Explore how Integrated FP&A empowers organizations to achieve analytical excellence through synchronised planning, driver-based models and...

In today's volatile, uncertain, complex, and ambiguous environment, finance is being asked to go far beyond traditional reporting and forecasting. The business no longer just demands numbers; it requires strategic insight, agility, and forward-thinking decision support. But can FP&A truly deliver this transformative value if it's not integrated?

What Defines Truly Strategic FP&A Business Partnering?

At its core, FP&A business partnering means embedding finance directly into strategic decision-making. It's about working side by side with business stakeholders, offering timely and relevant insights, robust scenario planning, and critical analytical support that directly influences outcomes and drives organisational success.

Yet, a persistent paradox cripples many FP&A teams: as demand for business partnering surges, our professionals often remain bogged down in operational tasks — closing books, reconciling disparate data, and manually generating reports. This operational burden severely limits our strategic contribution and creates frustration for both FP&A teams and our business partners.

To elevate FP&A beyond this reactive state, evolution isn't enough – integration is the critical enabler.

Why Integrated FP&A Isn't Optional for Strategic Partnership

Integrated FP&A is a mindset that moves away from isolated and reactive financial planning to a highly collaborative financial and operational planning approach, where finance works in partnership with business stakeholders on financial planning and investment allocation, leveraging joint tools and systems. I view integrated FP&A as journey, constantly requiring to adjust to evolving context including macro environment, organisational changes and technology available.

Business partnering without true integration remains reactive, fragmented, and often disconnected from broader enterprise priorities. Integration fundamentally transforms FP&A, empowering it to become a proactive, forward-looking, and strategic force.

Yet, according to the 2025 FP&A Trends Survey, only about one in ten organisations has truly integrated their strategic, financial, and operational plans into a single, coherent process. This shows how far most finance teams still are from achieving connected planning and why integration remains the critical enabler for FP&A to play its full strategic role.

Here's how integration changes the game:

Fuels Ambitious Goals: Today’s organisations pursue bold objectives. From Big Hairy Audacious Goals (BHAGs) to multi-year transformations, integrated FP&A provides the robust scenario modelling, agile investment allocation frameworks, and cross-functional alignment necessary for finance to strategically guide resource deployment toward these high-impact aspirations. Supporting a business leader who declared his aspiration to double the advertising business revenue over a 3-year period set clear direction to deploy a financial planning strategy and get buy-in from the broader organisation to partner towards goal achievement, given the in-depth transformation implied.

Enables Agile Investment Decisions: With integrated FP&A, we gain the agility to make timely and effective course corrections to investment allocation across business units and initiatives. New information, whether external (macroeconomic shifts, competitive dynamics) or internal (product performance, customer satisfaction), can be incorporated on time to ensure resources are always driving maximum value and align with long-term strategy. Business volatility associated with tariffs in H1’25 was a great example where successful organisations had to adjust their investment allocation in a timely manner, based on how customers and competitors would respond, while steering in the direction of their own strategy.

Creates Consistency and Capacity: Integrated FP&A processes foster a shared financial language and a single source of truth across regions and business units, driving enterprise-wide efficiency and allowing for a broader perspective to maintain a clear line of sight to strategy. In increasingly global, matrixed structures, the need for consistency is critical and often creates sizable opportunities for efficiency within the team, as well as for leadership. Integration enables scalable, standardised finance operations while retaining the flexibility for unique regional or business-specific needs. This critical balance directly creates capacity within finance, freeing our teams to focus on higher-value strategic analysis and genuine business partnering. I realised that no one is better positioned than our FP&A team to transform our ways of working: empowering team members and leveraging the combined wealth of knowledge is a valuable enabler, resulting in a win-win for finance and the business partners.

Fosters a Data-Driven Culture: Democratising access to consistent, reliable data, integrated FP&A empowers business users to self-serve foundational insights. This allows finance professionals to dedicate their expertise to deep, contextual analysis and strategic recommendations, fostering greater transparency, accountability, and faster, more informed decisions.

- Anchors Strategic Enablement in Systems: Investing upfront in finance systems and infrastructure is not merely an expense, but an imperative. Integrated platforms automate low-value, repetitive tasks, enabling a fundamental shift towards higher-impact analysis. A single source of truth streamlines planning and reporting, cultivates trust, and provides the foundation for a genuine strategic partnership.

Strategic Deployment: Pillars of Integrated FP&A

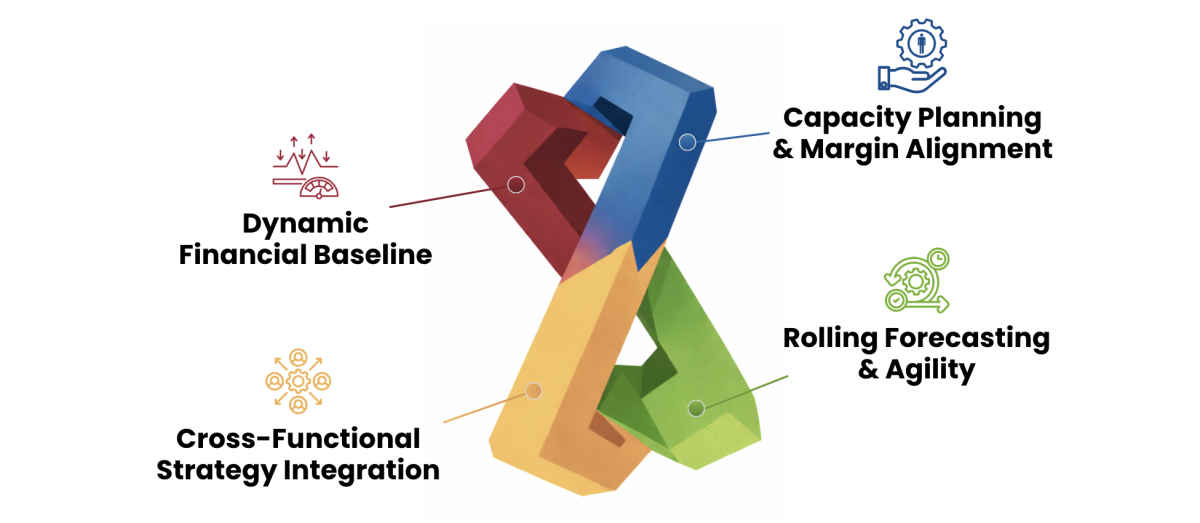

Integrated FP&A connects all layers of planning into one coherent ecosystem. As illustrated in Figure 1, the model rests on four interdependent pillars, each essential for achieving agility, alignment, and strategic impact across the organisation.

Figure 1. Pillars of Integrated FP&A

While the journey to integrated FP&A is unique for every organisation, several foundational pillars enable a successful transformation:

Establish a Robust, Dynamic Financial Baseline: Build a comprehensive financial foundation that isn't static, but dynamically reflects multiple scenarios, macroeconomic trends, competitive shifts (direct and indirect), and the organisation's specific lifecycle stage. This requires deep business knowledge and tight, continuous collaboration with business leaders to underpin all strategic planning.

Embed Finance into Cross-Functional Strategy: Financial planning must be intrinsically aligned with all cross-functional initiatives – from Product and Technology to Sales & Marketing, Operations and Pricing. This deep integration ensures finance actively supports strategic execution and goal attainment, rather than operating in an isolated silo.

Integrate with Capacity Planning and Margin Targets: Embedding FP&A into workforce and capacity planning is crucial. This creates essential visibility into resource constraints and funding thresholds, enabling the execution of a strictly prioritised roadmap and ensuring alignment between financial ambition and operational capability. While AI promises future capacity gains, near-term investment is often required, leading to strategic resource allocation decisions.

Adopt Rolling Forecasts for Agility: Move decisively beyond rigid annual budgets. Embracing rolling forecasts connected with Long-Range Planning enables real-time adaptation to changing market conditions while maintaining focus on strategic direction.

The 2025 FP&A Trends Survey reveals that while nearly half of organisations now forecast monthly, only 15% can produce a forecast in under two days, and 29% still require more than ten days. This highlights how much opportunity remains to build agility into forecasting processes and to better connect short-term forecasts with long-range strategy.

My observation is that establishing a robust yet simple process to provide weekly flash forecasts efficiently focused on the right drivers and data on a weekly basis was a real game-changer in delivering timely and insightful forward-looking projections to support decision-making, while substantially easing the monthly forecasting process, which eventually ran as another weekly refresh.

Navigating Common Challenges: Pathways to Success

Despite widespread recognition of the need for integration, many organisations struggle with execution. Common roadblocks, and how to overcome them, include:

Structural Complexity: Large, matrixed organisations with constant change often result in fragmented processes and systems. While beneficial for scale and innovation, it can hinder accountability and decision agility.

Solution: Focus on standardising core FP&A processes globally first, creating a unified foundation before tackling highly customised areas. In a highly complex context, the risk of getting lost in detail is real and constantly remembering to zoom out and simplify to focus on the main drivers is critical.

Alignment Gaps: Business units operating in silos with sometimes possibly conflicting targets make cross-functional collaboration difficult.

Solution: Position FP&A as the critical bridge — facilitating alignment by translating financial impacts across functions using a consistent framework and driving shared goals through collaborative planning. While alignment within business leaders is non-negotiable, I view the finance channel as playing a key role in reinforcing alignment across functions.

Resource Constraints: Modernising FP&A processes requires upfront investment in systems, data, and talent skills. This is often difficult when teams are already stretched.

Solution: Articulate the clear benefits of these investments, including those in the AI space, in terms of long-term capacity creation, efficiency gains, and enhanced value, making a compelling business case for modernisation. Finance leaders need to encourage team members to dedicate time to learn about how technology can unlock capacity, articulate use cases, and then support implementation.

The Path Forward: Building Customer-Centric FP&A

Integrated FP&A extends beyond internal efficiency; it's about cultivating a finance organisation that genuinely understands the business — its challenges, goals, and most importantly, its customers (our internal business partners) to support strategic planning and execution. The evolution toward integrated FP&A is not merely an option; it is an absolute imperative for finance to fulfil its critical role as a strategic enabler of performance in today's complex and fast-moving world.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.