In this article, Kevin Phillips explores the CFO’s New Reality: why traditional financial planning can’t keep...

Note: This article reflects conditions as of mid-August 2025. Given the pace of global developments, circumstances may have shifted significantly by the time you read this, which rather proves the point.

In 1900, there were 8,000 motor vehicles in the US. Each vehicle was hand-crafted by a skilled artisan, who looked after every nut, bolt, and panel used. It took weeks and months to build a car. Then, the demand for cars exploded, and the industry wasn’t set up to meet this demand.

Some car manufacturers doubled down on what had always worked for them. They hired more people, built bigger workshops, and worked longer and faster. Spoiler alert: none of these companies is still around today.

By contrast, Henry Ford reimagined the production process. He sacrificed some of the artistry for speed by introducing the production line. This sped up the process exponentially.

By 1918, half the cars on the road were Model Ts. By 1929, five million cars were being manufactured annually.

Beyond meeting immediate customer demand, Ford not only survived the Great Depression but also the 2008 financial crisis. Today, the 122-year-old company is navigating the transformation to electric vehicles and the financial impact of trade policy disruption.

Does this sound familiar? It should if you read the previous article in this series. As accountants, we are at a tipping point. The world is moving faster than the way we traditionally work, and we are running to stand still. We can double down on the way we have always done things, and hope we can get out ahead, or we can, like Ford, look for ways to reimagine how we work, and get out ahead.

The latter is what this article explores: how do we build financial systems that can pivot at the speed of change while maintaining control and accuracy? How can we rethink the architecture of financial planning processes to keep pace with, for example, tariff announcements that change weekly or market volatility that shifts daily?

The solution is integrated modelling – a methodology that's already proven essential for organisations navigating today's changing environment. In a nutshell, this means that instead of relying on detailed line-by-line budgets that can become obsolete before the ink is dry, we use a small set of key assumptions to drive entire financial models automatically.

The Integrated Modelling Approach

Instead of budgeting every account in detail, set up a range of key assumptions, around six to twelve critical drivers that automatically cascade throughout the financial model.

These assumptions will differ from company to company and industry to industry. For example, a company in the capital-intensive goods production sector might create assumptions around raw material, energy, and labour costs, regulatory compliance demands, foreign exchange volatility, and market demand changes. By contrast, a services company might focus its assumptions on headcount numbers and costs, and real estate costs. These very different industries require very different assumptions.

However, when something changes, irrespective of industry, you update the relevant assumption, and this ripples through the 100 to 200 line items in the income statement linked to the assumption. The modelling system recalculates all interdependencies, updates cash flow projections, and provides instant scenario comparisons.

This is the essence of integrated modelling: a small number of carefully chosen assumptions driving what actually happens to your numbers through built-in relationships and dependencies.

The 80/20 Principle in Action

But, on the other hand, not every budget element should be assumption-driven and automated. Some of your costs will still require detailed scrutiny. I’d suggest the key to making integrated modelling work is applying the 80/20 principle. Most organisations find that six to twelve key assumptions will drive approximately 80% of their financial volatility, freeing their accountants up to focus more carefully on the remaining 20%.

For instance, remuneration might be the largest expense in a people-heavy services organisation. This, for the most part, should remain under detailed control with line-by-line oversight. Of course, some payroll elements can be assumption-driven, such as mandatory deductions and annual increases. By comparison, a goods company might need to keep a very tight handle on a volatile commodity essential to its output, and decide to keep this under line-by-line oversight.

As accountants, we need to tap into our training, experience, and strategic position in the company to build the scaffold for an integrated modelling approach.

Speed vs Precision Trade-offs

It is likely that once you look at your forecasts and budgets through this lens, you will find plenty that can be assumption-driven without giving up meaningful control.

Then think about speed. There are likely to be some line items that you would ideally handle in detail, but the time saving you gain from automating them outweighs the accuracy benefit.

The Right Blend

The key is finding the optimal balance for your organisation between being flexible where you need to and having control where you can’t! And our goal should be a blended approach that combines both methodologies in line with your specific sector requirements.

Single-point forecasts for controllable, strategic elements:

Senior management compensation

Major capital projects

Key supplier agreements

Strategic initiative investments

Scenario-based modelling for volatile, market-driven elements:

Energy and commodity costs

Foreign exchange impacts

Demand fluctuations

Capital market volatility

The art lies in knowing which approach to use where.

Technical Requirements to Get this Right

On the tech side, we need to implement integrated modelling systems that can handle complex assumptions, ideally using hierarchies and dependencies to be more efficient and recalculate everything in real-time. Most importantly, they need to present scenarios in formats that non-financial managers can actually use.

Implementation Roadmap

Rome wasn’t built in a day. Take a phased approach to technically implementing the new approach, starting with identifying the six to twelve key assumptions that drive 80% of your volatility. Then build the mathematical connections, pilot with one business unit, and expand gradually to embed integrated modelling as your standard approach for budgeting and forecasting.

The Transformation in Practice

You should start seeing dramatic improvements in both speed and capability:

1. A significant reduction in budgeting time:

By automating the detailed line-item work and focusing human effort on key assumptions and strategic decisions, you can cut traditional budgeting cycles from months to weeks or days – potentially achieving an 80% time saving.

2. Rapid scenario modelling:

Modelling will now take minutes, not days, allowing you to quickly see the impact of regulatory changes, currency fluctuations, or demand shifts.

3. Opportunity capture focus:

Spend more time on identifying opportunities created by market shifts and helping the business respond quickly, instead of being bogged down in variance explanations.

4. Be ready for multiple outcomes:

You can now maintain visibility across multiple realities instead of being tied to a single forecast. This will help your leadership see which strategies are working and make more confident strategic decisions and pivots.

The Competitive Advantage of Speed

Take a moment to think about how this capability can change your responsiveness to current market chaos. According to the 2025 FP&A Trends Survey, only 11% of organisations have fully integrated strategic, financial, and operational planning, leaving most unable to respond quickly when conditions change. And the real clincher is that just 15% of FP&A teams can produce a forecast in under two days, while 29% take more than ten, meaning agile, assumption-driven modelling can deliver a decisive advantage.

So, just like Ford realised that to keep pace with the accelerating demand for cars, it needed to reimagine the fundamentals of how cars are built, we need to acknowledge that external conditions will continue to shift unpredictably. And that we need to rethink our financial architecture to keep pace with this speed of change.

But having the right technical system is only half the battle – implementation success depends on getting your team onboard. In our next article, we'll explore the human side of financial transformation and how to build adaptive finance cultures that make these systems effective.

Key Takeaways for FP&A Leaders

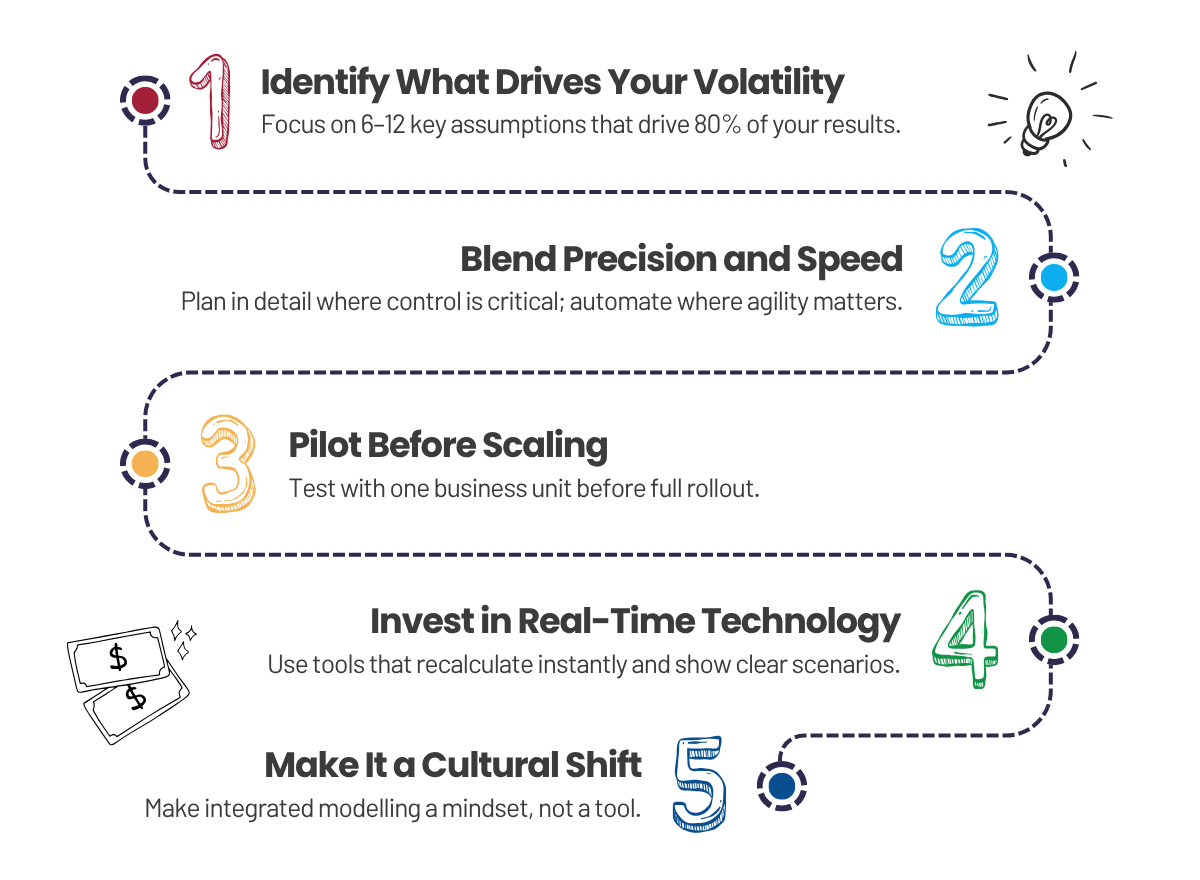

1. Identify the 6 - 12 assumptions that drive 80% of your volatility: focus your modelling here.

2. Blend precision and speed: apply detailed planning where control is critical, and assumption-driven modelling where agility matters most.

3. Pilot before scaling: start with one business unit to refine assumptions and relationships before full rollout.

4. Invest in technology that recalculates in real-time and presents accessible scenarios for decision-makers.

5. Make integrated modelling a cultural shift, not just a technical upgrade.

Source:

1. https://www.statista.com/statistics/1246890/vehicles-use-united-states-historical/

2. https://en.wikipedia.org/wiki/Ford_Motor_Company

3. https://en.wikipedia.org/wiki/Ford_Model_T

4. https://www.ebsco.com/research-starters/history/american-automobile-industry-1920s

5. https://www.britannica.com/technology/automotive-industry

6. https://americanhistory.si.edu/explore/exhibitions/america-on-the-move/online/americans-adopt-auto/building-fixing-cars

7. https://www.detroithistorical.org/learn/online-research/encyclopedia-of-detroit/model-t

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.