Introduction

The fourth Riyadh FP&A Board meeting brought together finance leaders for an evening that was both engaging and deeply relevant. Hosted at Regus, the Esplanade, the session explored what strong FP&A storytelling looks like in organisations that are growing quickly and becoming more data-intensive. Participants shared candid observations about the challenges they face, including simplifying complex data, improving narrative clarity, and aligning messages with rapidly changing leadership expectations.

Sponsored by Jedox, in partnership with Michael Page and the International Workplace Group (represented in Saudi Arabia by MEDAD Offices), the meeting blended global lessons with local insights, providing the room with a clear picture of how storytelling is evolving as a core FP&A capability.

Why Storytelling Matters?

In modern FP&A, data alone is not enough. Leaders make better decisions when the story behind the numbers is clear, relevant, and easy to act on. The group discussed how only a fraction of FP&A time is spent on high-value tasks, with much of the workload still tied to data gathering. This makes storytelling even more important: it helps teams cut through noise, focus attention, and guide the business towards what truly matters.

Across 15 global FP&A Board chapters, the same nine storytelling success factors consistently appear: audience, relevance, structure, clarity, engagement, trust, alignment, action, and impact. These themes echoed strongly in Riyadh.

Opening Question: What Makes Storytelling Work?

We opened with a simple question:

“In FP&A storytelling, what’s the critical factor for success?”

Participants responded with a consistent set of themes: communication, simplification, insightful thinking, understanding, visualisation, relevance, and data integrity. These reflections lay the groundwork for a deeper exploration of narrative, visuals, and data.

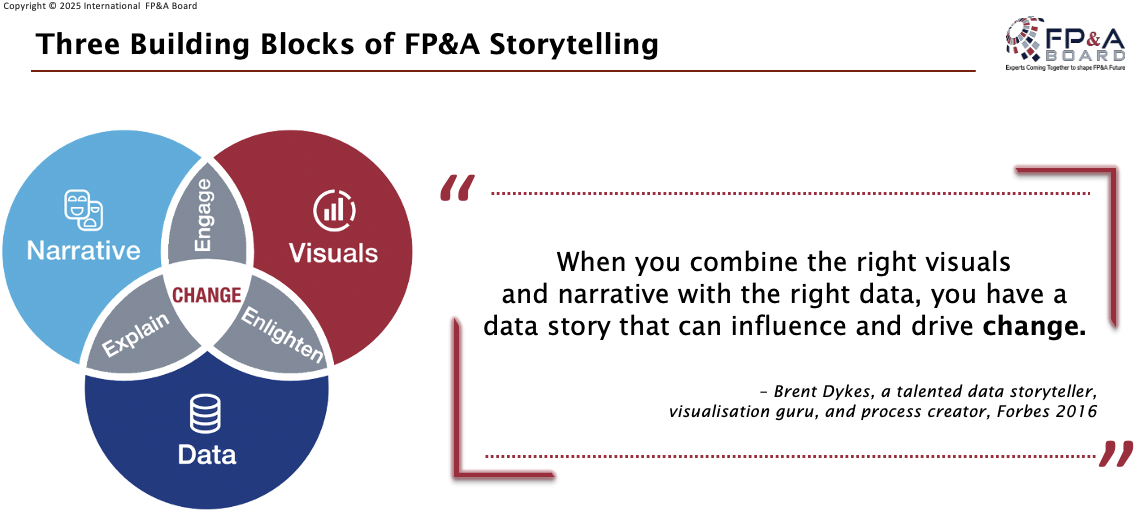

Narrative, Visuals, and Data — The Three Building Blocks

The session explored the three pillars of FP&A storytelling.

Figure 1.

Narrative sets context, frames decisions, and provides structure. The Board revisited the narrative arc: exposition, challenge, insight, and action, and discussed how most FP&A stories skip straight to the numbers, weakening the message.

Visuals should make insights easier, not harder, to understand. Participants reflected on the visualisation maturity matrix and shared experience of charts that confuse rather than clarify.

Data must be trusted, relevant, and timely. Without clean, structured data behind it, even the strongest narrative or visual cannot influence decisions.

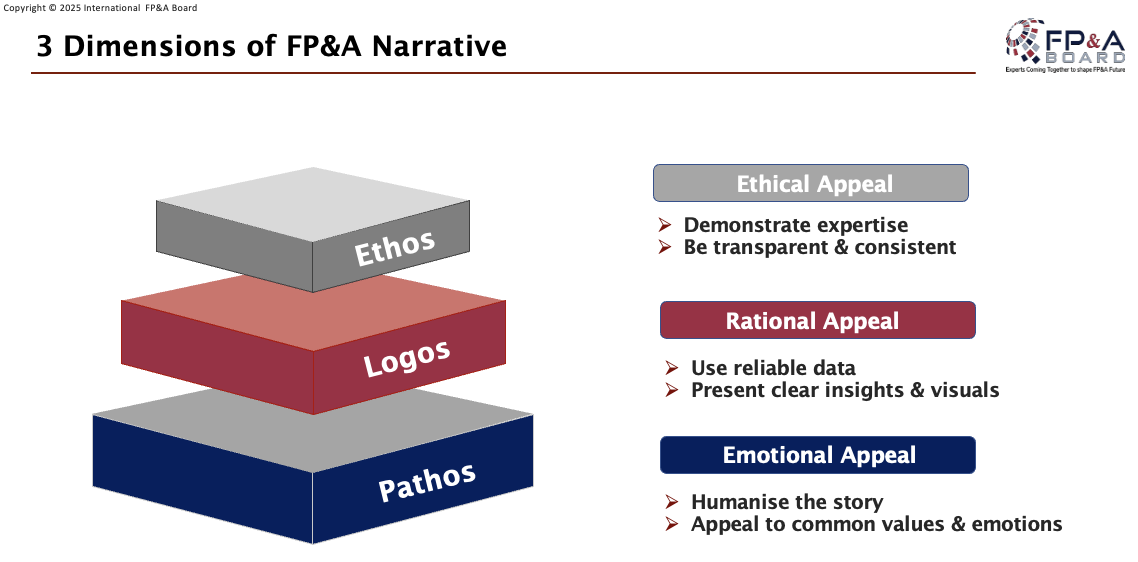

3 Dimensions of FP&A Narrative (Ethos, Logos, Pathos)

The Board discussed how strong storytelling depends on more than numbers. It requires balance across the three dimensions of narrative.

Ethos builds trust through expertise, transparency, and consistency.

Logos is where reliable data, clear insights, and logical structure make the message credible.

Pathos brings the story to life by connecting with shared values and emotions, reminding us that people, not spreadsheets, make decisions.

The strongest FP&A stories use all three, not only the analytical logic we naturally rely on.

Figure 2.

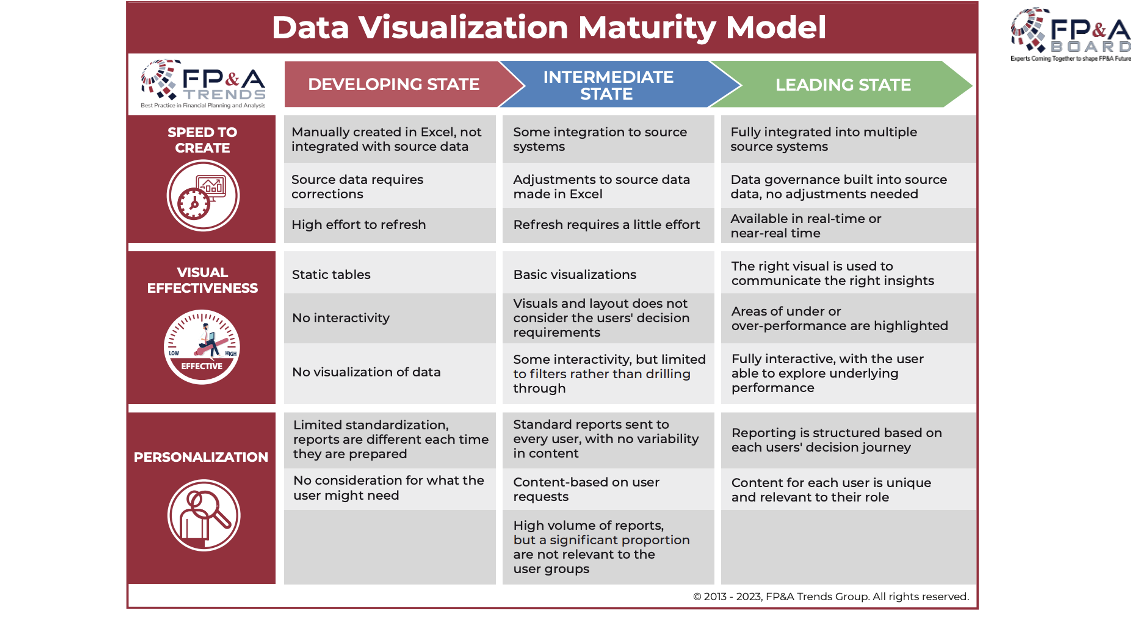

Data Visualisation Maturity Model

Participants explored where their organisations stand in the journey from basic reporting to advanced, insight-driven visualisation.

In the Developing State, visuals are slow to produce, mostly static, and lack relevance.

The Intermediate State introduces some integration and basic charts, but the user experience is still limited.

The Leading State reflects a fully integrated environment where visuals highlight performance, update in real-time, and adapt to each user’s decision-making needs.

The model helped attendees recognise that visual maturity is not about flashy dashboards, it’s about speed, clarity, and relevance.

Figure 3.

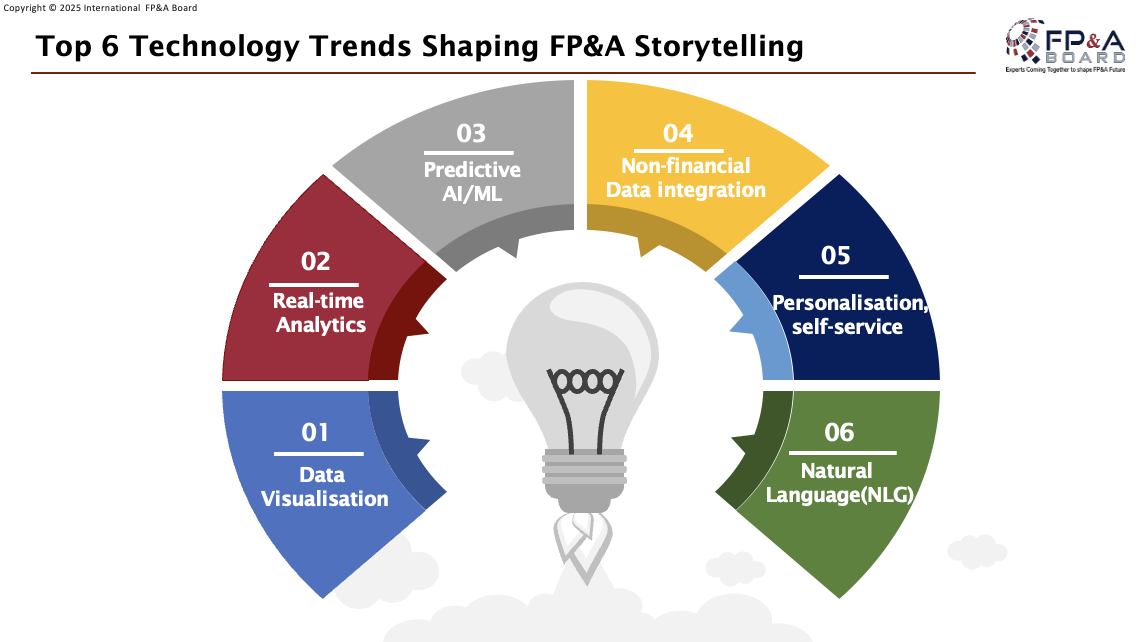

Top 6 Technology Trends Shaping FP&A Storytelling

The group reviewed six technology forces changing how FP&A teams communicate. These included data visualisation, real-time analytics, predictive AI/ML, and non-financial data integration, all of which improve the quality and timeliness of insights.

Personalisation and natural language capabilities are helping FP&A tailor messages to stakeholders and create more intuitive interactions with data.

Collectively, these trends are shifting FP&A from static reporting to dynamic, insight-led storytelling.

Figure 4.

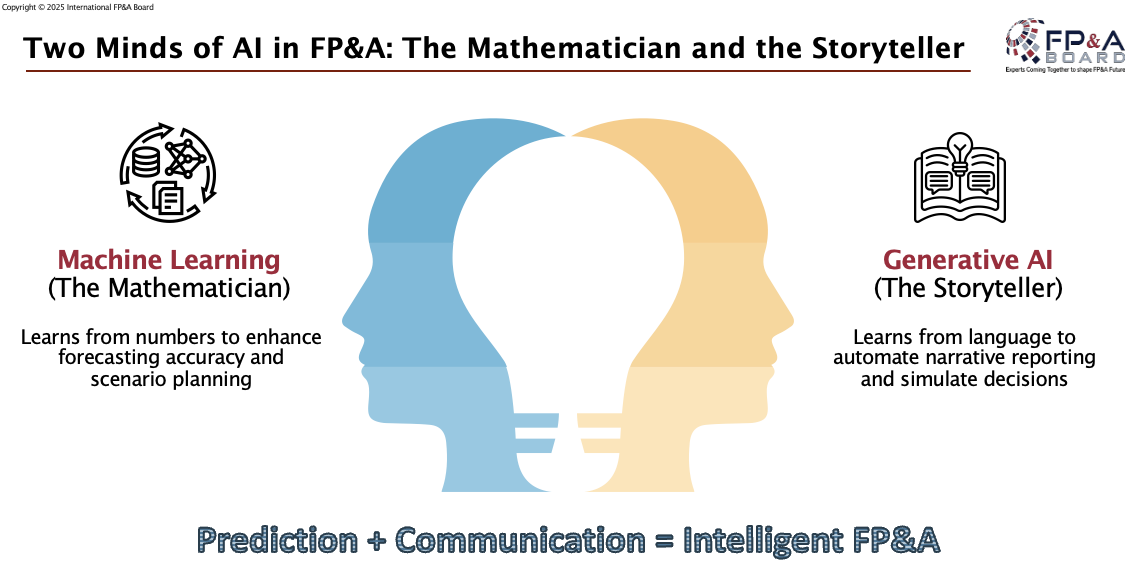

Two Minds of AI: The Mathematician and the Storyteller

Machine Learning serves as the “mathematician,” learning from numbers to strengthen forecasting and scenario planning.

Generative AI behaves as the “storyteller,” learning from language to help FP&A craft narratives, automate reporting, and simulate decisions.

When prediction and communication come together, FP&A becomes more intelligent, capable of producing insights quickly and explaining them clearly.

Figure 5.

Agentic AI as a Storytelling Enhancer

Arun Sadagopan, Regional Director - MEA Jedox, demonstrated how Agentic AI enhances FP&A storytelling by accelerating insight generation and supporting narrative creation. Machine Learning acts as the “mathematician,” while Generative AI becomes the “storyteller,” helping analysts summarise, compare, and communicate more effectively.

The message was clear: AI strengthens storytelling, but human judgment remains at the centre.

Group Work: Key Takeaways from Riyadh

The group work brought together three practical lenses — Narrative, Visuals, and Data and the outputs were simple and aligned.

Group 1 (Narrative) emphasised that every story must start with the audience and the objective. Clear purpose drives clear messaging. They highlighted alignment with the business, strong partnering, and using business acumen to shape a message that is clear, structured, and consistent.

Group 2 (Visuals) focused on choosing the right chart to support the storyline, keeping visuals simple and easy to read, and providing context. They stressed showing transitions, connecting the dots, answering the “so what?”, and designing visuals that are relevant to the audience.

Group 3 (Data) highlighted data quality, including historical trends, summarised insights, and a single source of truth. They emphasised relevant, structured data, and being ready with backup details when needed.

Together, the groups reinforced one key principle: effective FP&A storytelling relies on a clear narrative, simple visuals, and trusted data.

Conclusion

The Riyadh FP&A Board meeting reinforced that storytelling is becoming one of the most important skills in modern finance. In an increasingly automated and data-rich environment, FP&A teams create value not by showing more data, but by providing more meaning. The discussions, case study, and group work all pointed in the same direction: teams that master narrative, visuals, and data supported by smart technology will drive stronger influence and better decisions.

As Riyadh continues its exciting growth journey, FP&A sits at the centre of translating numbers into actions and insights into impact.