In this article, discover how Strategic Foresight enables FP&A leaders to navigate uncertainty, anticipate structural change...

Strategic Foresight is the systematic exploration of future developments that matter to strategy and decision-making. By design, it should be highly relevant to FP&A, if not driven by it, to provide a consistent, consequential, and effective framework for business success, both today and tomorrow.

This article continues the series on Strategic Foresight by exploring its potential within FP&A.

Strategic Foresight – A Quick Recap

Foresight helps navigate complexity by preparing for multiple plausible futures — anticipating change, identifying risks and opportunities, and stimulating innovation. Strategic Foresight is foresight applied with structure and purpose in organisations. Core concepts such as the Cone of Futures were introduced in Part 1 of this series.

Unlike the fixed nature of the past, the future is inherently open. This calls for capabilities to define and track early signals of change, understand their interdependencies, and activate strategic adaptability. As Peter Thommen, long-time CFO at IKEA Poland, Russia, and Japan, put it: “Foresight is not strategy. But without it, strategy is blind. Without strategy, foresight becomes fiction.” His perspective — shaped by decades of embedding foresight into finance at IKEA — is explored in depth in Part 2 of this series.

“We should all be concerned about the future because we will have to spend the rest of our lives there.”

Charles Kettering, an American inventor, engineer, businessman, and the holder of 186 patents

FP&A already plays a central role in strategy implementation, providing funding, driving investment logic, and coordinating performance. In turn, FP&A depends on foresight for assumptions, drivers, and future development paths. But is that dependence already integration?

Clarifying the Divide — and the Connection

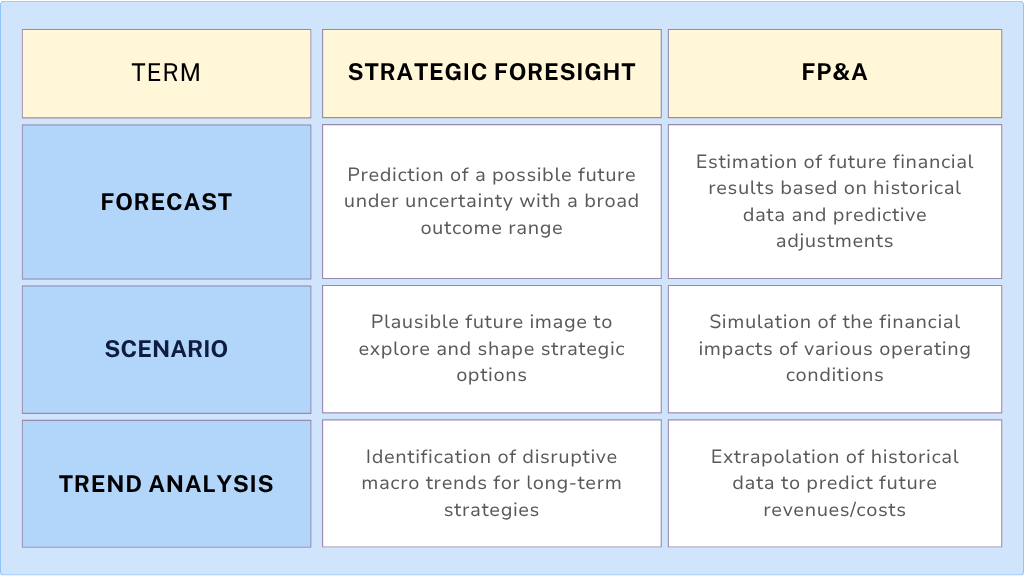

Every meaningful integration starts by understanding differences and overlaps. The two main differences between Strategic Foresight and FP&A lie in time horizon and terminology.

The time horizon is the easiest to differentiate and the most natural bridge. FP&A extends the business into the near future — typically one to three years, sometimes up to five. Strategic planning can go longer, but it's still anchored in today's logic.

Strategic Foresight, by contrast, works backwards from longer-term futures, probable, plausible, or preferred, and meets FP&A's range around the three-to-five-year mark. This creates a critical meeting point: the future, seen from both directions.

The terminology often overlaps with differing definitions, as shown in the figure below.

Figure 1

Another important distinction is that Foresight is imaginative first, descriptive second. It aims to shape the future, not just respond to it. Jane McGonigal, an American author, game designer, and researcher, imagined a computer game winning an Oscar and has been working towards that ever since.

“The real trick in life is to turn hindsight into foresight that reveals insight.”

Robin Sharma, a Canadian writer, best known for his The Monk Who Sold His Ferrari book series

FP&A, on the other hand, is often grounded in current operations. This apparent contrast sets the stage for a productive tension: top-down possibility meets bottom-up precision. It’s the interface where facts meet fiction and strategic value is created.

A Shared Need for Data — And Judgment

Both functions depend critically on data, yet in different ways. FP&A is strongest when grounded in actuals and reliable projections. However, uncertainty grows with time, so the usefulness of extrapolated data declines. Many strategic decisions must be made before data exists. That’s where foresight skills come in.

Strategic Foresight may appear fictional, but it’s data-informed. Megatrends are quantifiable. Meso and micro trends offer traceable signals and are handled with probability. Think demographics, biotech funding, AI adoption — these are not guesses, but early indicators of systemic shifts.

When data is scarce or missing, Foresight provides a structure for hypothesis-driven thinking that FP&A will also thrive on. The ability to detect weak signals early in either data stream, quantitative or qualitative, can unlock a proactive strategy. If FP&A lacks those sensing capabilities today, the joint stewardship is a strong argument to build and use those skills across both domains.

Scenario Management — Where Integration Begins

Scenario thinking is where the two disciplines converge. Strategic Foresight classifies futures from possible to plausible to probable, and defines preferred ones as targets. The Cone of Futures offers a framework to guide these distinctions.

FP&A scenarios, by contrast, are often limited to “worst”, “base”, and “best” cases within the existing business logic. In practice, few organisations embed FP&A scenarios into a coherent strategic narrative or align them with enterprise risk registers as the Corporate FP&A Professional Certification (FPAC) teaches.

By combining both approaches, organisations gain depth: Foresight prepares for change and expands thinking; FP&A aligns resources and sharpens execution. The former targets effectiveness, getting the big things right. The latter ensures efficiency in doing the right things well. Together, they form a system that bridges vision and action.

The first practical step can be to align FP&A scenarios with the Cone of Futures framework. Then ask: How do actions in our scenarios affect their preferability and probability, and ideally move both closer together? From a strategic perspective, those are the actions that are stable across many frames.

The Case for Integration: Three Key Arguments

The idea of merging Strategic Foresight into the FP&A function is compelling and timely. Here’s why:

1. FP&A already facilitates organisation-wide coordination.

Combining top-down foresight with bottom-up financial planning provides a holistic future view. The Office of the CFO is the natural place to anchor both.

2. FP&A processes are costly and deeply embedded.

Strategic Foresight is scalable but only delivers impact when, even if sourced as a stand-alone, it is applied across the business. Embedding foresight into existing FP&A structures maximises reach with minimal overhead and improves ROI.

3. Both rely on foresight and judgment.

The future will not reward those who simply extend trends. It will reward those who decide wisely in ambiguity. CFOs who listen to the “music of the future” (Jeremy Irons 2012) can translate it into meaningful decisions and inspire those around them to act.

“I can’t understand why people are frightened of new ideas. I’m frightened of the old ones.”

John Cage, an American composer and music theorist

Concrete First Steps for FP&A Teams to Begin Integrating Foresight

For FP&A teams operating with monthly rolling forecasts and annual budgeting cycles, the integration of foresight should begin with a shared foundation. Establishing a common understanding of terminology, time horizons, and scenario logic is key. At a minimum, the FP&A handbook or steering framework should reference, ideally embed, Strategic Foresight as a capability.

A good starting point is to reframe the mentioned standard FP&A scenarios through the Cone of Futures lens. It exemplifies the shared language across functions and aligns financial planning with broader narratives of, at least, probable and preferred futures.

Next, monthly driver-based forecast cycles are a natural rhythm to incorporate weak signal scanning and assumption tracking into regular review processes. As foresight thrives on broad participation, the extension across the business should be of value for Strategic Foresight. As a first and constant feedback to the Foresight team, assuming an organisation outside of FP&A, silo effects should be considered early.

As foresight practice becomes embedded, FP&A and operational teams will increasingly enrich their quantitative models with the strategic narratives that likely challenge established business logic. Including strategic scenarios in operational decision models is a sign of acceptance.

Over time, mapping megatrends to long-term business drivers may evolve the budget from a reactive allocation exercise into a forward-looking dialogue about directional choices. Those cross-functional scenario workshops structured around diverging assumptions rather than financial deviations will also position FP&A as a hub for judgment under uncertainty. This shift is a good measure of integration success.

It is worthwhile noting that these steps are not about replacing existing processes, but enhancing them. Then the rolling forecasts and budgets will meet the imagination of Strategic Foresight within one coherent dialogue.

Final Thought

The case for integrating Strategic Foresight into FP&A is strong. The time for debate is now. The future won’t wait.

References

- Kettering, Charles F. “We Should All Be Concerned About the Future Because We Will Have to Spend the Rest of Our Lives There.” Reader’s Digest, December 1946.

- Sharma, Robin. The Saint, the Surfer, and the CEO: A Remarkable Story About Living Your Heart’s Desires. Carlsbad, CA: Hay House, 2003.

- McGonigal, Jane. Reality Is Broken: Why Games Make Us Better and How They Can Change the World. New York: Penguin Press, 2011.

- Cage, John. Silence: Lectures and Writings. Middletown, CT: Wesleyan University Press, 1961.

- Irons, Jeremy. “Jeremy Irons: Music of the Future.” YouTube video, 1:40. Posted April 13, 2012. https://www.youtube.com/watch?v=Hhy7JUinlu0

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.