In this article, the author explains how FP&A teams can use the FAIR data management framework...

Finance teams today face increasing pressure to deliver insights faster, improve forecast accuracy, and support more agile decision-making — all while navigating manual processes, fragmented systems, and rising expectations from the business. The Digital EMEA FP&A Circle webinar, held on November 5, 2025, and attended by more than 400 professionals from 45 countries, explored how FP&A teams can take practical, achievable first steps into AI without becoming overwhelmed.

Four expert speakers from Miele, ETH Zurich, Takeda and Jedox shared real examples, lessons learned, and clear guidance on how finance teams can begin their AI journey.

Why AI is Becoming Essential in FP&A

Whilst AI adoption is growing globally, the 2025 FP&A Trends Survey shows that FP&A’s journey is still in its infancy:

- 53% of organisations still do not use AI in any FP&A process.

- Only 10% use AI for forecasting or data analytics.

- The majority of FP&A time is still spent on manual data preparation and reporting.

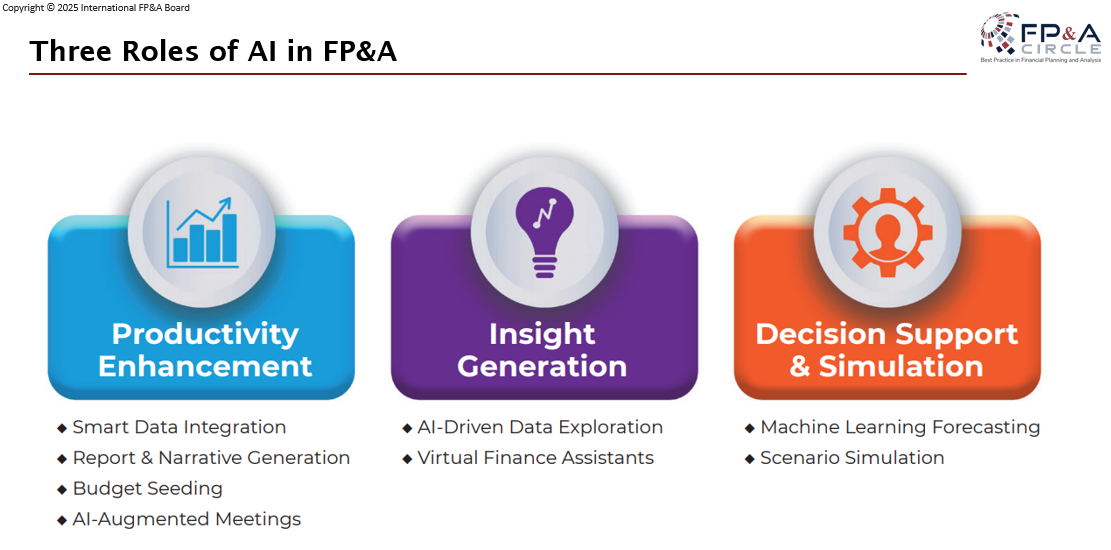

AI offers FP&A value in three key areas:

- Productivity enhancement — automating repetitive tasks and improving data quality

- Insight generation — identifying patterns, anomalies, and drivers

- Decision support — faster forecasting and scenario modelling

Figure 1

Getting Back to Basics: Quick Wins Come First

Joao Caldas, FP&A Director at Miele, emphasised that FP&A teams should start by targeting quick, simple wins rather than attempting large AI transformations. His three-step maturity model helps teams move forward with confidence.

Simple, Immediate Use Cases

AI can support everyday tasks such as creating draft dashboards, simple Python scripts, and exploring new concepts. Tools like Perplexity, Excel with Python, and Copilot help prototype in minutes.Automating Repetitive Work

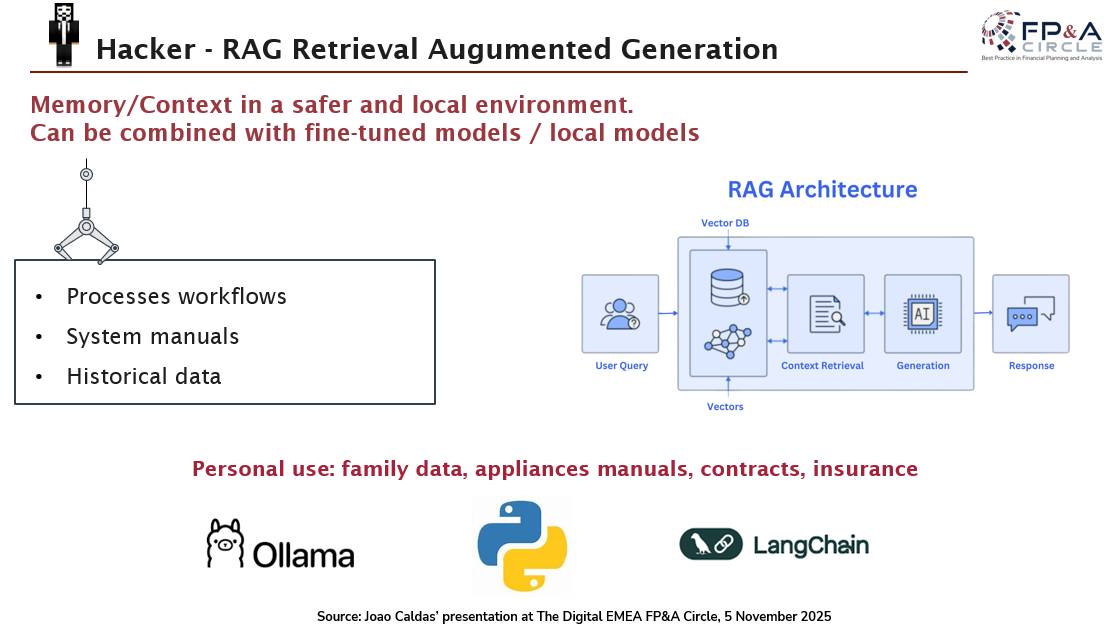

The next stage is automating manual tasks, including data cleaning, reconciliations, and recurring reporting. Python in Excel or VS Code, combined with GitHub Copilot, helps analysts automate tasks without relying on IT.Retrieval-Augmented Workflows

More advanced teams can use RAG to combine internal documents with AI for policy search, trend summaries, and extracting drivers. Joao’s advice: Start small and fix inefficiencies before automating.

Figure 2

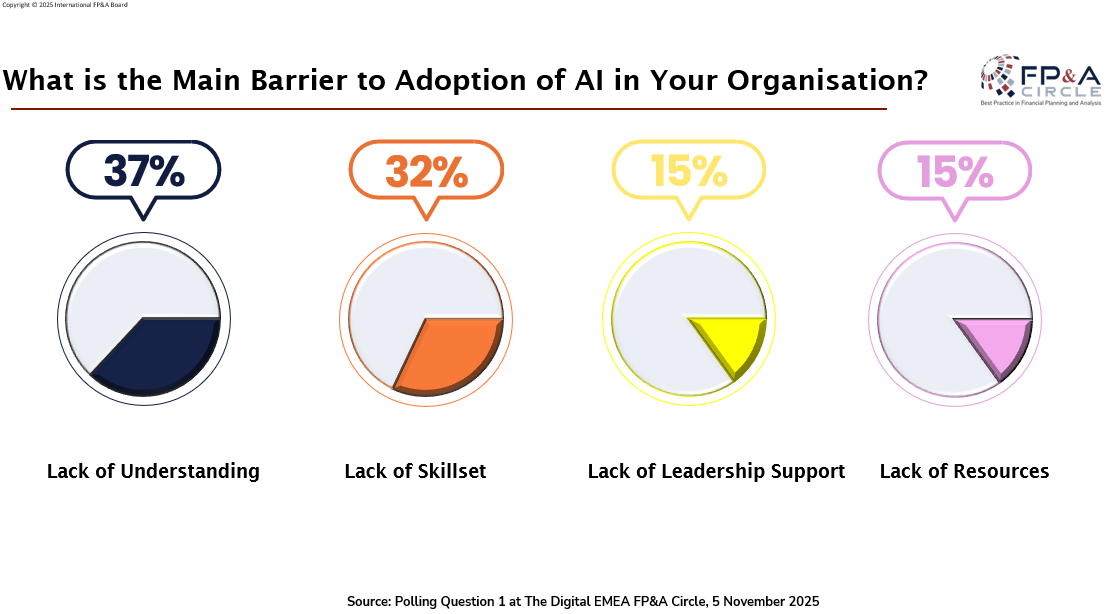

Poll Insight: What is the Main Barrier to Adoption of AI in Your Organisation?

When we asked participants about the main barrier to AI adoption, the responses told a familiar story, one that plays out in many finance teams today. Before any technology can transform the organisation, people must first understand it, trust it, and feel ready to use it. And that’s where the real challenges begin.

- 37% – Lack of understanding is the biggest barrier

- 32% – Lack of skillset is the second most common challenge.

- 15% – Lack of leadership support

- 15% – Lack of resources

Figure 3

Most organisations struggle not with technology itself, but with the lack of understanding of AI and skills, while leadership support and resources are secondary but still significant barriers.

Starting the AI Journey

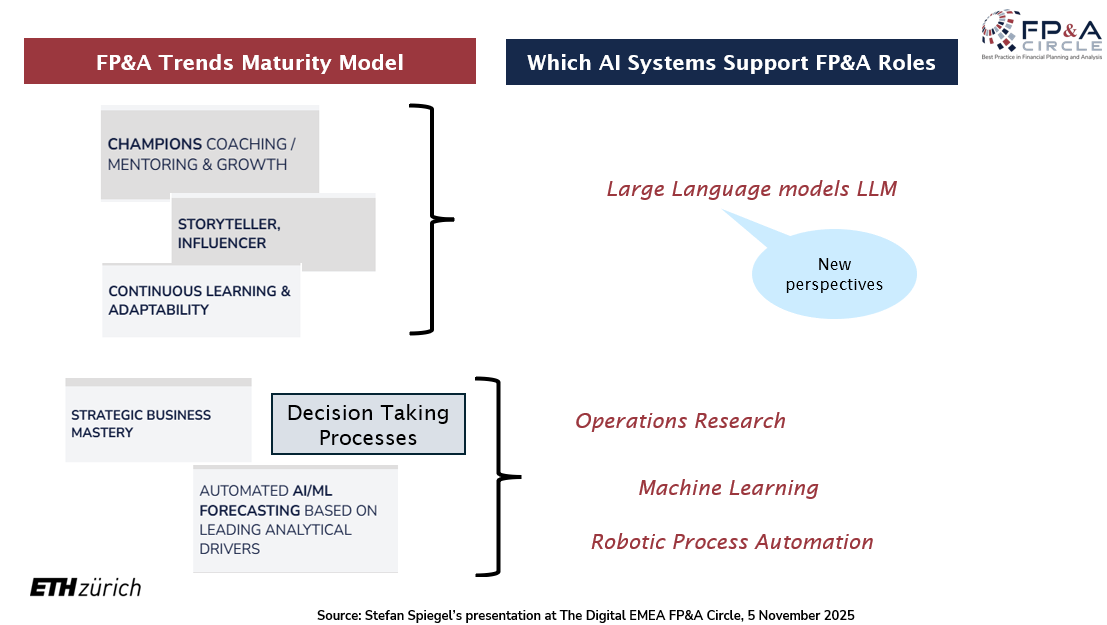

Stefan Spiegel, VP at ETH Zurich, provided a structured roadmap showing that AI is a toolbox of technologies, each suitable for different FP&A challenges.

Key technologies:

- LLMs for narrative creation and policy queries

- ML for forecasting

- OR for decision optimisation

- RPA for workflow automation

Figure 4

Use cases at ETH Zurich:

- Process optimisation (highest ROI)

- Decision optimisation, saving 1 million CHF

- Machine Learning based predictive forecasting

- Finance chatbots for policy support

- RPA for browser-based workflows

Stefan then gave us some insights into “How and where to Start”:

- Hire two digital/AI-focused project managers

- Roll out AI assistants like Copilot

- Build a small team for ML/OR/LLM use cases

- Ensure strong data and IT foundations

His story shows that starting the AI journey in FP&A does not require a massive transformation. It starts with clear priorities, small wins, and the right capabilities, building confidence as the organisation learns what AI can truly deliver.

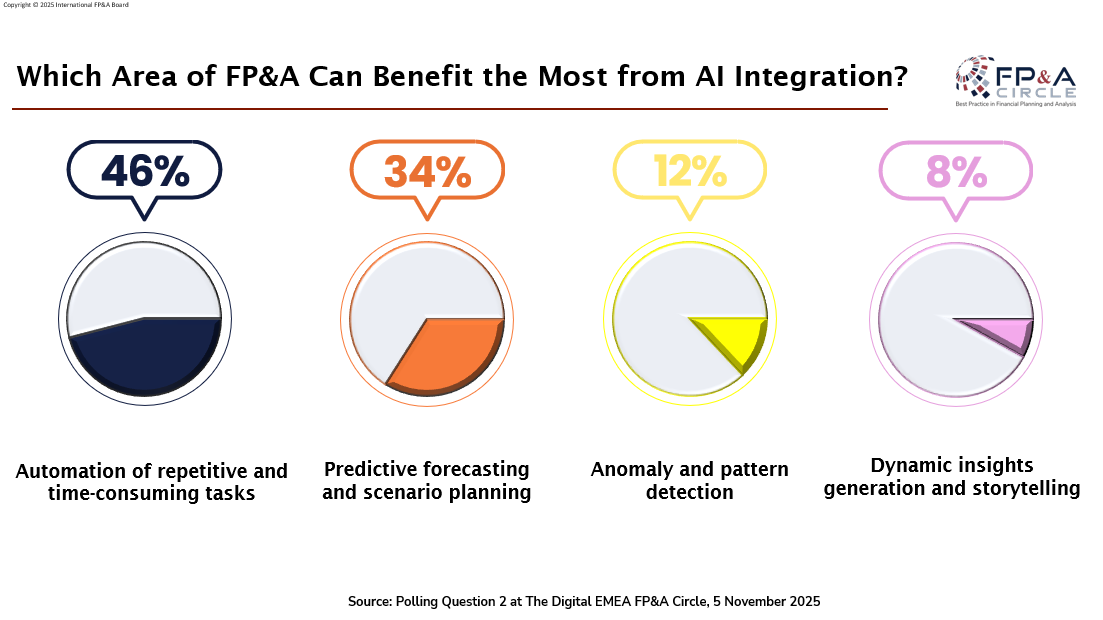

Poll Insight: Which Area of FP&A Can Benefit the Most from AI Integration?

In the second polling question, participants shared where they believe AI can create the greatest impact in FP&A. The responses reveal a clear pattern: teams are looking for AI to relieve pressure, simplify workflows, and strengthen forward-looking insights.

- 46% – Automation of repetitive and time-consuming tasks is seen as the biggest opportunity for AI.

- 34% – Predictive forecasting and scenario planning is the second-highest area of benefit.

- 12% – Anomaly and pattern detection

- 8% – Dynamic insights generation and storytelling

Figure 5

AI at Scale: Takeda Case Study

Takeda implemented AI/ML to predict revenue across multiple countries.

Figure 6

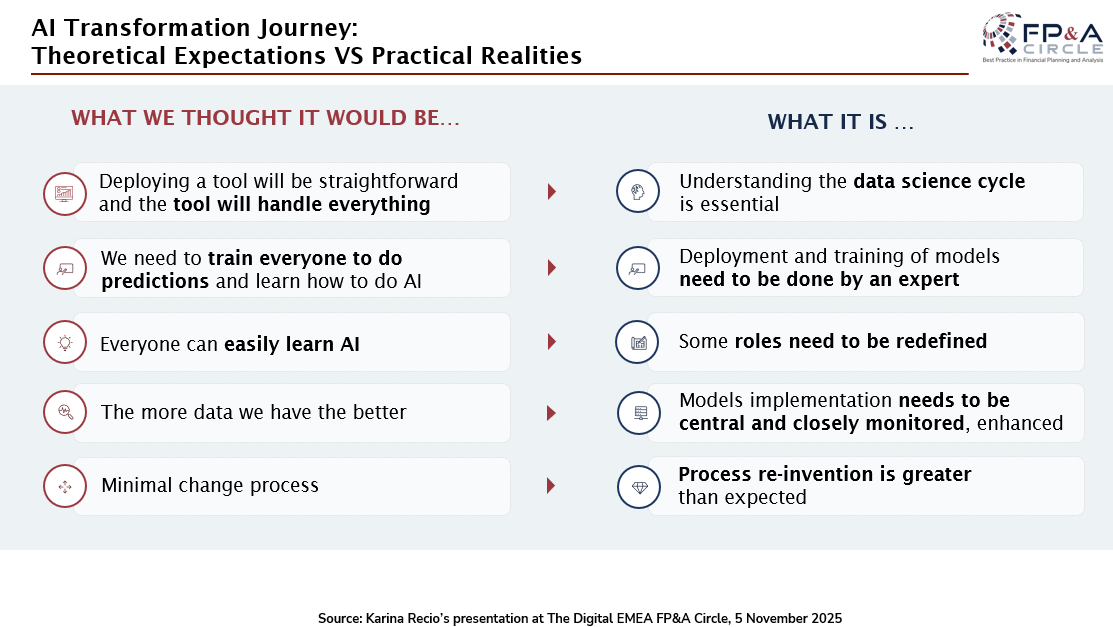

Many FP&A teams enter AI projects expecting a straightforward technology rollout. In reality, scaling AI across markets and business units requires deeper change, broader expertise, and stronger foundations than initially assumed.

Karina Recio, Head of FP&A at Takeda, shared what were Takeda’s Expectations vs Reality. Figure 6 illustrates this gap between theoretical expectations and practical realities.

It highlights common assumptions, such as the belief that AI tools can simply be deployed and will “handle everything”,contrasted against what actually happens in practice: the need for data-science literacy, specialist model oversight, redefined roles, and more extensive process redesign than most teams anticipate.

Teams learned that:

- AI is not autonomous — expert supervision is essential

- Data quality matters more than data quantity

- Not every analyst can become a data scientist — specialist skills are required

- AI requires process re-engineering, not plug-and-play automation

These realities shape how organisations must prepare, govern, and scale AI responsibly.

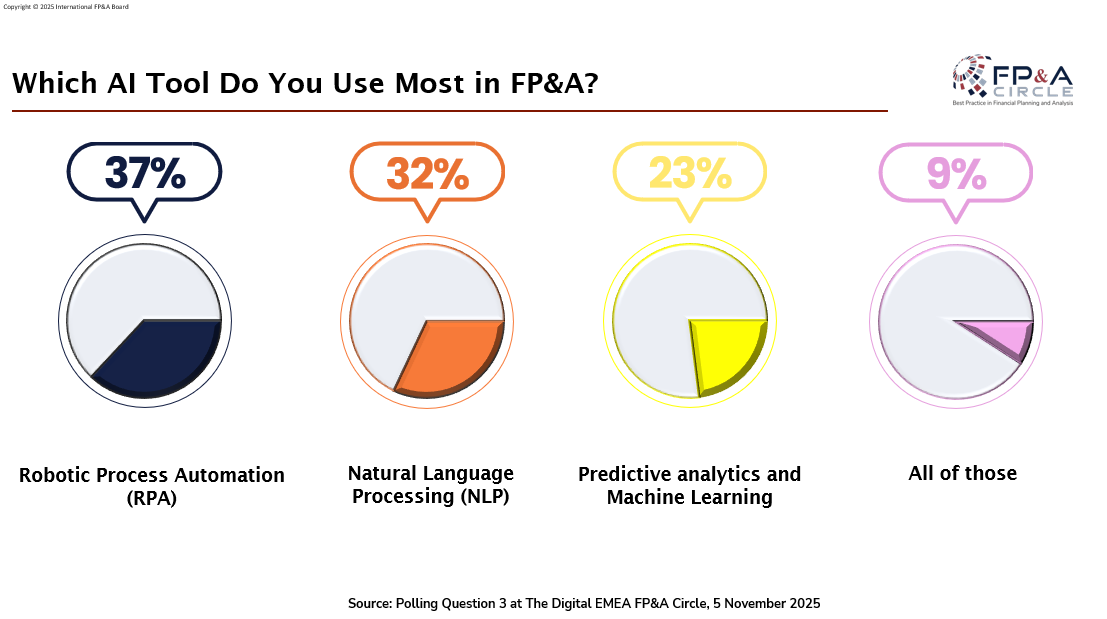

Poll Insight: Which AI Tool Do You Use Most in FP&A?

In the final polling question, participants revealed how AI is actually being used inside their FP&A functions today — and the responses paint a clear picture of where adoption is gaining traction. The most widely used category, selected by 37%, is Robotic Process Automation (RPA). Close behind, 32% of respondents pointed to Natural Language Processing (NLP) tools. Predictive analytics and Machine Learning accounted for 23%. Finally, 9% chose “all of the above.”

Figure 7

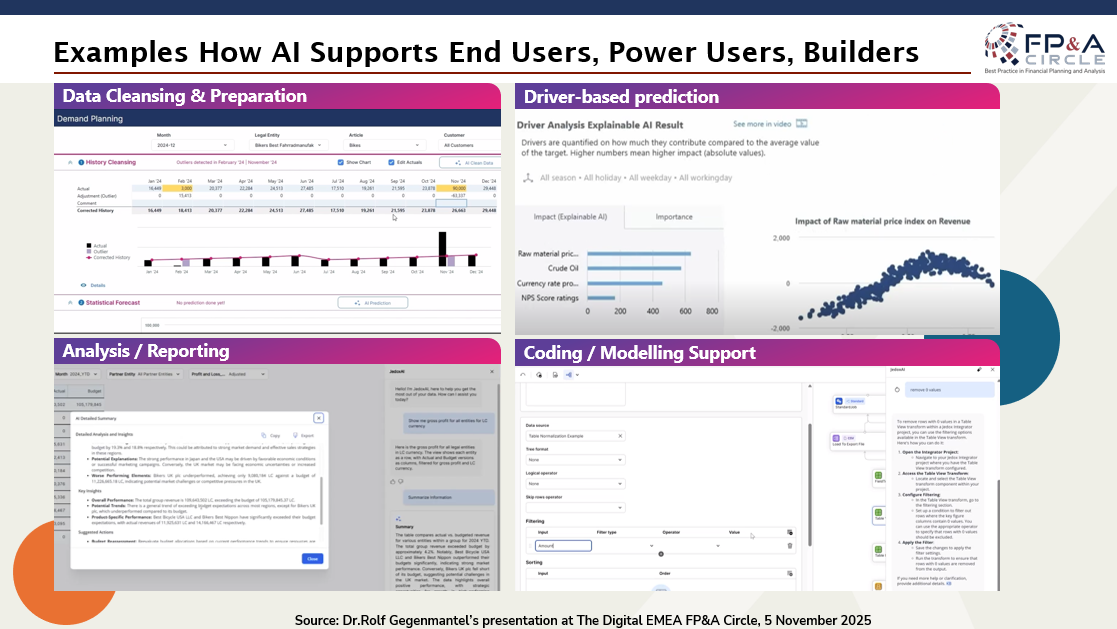

Technology’s Role in Enabling AI

One of the central messages from Dr. Rolf Gegenmantel, Chief Product Officer at Jedox, was that technology alone does not guarantee AI success. MIT research shows 95% of AI projects deliver no P&L impact due to weak integration.

Successful organisations take a different approach. They:

- Put practical AI directly in the hands of business users

- Integrate AI deeply with existing CRM, ERP, and HR systems

- Prioritise tools that learn, retain context, and adapt

- Focus on workflow-based AI, not just model-based AI

This aligns with FP&A’s need for reliability, accuracy, and trust.

Why FP&A Needs AI + Financial Context

Finance operates under conditions that most other business functions do not. Financial data requires:

- 100% accuracy

- Clear audit trails

- Structured hierarchies and drivers

For that reason, LLMs alone are not enough. FP&A needs systems that combine structured financial data with generative intelligence — enabling AI to produce insights that are both powerful and financially correct.

When these two capabilities work together, FP&A teams gain access to:

- Automated variance explanations

- Insightful narratives

- Driver-based prediction

- Forecast automation

- Scenario analysis

- Report and slide creation

- Self-service analysis for business partners

In practice, this creates a co-pilot for analysts and decision-makers — a system that accelerates routine work while strengthening the quality of insight and business dialogue.

Figure 8

Conclusion

The session delivered a clear message from all of our speakers:

- Start small

- Fix processes before applying AI

- Build strong data foundations

- Invest in people and skills

- Scale gradually

- Keep human judgment central

AI is already reshaping FP&A. Taking practical, incremental steps will unlock a meaningful impact.

We would like to thank Jedox, our technology sponsor, for bringing this webinar to our FP&A community and our panelists for their presentation and valuable insights.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.