The Austin FP&A Board convened on October 23, 2025, at the welcoming offices of Tarvos Talent, marking the final stop of the 2025 American FP&A Tour. The session brought together senior finance leaders from across the region to explore a defining question for the modern finance profession:

How can organisations move from traditional FP&A to Extended Planning and Analysis (xP&A)?

Sponsored by OneStream and hosted in partnership with Tarvos Talent, the meeting was characterised by open dialogue, shared experiences, and a clear sense of momentum toward integrated, cross-functional planning.

Why This Topic Matters

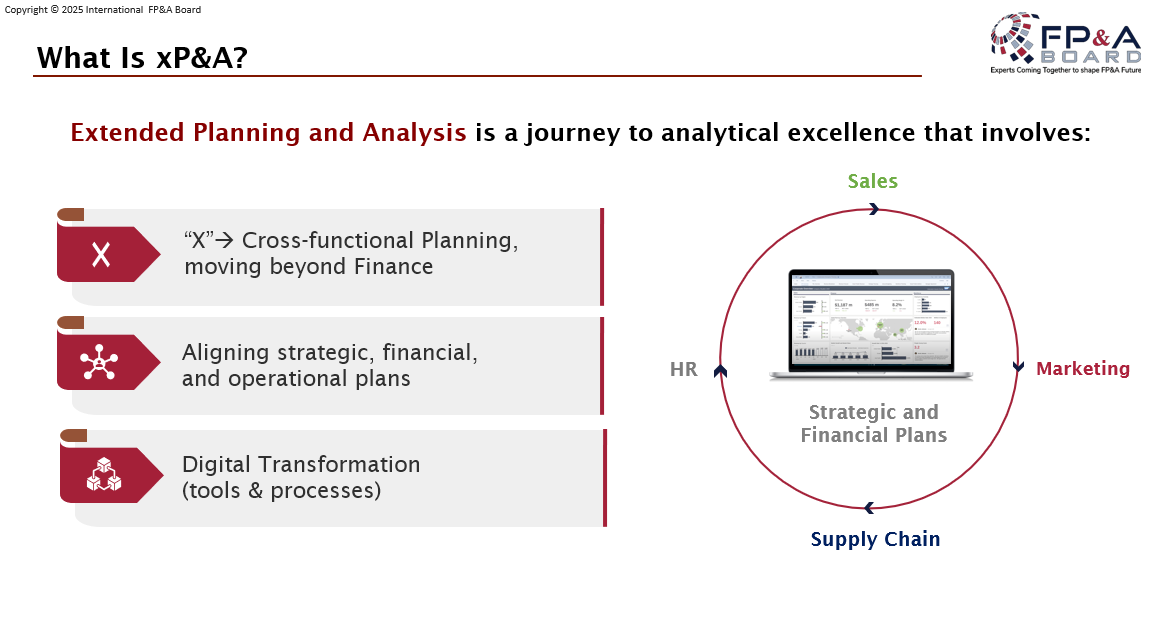

The Austin discussion began with an important reflection: xP&A is not just a rebrand of FP&A — it represents a broader shift in how planning supports decision-making across the enterprise.

Finance today faces growing uncertainty, increasing data complexity, and rising expectations from business partners. Traditional planning cycles and fragmented systems no longer provide the speed or alignment required. xP&A, as participants agreed, is about building a connected ecosystem that unites people, processes, and technology to plan faster, collaborate better, and respond dynamically to change.

Figure 1

The session also drew attention to the challenges that finance teams face globally, including the adoption and integration of AI, system and data consolidation, access to operational data, business partnering, transformation, uncertainty, and developing finance talent.

These themes echoed throughout the session, reinforcing that xP&A is not just a new framework — it is a practical path toward faster, smarter, and more connected planning.

Key Frameworks and Models

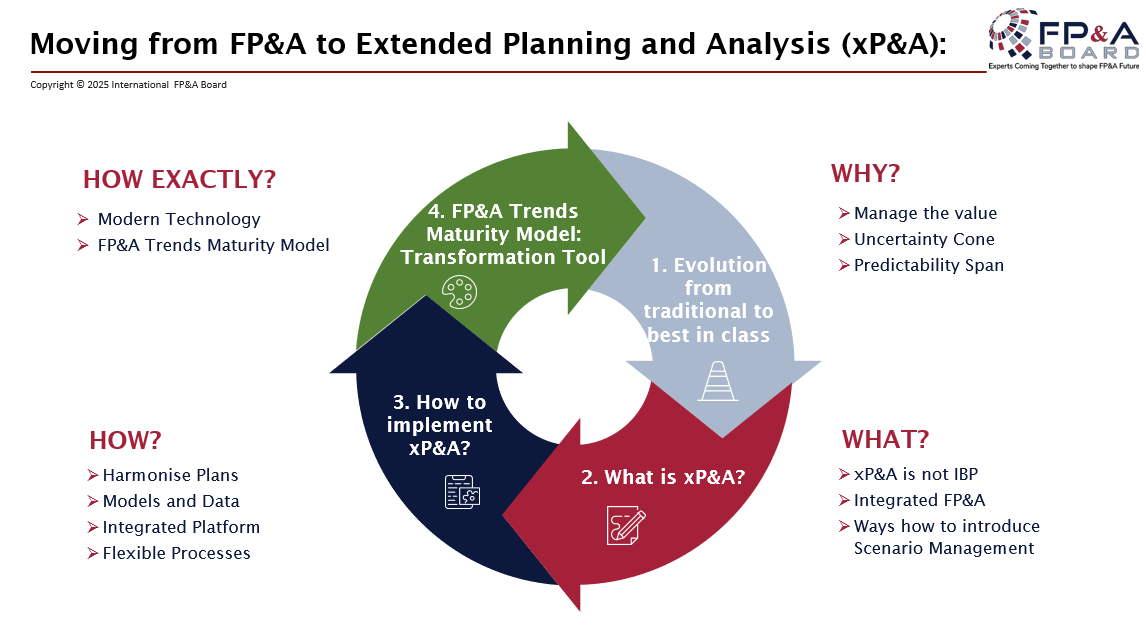

Figure 2

The transition to xP&A is a response to the realities of modern business — constant change, limited predictability, and the growing need for cross-functional alignment.

Participants described xP&A as a journey to analytical excellence, transitioning from siloed financial planning to a continuous, data-driven process that spans the entire enterprise.

Three key ideas shaped the discussion:

- The need for speed and flexibility in planning and forecasting.

- The power of technology and automation to connect systems and enable real-time insights.

- The importance of collaboration and accountability across departments to sustain transformation.

Finance’s role is evolving from information reporting to value creation — helping the business anticipate, not just react.

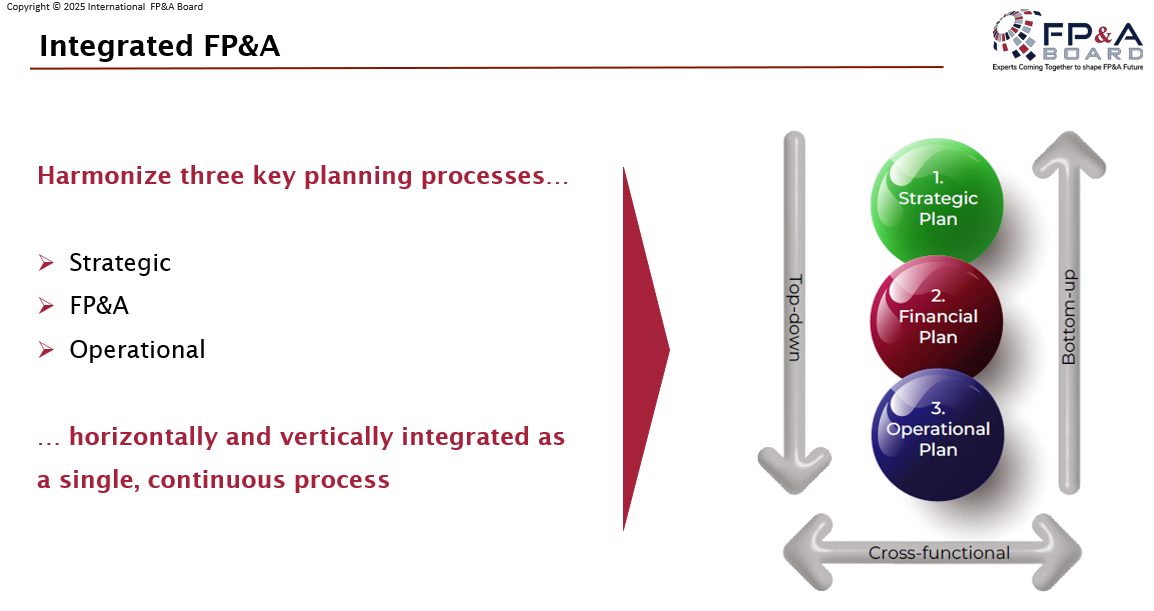

Integrated FP&A

Integrated FP&A formed the foundation of the Austin dialogue. It connects top-down strategy with bottom-up operations, creating a single ecosystem where data, models, and decisions align. Participants emphasised that integration is not purely technical, but about people working with shared goals and consistent data.

Figure 3

Key characteristics of Integrated FP&A discussed in Austin included:

- One version of the truth across finance and operations.

- Transparent, driver-based models that link key business factors.

- A continuous planning process supported by collaboration and agility.

- Clear governance and ownership of data and processes.

Integrated FP&A enables the connection between strategic ambition and operational delivery — the bridge that supports the broader shift to xP&A.

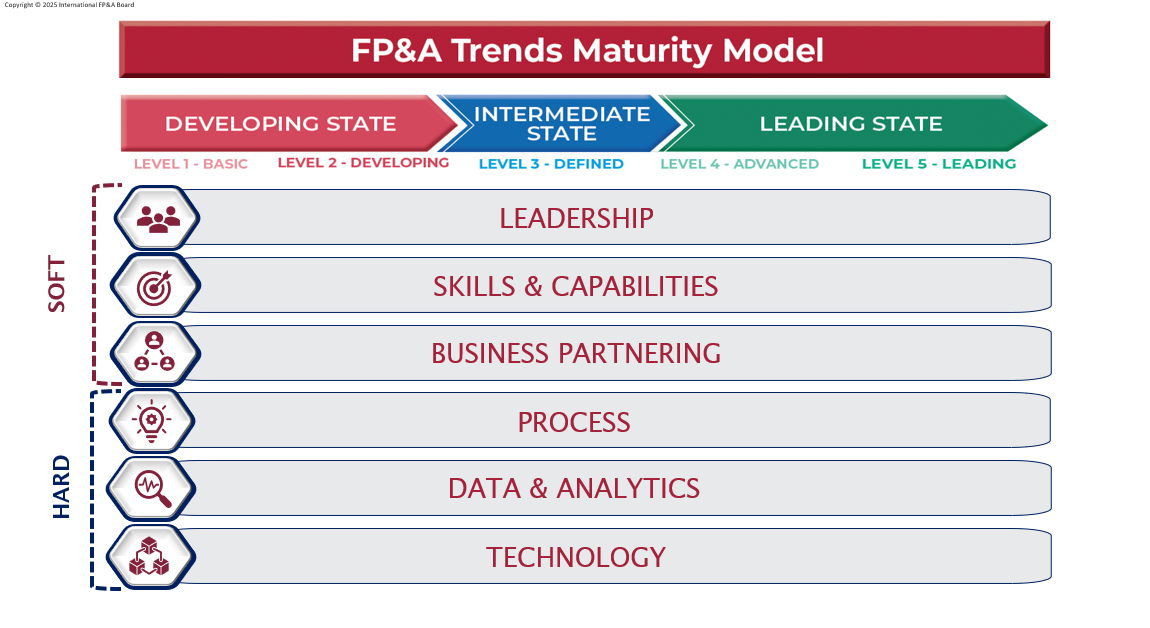

FP&A Trends Maturity Model

Participants used the FP&A Trends Maturity Model as a reference to assess their organisations’ readiness for xP&A. The model describes six dimensions of transformation: leadership, skills, business partnering, data, process, and technology. It shows how finance teams evolve from basic to leading practices.

Figure 4

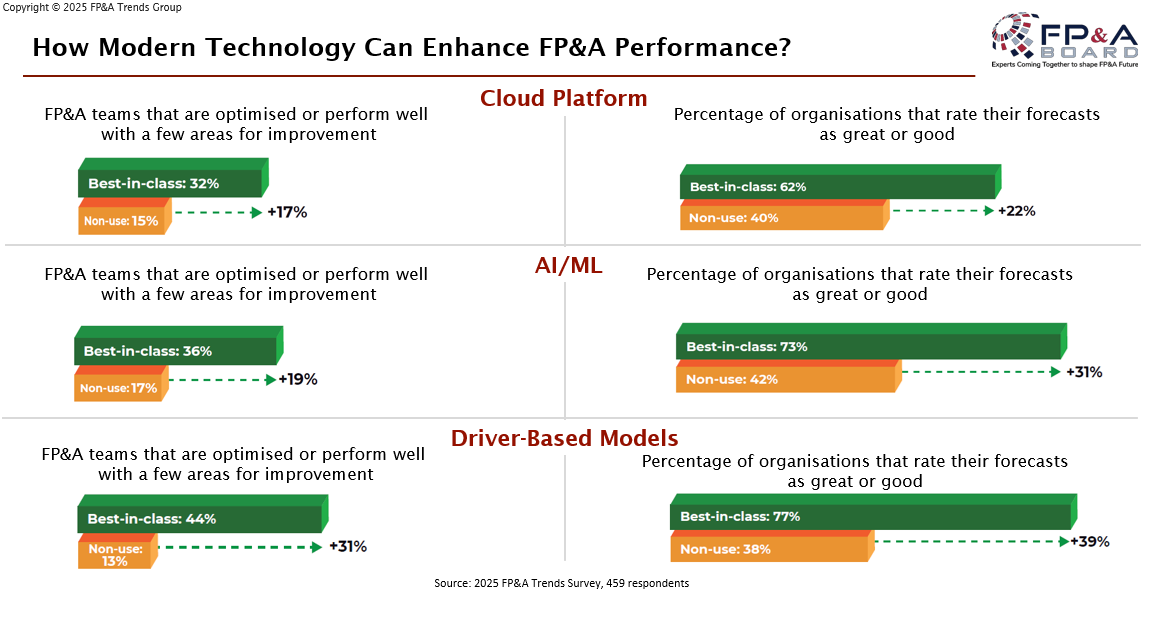

How Modern Technology Enhances FP&A Performance

Technology enablement was a key theme in the Austin discussion. Participants reflected on how Cloud Platforms, AI/ML, and Driver-Based Models are helping finance teams improve performance, agility, and forecast accuracy.

Figure 5

The slide illustrated that FP&A teams using modern tools consistently achieve stronger performance and forecasting outcomes compared to those without them:

- Cloud Platforms show a +22% improvement in forecast accuracy.

- AI/ML adoption drives a +31% uplift in forecast quality.

- Driver-Based Models deliver the strongest impact, with a +39% improvement among best-in-class teams.

The conversation reinforced that while technology provides measurable advantages, its full potential is realised only when paired with the right data, processes, and skills.

Automation and AI were viewed not as replacements for finance professionals but as enablers of faster analysis, improved collaboration, and more confident decision-making.

Group Work Insights

Participants were divided into three breakout groups to define practical steps for implementing xP&A across three key dimensions: Systems & Processes, Data & Models, and People & Culture.

Group 1 – Systems and Processes

- Map and standardise existing systems before automation.

- Build a strategic planning governance structure to ensure alignment.

- Establish a “single source of truth” for all planning data.

- Foster cross-functional collaboration to harmonise processes across business units.

- Drive change management through leadership sponsorship and clear accountability.

Participants agreed that process redesign must precede technology automation, without incurring simplification risks, as this would replicate inefficiency at scale.

Group 2 – Data and Models

- Develop a strategic data approach with clear classification and ownership.

- Prioritise data quality, accessibility, and governance as the foundation of xP&A.

- Create connected, driver-based models that link financial and operational metrics.

- Use technology transition roadmaps to move from spreadsheets to integrated platforms.

- Promote master data management discipline and consistent model definitions.

This group stressed that analytics excellence begins with clean, structured, and owned data — the true enabler of real-time, scenario-based planning.

Group 3 – People and Culture

- Encourage change-embracing leadership and a culture of trust.

- Invest in continuous learning and upskilling, especially in storytelling and data literacy.

- Recruit and retain business-savvy finance talent capable of cross-functional collaboration.

- Strengthen communication and business partnering as core competencies.

- Align incentives around shared vision and accountability for planning outcomes.

The group concluded that xP&A starts with people: technology and processes only succeed when supported by the right skills, motivation, and leadership mindset.

Conclusion

The Austin FP&A Board emphasised that the move to xP&A is not about implementing a new system; it is about redesigning how finance connects with the business.

Success depends on three intertwined dimensions:

- Systems & Processes that are simplified and unified;

- Data & Models that are accurate, integrated, and transparent;

- People & Culture that are empowered, collaborative, and agile.

Participants agreed that finance leaders must champion transformation by combining strategic vision with technical capability and human empathy.

As the final stop of the 2025 American Tour, the Austin Board captured the essence of FP&A’s evolution: from forecasting numbers to orchestrating enterprise performance through integration, insight, and innovation.