Do you aspire to be the Chief Financial Officer of Google, Microsoft, Tesla or any other...

Note: This article reflects conditions as of late June 2025. Given the pace of global developments, circumstances may have shifted significantly by the time you read this, which rather proves the point.

The Red Queen says to Alice in Through the Looking Glass:

— It takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run twice as fast as that!

I think this sums up what it feels like to be a CFO in 2025. Have you experienced this, too? Your team completes their detailed quarterly forecast, but before you have the chance to present the numbers to the board, all the assumptions change.

Take just three examples of the unprecedented global volatility we have experienced this year. Energy prices, already under pressure from the war in Ukraine, were further impacted by wars in the Middle East. Foreign exchange markets saw exceptional swings this year. And, of course, the on-again-off-again, will he, won’t he, trade tariff debacle.

I’d argue that we are experiencing the fundamental breakdown of traditional financial planning approaches in real time. The methodologies and frameworks that have served us well for decades — detailed variance analysis, single-point forecasts, annual budgeting cycles — are struggling to keep up with a world where external conditions change faster than internal processes can adapt.

Annual budgets used to be the gold standard of discipline. Today, they often feel like a pointless exercise. We’re like Alice, running as fast as we can, and still finding ourselves under the same tree.

This is because we are facing something unprecedented: a sustained period of policy whiplash and geopolitical chaos that operates with no internal logic, where all precedent and established rules of engagement have been thrown out the window. As globalisation gives way to isolationism, we're living through what could be the biggest shift in the global world order since the fall of the Berlin Wall. This isn't an isolated crisis to weather; it's our new operating environment.

When Traditional Financial Planning Hits a Wall

For finance teams, this creates impossible operational challenges. You need to present reliable cost projects amid hourly volatility. You need to maintain budget integrity with costs moving faster than approval processes. And you somehow also need to give your boards forecasts they can trust, when the numbers change before the next meeting happens.

The way we traditionally planned doesn’t work anymore. Instead of yearly budget processes that assume that there are not too many changes in 12 months, FP&A teams now need to make monthly or even weekly updates. Instead of unpacking operational insights, today's variance analysis needs to explain external volatility. And the clincher, the capital your business needs to pivot is locked up by approval delays, hamstringing a rapid response to challenges and opportunities.

This sets off a chain reaction of problems for you and your team. And just when you most need to supply your leadership team with real-time intelligence proactively, you’re at your most reactive and out-of-date.

Why Finance is Uniquely Positioned to Lead the Response

But there is some good news. We are uniquely positioned to solve the problem of how we traditionally work. If you think about it, accountants have always been responsible for creating systems and frameworks that allocate and track resources most effectively. This core capability hasn’t changed, even though our external circumstances have.

Looking at it this way, the breakdown of traditional financial planning hasn't diminished finance's strategic importance. If anything, it has amplified it. Today, survival depends on speed, and the people who can give real-time insights are the ones who keep companies moving forward. But this needs us to transform our role from that of historical scorekeepers focused primarily on accuracy and control to advisors who anticipate what's coming and help the business make quick decisions.

Walking the Tightrope

I’m not suggesting we abandon accuracy and the rigour fundamental to what we do. We need to figure out how we can turn on a dime, but still keep the control and accuracy that governance demands.

This can’t be about abandoning financial discipline; that way lies chaos. Nor can it be about planning more frequently using the same methodologies; that way lies exhaustion and diminishing returns. The answer lies in changing both our mindset and methods. We need to keep our core strengths, but start working with tools that can handle constant change.

Three Requirements for Modern FP&A

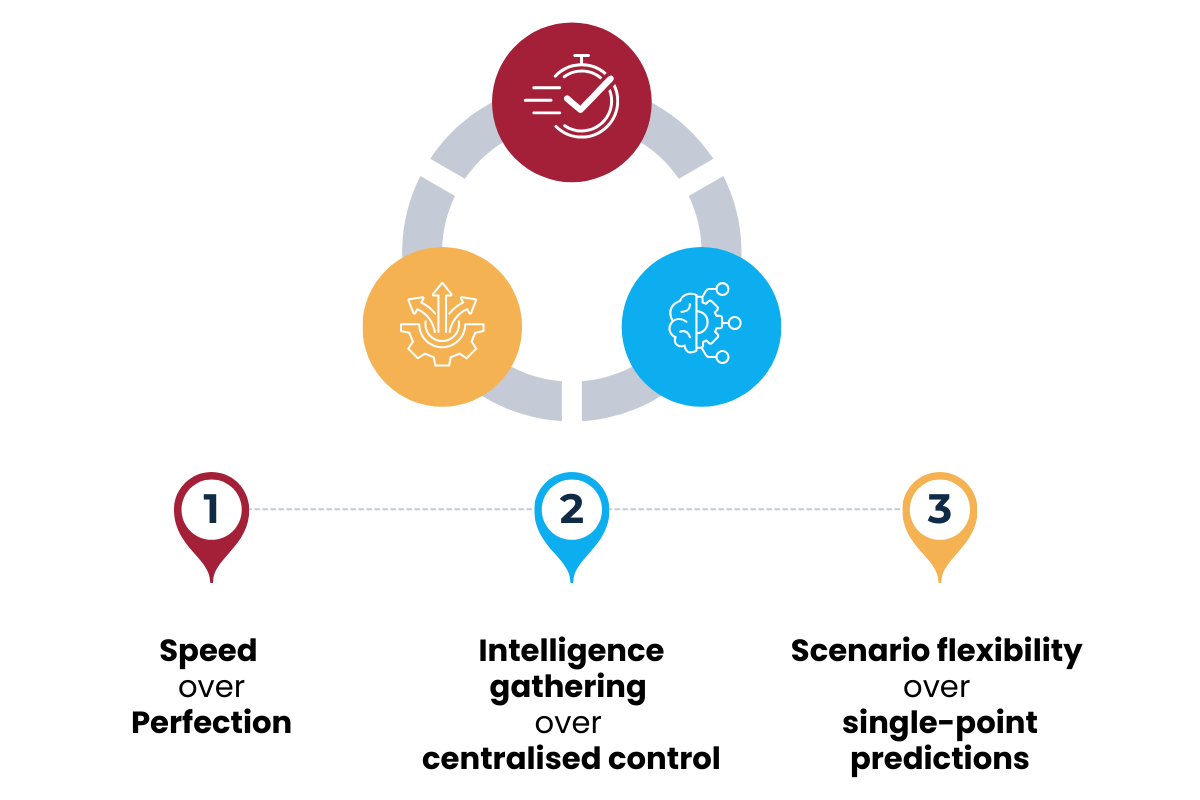

1. Speed beats perfection: When external conditions shift weekly, daily, or hourly, a "good enough" forecast that can be updated rapidly provides more value than a perfect forecast that takes weeks to produce. CFOs must develop planning processes that deliver decision-ready insights within days, not months or quarters.

2. Intelligence gathering over centralised control: The insights you need to navigate chaos exist throughout your organisation, not just within finance. Set up ways to capture those signals, sales trends, supply chain shifts, and HR costs, without drowning managers in data requests.

3. Flexible scenarios instead of single-point predictions: Today, we need to model multiple scenarios simultaneously and switch between them as conditions change. Don’t ask, “What will Q4 look like?” Ask, “What could Q4 look like under different scenarios and how fast can we adapt?”

Gain the Agile Advantage

The goal of all this? Agility.

Companies that master this won't just survive current uncertainty; they'll discover that being able to adapt gives them a real edge.

When competitors are paralysed by impossible-to-predict external forces, agile organisations will have systems that identify opportunities quickly and execute pivots decisively.

Think about how the current chaos would feel for a business that can, in real-time:

- Model the financial implications of supply chain shifts

- Assess the revenue impact of changing customer preferences

- Provide visibility into how volatility affects profitability

The question every CFO should consider today isn't whether traditional financial planning can keep up with the pace of change. You should ask how quickly I can support a culture and embed processes that turn agility into your secret weapon.

And you’ll discover that, unlike Alice, you are no longer running to stand still, but are moving with, and ahead of, the tidal wave of change and chaos.

In the next article, we'll explore the practical architecture of financial systems designed for rapid pivots, including the integrated modelling approaches that enable organisations to respond to constant chaos while maintaining essential financial control.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.