FP&A transformation can make the overall finance function more efficient whilst adding more value through analytical...

At the heart of many great organisations lies one pivotal function — Financial Planning & Analysis (FP&A).

At the recent Singapore FP&A Board session, I shared a framework that underpins the transformation we’re seeing in finance today.

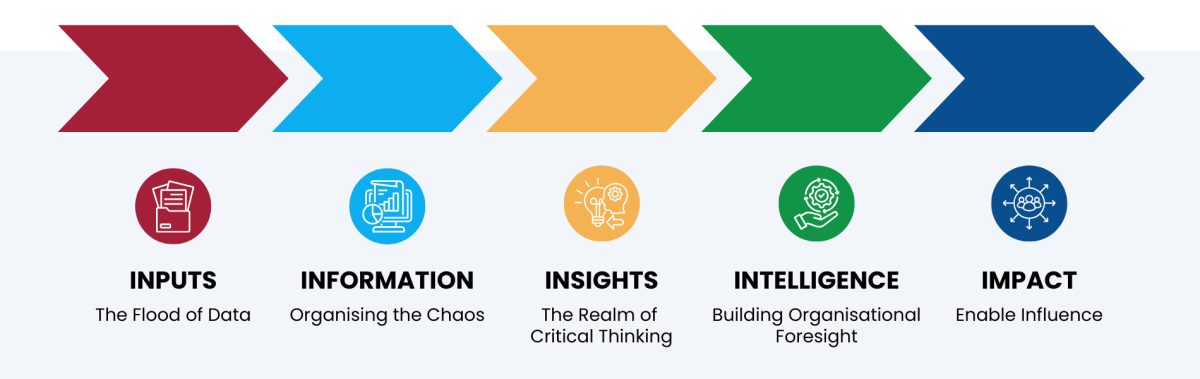

Figure 1 visualises the end-to-end FP&A value path — Input → Information → Insights → Intelligence → Influence. Each stage strengthens the organisation’s ability to make decisions that are not only faster, but also more future-focused.

Figure 1. The End-to-End FP&A Value Path

Figure 1. The End-to-End FP&A Value Path

More than a flow; it is the pathway from raw financial data to strategic financial influence.

1. Inputs: The Flood of Data

In today's digitised environment, we are inundated with many inputs — manpower expenditure, full-time-equivalent headcount, operating expenses, various cost drivers, carbon emission data, cash forecast, R&D burn rates, tariffs, macroeconomic signals, and more. But data alone is not power. Its value is unlocked only when data is structured, cleaned, and contextualised.

At A*STAR, we receive inputs from over 5,700 scientists, engineers and team members, plus various partners and grantees, across many research institutes and national platforms. Our finance team must first ensure inputs are reliable and complete, because the danger is not incomplete data, but in trusting the wrong data.

How-to Checklist for Inputs:

- Define critical data sources upfront (e.g., HR, procurement, R&D labs, sustainability systems).

- Establish clear ownership and accountability for each dataset (who validates, who reports).

- Run regular data quality checks to identify missing values, duplicates, and unusual variances.

2. Information: Organising the Chaos

Inputs become information when structured with purpose. FP&A teams today must master data architecture. A*STAR embedded processes to classify research expenses against various fund sources. Viewed in totality, this stage is about visibility and intentionality. Is the information real-time, business-centric, and transparent?

How-to Checklist for Information:

- Implement standardised reporting templates that align with business objectives.

- Map data into clear categories (e.g., CapEx vs OpEx, research vs admin).

- Use visualisation tools to make raw data immediately understandable.

3. Insights: The Realm of Critical Thinking

Information becomes insight only through analysis, but analysis through critical thinking. At the recent FP&A Board in Singapore, chaired by Larysa Melnychuk, I posed a riddle:

“Three birds are on a tree. A hunter came and shot down a bird. How many are left?”

Many answered zero, because the birds would have heard the gunshot sound or seen friends die, and flown off. However, the correct answer is a question, which depends on context: Are they live-birds? Because if they were wooden birds, it would be two.

This is a metaphor for poor analysis — making assumptions without evidence or a proper understanding of the context. Insight is about challenging assumptions, triangulating causes, and drawing non-obvious conclusions. For example, when a business unit or research institute reports reduced spending, is it due to cost-saving, or is development/innovation slowing? Insight distinguishes surface signals from root patterns. It separates noise from narrative.

How-to Checklist for Insights:

- Always ask the “second question”: What else could explain this trend?

- Triangulate financial results with non-financial data (R&D milestones, hiring patterns, customer feedback).

- Stress-test assumptions by asking: “What if the opposite were true?”

4. Intelligence: Building Organisational Foresight

When insights are used to support decisions, they become intelligence. This is where FP&A evolves into a strategic brain to gather forward-looking information. Intelligence includes Scenario planning that supports the management team in making informed decisions. For example, running simulations that test budget spends under different US tariff possibilities. These analyses provide early-warning signals derived from both research and operational data.

How-to Checklist for Intelligence:

- Build 3–4 scenario models (base, upside, downside, disruption).

- Use leading indicators (e.g., patent filings, grant approvals, energy prices) to flag early risks.

- Translate insights into “if-then” playbooks for management decisions.

5. Impact: Enable Influence

Ultimately, FP&A must move from intelligence to impact. This means influencing various parties to enable and carry out the decisions made by management, e.g., through budget allocation and reallocation, reshaping incentive schemes based on behavioural finance planning, and enabling management to share financial predictions with the board or stakeholders.

Impact is measurable in financial numbers in some cases, but in others, FP&A must consider subjective and qualitative elements.

How-to Checklist for Impact:

- Link financial recommendations directly to business KPIs (revenue growth, time-to-market, carbon footprint reduction).

- Document “decision-to-outcome” pathways — how intelligence influenced a funding or policy choice.

- Establish a feedback loop to measure whether the predicted impact materialised.

Illustrative Example:

At A*STAR, intelligence from scenario analysis revealed that underutilised lab facilities were driving hidden fixed costs, while demand for AI-driven bioinformatics was rising. Based on this foresight, funding was shifted from underused wet labs to high-demand computational research. Within a year, lab utilisation KPIs improved by 18%, and project output per dollar invested rose by 22% — concrete evidence of how FP&A intelligence translated into measurable organisational impact.

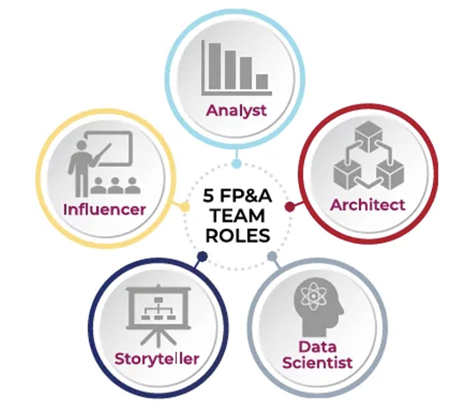

What This Means for FP&A Talent

To operate across the Chain, FP&A professionals must evolve. I would like to refer to the FP&A Board’s models below, as outlined in their recent paper.

Figure 2. Five FP&A Team Roles

This shift demands critical thinking and courage to change.

In Summary – Leadership in the 5I Era

In this new era, we should hire not just for skills, but for judgement, curiosity, and agility. Finance must be the voice that dares to ask:

- “Is this the real problem?”

- “What is the long-term effect?”

- “What’s missing from the model?”

From my time as APAC CFO across multinationals to my current role at A*STAR, one lesson has been constant: the organisations that rise are not those with the most data, but those with the most insight and the courage to change. FP&A can lead that charge.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.