In this article, the author shares a seven-step roadmap to help finance leaders cut through sprawl...

In a world that changes faster than quarterly forecasts can keep up, the ability to plan for the unexpected has become a defining skill for finance professionals. The FP&A Trends webinar, “From What-If to What’s Next: Scenario Management for Modern FP&A,” explored how finance leaders are embracing scenario management to navigate uncertainty with confidence.

The discussion brought together two experienced voices: Sonia Moscatelli-Diwan, Finance VP at Expedia Group, and Caroline Cramer, FP&A Expert at Planful. Together, they shared real-world perspectives on how finance teams can evolve from traditional planning cycles to agile, forward-looking scenario management.

The conversation resonated with hundreds of FP&A professionals across 59 countries. The same challenge connected them all: how do you plan for what comes next when everything keeps shifting?

Facing Uncertainty with Confidence

If there’s one thing that defines the modern business environment, it’s uncertainty. Market shocks, technological disruption, and shifting customer expectations have made long-term predictability a luxury few can rely on. For finance, this means that traditional forecasting methods, built for stability, must give way to more agile and responsive approaches.

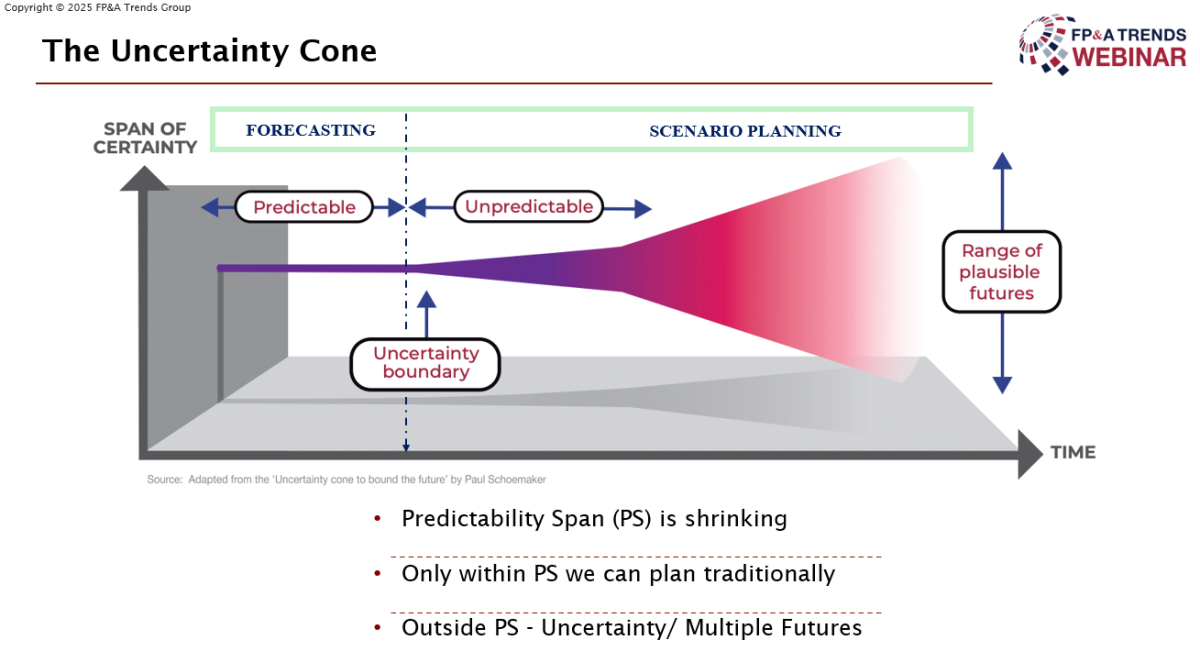

The concept of the Uncertainty Cone effectively captures this reality. The zone of predictability, where outcomes can be planned with confidence, is shrinking. Beyond it lies a broad field of unknowns — multiple futures shaped by economic volatility, competition, and change. Scenario management provides finance with a way to navigate uncertainty with structure and confidence.

Figure 1

The recent 2025 FP&A Trends Survey tells the story clearly:

- Only 9% of teams can run scenarios in real time.

- 14% can do so within a day.

- 57% say the process is still slow and painful.

- 20% can’t run scenarios at all.

The solution lies in agility. Agile FP&A empowers organisations to model, test, and adjust plans quickly, turning uncertainty into insight. Effective scenario management is analytical, multi-dimensional, and collaborative. It brings together data, technology, and people to create a continuous planning culture, rather than a periodic one. As finance becomes more agile, it moves from forecasting the past to shaping the future.

Rethinking Forecasting: Why Scenario Management Matters

Sonia Moscatelli-Diwan, Finance VP at Expedia Group, shared how scenario management has become a core capability within her team. For her, it’s not just a process — it’s a way of thinking that enables FP&A to move from reactive reporting to proactive decision support.

“The limitation of single-point forecasts,” she explained, “is that they become obsolete almost immediately. The world around us changes too quickly for one plan to hold.” Instead, Sonia’s team uses scenario management to bring options and foresight to the table — helping leadership make faster, more informed decisions.

She described how this approach proved invaluable recently with the changes in tariffs brought in by the USA. By running alternative scenarios daily, her team was able to identify risks, adjust pricing strategies, and even uncover new commercial opportunities. Scenario planning, she noted, isn’t about predicting what will happen — it’s about being ready for whatever does.

Sonia emphasised three enablers of effective scenario management:

- Data Quality and Governance – Reliable, well-structured data builds trust and enables faster response.

- Mindset and Leadership – Teams must embrace uncertainty and be comfortable with iteration rather than precision.

- Simplicity and Focus – Start small, avoid overcomplication, and iterate on what works.

Her advice was practical: identify five to ten key business drivers, build frameworks using available technology, and define triggers for switching between scenarios.

She concluded:

“Mindset is everything. Scenario planning isn’t about predicting the future, it’s about being ready for it.”

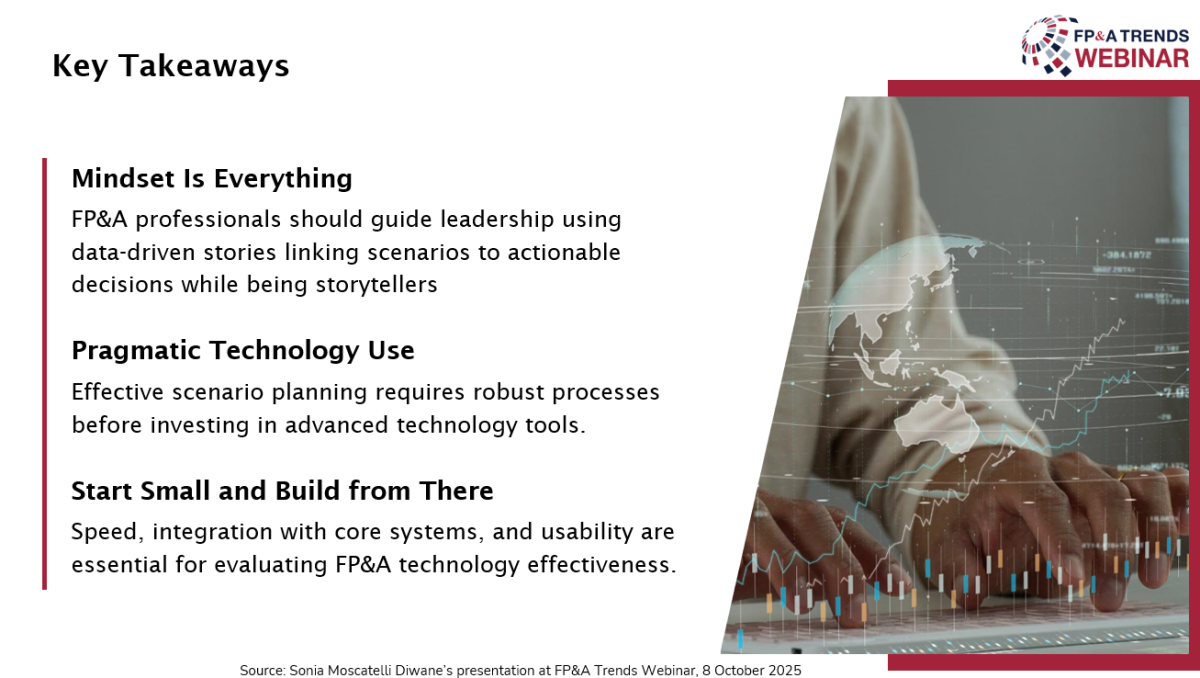

Figure 2

Technology as a Catalyst for Agility

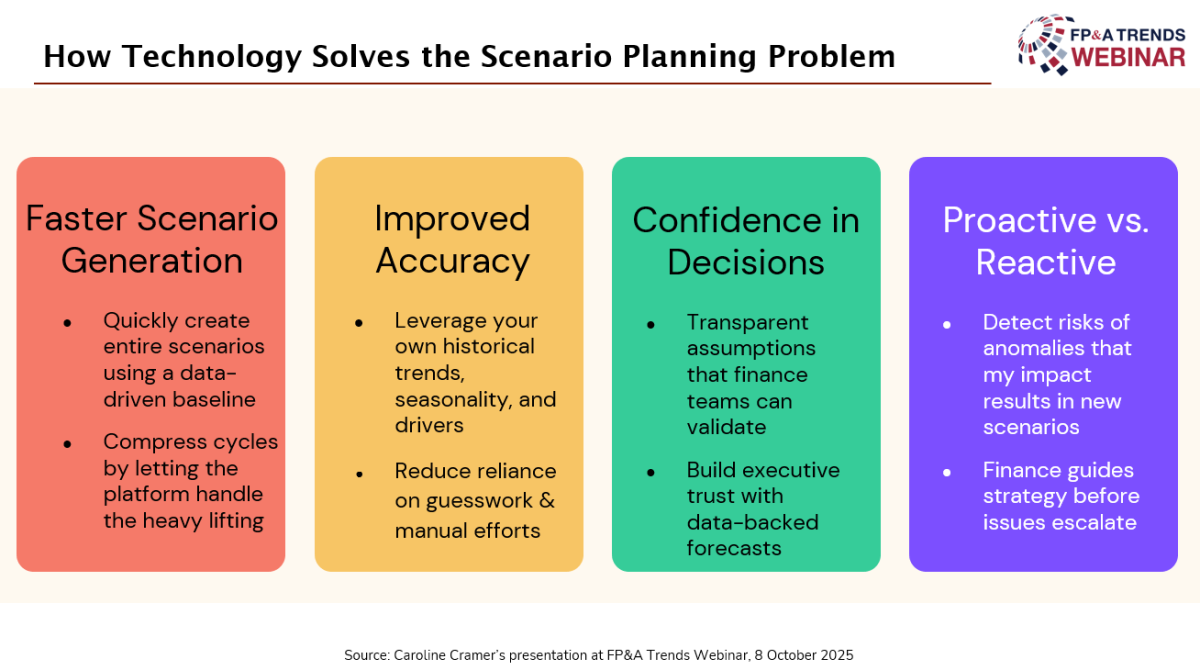

Caroline Cramer from Planful discussed the role of technology in accelerating and enhancing the reliability of scenario planning. Many finance teams still spend hours copying spreadsheets instead of interpreting results. Modern FP&A platforms remove that burden.

By connecting live data from ERP, CRM, and HR systems, teams can now build multiple scenarios in minutes. Caroline highlighted four ways technology is making a difference:

- Speed – Scenarios can be created almost instantly using existing baselines and drivers.

- Accuracy – Live, connected data eliminates version errors and ensures consistency.

- Confidence – Transparent assumptions and auditability build trust in the results.

- Proactivity – Finance teams can anticipate and model risks before they happen.

She also looked ahead to how AI and Machine Learning will further evolve this space, helping FP&A teams detect anomalies, identify key sensitivities, and even generate predictive forecasts automatically. “The real breakthrough,” she said, “is not just efficiency, but what finance can do with the time they get back.”

Figure 3

What Finance Leaders Are Saying

Three short polls during the webinar painted an honest picture of where organisations are today.

- 57% said their scenario process is still time-consuming.

- 20% cannot run scenarios at all.

- Only 23% can do it in less than a day.

When asked about the maturity of their scenario management approach, nearly half (49%) reported that they still rely on Excel-based models, while only 10% operate multi-dimensional, technology-enabled systems. However, there is progress ahead — over half of respondents plan to implement modern scenario technology within the next three years.

These results confirm what many finance leaders already sense: the opportunity for transformation is vast, but it starts with mindset, process, and data. As the discussion revealed, agility in FP&A isn’t just about speed — it’s about enabling finance to influence the future rather than explain the past.

The Balancing Act: Agility, Accuracy, and Adoption

The panel’s Q&A session added further depth to the conversation. One recurring question was how to strike a balance between accuracy and flexibility. Sonia noted that while accuracy will always matter, adaptability and responsiveness are what truly enable finance to add value in volatile environments. She added:

“We’ll be rewarded, not for being perfect, but for adjusting fast.”

Regarding AI and compliance, Caroline reassured participants that modern FP&A platforms are designed with strict data governance in mind. “Your data stays yours — it’s never shared externally,” she explained, emphasising the importance of due diligence when selecting technology partners.

The discussion also touched on longer-term planning. Sonia highlighted how scenario thinking enhances not only short-term forecasting but also three- to five-year strategic planning.

Sonia highlighted:

“It helps leadership visualise multiple futures and choose the right balance between risk and opportunity.”

Looking Ahead: The Human Side of FP&A Transformation

The biggest insight from the session was: the future of FP&A is not defined by tools or templates, but by people. Agility starts with mindset, encouraging teams to test, learn, and stay curious.

Key takeaways from the discussion:

- Mindset Over Mechanics – Agility is a cultural shift as much as a process change.

- Start Small, Scale Fast – Pilot, prove, and expand rather than waiting for perfection.

- Technology as an Enabler – The right tools accelerate insight without adding complexity.

- Collaboration and Storytelling – FP&A’s most significant power lies in connecting numbers to narrative.

One speaker said:

“Scenario planning isn’t about predicting the future but about being ready for it.”

And when finance teams combine foresight with flexibility, they don’t just plan better, they lead better.

Special thanks to Planful for sponsoring this session, and to all the finance professionals shaping the next chapter of intelligent planning.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.