The 25th London FP&A Board Meeting was brought together 25 Financial Planning and Analytics specialists to discuss some of the biggest trends in the industry.

The 25th London FP&A Board Meeting was brought together 25 Financial Planning and Analytics specialists to discuss some of the biggest trends in the industry.

The event focused on FP&A storytelling and the added value it can bring to organizations for the first time in FP&A Board Meeting history.

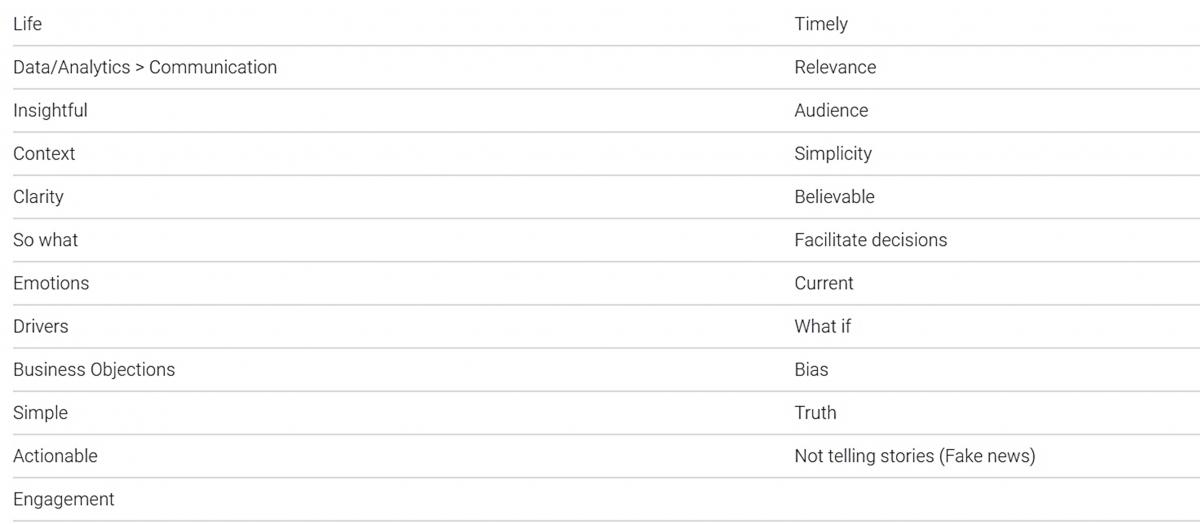

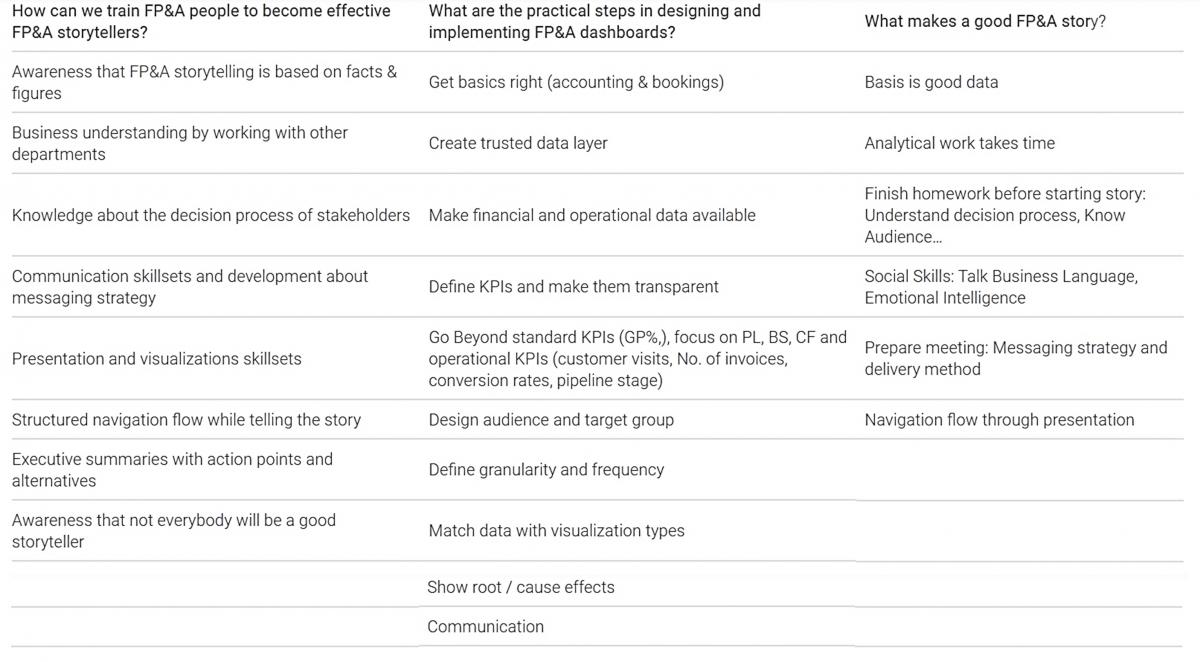

The meeting began with a general introduction in which the participants shared their views on the key factors for effective FP&A storytelling. The results are summarized below:

The outcome of this roundtable showed that a good FP&A storytelling needs to have proper preparation (data, analytics) and targeted communication with a clear messaging strategy that should differ depending on the audience.

The power of visualization and rules for effective communication

Following the introduction, management thinker, author and speaker Dr. Steve Morlidge emphasized the power and importance of visualization. One takeaway is that not every FP&A employee needs to be a graphic designer to build power and meaningful dashboards. In today’s world, there are enough books that the majority of FP&A employees can use to learn how to create meaningful dashboards as the basis for their storytelling.

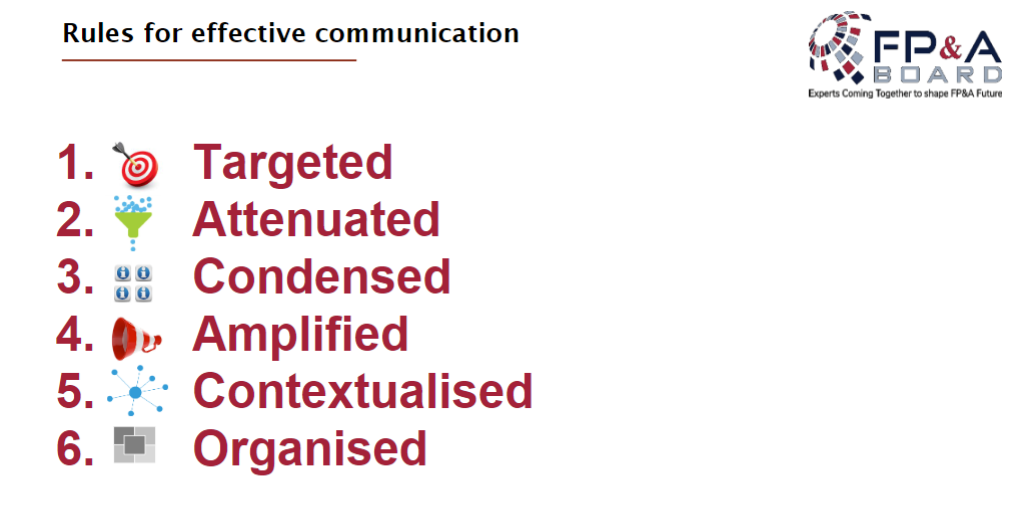

The rules for effective communication were summarized with the attached overview:

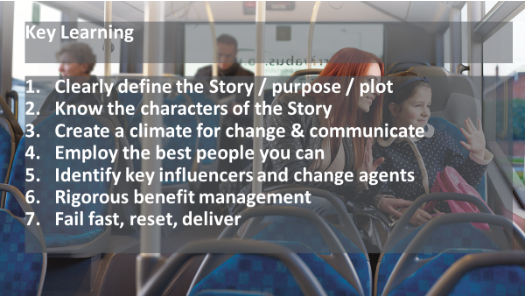

Furthermore, Adam Clegget, FP&A Director of Arriva shared his practical experience on their journey of implementing a meaningful, visual dashboard at Arriva. His presentation was split into three chapters: problem statement, response (match plan) and outcome. Furthermore, Adam shared with the FP&A Group, the key learnings from Arriva’s journey.

Excurse: A negative example of storytelling

Following the Arriva case study, Dr. Steve Morlidge shared a case of fake news as an example of negative storytelling. It was a newspaper article about the rise of robberies blamed on police cuts and the rise in the use of smartphones. After analyzing the available data behind the story, a careful FP&A employee can come to a completely different conclusion. This example underlines the fact that good FP&A storytelling always starts with the available data and a proper analytical thought process. Once the “homework” is done, the presenter needs to focus on how to best transport the message, depending on the target audience.

Group work

Following these presentations, the meeting’s participants partook in group workshops where they worked on the following questions:

Apliqo’s ideas on improving storytelling

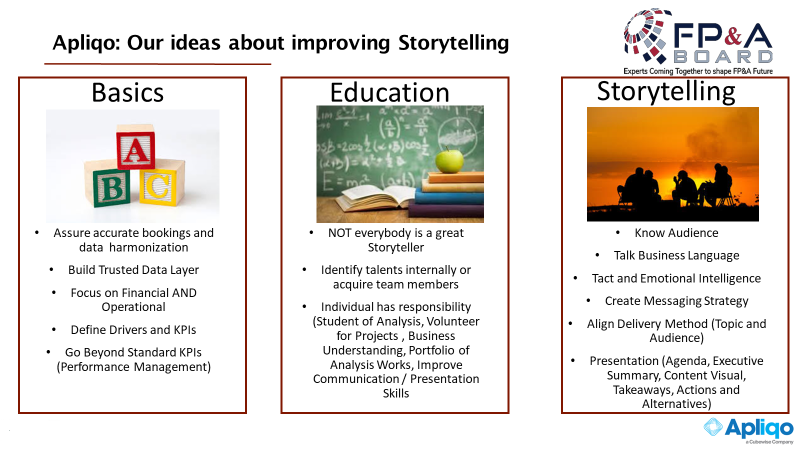

To conclude the meeting, Apliqo shared its ideas to improve FP&A storytelling in organizations.

Basic: Most important is a trusted data layer based on accurate bookings and harmonized master data. Companies need to focus on financial and operational data including the most relevant business drivers and KPIs.

Education: Managers need to understand that not every team member can become a great storyteller. Companies need to identify internal talents or acquire new team members. Furthermore, all individuals need to understand that they are responsible for their education and should constantly focus on becoming a better storyteller by sharpening their analysis skills, volunteering for projects, deepening their business understanding, enlarging their portfolio of analyses and improving their communication and presentation skills.

Storytelling: Once companies have the right fundaments in place, the preparation of each meeting/presentation is of great importance for achieving compelling and effective storytelling. The storyteller needs to focus on the following: Know the audience, speak business language, make use of emotional intelligence, create a messaging strategy, align the delivery method (topic and audience), improve the presentation (agenda, executive summary, visualize the content, offer takeaways, actions, and alternatives).

This week’s event was hosted and sponsored by FP&A partners Apliqo, Michael Page and IWG.

The FP&A Trends Group offers as well a website for the FP&A Board Meeting in London.