Introduction: Strategic Dialogue at the Heart of Finance

The 16th meeting of the Amsterdam FP&A Board brought together 43 senior finance professionals from leading multinational firms, including Johnson Controls, Aon, Sandoz, Kraft Heinz, Unilever, Equinix, Heineken, Coty, and Philips. Held in partnership with Robert Walters and sponsored by Revelwood, this in-person Board was moderated by Hans Gobin, International FP&A Board Ambassador.

Figure 1: Hans Gobin at Amsterdam FP&A Board №16, February 2025

What It Means and Why It Matters

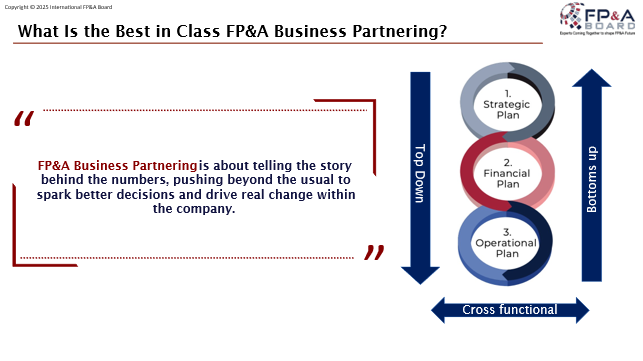

“Business partnering” in FP&A is not a buzzword. It marks a fundamental shift from reporting past performance to becoming a strategic influencer and decision enabler. In today’s business landscape, finance must work across silos, use data to shape direction, and build trust through relevance, not just accuracy. As xP&A and AI reshape finance, FP&A business partnering becomes the linchpin for turning real-time data into strategic clarity.

Best-in-class FP&A teams act as connectors, translating strategy into numbers and numbers into action. They provide insight, influence, and integration — not just information.

Figure 2

The implementation roadmap presented a circular plan connecting strategic goals to execution, reinforcing that business partnering is an ongoing capability, not a one-off project.

Core Attributes of a Best-in-Class FP&A Business Partner

This visual summarised the critical skills of modern FP&A leaders, including influence, curiosity, business acumen, and collaboration.

Figure 3

What Drives Progress?

At the event, participants also discussed a circular implementation plan that connects strategic goals to execution. Figure 4 describes six of the most essential steps.

Figure 4

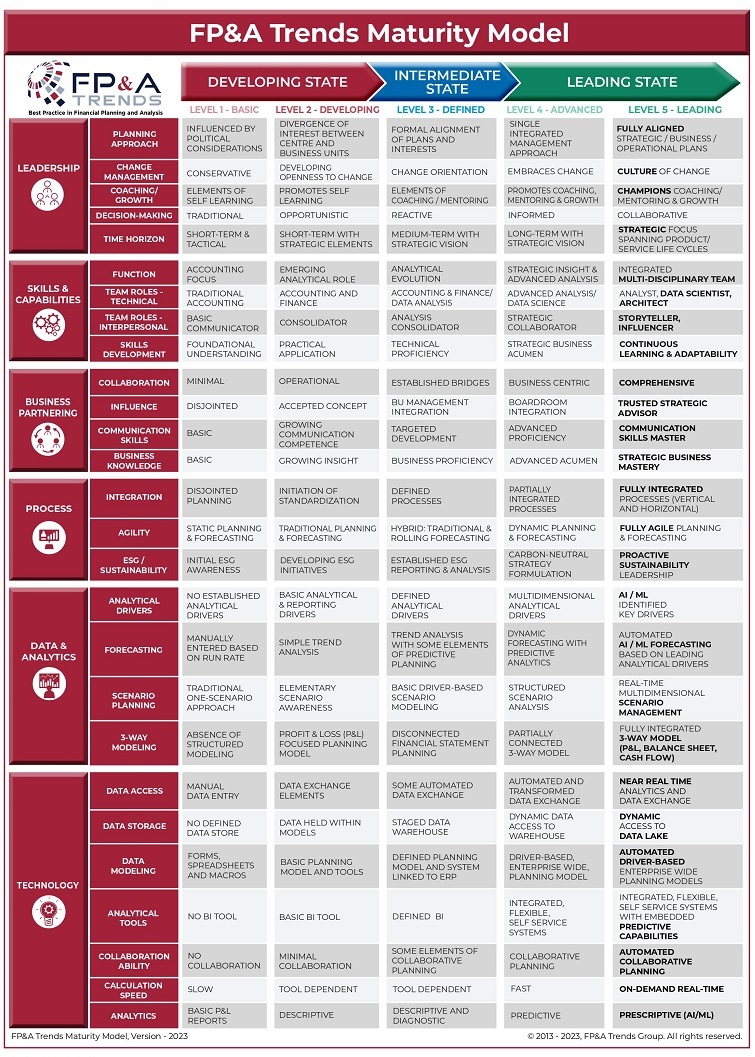

To help frame where teams stand today, the discussion turned to the FP&A Business Partnering Maturity Model — a five-stage framework ranging from “Basic” to “Leading.” Most attendees placed themselves somewhere in the middle. This model served as the central diagnostic framework for assessing an FP&A team’s partnering capability.

Most organisations today sit between Levels 2 and 3, with aspirations to reach 4 or 5. The leap requires both cultural and technical transformation.

Figure 5

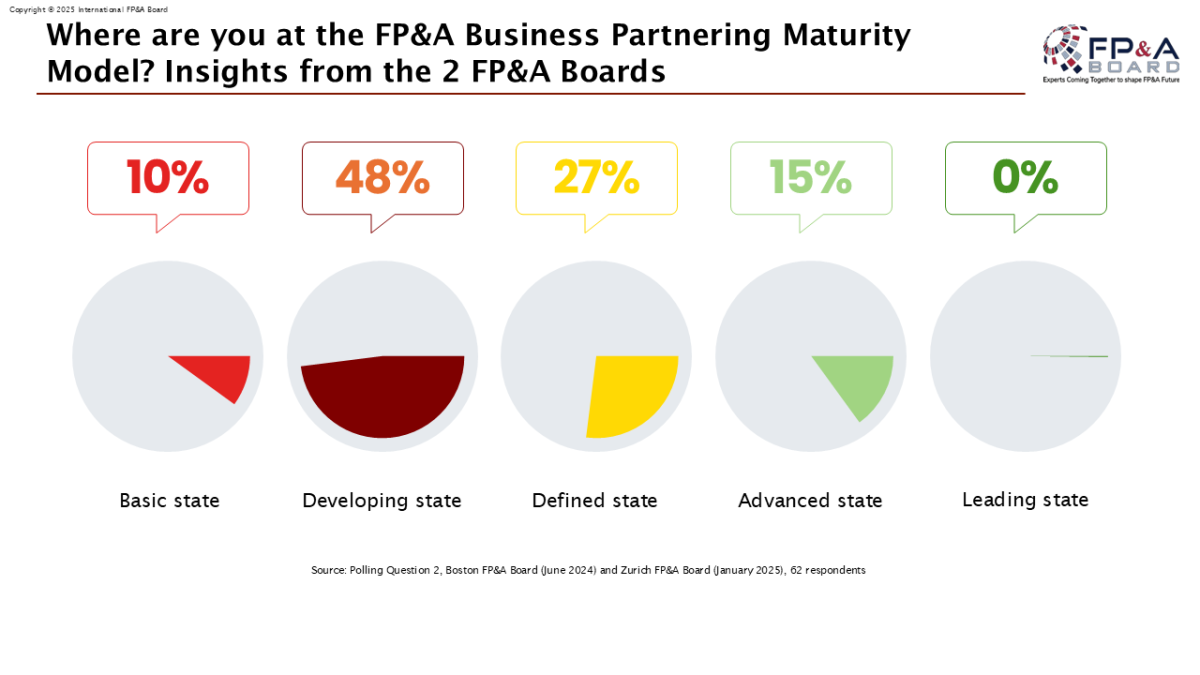

A recent poll from other FP&A Boards (Boston and Zurich) revealed that none of the respondents placed their teams at the ‘Leading’ maturity stage, with the majority identifying as either ‘Developing’ (48%) or ‘Defined’ (27%). This underscores a widespread ambition to progress toward strategic, tech-enabled FP&A business partnering.

Figure 6

Case Studies: Real-World Business Partnering in Action

Unilever – Performance Management Transformation

Oleg Koltsov, Global Head of FP&A at Unilever, shared a powerful example of how his team reimagined performance management. Faced with manual processes, disconnected tools, and slow access to insight, the solution was the Performance Cockpit —a centralised platform designed to reduce effort and speed up decision-making.

Figure 7: Oleg Koltsov shares his practical insights at Amsterdam FP&A Board №16, February 2025

Marco Ruzzante, Head of Procurement Finance — East at Kraft Heinz, presented a case study on how FP&A can provide a competitive advantage, particularly in supporting growth strategy across emerging markets.

Group Work: What Makes Best-in-Class Business Partnering?

Participants were divided into three small working groups to explore core enablers of effective business partnering. Each group tackled a specific theme and shared practical suggestions based on their experiences and collective reflection.

Group 1: Implementing a Best-in-Class FP&A Business Partnering Model

This group focused on aligning FP&A to the wider business context:

- Align business goals with FP&A to ensure relevance and impact

- Start with customer expectations and use SWOT analysis to uncover value

- FP&A must move from transactional to strategic, acting as an influencer

- Position FP&A as a confidence builder, not just a reporter

- Recognise that the journey starts with the right talent—those who understand value drivers

- Ask hard questions: What’s the challenge? Why is it happening?

Technology was also a key theme:

- Integrate real-time data and insight tools to enable faster decision-making

- Build use cases to illustrate value

- Be agile with data, encouraging iteration and feedback

- Improve data correlation, share and evolve findings

- Emphasise focus and prioritisation in what gets measured and communicated

Figure 8: Group Work at Amsterdam FP&A Board №16, February 2025

Group 2: Developing Skills for Effective Business Partnering

This group tackled the practical question: How can FP&A teams build the right skills?

- Encourage FP&A staff to engage with other departments, beyond finance

- Join meetings across the business to improve the information flow

- Let finance teams present findings, not just crunch data

- Cultivate curiosity and exposure to commercial operations

- Foster communication and collaboration, not just technical skill

Key traits identified as critical in a modern partnering team:

- Curiosity

- Communication

- Innovative mindset

- Focus on best practices and benchmarking to accelerate learning

Figure 9: Group Work at Amsterdam FP&A Board №16, February 2025

Group 3: Leveraging AI and Technology for Insightful FP&A

This group explored the question: How can FP&A use AI, automation, and technology to focus less on data gathering and more on insights?

- Use AI to enhance predictive forecasting

- Spot anomalies and identify trends

- Support scenario planning

- Analyse external data

- Leverage assistant tools and language-based interfaces

Key barriers discussed:

- Data complexity and protection

- Change management

- Lack of understanding of what’s possible

- Challenges integrating into the tech stack

Figure 10: Group Work at Amsterdam FP&A Board №16, February 2025

Across all three groups, the tone was practical: transformation is not just about ambition. It requires structure, tools, and, above all, people who can lead through change.

Conclusion: What Comes Next?

This session confirmed something many finance leaders already sense: FP&A business partnering is not a buzzword — it’s a strategic capability that takes real effort to build.

The maturity model gave participants a language to frame where they are. The polls revealed the reality of AI adoption. The case studies provided inspiration. And the group work made it clear: there is no shortcut, but there is a path.

Key takeaway checklist:

- Align FP&A to strategic priorities

- Build talent with curiosity and commercial fluency

- Use real-time insight tools to speed up decisions

- Focus on influence, not just reporting

What’s next? FP&A teams should begin by diagnosing their maturity level, aligning with business leaders on key goals, and developing a roadmap with both cultural and analytical enablers.