The 16th Dubai FP&A Board meeting convened with senior finance professionals to explore Agile FP&A. In today’s volatile business environment, Agile FP&A is no longer a buzzword — it is a strategic necessity for finance teams to move from static planning to real-time business decision support.

Chaired by Larysa Melnychuk, CEO of FP&A Trends Group and Founder of the International FP&A Board.

The event was proudly sponsored by Jedox and held in partnership with Page Executive and Michael Page.

Finance leaders from organisations such as Emirates Group, Honeywell, Unilever, Nestle, Kraft Heinz, and Emerson, among others, engaged in dynamic discussions and shared perspectives grounded in real operational complexity.

As we opened the year in Dubai, the conversation naturally turned to a familiar question: what does Agile FP&A really mean in practice?

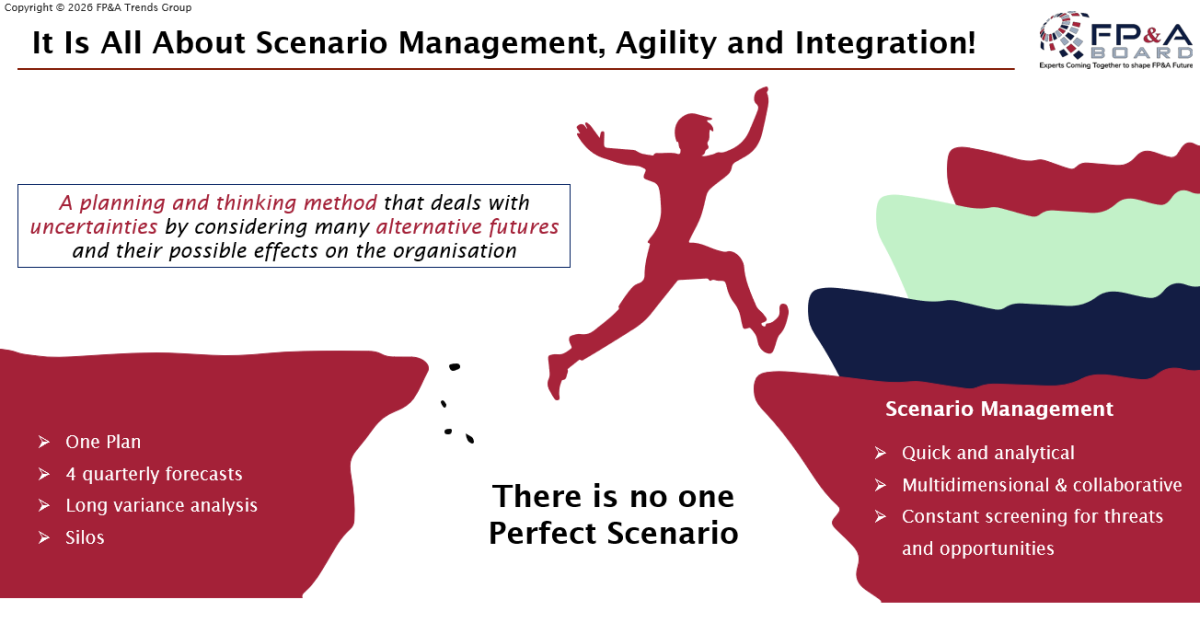

One message came through clearly: Agile FP&A is not primarily a technology challenge. Participants consistently highlighted the same foundations — mindset, understanding of business drivers, data quality and governance, disciplined processes, people, speed, and accuracy. Technology only adds value once these basics are in place. Agile FP&A starts with an agile mindset and clear drivers, then builds flexible, modular capabilities. Agility is ultimately about scenario management, not a single “perfect” plan, enabling faster, more relevant decisions as conditions change.

Agile FP&A: What and Why

Agile FP&A is an approach to Financial Planning and Analysis that emphasises speed, flexibility, continuous forecasting and close business partnering. It uses rolling forecasts, scenario planning, and real-time data insights to support dynamic business decisions.

In a world where predictability is shrinking and volatility is structural, the objective is no longer to produce a single accurate forecast, but to build the capability to respond rapidly when assumptions change.

Figure 1

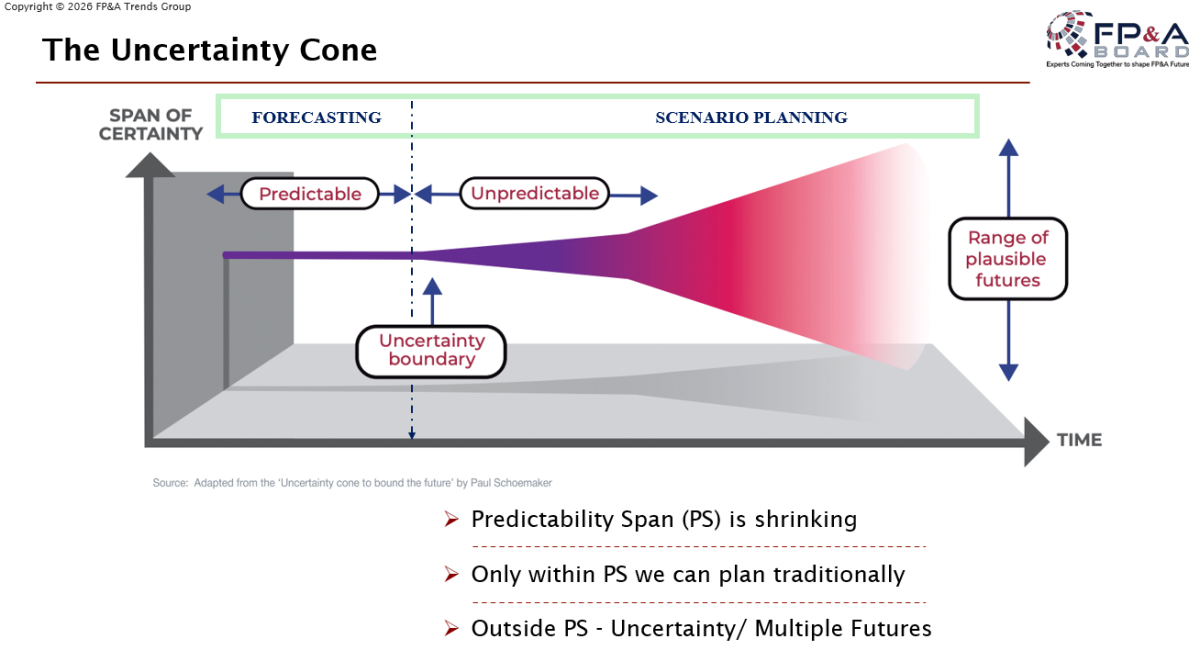

How Can We Plan for Uncertainty?

In today’s volatile environment, uncertainty is no longer an exception — it is the baseline. Agile FP&A does not try to predict a single future; instead, it prepares the organisation for multiple possible futures.

The discussion introduced the concept of the “Predictability Span” and the Cone of Uncertainty. Within a short, stable time horizon, traditional forecasting can still be effective. Beyond it, forecast accuracy declines sharply, making scenario management essential. Agility is therefore measured not by prediction perfection, but by the speed and confidence with which an organisation can recalibrate its assumptions.

Figure 2

Move from Single Forecast to Scenario Planning

Traditional FP&A focuses on one forecast. Agile FP&A builds multiple scenarios:

- Base case

- Upside (growth acceleration)

- Downside (economic slowdown, disruption)

This shift enables finance teams to evaluate potential outcomes in advance, reducing decision latency and strengthening executive responsiveness when conditions change.

Adopt Rolling Forecasts Instead of Annual Budgets

Replace static annual budgets with monthly or quarterly rolling forecasts (12–18 months forward). This ensures plans are continuously refreshed with the latest business realities.

Rolling forecasts shorten feedback loops and align planning cadence with business dynamics, increasing adaptability without sacrificing control.

Focus on Key Value Drivers, Not Just Line Items

Uncertainty is best managed through driver-based planning:

- Volume and price drivers

- Cost drivers

- Productivity and efficiency levers

- Working capital levers

Rather than managing thousands of line items, Agile FP&A concentrates on the critical drivers that explain performance outcomes. Adjusting these drivers enables rapid scenario simulation and clearer visibility of cause-and-effect relationships. Drivers create modularity and modularity enables agility.

Use Real-Time Data and Predictive Analytics

- Early warning indicators

- Trend detection

- Predictive forecasting

These capabilities strengthen forward-looking insight and allow finance to move from reactive reporting to proactive decision support.

Figure 3

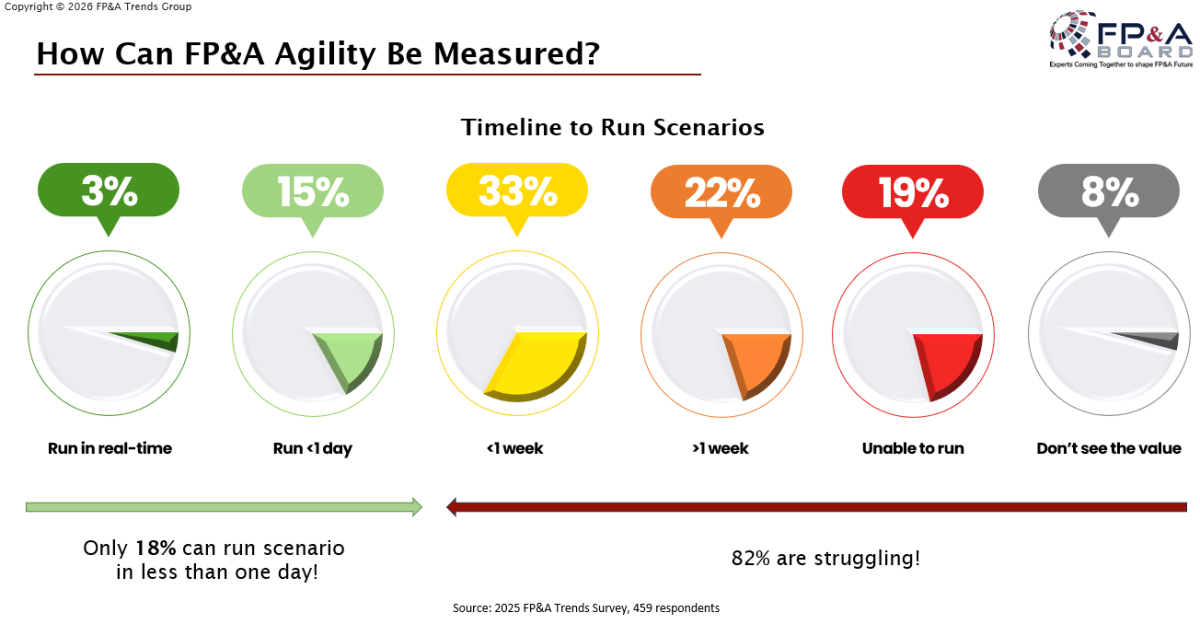

Polling question: How Long Does It Take to Run the Scenarios?

The outputs below clearly show that only 18% can run a scenario in less than one day, while 82% are still struggling.

This reveals a material capability gap. In environments where market signals shift rapidly, delayed scenario analysis directly impacts strategic agility and competitive positioning. Scenario turnaround speed, therefore, becomes a measurable indicator of FP&A maturity.

Figure 4

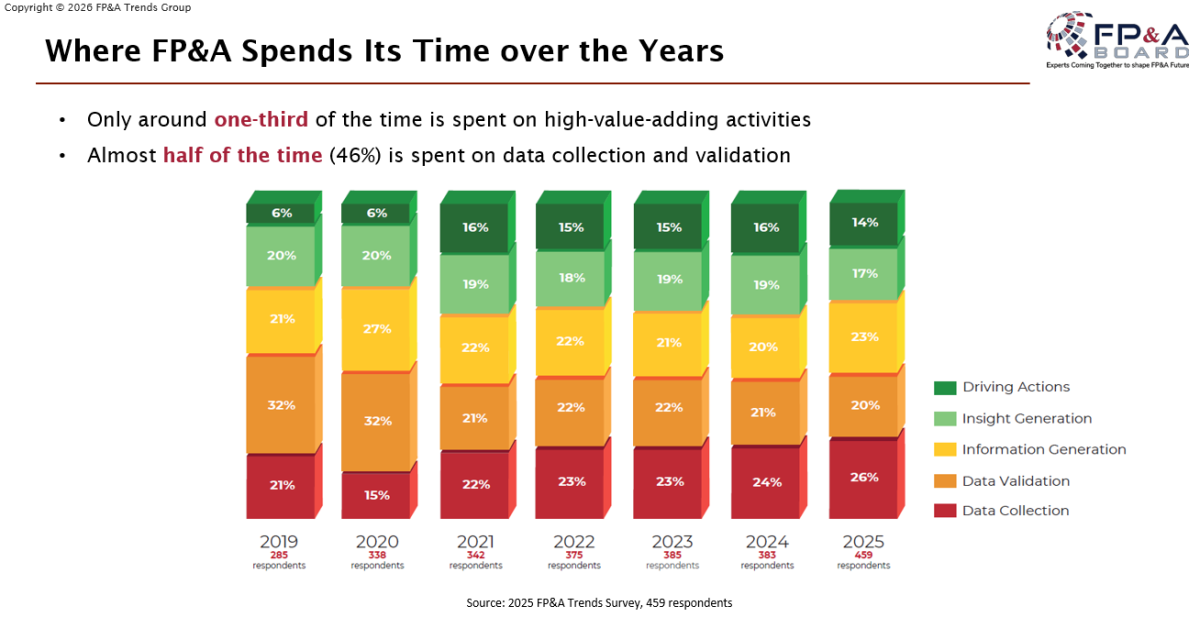

Where FP&A Spends Its Time over the Years?

The discussion then moved to the time teams spend in various activities: only one-third is spent on high-value-adding activities, while half of the time is still spent on data collection and validation.

This structural imbalance limits finance teams' ability to prioritise insight generation, strategic partnering, and forward-looking analysis. Strengthening data foundations is therefore a prerequisite for sustainable agility.

Figure 5

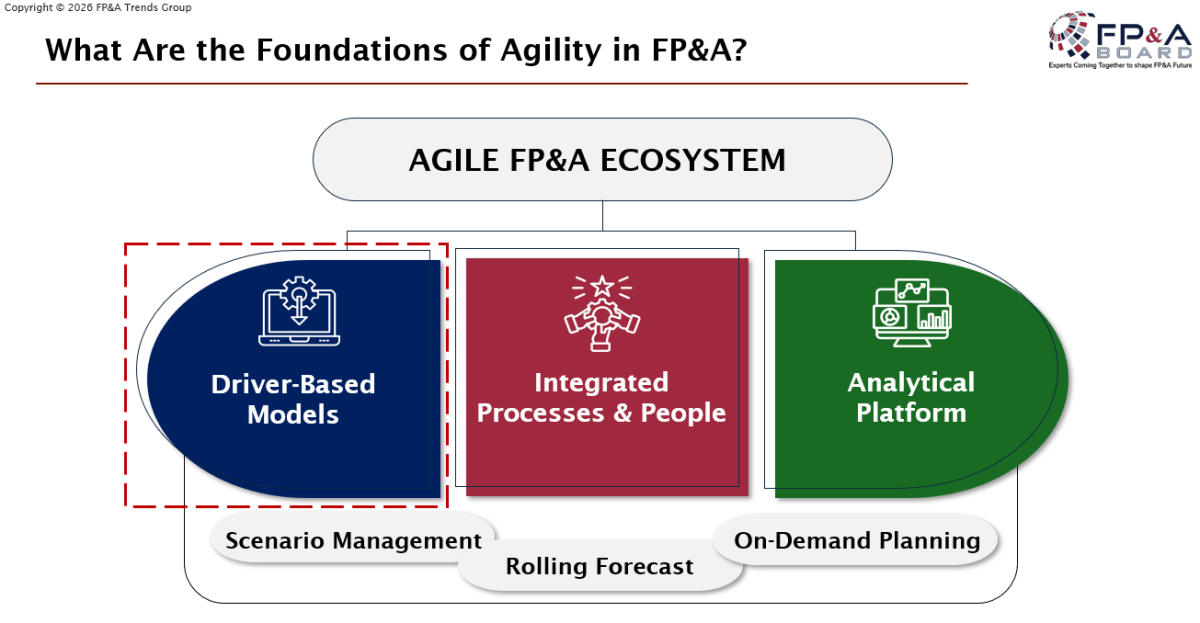

What Are the Foundations of Agility in FP&A?

The session emphasised that agility operates as an ecosystem rather than a single initiative. The foundations include:

Driver-Based Models: Focus planning on the key business drivers that move performance, enabling rapid scenario modelling and faster decision-making.

Integrated Processes & People: Break silos by integrating finance with business functions to align strategy, execution, and resource allocation in real time.

Analytical Platform: Leverage data, automation, and AI-enabled analytics to provide real-time insights and predictive decision support.

Improving one pillar in isolation does not create agility — the system must function as a whole.

Figure 6

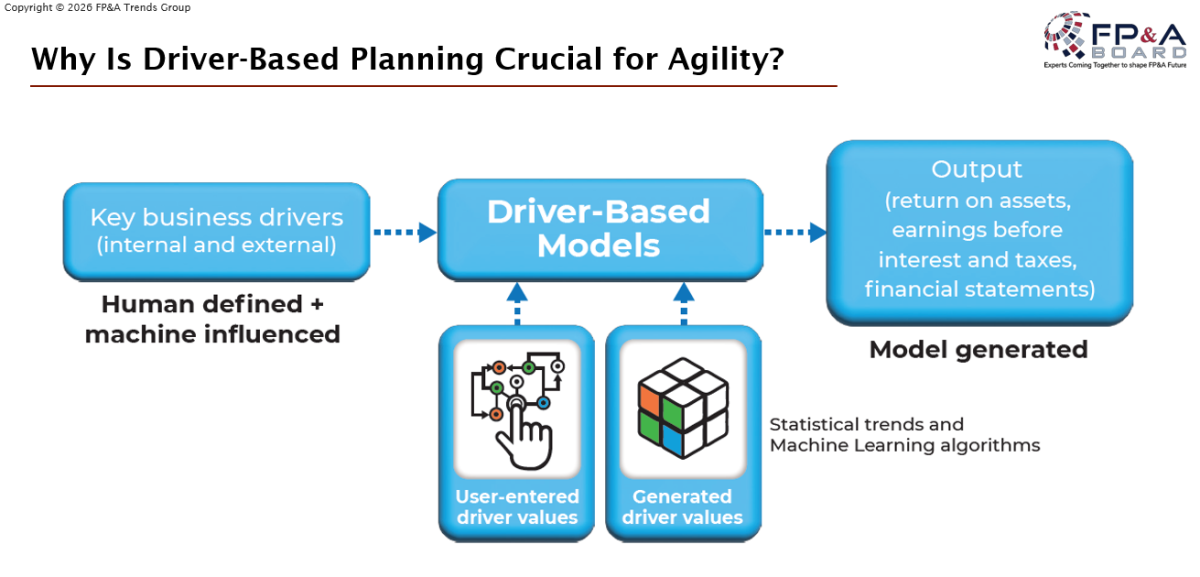

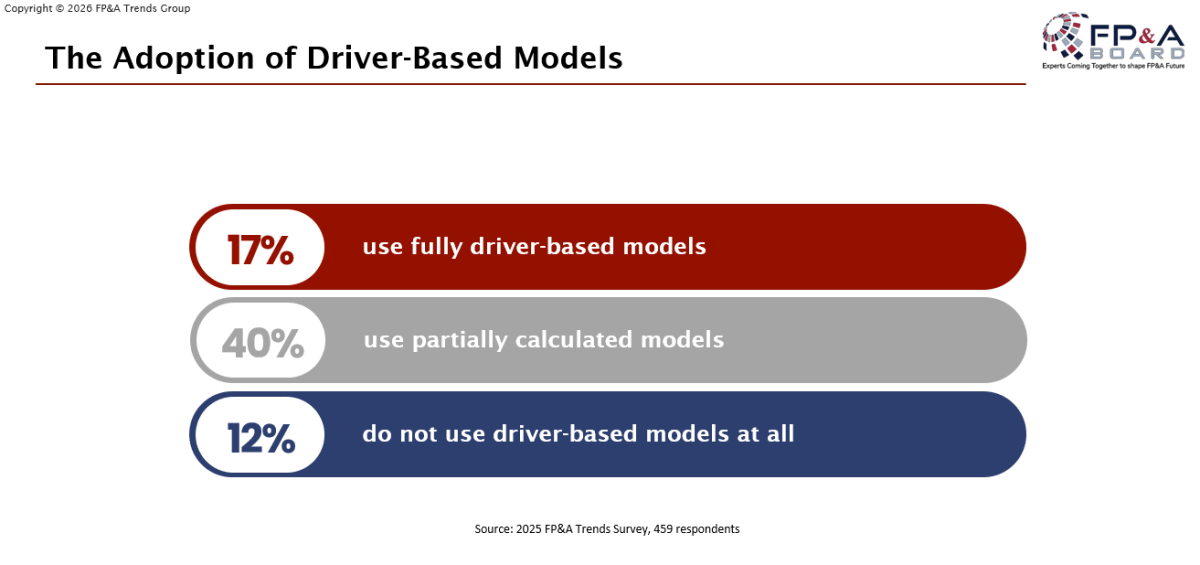

Why Is Driver-Based Planning Crucial for Agility?

Driver-based planning enables organisations to model financial outcomes based on key business levers rather than static line items. By adjusting drivers in real time, FP&A can rapidly simulate scenarios and support agile, data-driven decisions.

Figure 7

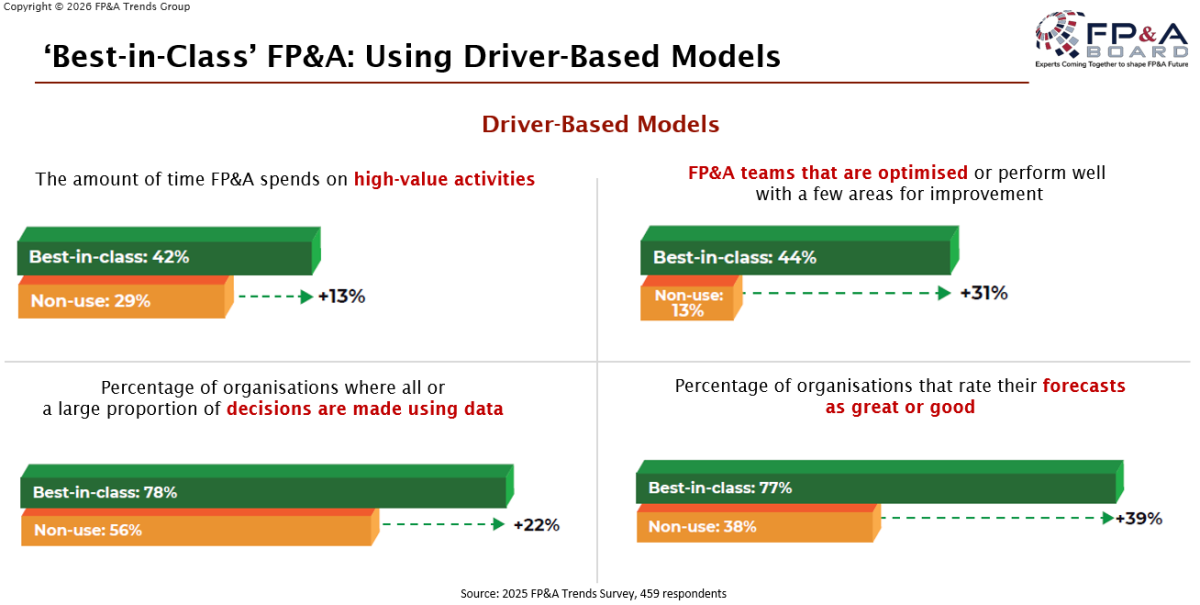

The chart below shows the time FP&A spends on high-value and non-use activities.

Figure 8

Applying the Pareto Principle (80/20 rule), a small number of drivers typically explain the majority of business outcomes. Identifying and managing those critical drivers significantly enhances planning effectiveness and responsiveness.

Figure 9

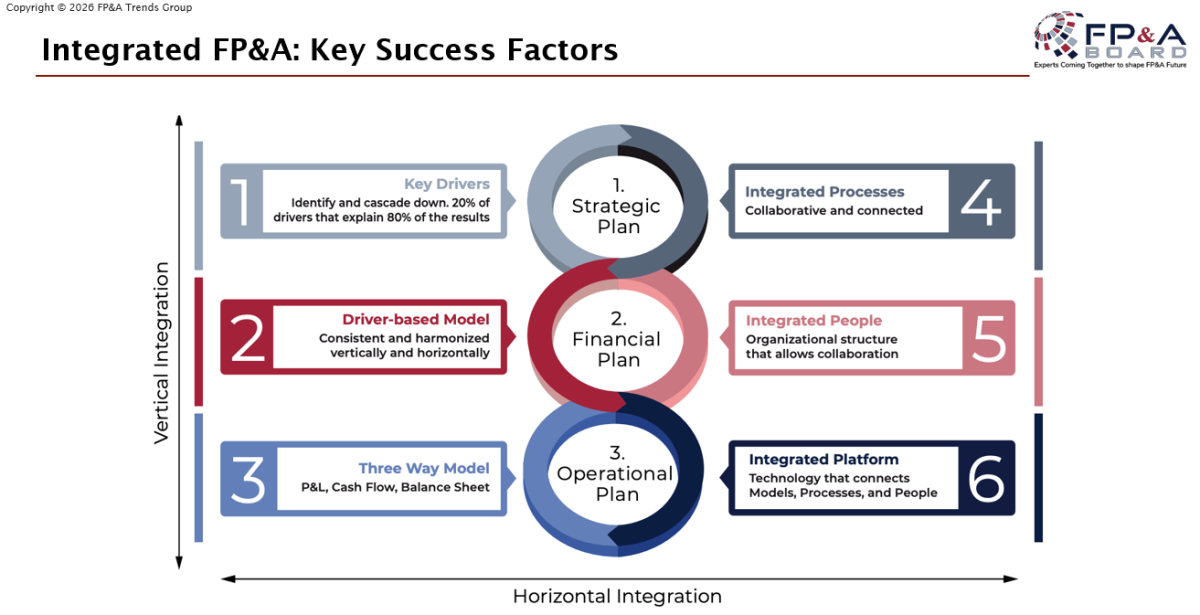

What Is Integrated FP&A?

Integrated FP&A is a planning and performance management approach that connects financial planning with operational, strategic, and workforce planning across the organisation to enable aligned, data-driven decisions.

This integration ensures alignment among strategy, resources, and execution, enabling faster, more informed business decisions. Agility becomes possible when financial, operational, and strategic planning operate on a unified framework.

Figure 10

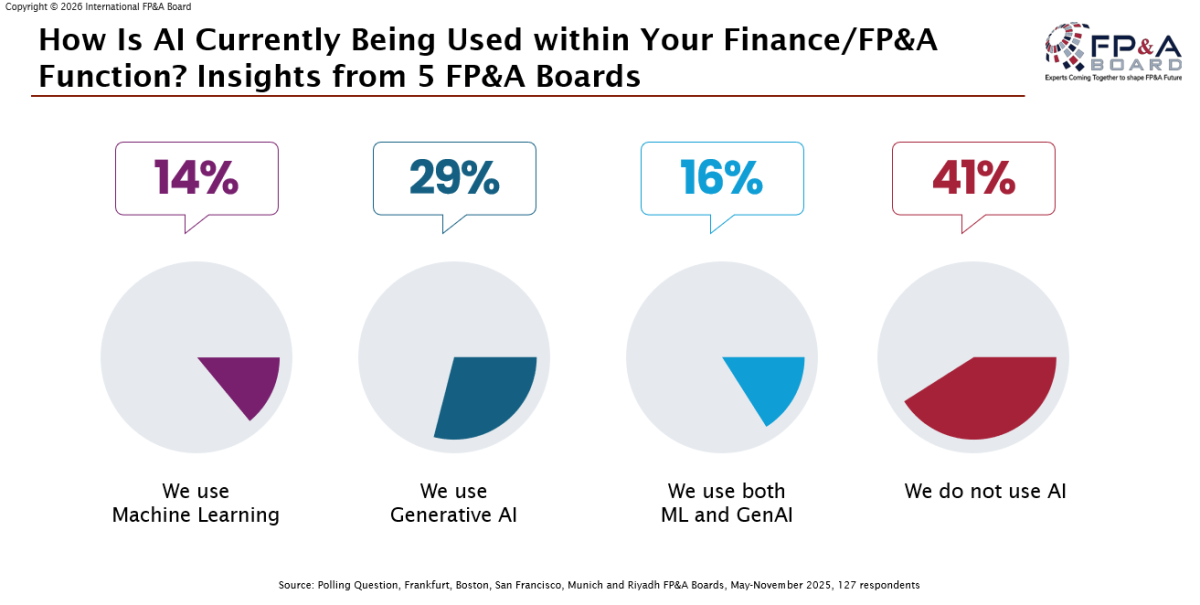

Polling Question: How is AI Currently Being Used Within your Finance/FP&A Function?

The insights below show that a large share of FP&A teams don’t use AI, while others use ML, Generative AI, or both.

Figure 11

What Key Roles Does AI Play in FP&A

When asked how AI is currently being used within FP&A functions, results showed that a large portion of teams still do not use AI, while others use Machine Learning, Generative AI, or a combination of both.

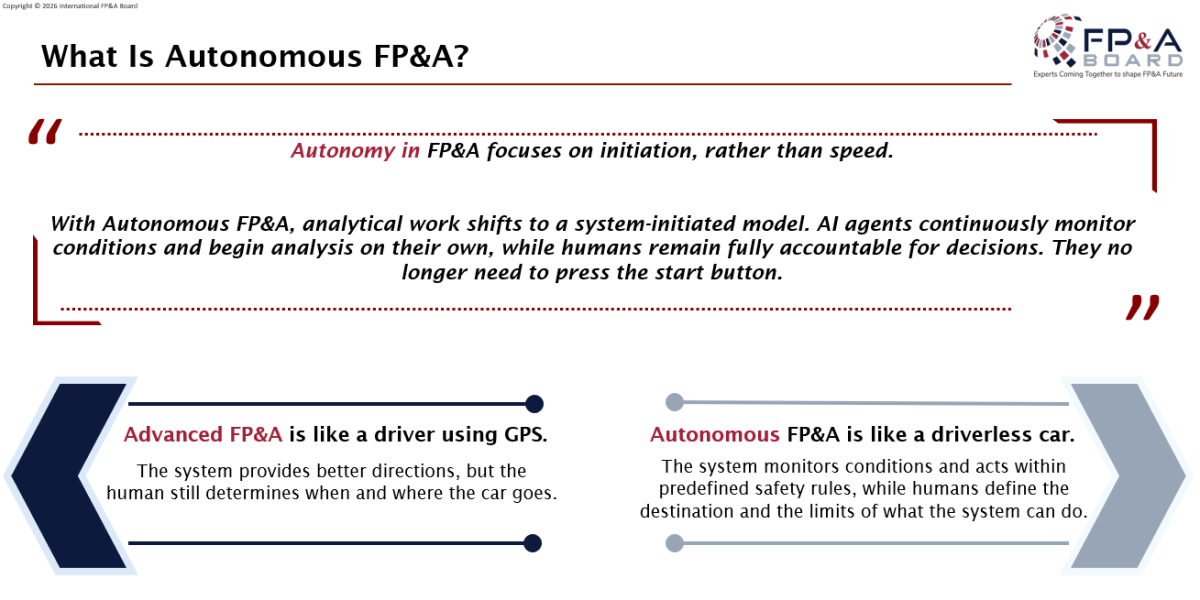

AI is transforming FP&A from a historical reporting function into a predictive, proactive, and decision-centric finance capability. Its roles span analytics, automation, and strategic support.

Machine Learning enhances forecasting accuracy and scenario modelling, while Generative AI supports narrative reporting and communication of insights. The concept of Autonomous FP&A was introduced as a future-state model in which AI-driven systems automatically plan, forecast, analyse, and recommend actions within defined governance boundaries. However, technology enhances agility only when supported by strong data governance, driver-based models, and disciplined processes.

Figure 12

Arun Sadagopan, Regional Director – MEA at Jedox, shared a clear and practical perspective on how agentic AI can support FP&A agility, explaining how AI agents can interpret objectives, execute workflows, and accelerate scenario analysis — provided that strong data foundations, governance, and driver-based models are already in place.

Technology accelerates agility, but it does not replace structural discipline. Without robust data governance, integrated processes, and clearly defined drivers, automation amplifies inefficiency rather than eliminating it.

Group Work

Attendees worked in small groups to define practical next steps for strengthening Agile FP&A capability.

Group 1: Prioritising Drivers

The first group focused on building clarity and discipline around drivers. Key themes included:

- Prioritising internal and external drivers

- Defining scope clearly

- Improving data quality and collection processes

- Establishing appropriate planning frequency

- Strengthening data governance

- Managing complexity and identifying outliers

- Reducing stress in planning cycles

The discussion emphasised that agility begins with simplifying complexity and focusing on the drivers that truly influence outcomes.

Group 2: Designing a Value-Added Process

The second group structured their discussion around creating a clear value-added FP&A process:

- Define the problem and align on objectives

- Ensure stakeholder alignment and sponsorship

- Clarify functions and ownership

- Set KPIs and define success criteria with clear timelines

- Focus on execution and post-implementation review

The group also highlighted implementation challenges:

- People and behavioural resistance

- Experience and skill gaps

- Security and technology considerations

- Changing landscapes and decision paradigms

Their conclusion was that process clarity and stakeholder buy-in are essential to embed agility sustainably.

Group 3: Structured Implementation Roadmap

The third group proposed a structured transformation sequence:

- Assessment

- Process redesign

- Understanding and strengthening the underlying data

- Stakeholder and change management

- Cost-benefit analysis

This roadmap reinforced that agility requires deliberate sequencing — starting with assessment and data foundations before moving into technology or automation.

The group's collective outputs reinforced one clear message: Agile FP&A is not achieved through isolated initiatives. It requires prioritised drivers, structured processes, disciplined data foundations, stakeholder alignment, and measurable value delivery.

Conclusion:

Agile FP&A is no longer a conceptual aspiration — it is a practical operating model for modern finance. By shifting from static budgets to driver-based planning, integrating strategic, financial, and operational processes, and leveraging advanced analytics and automation, finance can move from reporting the past to shaping the future.

The Dubai discussion reinforced a central message: agility begins with a mindset and a clear business understanding. Technology enables it, but does not define it. In an environment where volatility expands and predictability shrinks, Agile FP&A becomes the operating language of modern finance.