Discover how FP&A professionals can lead digital transformation by integrating AI, Power BI, automation and continuous...

FP&A teams are under growing pressure to deliver faster, sharper insights and support more agile decision-making as expectations rise. Yet, according to the 2024 FP&A Trends Survey, 46% of organisations still aren't fully leveraging data to inform strategic decisions.

Senior finance leaders and industry experts gathered at the FP&A Trends webinar on 18 June 2025 to examine what's holding teams back- and how to accelerate progress. The session explored actionable strategies, practical tools, and highlights from the newly released FP&A Trends Insights Paper on Analytical Transformation, providing finance professionals with a roadmap for moving from reactive reporting to proactive, insight-driven planning.

Navigating the Investment Priorities of FP&A

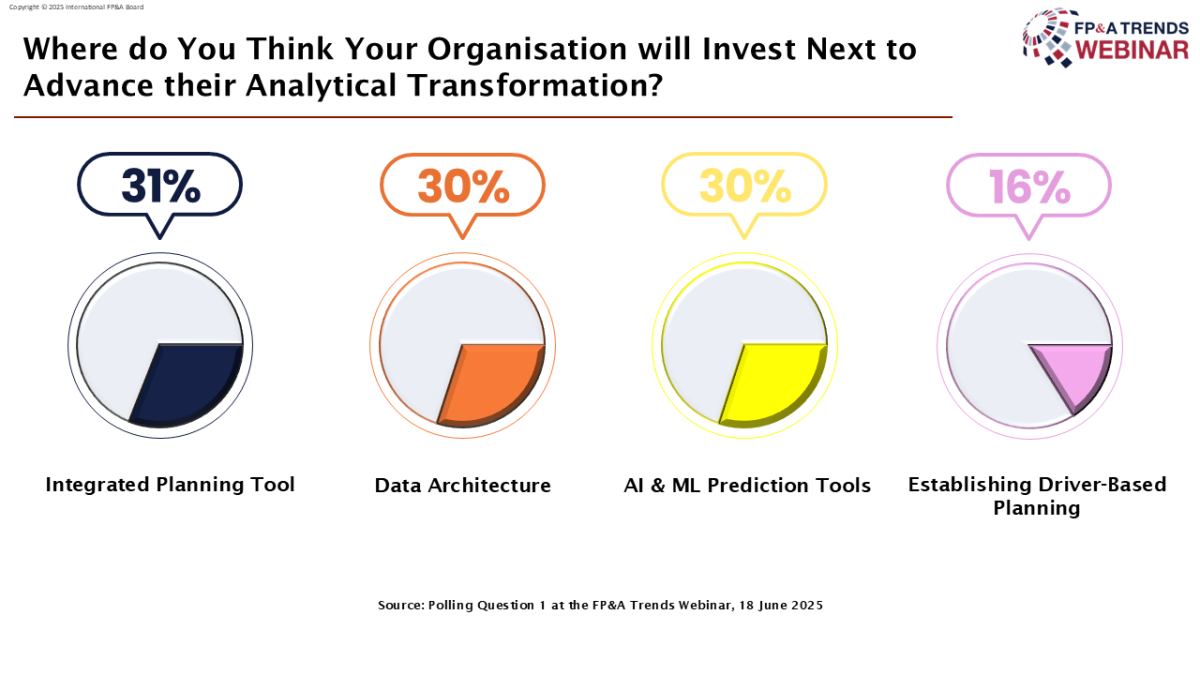

A live poll during the session revealed a telling split in where organisations place their next bets in analytical transformation. When asked where their company plans to invest next, 31% of participants cited Integrated Planning Tools as their top priority, followed closely by Data Architecture (30%) and AI & ML prediction tools (23%). Surprisingly, Driver-Based Planning trailed at just 16% of responses.

Figure 1

These results underscore the shift toward unifying fragmented planning systems and leveraging AI-powered capabilities, while foundational practices like Driver-Based Planning still await broader adoption.

Driving Growth with the FP&A Maturity Model

Matt Poleski, Regional CFO at Arthur J. Gallagher & Co., offered a practical look at how his team uses the FP&A Maturity Model to support continuous growth and improvement. For Gallagher& Co., the model is not a checklist, but a mindset. Matt shared that it's about asking, "How do we get 10% better daily?"

Putting the Model into Practice

At Gallagher & Co., the model acts as a foundation for strengthening strategic planning, change leadership, and business decision-making. It reinforces the importance of strategy-led plans, grounded in meaningful data rather than internal politics. This structured approach enables FP&A to deepen its role as a trusted advisor to the business.

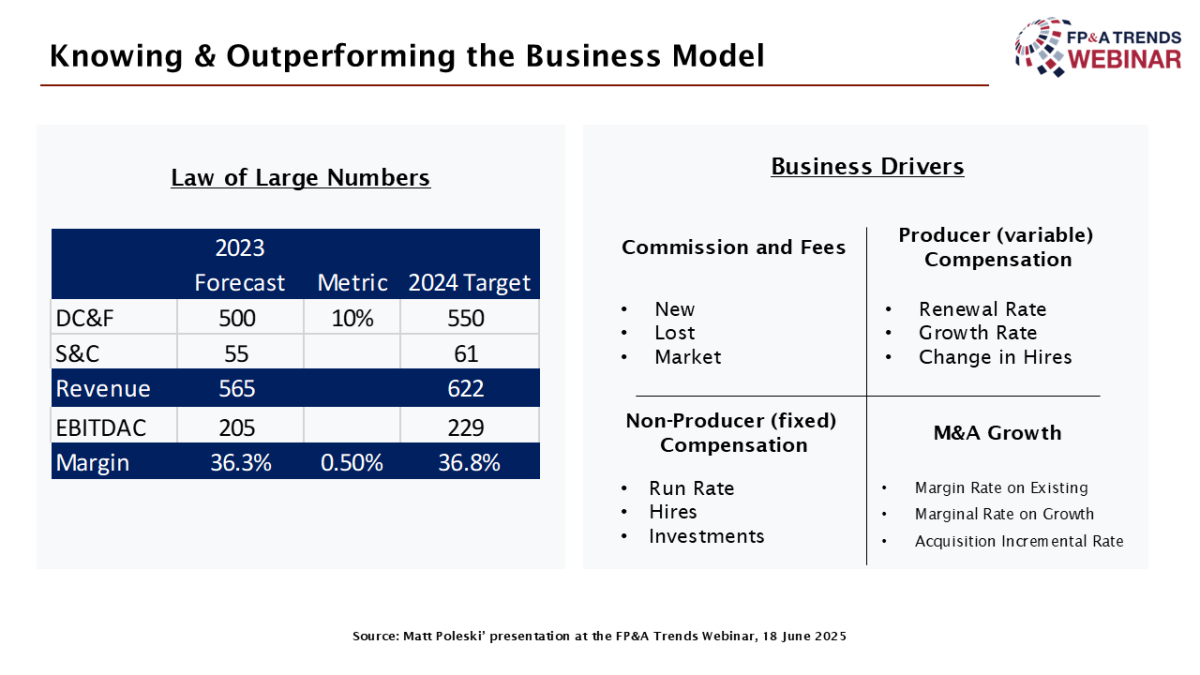

Matt emphasised that performance metrics must go beyond the top line. Rather than focusing solely on the P&L, his team zooms in on actionable drivers: customer acquisition, retention, pricing shifts, compensation plans, and M&A activity. These are the levers that enable real impact.

Figure 2

Five Roles Behind FP&A Success

Matt outlined five essential roles that enable his FP&A team to create value:

- Storyteller – Framing insights with compelling narratives that spotlight challenges, opportunities, and business impact.

- Influencer – Engaging across the organisation to build partnerships and drive change.

- Architect – Aligning org structures and incentives with business strategy.

- Analyst & Data Scientist – Generating trusted insights that fuel smarter decisions.

Rethinking Financial Views

Another tip from Matt Poleski: avoid static snapshots. Gallagher& Co., uses rolling 12-month views to better track momentum, reduce seasonal noise, and uncover performance patterns. It's a smarter way to connect short-term movements with long-term strategy.

Building a Culture of Progress

For Gallagher& Co., the FP&A Maturity Model is more than a diagnostic tool — it's a guide for building a smarter, more responsive finance function. The team continuously raises the bar by focusing on small, daily improvements.

Addressing the Core FP&A Pain Points

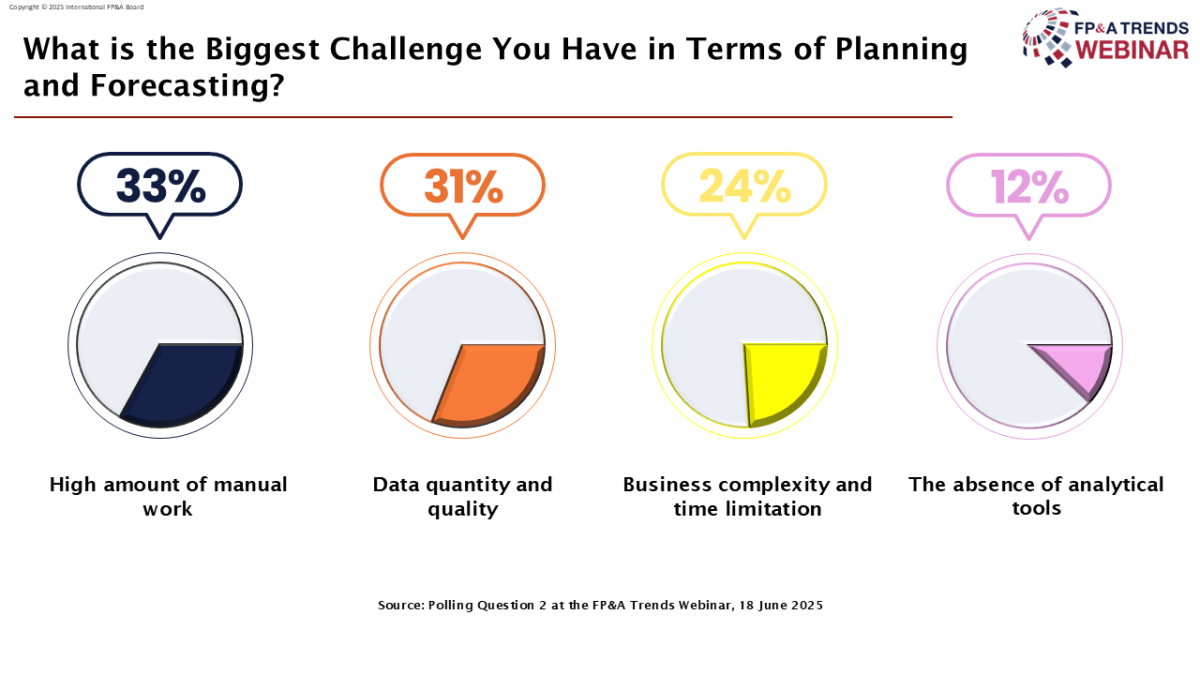

Another live poll during the webinar provided insight into what's holding FP&A teams back operationally. The most significant challenge reported was the high amount of manual work (33%), closely followed by concerns over data quantity and quality (31%). Business complexity and time limitations (24%) also ranked high, while only 12% cited the absence of analytical tools as the primary issue.

Figure 3

These insights reflect a maturity gap: while advanced tools exist, many organisations are still struggling with fundamental barriers like data readiness and workflow inefficiencies.

Data Excellence at DB Regio AG: A Case Study

Tanja Schlesinger, VP at Deutsche Bahn Group, shared a powerful case study on how DB Regio AG is strengthening data quality to drive more effective FP&A. As one of Europe's leading public transport providers, her team faced a familiar challenge: unreliable data standing in the way of strategic progress.

Figure 4

Data Ownership Starts with Process Ownership

Rather than treating data issues as isolated technical faults, the team recognised a deeper link: data quality depends on process quality. That insight led to a clear shift: aligning data ownership with process ownership.

A four-step approach helped bring this to life:

- Map the data flow

- Identify quality gaps

- Define KPIs and data quality standards

- Build a support team to drive change

These "data stories" were documented and shared across the business to foster visibility and shared accountability.

Tracking What Matters Most

With over 150 processes mapped, a KPI dashboard now tracks improvements in data quality. The initial focus? The processes are most critical to business success. As Tanja explained, transformation isn't about doing everything at once but starting where it matters.

Strategic Impact through Better Data

For DB Regio AG, master data quality in areas like fleet management and maintenance planning directly influences EBIT. Poor data has real financial consequences, from delayed maintenance to inaccurate claims.

The team built a decentralised support structure to fix this: a central data owner working closely with regional stewards across 12 business units. They addressed pain points, secured leadership buy-in, and rolled out AI tools — all with strong involvement from operations.

Three Lessons from the Journey

- Link data to process ownership – Accountability is key.

- Customise onboarding – Each function has different needs.

- Think beyond tech – Data excellence is a cultural and analytical shift, not just an IT project.

Tanja's message: becoming data-driven starts with people and process — technology supports but doesn't lead.

Solving FP&A Pain Points with Technology: Insights from SAP

Chris Clay, Senior Director at SAP's Global Centre of Excellence, shared how technology is helping FP&A teams overcome some of their biggest challenges, from manual work and fragmented tools to static planning cycles.

Figure 5

Shifting from Retrospective to Predictive

Chris began by highlighting a core challenge: most businesses generate vast amounts of data across functions like sales, HR, IT, and supply chain, but struggle to use it effectively. While traditional reporting is backward-looking, today's FP&A must look forward.

With intelligent systems, FP&A can now automate manual tasks, reduce reconciliation time, and shift focus to forecasting, scenario modelling, and insight generation. The goal is smarter planning, not just faster reporting.

The Rise of Extended Planning & Analysis (xP&A)

Chris introduced the concept of xP&A, an integrated approach that brings financial and operational planning into one cohesive framework. Whether aligning workforce plans with financial targets or syncing demand planning with supply capabilities, xP&A enables strategic alignment across the business.

What Modern Technology Must Deliver

To support this shift, Chris outlined six capabilities today's FP&A platforms should offer:

- Flexible business modelling

- Robust profitability analysis

- AI-powered predictive forecasting

- Agile scenario planning

- Embedded visualisation and reporting

- Seamless cross-functional collaboration

He also emphasised the importance of pre-built content and best-practice templates to help organisations get started quickly and drive adoption.

Tech + Talent = Future-Ready FP&A

While advanced tools are vital, Chris reminded attendees that human insight remains critical. Technology can model possibilities, but people bring context, like upcoming tariffs, competitor moves, or product launches.

Chris's key message is that technology should empower finance professionals to spend less time wrangling data and more time shaping the future.

Key Takeaways from the Panel

Matt: Continuous improvement drives long-term success — focus on incremental progress using the FP&A maturity model.

Tanja: Data quality is foundational — start with ownership and build momentum from the processes that matter most.

Chris: Don't wait for perfection — ake small, meaningful steps toward smarter planning with the right technology.

We especially thank SAP, our technology sponsor, and all the speakers for their insights and leadership on the future of FP&A.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.