This article explores how leading finance teams are rethinking JIT, adopting AI scenario planning, and doubling...

FP&A has evolved quietly over the years. Not because we use different tools, but because the business now expects something different from the function.

The role started with stewardship and was part of the controller’s office. Getting the numbers right. Building credibility through accuracy, control, and consistency. That foundation still matters. If the numbers are not right, nothing else in the process really matters.

Over time, the focus expanded into budgeting, forecasting, and explaining variances. Useful work, albeit still focused on explaining what had already happened. Thanks to Excel Revolution.

Today, the expectations are higher, and it has become a “must-have” rather than a “nice-to-have”. FP&A is expected to support strategic decisions and, in many cases, help shape them. In my experience, the value of FP&A increases when it is embedded in the decision process rather than brought in at the end. That is when the function moves from reactive reporting to proactive shaping.

The Natural Evolution of FP&A

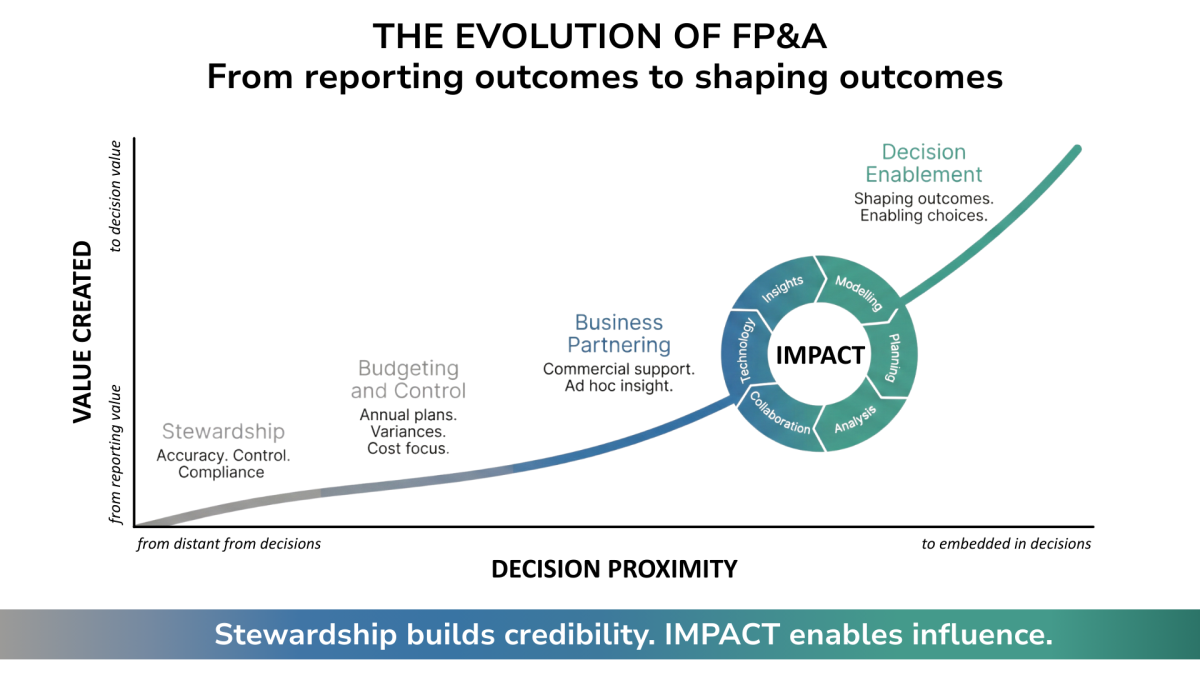

Most finance functions follow a similar journey. It starts with stewardship, focused on accuracy, control, and compliance. This is where credibility is built.

Then comes budgeting and control. Annual plans, variances, and cost focus become the rhythm of the business.

As organisations grow, FP&A moves closer to the business. Business partnering emerges. There are more commercial conversations and more ad hoc analysis.

The real shift happens when FP&A becomes embedded in decision-making. This is where the function moves from reporting outcomes to shaping them.

Figure 1

Strategic Decision Support Is not about Better Spreadsheets

There is a common misconception that strategic decision support is about sophisticated financial models, heavy data crunching, or beautiful dashboards with hundreds of KPIs that no one really looks at.

In reality, good strategic support does not start with Excel. It starts with understanding what problem the business is actually trying to solve and what value an initiative is meant to create.

Take a simple example. A company wants to expand into another region. The typical response is to jump straight into building a model with broad assumptions.

But before doing that, FP&A needs to understand the rationale.

Is there a proven market in the region?

Who is currently providing the product or service?

How can we leverage our existing resources to test the waters?

What is the minimum viable project before committing more capital?

What does success look like and over what timeframe?

This thinking does not come when FP&A builds the model in isolation. It comes from collaborating with the business and asking the right questions.

Only after this is clear does the modelling make sense. At that point, the job is not about arriving at a number in Excel. It is about converting a possible outcome into a number after considering practical assumptions and real-world constraints.

Analysis in this context does not need huge amounts of data. It needs the right data, framed in the right way, and grounded in how the business actually works.

The Capabilities that Make the Difference: IMPACT

Over time, I have noticed that FP&A teams that genuinely influence outcomes tend to look different. They are not defined by a single skill, but by a combination of capabilities that reinforce one another. I summarise these as IMPACT.

IMPACT is not a framework for the sake of it. It reflects how effective FP&A teams actually operate in practice.

Insights

Insights are not about converting numbers into commentary or simply saying what has happened. Good insights explain why it happened, what we missed, and what actions are needed. They also tell the business whether an issue is structural or temporary and what the pathway back to green looks like, or how to sustain performance if things are already green. For example, mentioning that margins are down is just a fact, but an insight would be that margins are down due to a one-off new job that took longer than quoted. There is nothing structural here, but quoting needs to be tightened to avoid recurrence. Insights must be actionable. Otherwise, they are just descriptions.

How to hone this capability:

Always articulate the implication before the number. Focus on what management should do next.

Modelling

Modelling is about weaving business assumptions into numbers. It requires business understanding first and financial technique second. The job of FP&A is to understand the drivers behind the numbers and help firm up assumptions with the business. There is no point modelling $ 10m in EBITDA for an initiative when the market itself is less than $2m. That is not a modelling problem. That is a business understanding problem.

How to hone this capability:

Design models around business drivers. Keep them simple, transparent, and easy to explain.

Planning

Planning is a critical mechanism for making the best use of limited resources. A plan should align with the strategy and provide a pathway to it. Planning without practical alignment to the business is useless. FP&A cannot plan in isolation. It needs to work with the business to understand capacity, constraints, and sequencing, and then weave those realities into the plan.

How to hone this capability:

Anchor plans to operational levers and clear ownership, not just financial targets.

Analysis

Analysis is about understanding the truth from complex data structures and eliminating the noise around it. It is easy to get lost in analysis for days or weeks. Speed is critical. That is why asking the right questions matters. Unit economics, key KPIs, trends, and covenants often tell a clearer story than a long list of detailed cuts. Trends can show where the business is heading, even when fluctuations distort short-term KPIs.

How to hone this capability:

Analyse price, volume, mix, and cost behaviour before looking at totals.

Collaboration

Collaboration is a key ingredient and connects all the other capabilities. Without it, FP&A remains reactive. Too often, FP&A is brought in at the end to explain what has happened. Earlier collaboration helps shape thinking, challenge assumptions, and improve decisions before they are locked in. True collaboration also means sharing ownership and accountability with the business.

How to hone this capability:

Spend time in the business. Ask better questions. Share ownership of outcomes, not just numbers.

Technology

Technology is crucial for FP&A professionals to stay ahead, but its main role is to automate routine reporting and production work. This frees up time to focus on uncovering what actually matters. Every hour saved on manual work is an hour that can be spent on insight, analysis, and decision support.

How to hone this capability:

Invest in tools that remove manual work and improve data trust before adding complexity.

From Credibility to Influence

Stewardship builds credibility. IMPACT enables influence.

Many FP&A teams stop at credibility. They are good at reporting, but not always embedded in decisions. The shift to influence does not come from better templates. It comes from being closer to the business and helping leaders make better choices.

FP&A today is not just a reporting or planning function. It is increasingly a decision enablement function. The organisations that get this right do not just have better numbers. They make better decisions.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.