improvement Model links objectives, themes and initiatives, which are linked to specific business processes. Here you can consider the costs, workloads and outcomes of each initiative either in isolation or in combinations- in essence “what can we do differently and what would it cost?”

Lastly, the Scenario Model looks at options and their impact on corporate goals, which looks at “what if?” scenarios and allows comparison of different scenarios.

The Management Processes (Reporting/Forecasting/Planning) then sit alongside these models, where there is a dynamic workflow and there needs to be continuous planning as these impact on each other.

The 5 myths of FP&A Analytical Transformation

Richard Hanson, Head of FP&A at Endava with over 20 years of FP&A experience with the tech sector, laid out his opinion on the 5 myths of FP&A Analytical Transformation.

Firstly, Our roles will be replaced by robots is relevant to data and analysis, but communication, negotiating and influencing are key skills used in turning data into useful information.

Secondly, The budget is dead is to ignore the importance of targets, which are critical to a business. It also neglects the role of the budget as a driver for thinking and strategy planning. However, that the budget is not dead is not to say that the traditional budgeting method isn’t on its way out, especially with forecasting as a distinct, separate process.

Thirdly, Forecasting can tell you everything is predicated on the assumptions that lie behind. As the forecasting horizon draws further into the future, so does the level of uncertainty, which increasingly relies on assumptions and trends. Moreover, as forecasts are determined by humans, personal biases or agendas become incorporated, from the ‘hero’ to the ‘sandbagger’.

Fourthly, You can run a business from a single dashboard relies on the measures established as the best possible determents of performance; can complex, dynamic entities be measured with a few metrics? While a potential solution, balanced scorecards as finance originated reports, are often skewed in favour of financial measures. Therefore, an attempt needs to be made to get the balance right – the “Goldilocks” philosophy.

Lastly, There is a single ‘right way’ of doing things ignores that there are any manner of ways to tackle a project or process. Six 4x2 lego pieces have almost one billion different combinations to combine them together; thinking this way, consider projects or processes as modules and blocks, and build it from there. Diverse teams drive innovation, and sometimes it’s better to start from scratch.

And there you have it: three great presentations that focused on different areas of FP&A analytical transformation.

One last thing sparked my curiosity: that of how long does it take to produce a forecast? There was an interesting debate in the audience of how accurate a three day long international forecast could be. Technology and talent was behind this position, which appears to be the two elements on all leaders’ mind; Finance, FP&A or otherwise.

Last Thoughts

At the 7th London FP&A circle, we had an operational framework by Michael; thoughts to consider from Richard; and a case study of implementing FP&A transformation from Sile. Within the space of an hour, three incredible speakers summarised strategic, tactical and operational aspects of approaching FP&A analytical transformation.

FP&A has the potential to be the strategic advisory unit and the bedrock of business decisions, and I hope by reading this, you have an idea of what was discussed and a reason to attend our next FP&A meeting.

Our Sponsors

We are very grateful to our global sponsors and partners Unit4 Prevero and Michael Page for their great support.