In this article, the author shares a seven-step roadmap to help finance leaders cut through sprawl...

In today’s fast-moving and unpredictable business environment, finance teams are under growing pressure to do much more than just report numbers. They are expected to interpret them, guide strategic decisions, and enable organisations to plan for the future with agility. Yet despite this shift, many FP&A teams still find themselves constrained by manual processes, fragmented data, and a heavy reliance on spreadsheets.

The recent FP&A Trends webinar explored how organisations can move from foundational reporting towards integrated, insight-driven planning. The session brought together finance leaders and technology specialists to discuss real examples of transformation, from starting small with quick wins to implementing enterprise-level planning systems with embedded AI.

The conversation connected more than 360 FP&A professionals from 56 countries — all facing similar challenges.

The Challenge: High Expectations, Limited Capacity

The stats below from the 2025 FP&A Trends Survey highlight some of the gap that still exists:

Where does the FP&A team spend most of its time?

- Only 18% of FP&A teams demonstrate strong performance.

- Just 31% of the time is spent on value-added activities such as analysis and storytelling.

- Meanwhile, 69% of the effort is still tied up in manual data gathering, reconciliation, and reporting

How long does it take an organisation to run scenarios?

- Only 18% of organisations can run scenarios in under one day.

- 33% require a week.

- The remaining 49% take longer or cannot run scenarios at all.

This imbalance limits finance’s agility and ability to influence strategic decision-making.

Evolving FP&A: From Spreadsheets to Strategic Intelligence

Janice Lambert, CFO, American Council on Education, described her organisation’s journey from spreadsheet-driven FP&A to a more strategic, forward-looking capability — all within the constraints of a small finance team and limited budget.

Instead of aiming for a large transformation initiative up front, her approach focused on:

- Identifying manual pain points. Small automations around repeatable tasks delivered immediate time savings.

- Standardising data and establishing a single source of truth. This built trust, improved forecast reliability, and reduced internal debate.

- Building buy-in through collaboration and transparency. Teams were invited to contribute assumptions and understand drivers, not just receive numbers.

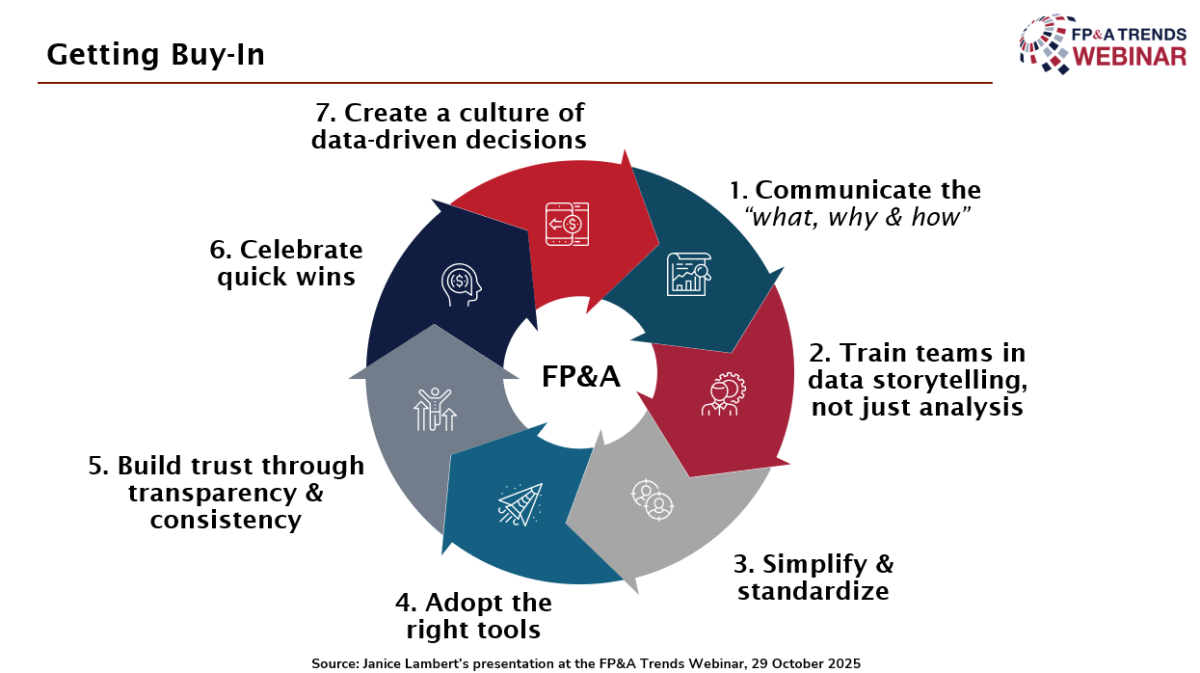

Janice emphasised that the real shift is cultural:

“It’s not about perfection — it’s about momentum. We’re building a culture of insight and readiness.”

Figure 1

Her advice to teams in the early stages:

- Start with quick wins

- Keep tools and models simple

- Invest in storytelling and communication, not just data

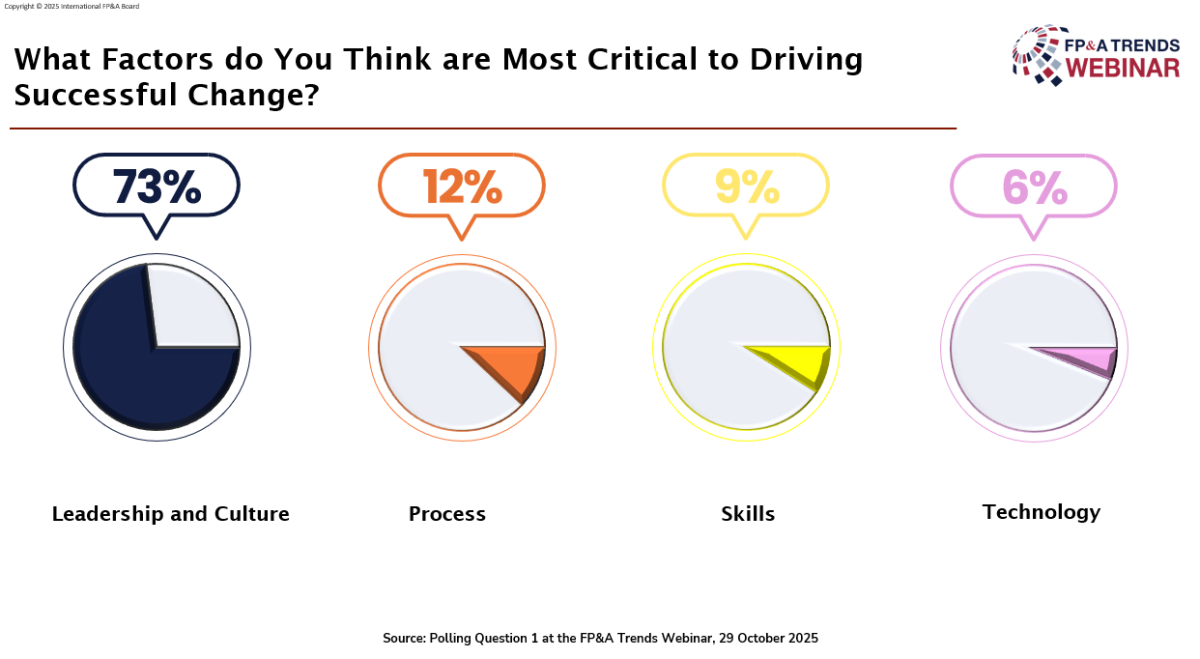

The session began with a poll on what drives successful change. The results were clear: Leadership and Culture dominated with 73% of votes, while Process (12%), Skills (9%), and Technology (6%) trailed far behind, reinforcing the view that people and leadership remain at the heart of any transformation effort.

Figure 2

Unlocking Tomorrow’s Cash Flow Today

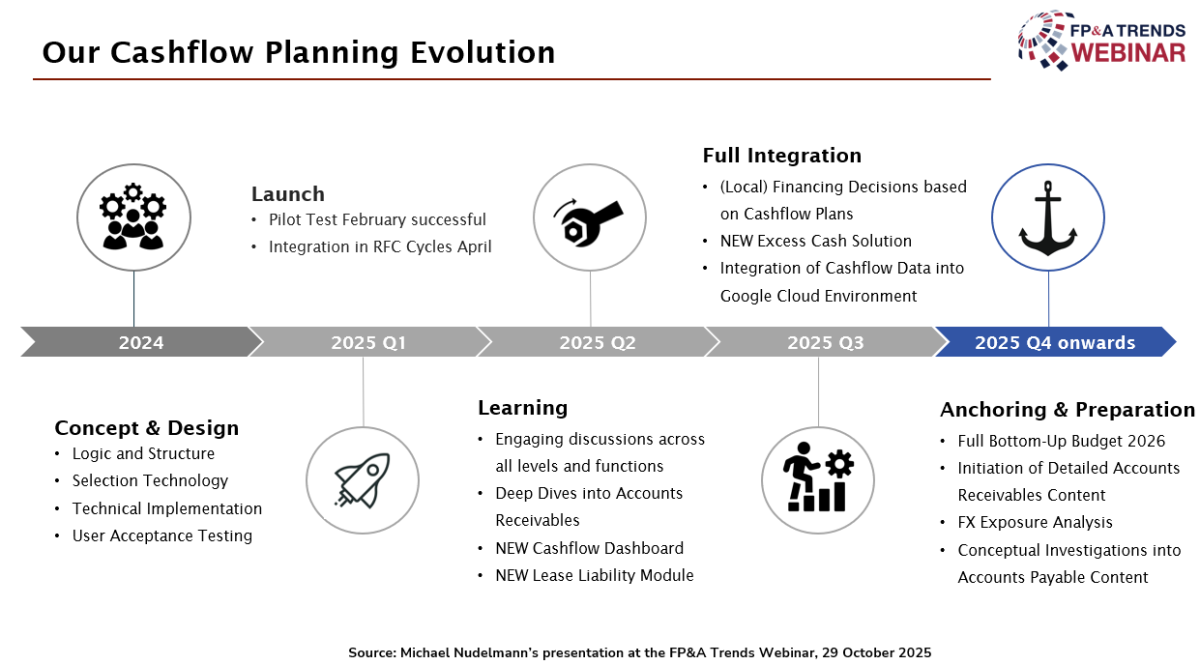

Michael Nudelmann, VP Group Controlling and Head of Group FP&A, Swarovski, shared Swarovski’s impressive transformation from a basic level of cash flow planning to an integrated, driver-based forecasting framework within 12 months.

Their motivation for the transformation was clear at Swarovski. Cash is strategic for their business. It enables operational stability, planning and growth. Most importantly, cash visibility is key to improving decision-making.

Figure 3

To drive change, Swarovski formed a cross-functional “Cash Squad”, meeting bi-weekly to:

- Analyse drivers behind cash performance

- Collaborate across regions and business units

- Prioritise actions and ensure accountability

The organisation now runs a lean, two-day cash flow forecasting cycle, leveraging automation and driver models.

The focus is:

- Less granularity

- More frequency

- Better steering decisions

For Michael, change management is 80% of the effort. Tools matter, but people and process matter more.

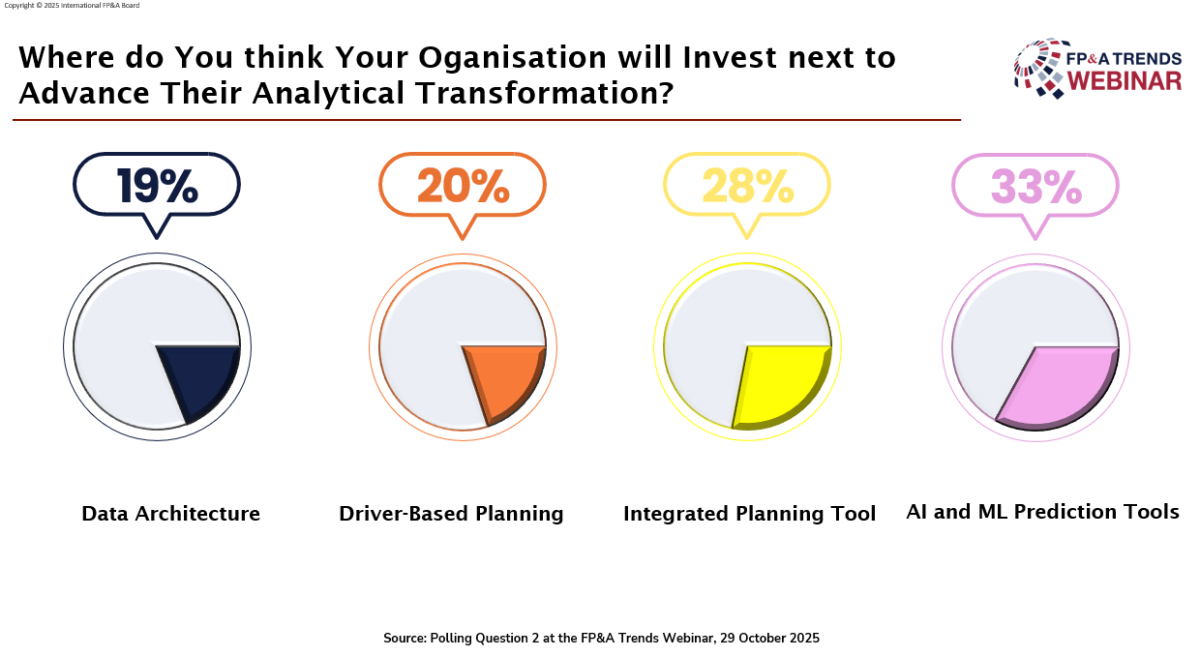

The second poll looked at future investment priorities in analytical transformation. AI and ML Prediction Tools took the lead with 33%, signaling growing confidence in intelligent automation. Integrated Planning Tool came next at 28%, followed by Driver-Based Planning at 20% and Data Architecture at 19%, reflecting ongoing efforts to build more connected and data-driven FP&A environments.

Figure 4

Technology in Action: Modern FP&A Systems with Embedded AI

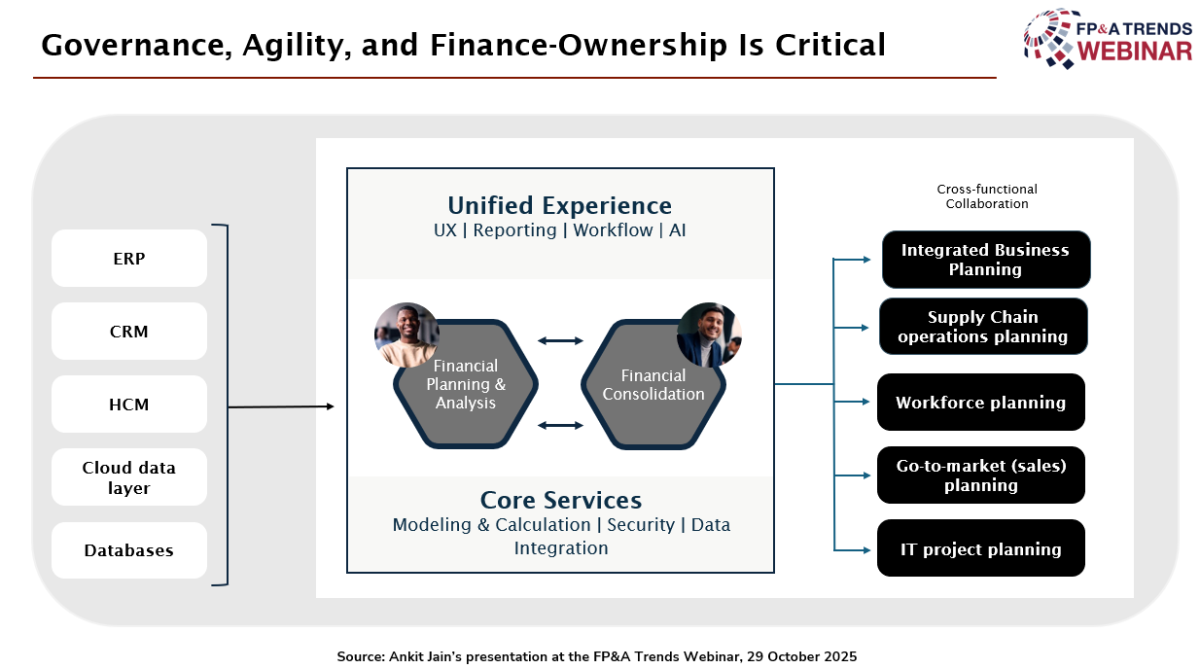

Ankit Jain, Senior Director, Finance Applications at Anaplan, placed technology in context: systems are not the starting point, but they are essential to scaling.

He highlighted four core capabilities required for modern FP&A:

- Connected Data Integration. One platform pulling from ERP, CRM, HRIS, and operational systems without manual consolidation.

- Unified Planning and Scenario Modelling. Configurable models that allow finance to simulate changes rapidly.

- Collaboration and Workflow. Guided planning processes reduce complexity and increase adoption.

- AI-Driven Forecasting and Insight. AI can:

- Detect anomalies

- Improve forecast accuracy

- Generate narrative commentary

- Supercharge scenario planning

Ankit Jain states:

“Technology frees finance teams to focus on influence, insight, and impact.”

Figure 5

Conclusion:

- Start Small and Scale: Quick wins build credibility and momentum.

- Focus on Data and Standardization: A shared version of truth unlocks collaboration.

- Technology Enables — It Does Not Replace Finance Leadership: Tools accelerate maturity, but culture drives transformation.

- Scenario and Cash Flow Planning Are No Longer Optional: Agility is a strategic necessity.

A big thank you to Anaplan for sponsoring the event and to our FP&A community for their continued support.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.