CFOs play a crucial role in driving xP&A transformation, enabling cross-functional collaboration, integrating planning beyond finance...

Introduction: The Promise and Peril of xP&A

Extended Planning and Analysis (xP&A) represents a massive paradigm shift in enterprise management. We are finally moving to break down the functional silos between finance, sales, supply chain, and HR. The promise is transformative: a single, holistic view of the enterprise that allows us to operate from a "single source of truth".

However, I see a widening chasm between this promise and the reality of implementation. Organisations are investing millions, yet many are facing systemic failure. These failures are not an indictment of the xP&A concept itself. Rather, they are the direct result of ignoring a deeply embedded "unspoken prerequisite": the maturity of the end-to-end (E2E) business processes that generate the very data xP&A depends on.

The Anatomy of an xP&A Failure

While we all agree on the strategic value of xP&A, the view from the front lines reveals a stark disconnect. The most pressing challenges for FP&A leaders today aren't high-level strategy; they are foundational data issues. According to the 2025 FP&A Trends Survey, teams still spend a staggering 46% of their time on data collection and validation. This leaves barely half of their capacity for the high-value analysis that xP&A was supposed to enable.

We consistently misdiagnose this problem. Data is not an abstract resource that is simply "clean" or "dirty." Data is the exhaust of an executing business process. If your data is fragmented, it is because your underlying business process is fragmented. A "data silo" is not a technology problem; it is the digital manifestation of a functional silo.

This misdiagnosis leads to the "technology-first" fallacy. I see many organisations rush to implement sophisticated xP&A software, believing the tool itself will solve their alignment problems. However, software vendors often gloss over the effort needed to ensure data quality. When you connect a new platform to disparate, "dirty" data feeds, you don't fix the discrepancies — you automate them. You create a "single source of truth" that is demonstrably wrong, destroying trust and cementing the very silos you meant to destroy.

The Source of Truth: Your Core E2E Processes

The flaw in the technology-first approach is a fundamental misunderstanding of the data supply chain. The xP&A platform is a consumer of data; your E2E processes are the suppliers. To align granular operational plans with financial forecasting, we need operational data that is exclusively generated by core E2E processes. For example, "On Time In Full (OTIF)", a critical driver for revenue predictability, does not originate in the General Ledger; it is the final output of the Order-to-Cash (O2C) process. Similarly, "supplier pricing trends" are the result of the Procure-to-Pay (P2P) process.

You can not implement xP&A in isolation. You can only implement it on top of your existing processes. If the supplier (the process) is dysfunctional, the consumer (the platform) starves.

Case Study in Failure (Revenue): The Broken Order-to-Cash (O2C) Process

The Order-to-Cash (O2C) process is the engine of revenue data, yet it is often riddled with "process break points" like cross-functional silos and weak validation of credit memos. When these underlying processes fracture, they don't just cause operational headaches; they poison the xP&A model in three specific ways:

It overstates revenue: I often see platforms ingest an initial sales order, while the subsequent "credit memo" processed weeks later sits in a disconnected system. Without that process context, the model forecasts revenue that the company will never actually collect.

It misinterprets future demand: In a major post-merger integration I led, we discovered that 18% of credit memos were being processed in a separate legacy system. Our shiny new planning tool was confidently forecasting revenue from customers who had already churned. Why? Because the 'reason code' for those credit memos never reached the planning model. It was a "holistic illusion" that only deep process mining could uncover.

It understates the cost of revenue: When orders break, teams resort to "manual review". This is a massive Cost of Poor Quality, but it is usually buried in a General and Administrative (G&A) cost centre rather than tied to the specific broken order. Consequently, the model understates the true cost of sales and dangerously overstates profitability.

Case Study in Failure (Expense): The Immature Procure-to-Pay (P2P) Process

A parallel failure occurs on the expense side. We rely on Procurement to provide "supplier pricing trends" and "contract obligations" to feed financial forecasts. But if the Procure-to-Pay (P2P) process is immature, those drivers simply don't exist.

Without an automated "three-way match" (linking the Purchase Order, Goods Receipt, and Invoice), Finance doesn't know the true landed cost of inputs.

I witnessed this firsthand at a multi-billion-dollar hardware division. The procurement team had successfully negotiated a 5% cost-down on a key component. However, because the P2P system wasn't configured to track that granular win, the FP&A team was flying blind. They built their forecast using the traditional method: taking last year's budget and adding 3% for inflation. The operational teams were delivering savings, but the financial forecast was predicting cost increases. The "driver-based" platform was rendered useless because the underlying process failed to capture the reality of the business.

The "Garbage In, Garbage Learned" Cascade

This data integrity collapse makes the most valuable features of xP&A, namely Artificial Intelligence (AI) and predictive modelling, actively dangerous.

Predictive technologies require a consistent and reliable taxonomy as a prerequisite. It goes beyond the old adage of "garbage in, garbage out"; we are creating a "garbage in, garbage learned" scenario.

When an AI model trains on "dirty" historical data, it mis-educates itself. It sees a $1M sale in Q1 and a disconnected $100k credit memo in Q2. Lacking process context, the AI learns to overstate revenue systematically. Alternatively, it may perceive a one-off event, such as a rent discount, and incorrectly predict that it will recur. In these cases, the AI hasn't just produced garbage; it has codified your "definition discrepancies" into its core logic, confidently generating forecasts that are systematically flawed.

The Process-First Framework for xP&A Success

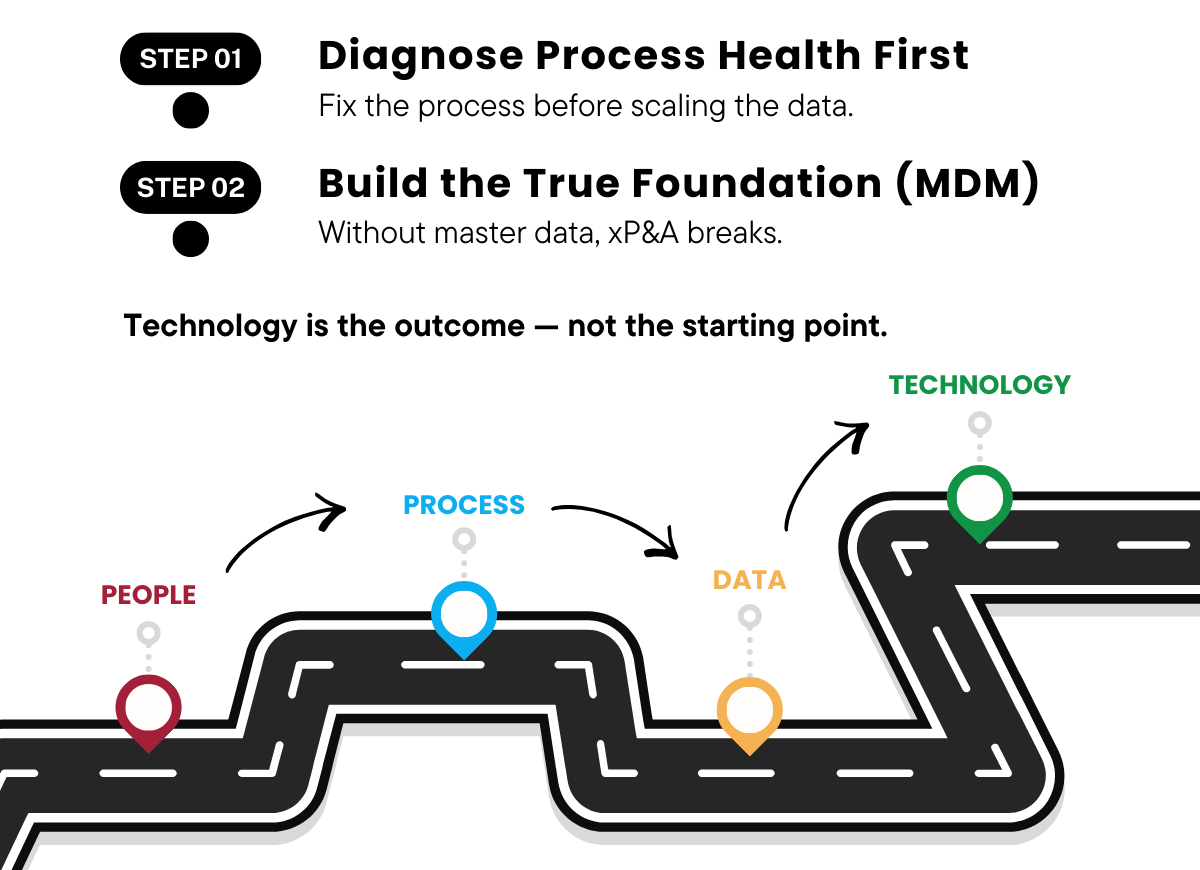

To succeed, we must invert the failed technology-first model. The prerequisite is a "process-first" strategy that stabilises the organisation's operational core before building a planning layer on top of it.

Diagnose process health first: The antidote to the "technology-first" fallacy is Process Mining. Instead of relying on subjective workshops, we must use the digital event logs from existing systems (such as ERP, CRM) to create a "digital twin" of business processes. This allows leadership to objectively quantify bottlenecks, like finding that 40% of all sales orders require manual review, before committing millions to a new platform.

Build the true foundation (MDM): Process maturity is only half the battle. The other half is Master Data Management (MDM). An xP&A platform is not an MDM tool. MDM governs the "nouns" of your business (Customer, Product), while E2E Process Maturity governs the "verbs" (Order, Pay, Ship). An xP&A implementation will fail if either is missing.

This provides a clear roadmap: People, Process, Data, then Technology. The journey begins with people securing buy-in for a process-first transformation. This creates a stable data foundation. Only then should the organisation deploy the technology, which can finally sit on top of a stable core and consume reliable data streams.

Summary

Extended Planning and Analysis is not a project to be implemented; it is a state of maturity to be achieved. The prevalent technology-first approach fails because it fundamentally mistakes the symptom (bad data) for the disease (broken processes).

The xP&A platform is the reward for a transformation that has already begun. The "unspoken prerequisite" for success is the deep, foundational work of stabilising E2E business processes and harmonising master data. Only by building this process-first foundation can we unlock the true promise of a holistic, agile, and predictive enterprise.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.