Introduction: A Strategic Shift in Modern Finance

In May 2025, the 17th Amsterdam FP&A Board convened senior finance leaders to explore a defining shift in modern finance: the synergy between Human Intelligence and Artificial Intelligence in FP&A. Held at the Robert Walters office and chaired by Larysa Melnychuk, CEO of FP&A Trends Group, this session marked the launch of a global tour in partnership with EY, spanning Europe, America, Asia, and Australia. Participants represented leading firms, including Philips, Unilever, TIP Group, FrieslandCampina, and Kraft Heinz.

The meeting was sponsored by EY in partnership with Robert Walters.

Figure 1: Amsterdam FP&A Board №17, May 2025

Why AI Adoption Still Lags in FP&A

Despite rising excitement around AI and Machine Learning, widespread adoption in FP&A remains limited. FP&A Trends’ latest global research in partnership with EY identified seven key barriers:

- Resistance to change

- Lack of a clear vision for AI

- Poor data quality

- Skills gaps

- Regulatory and governance concerns

- Competing investment priorities

- Doubts about AI transparency and reliability

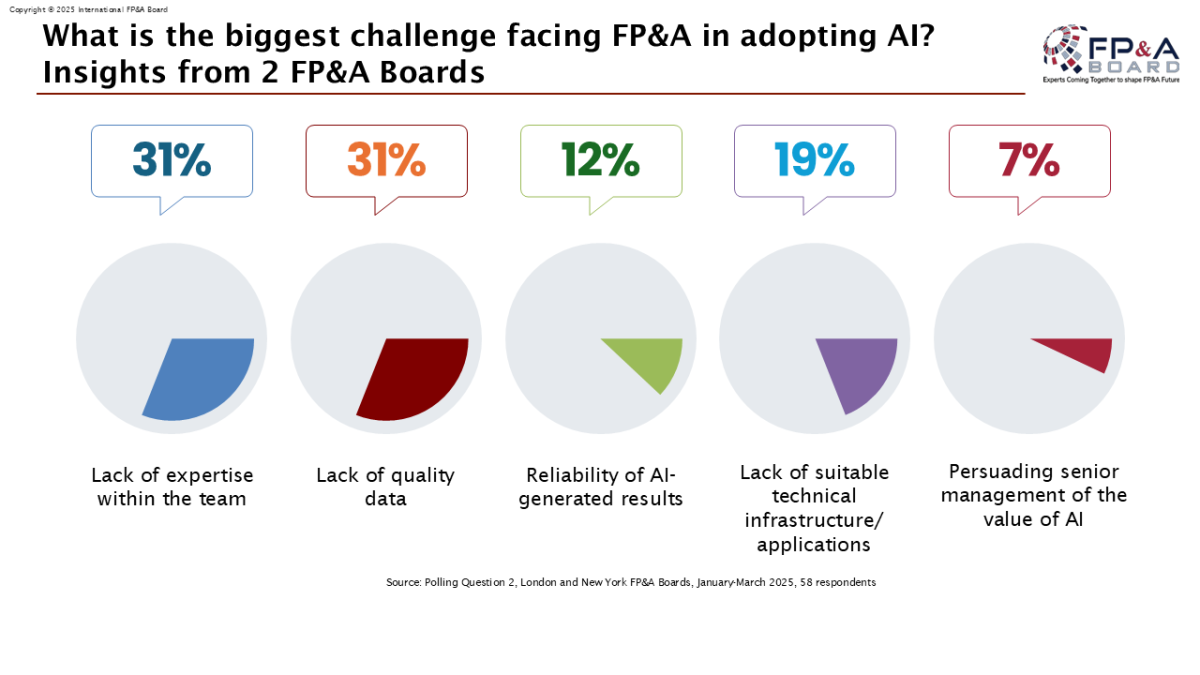

Polling insights from recent London and New York FP&A Boards reinforced this reality:

Figure 2

Yet those who overcome these hurdles reap clear benefits.

Two Complementary AI Technologies

The Amsterdam Board examined the two primary branches of AI transforming FP&A:

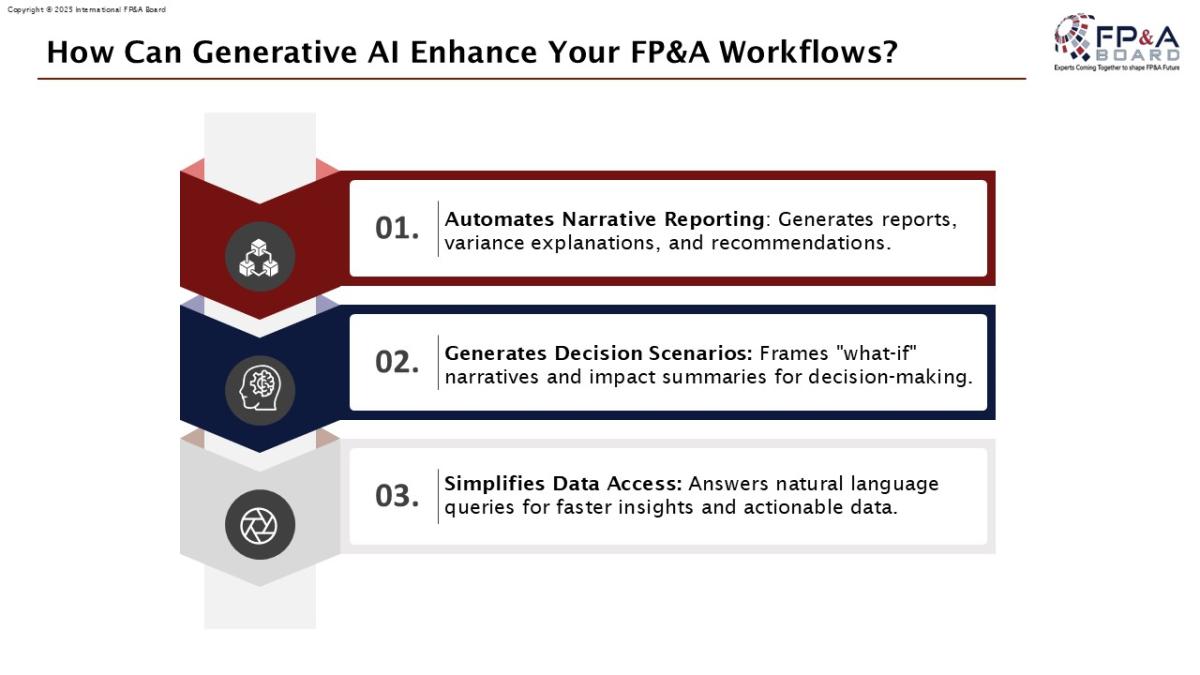

- Machine Learning (ML): Enhances forecasting accuracy, scenario planning, and uncovers hidden business drivers.

- Generative AI (GenAI): Automates narrative reporting, decision scenario creation, and enables natural language queries.

What Sets AI Leaders Apart

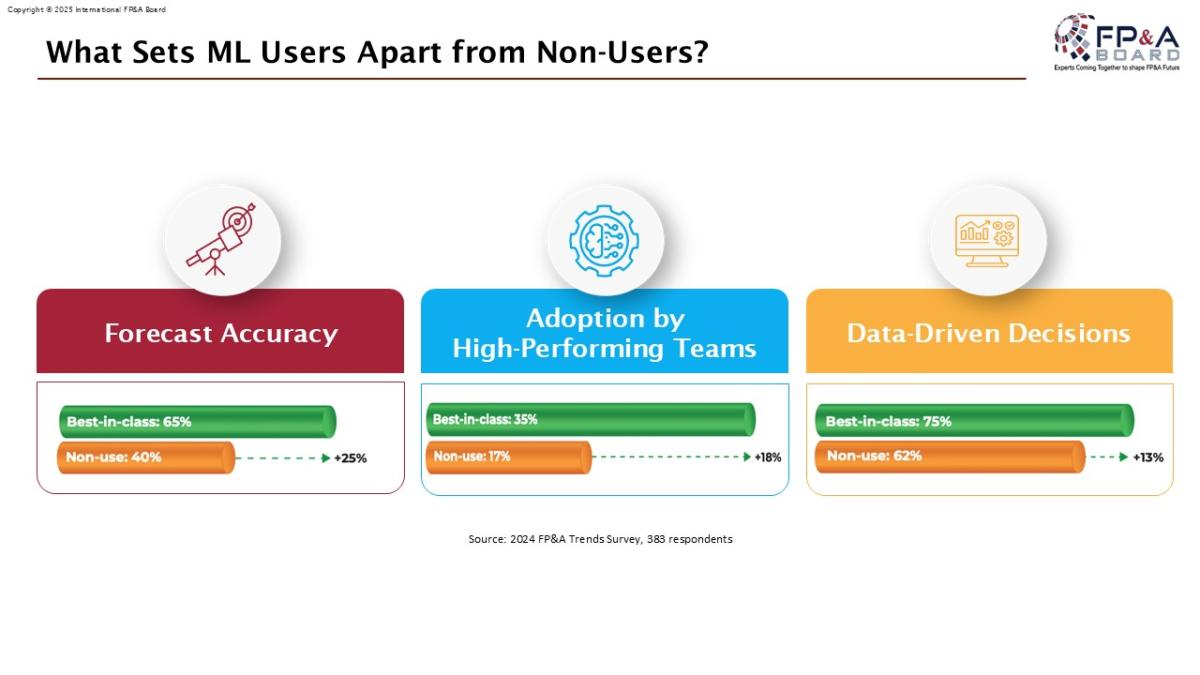

Data from the 2024 FP&A Trends Survey revealed that organisations using AI report better forecasting, smarter decisions, and stronger performance, as shown in the picture below.

Figure 3

Participants explored how Generative AI supports FP&A workflows by simplifying data access, generating scenarios, and automating reporting.

Figure 4

Case Studies: EY and Philips Demonstrate AI in Action

Two impactful case studies illustrated practical AI applications.

Scott Campbell outlined Philips’ co-creation approach, where GenAI enhances predictive planning and insight generation.

Figure 5: Scott Campbell’s presentation at Amsterdam FP&A Board №17, May 2025

The EY team — Jonathan Eggersman, Sven de Been, Britt Smeets, and Menno Bonninga — presented the EY Client Zero journey, showcasing how finance-led transformation and GenAI adoption streamlined simulations and reporting.

Figure 6: Britt Smeets is sharing the EY “Client Zero” Case Study at Amsterdam FP&A Board №17, May 2025

Group Work Outputs: Strategies for Implementation

Participants collaborated in three groups to explore implementation strategies for AI in FP&A.

Group 1 – Generative AI Use in FP&A Reporting and Decision-Making

Figure 7: Group discussion of Amsterdam FP&A Board №17, May 2025

The first group examined the use of GenAI in FP&A. Their key insights included:

- Use GenAI to automate budget commentary and generate code (e.g., Python) for analytical tasks

- Enhance storytelling and data visualisation capabilities

- Data quality is essential — GenAI’s effectiveness depends on rich, reliable datasets

- Impacts include a reduction of junior analyst workload and emerging concerns over AI’s energy consumption

Takeaway: Start with high-value, repeatable outputs, such as management reporting, and ensure robust data governance before scaling.

Group 2 – Implementing Machine Learning in FP&A

Figure 8: Group discussion of Amsterdam FP&A Board №17, May 2025

The second group debated how Machine Learning can be implemented in FP&A. Their success factors were:

- Focus on clear use cases like order analytics or inventory forecasting

- Approach: Start small: build experience, run ML models in parallel, facilitate business involvement

- Success factors: strong collaboration between finance and data teams, and a philosophy change

Takeaway: Begin with a narrow, well-defined ML use case. Co-own it with the business, measure performance, then expand.

Group 3 – Ensuring Effective Human + AI Collaboration in FP&A

Figure 9: Group discussion of Amsterdam FP&A Board №17, May 2025

Participants of the third group identified several enablers for fostering successful collaboration between finance professionals and AI tools:

- Training

- Clear expectations

- Support, adoption, and acceptance

- Appreciation

- Transparency

- Mindset and leadership

- Investment

- Validation

Takeaway: Build a structured enablement plan — combine training, transparent communication, and leadership buy-in to embed AI into the finance culture.

Conclusion

The Amsterdam FP&A Board session confirmed a growing truth: AI won’t replace finance professionals, but finance professionals who use AI will replace those who don’t.

As FP&A moves from reactive reporting to proactive leadership, Human + AI collaboration is no longer optional — it’s a competitive imperative.

To act on this shift, FP&A leaders should:

- Select one AI use case to pilot — ideally with measurable, low-risk outcomes

- Ensure foundational data quality and access

- Invest in cross-functional training and change enablement

- Co-create solutions with business partners, not just for them

The era of intelligent finance has begun. The question is not whether to adopt AI, but how fast, and how well.