In this article, Kevin Phillips explores the CFO’s New Reality: why traditional financial planning can’t keep...

Picture two CFOs working in 2025. One keeps detailed, consistent forecasts and achieves 92% accuracy by avoiding frequent revisions. The second changes assumptions five times in July alone, helps their leadership navigate shifting tariff policies and supply chain disruptions, and identifies multiple strategic opportunities amidst the volatility.

Unfortunately, traditional metrics would celebrate the first CFO and penalise the second. But I know which CFO I would rather have on my team.

It is clear that the second CFO delivered exponentially greater strategic value by rolling with the punches rather than chasing an unattainable and artificial precision and adherence to an original plan, even if it is no longer appropriate. In addition, they take a more holistic view of Financial Planning and Analysis (FP&A). Instead of fixating on variations by budget account, or cost centre by cost centre, they can see the wood for the trees. They can see that, for instance, the higher cost of using air transport to land goods in a market before tariffs bite will be offset by increased sales and brand value.

Yet legacy measurement systems reward yesterday's capabilities and ignore what drives success today. For instance, variances in the wake of overnight currency spikes aren’t mistakes or failures. Instead, they need to be seen as proof that the system is working for the current, volatile business environment.

Changing how you approach FP&A without changing how you measure it creates an unfortunate and problematic disconnect. It’s like what Einstein said:

"If you judge a fish by its ability to climb a tree, it will live its whole life believing it is stupid."

Likewise, if you penalise your FP&A team for doing what they need to do for your organisation to thrive today, you’ll cut off any attempt at financial agility at the knees.

The Transformed FP&A Function

In this series of articles, we have considered how we need to change the way we work and how to embed this change across the organisation. Before digging into how to best measure the modern FP&A function, let’s look at what is, if you follow my advice, different today.

From inward to outward looking

Where we traditionally guarded internal controls and kept historical records, we now scan the external environment and interpret market signals.From backwards to forward-looking

You can't identify future opportunities while looking backwards, so while traditional variance analysis explained what happened last quarter, scenario analysis explores what could happen next quarter and advises on the best course of action.From boardroom to coalface

Traditionally, finance reported up to executives every quarter, but now our gaze has turned outwards. In my experience, the most effective FP&A teams spend more time engaging with the coalface than in the boardroom. And this engagement is a two-way street. We take finance in the business and bring business into finance to catch the signals early.From control to enablement

Finance lets go of its traditional role as a gatekeeper and instead collaborates with operational teams, empowering them to figure out how to make their budgets work for them. (A reminder, though, and I can’t stress this enough, this does not mean turning everyone into junior accountants!)

These four shifts represent a fundamental change in finance's role within the business. And the measurement of financial outcomes must both reflect and reinforce this shift. In other words, you need to start measuring your fish on their ability to swim underwater, not climb trees!

How Do We Measure the Success of FP&A Today?

A transformed FP&A function needs new measurements that both reflect the external changes in the world and validate and reinforce the changes we have made to succeed, despite the chaos.

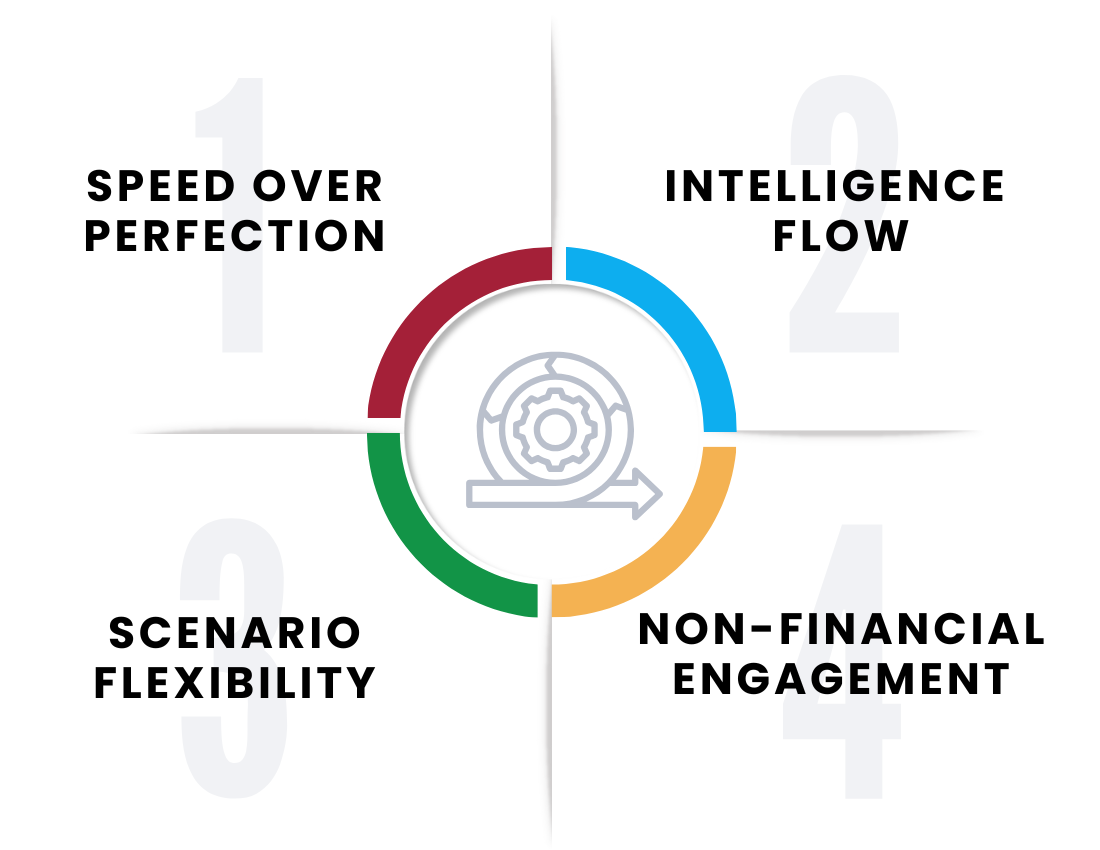

I’d suggest that measurement today should focus on four things: speed over perfection, intelligence flow, scenario flexibility, and non-financial engagement (Figure 1).

1. Speed matters more now

A critical metric here is time-to-insight. This tracks how quickly external changes translate into decision-ready analysis. Therefore, a manufacturing company might track the days between a tariff announcement and the update of scenario models. A services firm might measure the hours from the regulatory change to the revised projections.

To be honest, the specific timeframes matter less than being faster than your competitors. For instance, consider the disruption of the Suez Canal. If alternative shipping costs cascade through your models immediately, not days later, you can respond ahead of your competitors and gain a significant market advantage.

2. The pace at which insights become actions

Tracking the time from scenario generation to leadership decision, or measuring how quickly resources are reallocated when opportunities arise, can reveal how quickly financial intelligence drives decisions and actions.

In addition, measuring cross-functional engagement shows whether your integrated modelling actually works. Track participation rates and input quality: Marketing teams should update demand variables, while operations should control efficiency factors, etc. But remember: finance handles the admin, insights flow from the business.

3. Flexibility and forward-looking outlook

Traditionally, the past has been a good indicator of what the future holds. This doesn’t hold true anymore for any aspect of our business. So, where traditional metrics rewarded commitment to original plans, today you need to measure and reward adaptability. In uncertain times, it is essential to keep your options open by maintaining strategic alternatives rather than committing to a single path.

The ability to generate and switch between alternative scenarios, and then respond to the opportunities and challenges, is a clear marker of responsive organisations versus reactive ones. When geopolitical events create disruptions, you need to assess the financial impacts of alternative strategies immediately, rather than writing variance reports that explain what has already happened.

It's not only finance that needs to spend time looking forward. It matters at all levels of the business. Management teams should be rewarded for spending more time on future scenarios than on historical analysis.

4. Transparency and engagement

The number of non-financial managers actively using your dashboards is important, as is the frequency with which they update assumptions. Track the business impact of this through operational decision speed and early opportunity identification. As non-financial managers become more comfortable with financial concepts and take ownership of them, they contribute better inputs and extend the impact of finance beyond what centralised teams could achieve alone.

Communicating to Leadership

It could come as a surprise to your board that the CFO who pivoted five times in July wasn’t being erratic or uncertain. In fact, they were skilfully navigating a tough environment and delivering important business outcomes.

Boards are used to traditional measures, and you’ll likely need to convince them about the value and wisdom of this new approach.

I'd suggest developing hybrid dashboards that show traditional metrics for governance alongside new agile metrics for strategic insight. This helps leadership shift their thinking from precision-focused to agility-focused while maintaining the accountability standards they need. It is important that boards understand that in unpredictable environments, modelling multiple possibilities provides more value, risk avoidance, and a competitive advantage than precise single predictions

Bringing Measurement and Transformation Together

Start simply and evolve based on what provides the most value in decision-making. Some organisations emphasise speed metrics during periods of volatility, but shift to accuracy indicators during periods of stability. Others prioritise engagement whilst building collaboration, then move toward outcome metrics once their capabilities mature.

What matters is that your measurement systems influence behaviour in the right direction. Rewarding adaptive responses encourages flexibility, and celebrating cross-functional engagement reinforces the coalface presence that FP&A needs. On the other hand, penalising "inaccurate" forecasts in volatile conditions discourages the responsiveness you need.

We need to measure continuous adaptability, not steady-state performance, as a core capability now. And these metrics must validate that finance's role has fundamentally changed from scorekeeper to strategic partner, shifting from a backwards-looking to a forward-looking perspective, from the boardroom to the coalface, from control to enablement. (In football terms, think of it as moving out of the director’s box looking down on the field, to a hands-on coach standing in the dugout.)

In an environment where change is the only constant, companies that measure and reward adaptability outmanoeuvre those prioritising precision over responsiveness. Remember our two CFOs. The second one didn't just use different metrics, they transformed their entire role. Your measurement systems should both demonstrate that you've made the same change and reinforce this change

Building financial systems for uncertainty requires measurement frameworks that reward and reinforce the adaptive capabilities that drive success in our unpredictable world.

Key Takeaways for FP&A Leaders:

Ask yourself: Are you measuring finance teams by their tree-climbing ability when you need them to swim?

Stop measuring forecast accuracy in chaos: When conditions shift weekly, precision rewards the wrong behaviours and punishes adaptive response.

Track time-to-insight, not variance explanations: Measure days from upheaval to updated scenarios, not how close you were to last quarter's obsolete forecast.

Measure decision velocity across your organisation: Speed from insight to action determines competitive outcomes when opportunities emerge or crises hit.

Start with three metrics maximum: System speed, decision velocity, and forward-looking time allocation give you enough signal without overwhelming your team.

Communicate ROI of agility to your board: Translate avoided losses and captured opportunities into language that demonstrates strategic value beyond cost control.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.