The 6th meeting of the Dubai FP&A Board took place on November 20, 2019 at “The H Hotel, Sheikh Zayed Road, Dubai”. The weather was stormy and rainy but still 30 Senior Finance and Business professionals participated at the meeting. The Dubai FP&A Board was proudly sponsored by Michael Page, Jedox, and Azdan.

The 6th meeting of the Dubai FP&A Board took place on November 20, 2019 at “The H Hotel, Sheikh Zayed Road, Dubai”. The weather was stormy and rainy but still 30 Senior Finance and Business professionals participated at the meeting. The Dubai FP&A Board was proudly sponsored by Michael Page, Jedox, and Azdan.

The professional debate was devoted to the new age of Zero-Based Budgeting (ZBB).

Zero-Based Budgeting: Advantages and Disadvantages

ZBB is a method of developing a budget from scratch or “zero base” by examining every cost or P&L/BS item to see if they are essential to the company’s operations without regard to prior years’ activities. [1]

At the beginning of this highly interactive session, participants were requested to share their experiences with ZBB and what they consider as advantages and disadvantages of ZBB. We received different responses:

- “handled ZBB in start ups with success but could not make it a success in established businesses”;

- “have not handled ZBB, look forward to learn more in the meeting”.

Some of the responses were about clarifying their doubts or seeking a different perspective.

According to the participants, the following are the general advantages of ZBB:

- It is a fresh perspective.

- It provides detailed analysis.

- It leads to reengineering of the operations.

- Every expense is considered in terms of what value it can add to the business.

- It leads to creativity with new ideas.

- It requires to focus on identifying key activities and to focus resources on the same.

- Opportunity exists even when you think there is none.

- It is forward looking.

Disadvantages of ZBB are noted below:

- It is time consuming.

- It can upset standard business if used frequently.

- Sometimes risks and reward may not match.

- It needs a lot of mind set changes.

- It can lead to conflicts between traditional budgeting and ZBB.

How to successfully implement ZBB?

Participants exchanged some ideas:

- Is ZBB a top line / revenue related or expenses related exercise? ZBB started historically with expense-based driver-based planning. Unlike in traditional budgeting, where expenses are more linked to revenue, ZBB specifically focuses on what an expense will lead to the value addition in the business.

- Making revenue a driver-based tool for ZBB can sometimes be difficult. Revenue trends can be considered for other competitors in the market and assessment can be made for what can be the potential revenue.

- ZBB is effective for startups but the implementation dynamics of ZBB undergo a change for established businesses.

- It is not correct to say that no past is looked at. Unlike in traditional budgeting where the past becomes the base to make a forecast, in ZBB the past helps to see what value can be obtained from an expense to the business.

Speakers’ presentations

At the meeting, Lukas Herbert, FP&A Director, ICMEA, Takeda, shared his experience of a successful implementation of ZBB. The presentation was very insightful, highly interactive and all the participants benefited from the presentation.

The key takeaways from Lukas’ presentation were:

Recommendations:

- Focus on ZBB exercise fully. It is not a piecemeal exercise.

- Support from the top ownership and the senior management is crucial.

- Know the entire company – Top to Bottom, entire operations.

- Focus on non customer G&A expenses.

- A mindset change is needed.

- Involve stakeholders in data validation, baseline definition and target setting.

Characteristics of ZBB which are important to keep in mind:

- Cost cutting at right places.

- Global policy can be rolled out as every region becomes part of ZBB exercise.

- Successful ZBB leads to consistency in reporting, in expenses management and in bringing uniformity. Cost packages become integral part of financial reporting.

- There is overall better visibility on the expenses.

- New Dashboards can include financial and non financial KPI’s post ZBB.

- ZBB is tough in the first year but with right drivers it is relatively easy in the next years.

Risks of ZBB:

- There can be disruption in the business.

- We need to be careful in deciding on which drivers to choose.

At the meeting, we also had insights from several FP&A Board participants:

- Clara Hoon suggested a soft approach to the whole process.

- Siddhartha Garg (CA, PMP) shared his experience of successful implementation of ZBB.

- Anand Soni, CPA, CA shared his experience of implementing ZBB at a startup venture but explained his difficulty in implementing the same project in another established business.

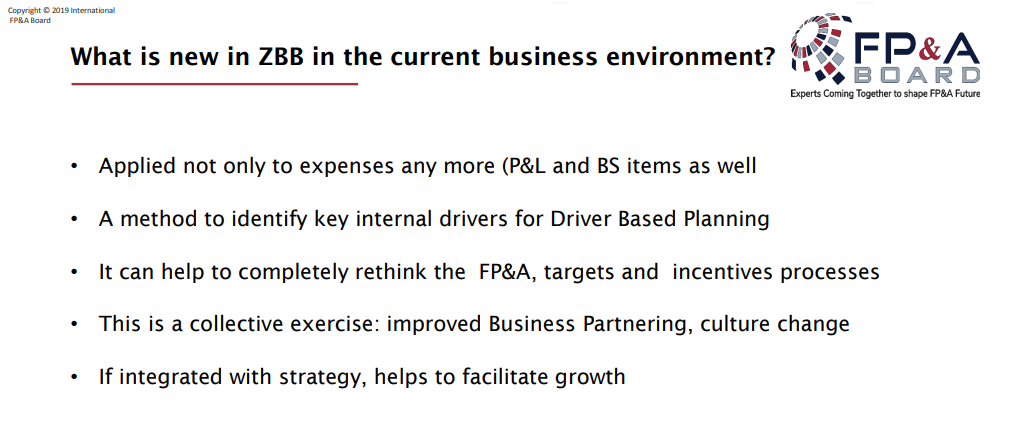

Larysa Melnychuk, MD of FP&A Trends Group and Founder of the International FP&A Board, highlighted the new trends in ZBB:

She also stressed the need for embracing technology and investment in right areas as new key trends for a successful ZBB implementation.

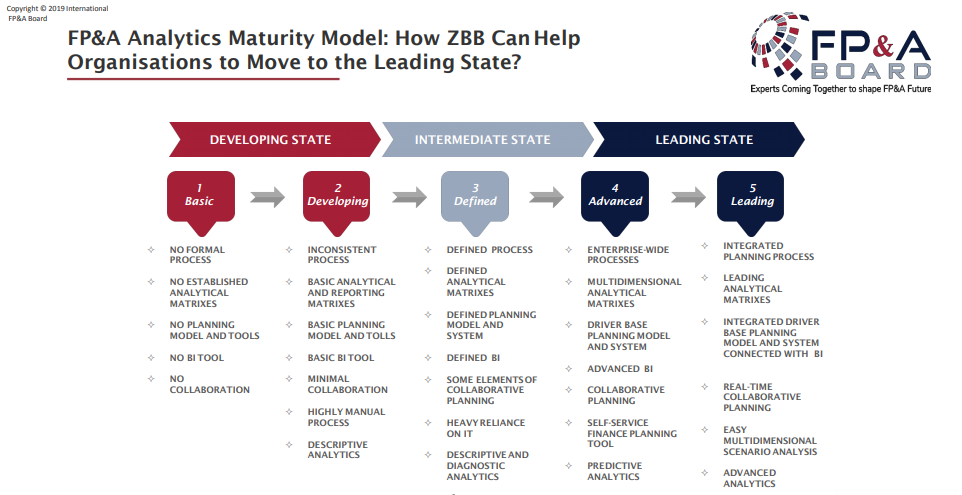

Larysa also dwelt on FP&A analytics maturity model:

Group Exercise

Clearly the meeting and the participants had interesting and even divergent views. To ensure consolidation of views and exchange of ideas, the meeting conducted a 20-minute group exercise. There were 4 groups and each group was asked one of the below question:

- What are the key steps in ZBB implementation from the people point of view?

- What are the key steps in ZBB implementation from technology and analytics point of view?

- What are the key steps in ZBB implementation from business process point of view?

- What are the key steps in ZBB implementation from culture point of view?

This was an interesting part of the meeting as all the senior professionals deliberated their viewpoints in their respective groups.

It is interesting to note that there were divergent views in Group 2. Some members of Group 2 believed that while technology and analytics are absolutely critical to have a deep dive into the expenses, one member, Anand Soni, had a different view. Anand mentioned that technology and analytics are not the most important aspect in successful ZBB implementation as they are also used for traditional budgeting. Nevertheless, change in mindset of people is the most crucial aspect for a successful ZBB.

On other Group questions, there was a common consensus: ZBB is a group exercise and that the buy in from all the stakeholders is a necessity and that the first year of implementation is the toughest.

The meeting ended with the following closing key thoughts:

- Implementing ZBB is tough, but sustaining it is much harder.

- Without support of senior management, and showing their commitment, it will not yield desired results.

- Most staff may not like ZBB, and it may cause attrition.

- It is a great method to have a lean organization, but it is not easy to find the right balance between cuts and investment.

Notes

[1] https://www.fpa-trends.com/report/fpa-circle-notes-new-age-zero-based-budgeting