In this article, the author explores how the evolution of dashboards and AI-powered business intelligence mirrors...

People keep saying AI will replace finance. I hear it on panels, see it in articles, and get the question in meetings. Then I sit in a forecast review and remember how human this job really is.

The AI buzz is everywhere now. It sits on every board agenda. In Deloitte’s third quarter 2023 CFO Signals survey, 42% of CFOs said their organisations are experimenting with generative AI. That sounds promising. But if you talk to finance leaders, most will tell you what I see too — a lot of pilots, a lot of learning, and an impact that’s still uneven.

I have sat in enough forecast rooms to see the gap between what the numbers show and what the business actually needs. That is why this AI conversation matters for FP&A. Our job is to plan the future and help people make sense of complexity. You need judgment, timing, and business acumen for that. A model can help, but it cannot do the whole job.

So when I hear that AI will upend FP&A, I pause. It will change things; it already is. The better question is how? Where does it help and where does it fall short? And what kind of FP&A leader will thrive because of it?

Three Lanes of FP&A Work

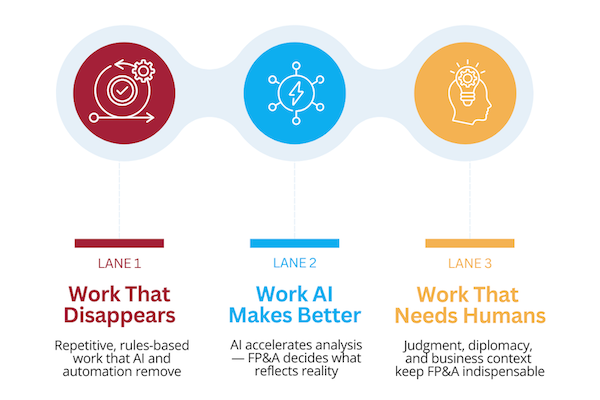

Over time, I have come to see FP&A work falling into three lanes (Figure 1).

Lane 1: Work that disappears.

When I started out, I spent hours pulling data from multiple systems, reconciling numbers, and formatting the same report in twenty ways. None of that required much judgment. Tools like Scribe have already made SOP documentation easier, and RPA and AI are replacing finance equivalents. This lane is closing, and truthfully, I am relieved to see it go.

Lane 2: Work that AI makes better.

This is the co-pilot lane, where AI actually makes life easier. Forecasting is the clearest example. I have seen AI crunch years of data and generate scenarios in minutes.

- In retail, it can show how promotions shift demand.

- In energy, it can link weather and regulation to load forecasts.

- In healthcare, it can simulate how reimbursement lags hit cash flow.

The insights are faster and broader. But I have also seen how the final call still rests with FP&A. We decide which scenarios are grounded in reality and which ones leadership should act on.

AI is powerful at crunching scenarios, but the decision of which one reflects reality is still ours. The value isn’t in what the algorithm spits out, it’s in how we test it against what we know about the business. Forecasts are only useful when someone with judgment translates them into actions that leadership can believe in.

Lane 3: Work that needs humans.

This is the lane that keeps FP&A indispensable.

A model may recommend smoothing inventory, but only FP&A can reconcile sales’ optimism with operations’ true capacity. When tariffs change overnight, AI may highlight historical swings but not the timing of contracts or how customers react to price changes. And in the politics of business, a machine can flag overspend but cannot frame the message in a way that builds collaboration instead of conflict. These are the conversations that still require a human voice.

Lesson: Automation can help, but the calls that matter still need human judgment.

Figure 1. The Three Lanes of FP&A Work in the Age of AI

Context Still Decides

Earlier this year, tariffs spiked on a critical raw material. The model showed margins falling off a cliff for two straight quarters. It looked bad. But when we brought sales and sourcing into the discussion, the story changed. Sales already had price adjustments ready. Procurement was already opening a contract window. We knew from history that customers could absorb a modest increase. Margins dipped for a moment, then recovered by year-end.

I have also seen the opposite. In retail, a neat forecast unravelled in days when a competitor launched a flash sale. The model did not catch it. FP&A had to rewrite the story, explain why demand pulled forward, and reset expectations for the rest of the quarter.

Models are built on stories and assumptions, but business moves in real-time. A tariff spike, a competitor’s flash sale, or a sudden regulatory change can flip the story in an instant. FP&A earns its seat by pressure-testing the forecast against these realities and adjusting the story before the numbers go to the board.

The market data tells the same story. The 2024 FP&A Trends Survey found that only 6% of departments currently use AI or Machine Learning, while 59% plan to do so. Gartner reports that 56% of finance functions plan to increase AI investments by at least 10% over the next two years; however, many are still working through data quality and governance issues before they can scale to production. Ambition is high. Readiness still varies.

Lesson: Context can change everything. FP&A has to pressure-test the model against business reality.

The Human Touch and FP&A’s True Role

At its core, FP&A is about translation.

- Sales speaks in bookings and pipeline.

- Operations speaks in throughput and capacity.

- Procurement speaks in supplier risk and cost curves.

Finance listens, turns everything into numbers, and then translates them back into a plan that each team can act on.

That takes more than accuracy. It takes judgment, timing, and diplomacy. I have seen automated reports flag overspend. I have also seen a finance partner deliver that same message in a way that kept the CMO engaged in the room and onside. Trust is what makes the numbers valuable. That is not something a tool can do for you.

Right now, AI is a collaborator. It drafts; we interpret. Over time, FP&A will evolve into the orchestrator — the team that sets the rules for which data sources are trusted, when human review is required, and how outputs are audited.

It means pulling insights across sales, supply chain, and operations into one story the CFO can sign. Most of all, it means taking responsibility. Even if a model produces the forecast, FP&A still owns the call to the board.

Lesson: Translation is not just about numbers, it is about trust. Orchestration is not about coding, it is about leadership.

The FP&A Leader Who Will Thrive

The future FP&A leader will not be the fastest report builder. They will be the one who balances machine scale with human judgment. They’ll know enough analytics to challenge a model when an assumption smells wrong. They will be storytellers, people who can turn data into action. They will build guardrails that keep automation accurate, fast, and accountable.

That combination of analysis, storytelling, and governance is how the next generation of CFOs will be built.

Where We Go From Here

Some FP&A work will disappear. Some will be supercharged by AI. And some will always need people. Our challenge is to know which is which and to prepare for it accordingly.

AI can be a co-pilot, but it is not the pilot. AI will keep getting better. It will surprise us, the way RPA did a decade ago. However, this time, the scale and speed are far greater. That means FP&A must evolve even faster.

We all have a choice. We can wait for AI to tell us how to work, or we can shape how it supports us. The future of FP&A will be written by those who do the second. The ones who bring clarity to complexity, balance automation with accountability, and turn insight into action. AI may change the tools we use. But it will not replace the reason leaders need FP&A. Our value is turning uncertainty into strategy.

That, in the end, will always be the human edge.

Sources

Deloitte’s third quarter 2023 CFO Signals Survey: https://www.deloitte.com/us/en/services/consulting/articles/time-to-gather-intelligence-on-genai.html

2025 FP&A Trends Survey: https://fpa-trends.com/fp-research/fpa-trends-survey-2025-ambition-execution-how-leading-fpa-teams-turn-insights-impact

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.