In this article, Juniper Networks shares two practical GenAI use cases in Finance that redefine finance...

More than 380 FP&A professionals from 44 countries joined the latest Digital North American FP&A Circle session on the 9th of December 2025, where we looked closely at how Generative AI is beginning to shape modern finance teams. What stood out most is that while the technology is moving fast, FP&A’s ability to adopt it varies significantly. Across four excellent speakers, we explored what works, what doesn’t, and how teams can close the gap between expectations and reality.

AI in FP&A: Moving from Potential to Payoff

Gaby Makstman, Director of Financial Planning and Analysis at SquareTrade, opened the session by calling out something many of us quietly acknowledge: FP&A is still catching up. Although AI today can offer real-time forecasting, automated variance analysis, anomaly detection, narrative dashboards and more, most organisations don’t yet have the foundations to truly benefit from these capabilities.

For Gaby, there are four main reasons why AI initiatives often struggle:

- Data quality issues: far too many teams still work with Excel-heavy, manually adjusted datasets.

- Disconnected systems: KPIs and definitions often differ by team or business unit.

- Trust and transparency concerns: leadership can be sceptical if the underlying logic is unclear.

- Insufficient investment: Finance transformation remains underfunded in many companies.

She also outlined the steps that FP&A teams should take to ensure AI projects succeed. Much of it comes back to the basics: cleaner data, integrated systems, well-governed datasets, thoughtful deployment of tools, and a strong push towards automation rather than manual workarounds.

Figure 1

Her closing comment was simple but important: AI will only take us as far as our foundations allow. And those foundations require investment, resourcing, and proper training, not shortcuts.

Polling Results to Poll 1: When We Asked the Audience Which AI Tools They’re Using Most:

- 34% chose natural language processing

- 31% selected RPA

- 28% pointed to Predictive Analytics

- 7% said they use all the above

A balanced spread, but the dominance of NLP suggests many teams are starting with the tools that feel most accessible.

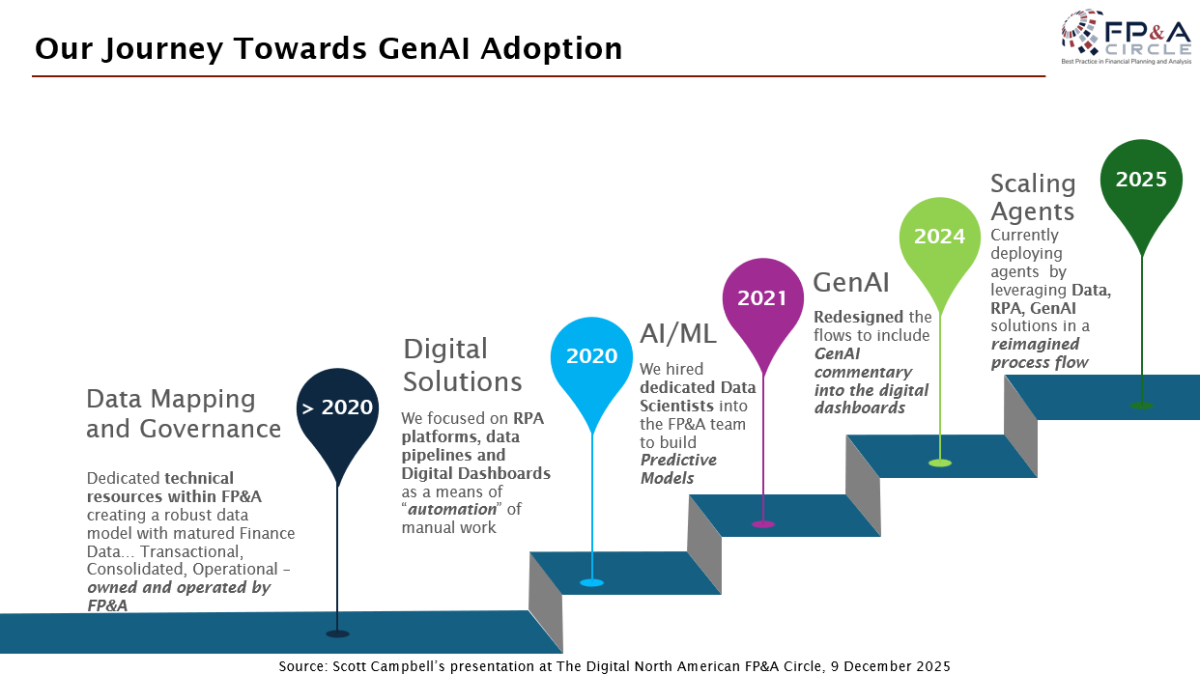

From Data Cleansing to GenAI: Philips Case Study

Scott Campbell, Head of Digital COE - Finance FP&A at Philips, shared Philips’ six year AI journey, and it was refreshing to hear a truly end-to-end example. Many organisations talk about AI; Philips rebuilt its finance infrastructure to support it.

Their approach revolves around four cornerstones:

- People – FP&A roles are shifting, and skills around digital literacy and interpretation are becoming essential.

- Data – governance, consistency, and accuracy are now non-negotiable.

- Process – broken processes can’t be “patched” with AI; they must be redesigned.

- Technology – no single AI tool solves everything; choose based on the problem.

Figure 2

Scott shared several real-world FP&A use cases now live at Philips, some with very high adoption and some low, depending of where they are in the evolution:

- Intelligent detection of outliers and unusual journal postings

- Automatically generated dashboard commentary

- Predictive models supporting various planning processes

- Natural language tools for querying data

- Early versions of agentic workflows

One thing Scott stressed strongly was this: AI won't magically fix inefficient processes. If anything, it magnifies where the inefficiencies are.

Polling Results to Poll 2 - When We Asked What Holds AI Back the Most in Organisations:

- 38% said lack of resources

- 24% noted a lack of understanding

- 21% pointed to a lack of skills

- 17% highlighted leadership support

This mirrors what many FP&A leaders experience daily: interest is high, but resources and readiness still lag.

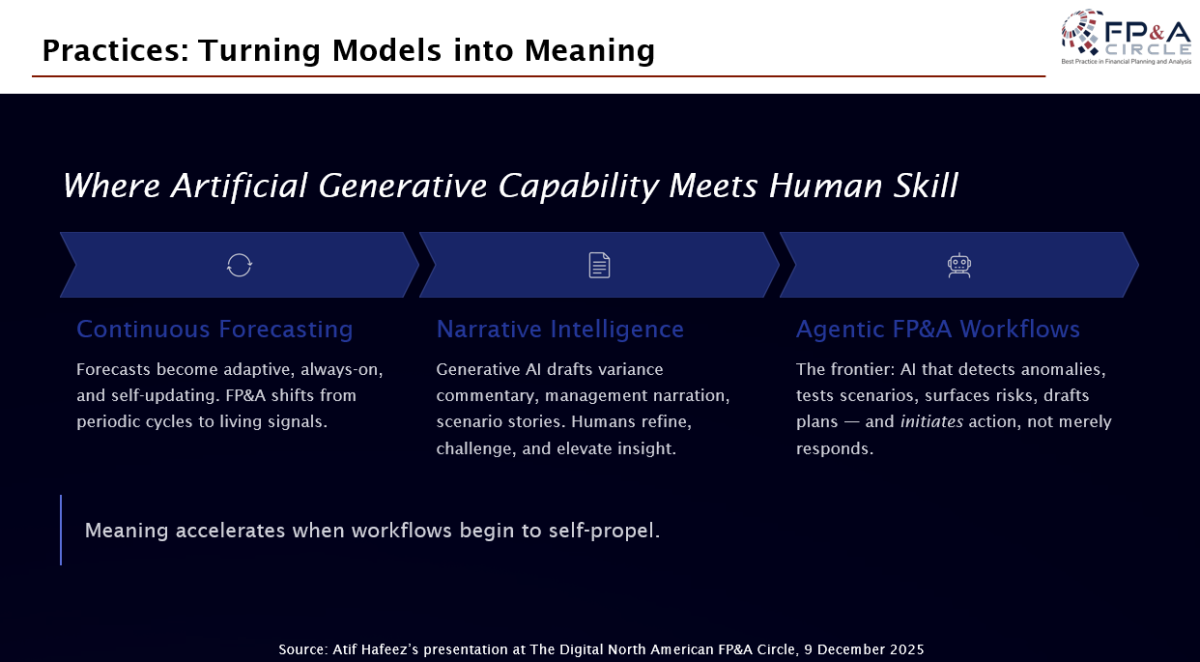

From Models to Meaning

Atif Hafeez, Global CFO & Board Advisor, brought a more philosophical, yet very practical viewpoint. He argued that FP&A is now entering a cognitive era, one where the challenge isn’t building more complex models, but extracting deeper meaning from them.

He highlighted three key principles shaping the FP&A function of the future:

- Judgment remains the first model. AI can speed up analysis, but it cannot replace human accountability or contextual understanding.

- Data is the atmosphere FP&A breathes. Poor data suffocates insight; strong data governance amplifies it.

- Culture determines capability. AI fails in environments where trust is low or where the purpose isn’t aligned across teams.

Figure 3

He gave a helpful snapshot of how FP&A work is evolving:

- Forecasts that continuously update themselves

- Narratives drafted by AI and refined by humans

- Workflows that flag anomalies, test scenarios, and even propose actions

Atif summarised it beautifully: AI accelerates logic; humans elevate meaning.

Polling Results to the last Poll of the day - When We Asked Where AI Can Benefit FP&A the Most:

- 38% – Automation of repetitive tasks

- 26% – Predictive forecasting and scenarios

- 25% – Dynamic insights and storytelling

- 11% – Anomaly detection

Automation still clearly dominates, likely because it frees analysts to spend more time interpreting rather than producing numbers.

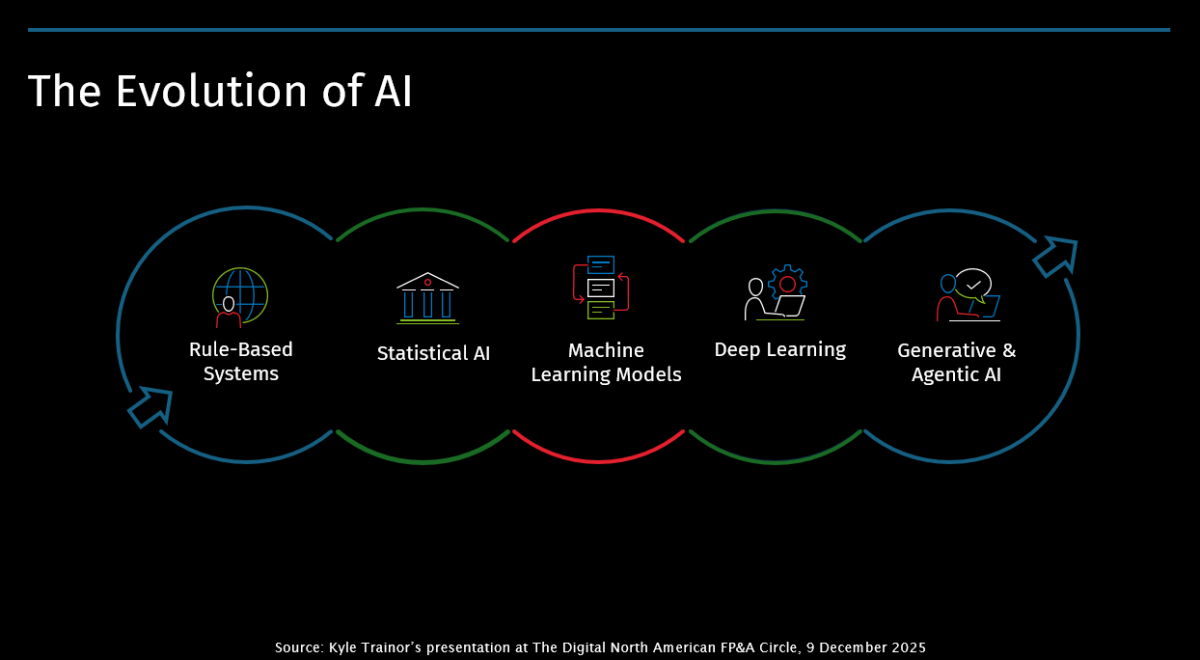

GenAI in Action

Kyle Trainor, Senior Technology Manager at Wolters Kluwer CCH Tagetik, walked us through how AI has evolved, from rule-based logic to Machine Learning, to deep learning, and now to early-stage agentic systems that can initiate tasks rather than simply respond to them.

Figure 4

He also shared findings from recent research:

- 56% of finance professionals believe AI will transform their function

- 52% already use some form of AI, with 70% still in exploratory stages

- 6% have implemented AI broadly in finance

- 70% expect to increase investment over the next five years

Kyle demonstrated how tools allow analysts to query data in natural language, uncover insights almost instantly, and connect operational and financial plans more naturally. It was a practical example of how GenAI is shifting software from being a passive system to an active partner.

Will AI Replace FP&A?

A question that always comes up and the panel all agreed on the answer: no.

AI removes manual tasks, not people.

FP&A roles will evolve, becoming more strategic, more meaningful, and more connected with cross-functional decision-making. If anything, AI gives FP&A more influence, not less.

Conclusion

To make FP&A’s AI journey successful, the message from all speakers was consistent:

- Start small, but start with purpose

- Get the data and processes right before layering in AI

- Invest in people: skills, training, and governance

- Move toward continuous planning and more intelligent workflows

- Keep human judgment firmly at the centre

Generative AI is more than a trend. It’s becoming a key driver of FP&A’s next evolution, and those who prepare now will lead the transformation rather than chase it.

A big thank you to CCH Tagetik for sponsoring the session, and to all our speakers for sharing such valuable insight.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.