Learn how FP&A teams can transform cash flow forecasting with driver-based models, technology and collaboration to...

Everybody has a plan these days, and some often feel like they do little else. This happens for the most disparate reasons, spanning from a request from above to trying to predict the future, getting ready for it, or just thinking about it. In many cases, it feels like unnecessary work, but you never know; it is a company-wide exercise, so it makes sense to take part and be seen.

The truth is, even the best plan is ineffective if it is not implemented. At the end of the day, it is difficult to maintain ownership and accountability for a numerical exercise done months before, in a world that is changing so quickly.

There is one area, though, where it is impossible not to live by the plan, as it immediately gives daily feedback that concerns all departments in a company: liquidity planning.

Often confined to some parts of the Finance Department, it is very detailed and structured for cash-rich organisations, and chaotic, imprecise and improvised for cash-hungry companies: cause or effect?

Here, we aim to explore how classic FP&A principles and processes can be applied to liquidity planning.

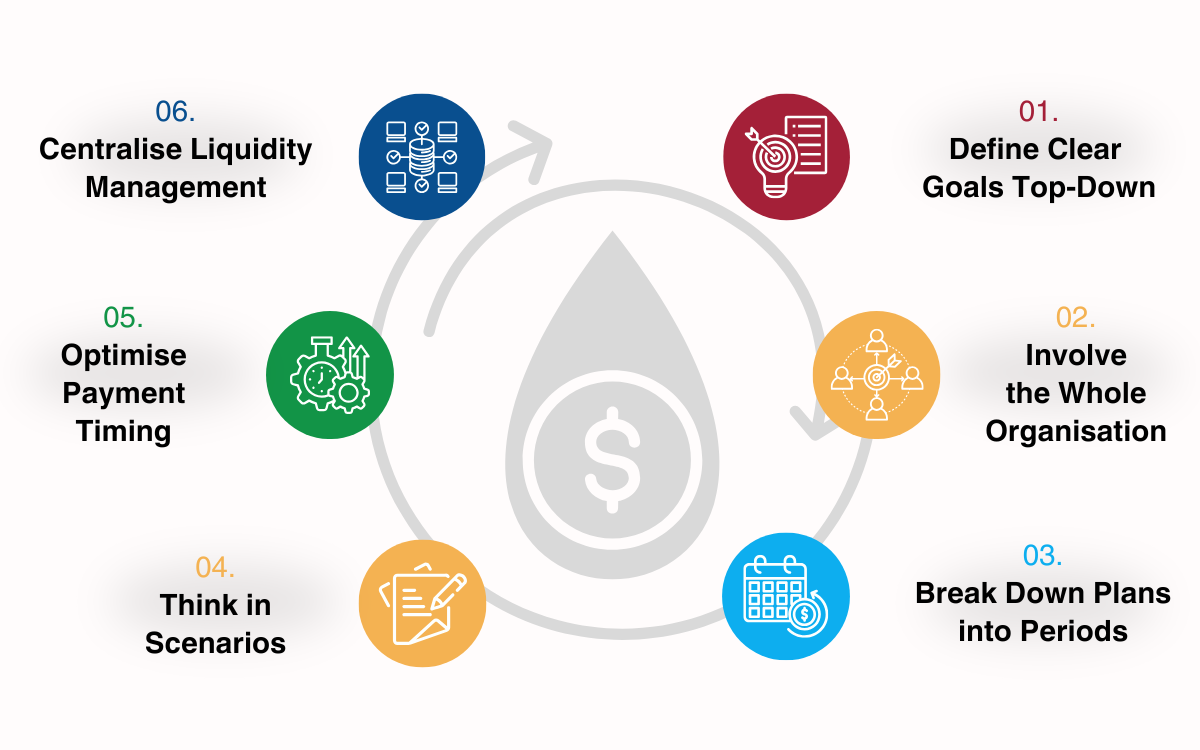

Figure 1. The FP&A Approach to Liquidity Planning – Six Implementation Steps

1. Define Clear Goals Top-Down

A key success factor for any type of planning is defining clear goals. In this case, it means specifying, among other things, the minimum liquidity you should keep to comply with your commitments.

The question is how much is enough and how much is too much when financial resources are sitting idle and not producing any return.

To this purpose, I always find it useful to classify cash flows into fixed clusters, such as:

- legal obligations vs. external creditors

- payroll

- suppliers for your production

- interests

It should help you identify the ones where you need to use discretion, if necessary, and adjust value and timing to suit your needs. In liquidity planning, it is particularly important that you also apply a clear safety margin to your calculations and goals.

2. Involve the Whole Organisation

This is always important, but particularly so when planning liquidity. While setting goals is a typical top-down exercise, liquidity planning requires all departments' input on their cash flow needs and when they will materialise.

Pay attention to all interdependencies when it comes to timing. Clustering into projects can also be a helpful guide. In the end, you may not have enough cash to satisfy all needs and wishes, but you need to make sure your decisions are well-founded and that you have the whole picture available.

3. Break Down Your Plans into Suitable Periods

It does not help to have a positive plan for a year if you cannot make it past May. The only difference is that in the case of liquidity plans, all significant periods are much shorter than for P&L and Balance Sheet.

You will often plan on a weekly basis and report daily. This requires more effort in planning, controlling, reporting, and adjusting. Connected to the above, update your plans regularly, frequently, even daily.

4. Think in Scenarios

Identify what variables can break your plan, quantify their ranges and see how they can affect your liquidity. Set your confidence level in a transparent, honest way.

If the effect of a single variable is very high and your confidence in your prediction is not, then think again. Additionally, the intervals here are much shorter than those for turnover or cost plans.

5. Optimise Payment Timing

Decide what day of the week you pick for cash outflows, whenever you have the chance. In that case, make sure your creditors know what day of the week you pay.

My recommendation: Fridays. You can balance the inflows for the week. You have a relatively limited number of new payments you have to make, and you can calculate the safety margin with which you start the following week.

6. Centralise Liquidity Management

Concentrate liquidity management in one place in the organisation. All departments are stakeholders, and there can be phases in the life of a company where some departments are more affected than others and must be considered priorities.

However, liquidity is a discipline where understanding interdependencies and keeping an eye on the whole is extremely important.

My recommendation: it can only be placed in the Finance Department.

Conclusion

Liquidity planning and management is one of the least transparent processes in Finance. It is subject to continuous adaptations, yet it has the biggest potential for ruining a company. It requires an understanding of all processes and the ability to take both short-term and long-term views, while maintaining the flexibility to adapt to quick changes in the market.

Key FP&A Lessons for Liquidity Planning:

- Cluster cash flows to separate fixed obligations from flexible items.

- Plan and update in short-term cycles — weekly planning, daily reporting.

- Centralise control in Finance while involving the whole organisation.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.