In this article, discover how FP&A professionals can lead digital transformation by blending human insight and...

FP&A Business Partnering is entering a new era, shaped by rising expectations, smarter technologies, and the growing influence of AI. As automation frees up time across finance teams, the real opportunity is becoming clear: empowering FP&A to connect plans more effectively, influence better decisions, and drive greater business value.

Yet many teams have not fully made this shift. According to the FP&A Trends Survey, only 35% of FP&A time is currently spent on generating insights and driving action. To explore how the role is evolving and what it takes to lead this transformation, senior finance leaders and technology experts came together on the FP&A trend webinar on 28 May 2025 to provide practical insights and strategic guidance on the future of FP&A Business Partnering in the age of AI.

FP&A Business Partnering in the Age of AI: Mars' Transformational Approach

Gaby Makstman, Director, Finance - Transformational Initiatives at Mars Veterinary Health, shared how the company is evolving FP&A by embracing AI, deepening business partnerships, and preserving the human element in strategic decision-making.

The Human + AI Advantage:

At Mars, FP&A is being reimagined through the fusion of Artificial Intelligence and human insight. Gaby emphasized that this combination is not futuristic — it is already in motion across industries.

Mars is building a model in which AI handles scale and speed, while humans bring context, judgment, and creativity.

Gaby noted the evolution of finance tools — from Excel in 1985 to today’s AI-powered platforms. Despite tech booms, most FP&A teams still depend on Excel. The real transformation lies in how AI is used to elevate FP&A roles from number crunchers to strategic navigators.

Mars’ Vision for AI-Enhanced FP&A:

The future of FP&A at Mars is centered on enabling finance teams to focus on higher-value contributions:

From Reporting to Insight: AI will auto-generate reports, allowing finance to invest more time in interpreting results and crafting strategic narratives.

From Lag to Real-Time Analysis: Tasks like assessing the impact of shifting tariffs will become faster, enabling agile responses to market changes.

From Dependence to Empowerment: With AI tools, FP&A teams will self-serve complex analytics without needing IT or deep coding knowledge.

Getting Ready for the AI Future:

Gaby outlined a practical roadmap for FP&A professionals preparing for AI integration (Figure below)

Figure 1

FP&A should be seen not just as data interpreters but as business storytellers. With years of experience and a deep understanding of the business, finance professionals are uniquely positioned to translate data into action, and AI is the partner, not the replacement.

Gaby closed with an energizing message: “AI won’t run the race for us, but it will help us navigate the course better than ever before.”

1st Polling Summary: AI in FP&A

Over half of the audience (51%) reported not using any AI tools in FP&A, while the rest are starting to adopt technologies like Natural Language Processing (20%), Predictive Analytics & Machine Learning (17%), and RPA (13%).

Key Insight:

Adoption is still in early stages. Gaby Maxman noted this is expected due to budget and access barriers, but highlighted strong potential for future growth as the adoption curve advances.

First Panel Discussion Question: Will the FP&A Business Partnering Role Disappear with AI?

The panellists unanimously agreed that AI will not eliminate the FP&A business partnering role, but rather transform and enhance it:

Olha emphasized that while AI brings powerful capabilities, it has limitations and still requires human judgment. The role will evolve with new skill requirements, but won’t disappear.

Greg reinforced that AI is meant to augment human decision-making, not replace it. In fact, some organizations have expanded their FP&A teams after adopting AI, due to the increased focus on strategic work and storytelling.

Gaby concluded by echoing her co-panellists, noting that AI will make FP&A professionals better and more impactful, but the human element will remain essential.

From Spreadsheets to Storytelling: TMF Group’s Vision for FP&A in the AI Era

Olha Zotova, Market Finance Director for Western Europe at TMF Group, explored how FP&A professionals must evolve from data processors to strategic storytellers in a future shaped by AI.

Olha opened by reflecting on the journey FP&A has taken from traditional budgeting and forecasting to a more strategic, advisory-led function. With the rise of AI, less time is needed for data collection and reporting, creating space for FP&A to deepen its role as a business partner.

Importantly, she emphasized that this shift is not entirely new. Strategic thinking has always been part of FP&A, but now, technology is amplifying its importance and enabling professionals to deliver greater value.

AI as a Partner, Not a Replacement:

Echoing her co-panellists, Olha described AI as a tool, not a threat. While AI delivers real-time analysis, fast data absorption, and even automated storytelling, it still lacks human judgment, business context, and critical thinking.

She highlighted key limitations of AI:

- Data dependency: AI is only as good as the data it is given.

- Context gaps: It cannot fully grasp company-specific nuances.

- Bias risk: AI may reflect hidden biases within the datasets.

- Over-reliance: As AI becomes embedded in daily life, it is crucial to retain human oversight and questioning.

Evolving Skillsets for the Future of FP&A:

To thrive in the AI-augmented future, Olha outlined three critical skills FP&A professionals must develop:

- Interpret AI Outputs: Understand and validate results to ensure alignment with business realities.

- Apply Ethical Judgment: Evaluate AI insights critically to avoid biased or misleading outcomes.

- Master Storytelling (her top priority): Bring data to life in a way that drives business understanding and action.

The Four Steps to Effective Storytelling:

Figure 2

FP&A is not disappearing; it is evolving. With AI as a powerful partner, professionals must build new skills to stay relevant. Olha closed with a call to action: embrace change, sharpen your storytelling, and be ready to lead FP&A into its next chapter.

Second Polling Question: FP&A Skill Least Likely to Be Replaced by AI

In the second poll, 49% of the audience chose stakeholder management as the FP&A skill least likely to be replaced by AI, followed by strategic thinking (24%), communication and storytelling (15%), and innovation (13%).

Key Insight:

Stakeholder management is seen as the most human-centric skill — one that AI can’t replicate. Olha agreed, noting that while AI may reduce the need for data handovers, strong relationships will remain vital for FP&A success.

Summary: Second Panel Discussion – Key Skills for FP&A Business Partners in the Age of AI

The panel discussed which skillsets FP&A professionals should strengthen as AI becomes a core part of their function.

Gaby emphasized the need to go beyond Excel and build broader technical capabilities, such as understanding relational databases, how algorithms work, and becoming more tech-savvy overall.

Greg agreed, adding that curiosity is key — being willing to explore new tools and technologies. He stressed the importance of learning how to ask the right questions when using AI, especially with conversational planning tools. He also reassured professionals that they don’t need to become data scientists, as leading AI tools are designed for ease of use.

Olha echoed both points and added that human relationships must not be overlooked. Even in a future where “your AI may talk to my AI,” strong interpersonal connections will remain essential for successful business partnering.

AI-Powered Transformation: Enhancing FP&A’s Role as a Strategic Business Partner

Gregory Volpe (Solution Marketing Director at Workday) presented how evolving technology, particularly AI, is empowering FP&A teams to overcome operational challenges and become more agile, insightful partners to the business.

Current FP&A Pressures:

Today’s FP&A teams face unprecedented demands due to economic volatility, shifting consumer behaviour, and competitive pressure. CFOs expect faster, deeper forecasts, more frequent scenario modelling, and smarter insights — all with increasing data volumes.

But many teams are held back by outdated tools and processes:

- Manual reconciliations, Excel spreadsheets, and siloed systems slow down insights.

- High data volumes overwhelm traditional analysis methods.

- Time-consuming number-crunching limits the ability to focus on strategic decision-making.

According to a recent metric, 72% of CFOs see financial planning applications as critical to delivering value across the organization. This reinforces the importance of equipping FP&A teams with the right digital tools, not just to streamline operations, but to elevate their strategic role.

Greg outlined the advantages of adopting modern, AI-powered planning tools:

- Automation & Efficiency: Reduces time spent on routine tasks, allowing FP&A professionals to focus on strategy and value creation.

- Collaborative Planning: Engages cross-functional stakeholders in real time, enhancing alignment across the business.

- Real-Time Analytics: Integrates internal and external data sources, enabling faster, more informed decisions.

- Scalability: Supports planning complexity across organizations of all sizes.

Why AI Matters in FP&A:

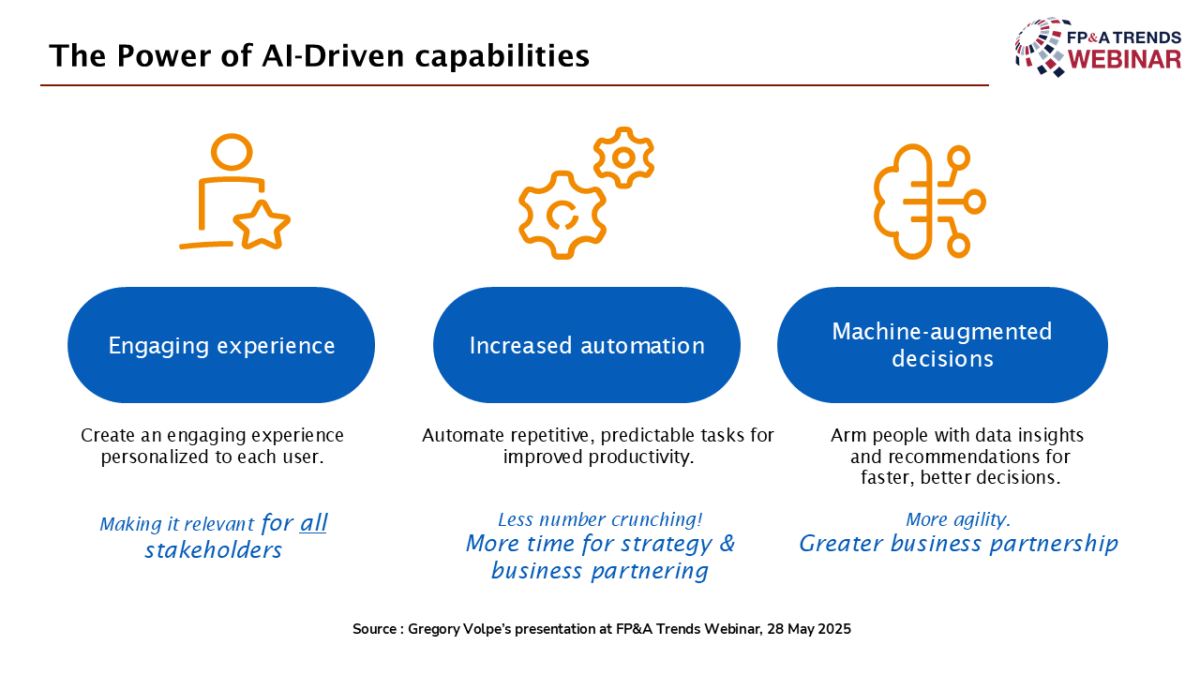

AI capabilities are central to this transformation. Greg highlighted four key ways AI enhances business partnering:

Tailored, Engaging Insights: AI enables personalized insights that foster better collaboration and relevance across business units.

Process Automation: Repetitive tasks like reconciliations and data validation are streamlined, freeing up capacity for strategic work.

Advanced Pattern Detection: AI algorithms detect trends, seasonality, and anomalies across massive data sets, improving forecast accuracy.

Faster, Smarter Decision-Making: Natural language and conversational tools deliver real-time recommendations, boosting agility and responsiveness.

Figure 3

Key Conclusion of the Session:

The panellists agreed on a clear takeaway: AI is not a threat, but an opportunity.

Gaby encouraged FP&A professionals to embrace AI, get educated, and build skills to become stronger strategic partners.

Olha emphasized viewing AI as a journey of evolution, urging attendees to focus on the opportunity ahead rather than the fear of change.

Greg advised to start small, experiment with AI tools, and gradually adopt them to uncover their value in enhancing business partnering.

Stay curious, build confidence, and be ready — AI is here to support, not replace, the future of FP&A.

Special Thanks

We extend our gratitude to Workday, our technology sponsor, and to our panellists for their invaluable contributions and thought leadership.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.