In this article, discover why FP&A has become the most powerful launchpad to the CFO role...

A few years ago, I was turned down for a promotion.

At the time, I was working as a Commercial Finance Manager, responsible for a portfolio of commercial property assets. Across our business, there were around fifteen commercial finance managers and analysts, and opportunities to step up into senior commercial finance roles were rare. When a role finally opened up, it was awarded to a colleague largely because he had been in his position marginally longer.

Like several of my peers, I was left feeling disappointed and somewhat disillusioned.

Did this mean I would have to wait years for another opportunity? Why, despite consistently strong performance ratings and high-quality delivery, was I being overlooked? What could I do differently?

On paper, I was highly qualified, Oxbridge educated, Big Four trained, yet the recognition and career progression I was aiming for felt out of reach.

Fast Forward Seven Years

Today, I am Head of FP&A for a global business with £900m of annual turnover. It is an intellectually demanding, commercially engaging role that also offers a level of flexibility that allows me to balance a senior leadership position with raising three young children. So how did I get here? And what would I recommend to others who may now find themselves in a similar position to the one I was in seven years ago, in their early to mid-30s, and eager to accelerate to the next level?

The answer lies in a combination of factors, but above all in developing a differentiated and hard-to-replicate skill set.

Building a Strong Foundation in Commercial Finance

Commercial finance is a fantastic training ground. In my case, this involved working closely with commercial property managers and developing a deep understanding of the dynamics of supply and demand within shopping centres. I saw firsthand how seemingly minor decisions, such as removing an escalator, could materially affect footfall, tenant demand, and rental tension across multiple floors. I supported investment decisions around alternative uses, including large-scale leisure developments such as bowling and trampoline parks, which required significant capital investment but offered more stable income streams than traditional retail. Alongside this, I sat on property boards and regularly presented financial analysis to senior stakeholders. It was an excellent grounding in business and provided a strong platform for a future role as a CFO, or even for roles in strategy or operations.

But from a promotion perspective, this foundation only got me so far.

The Promotion Bottleneck

Finance teams are typically structured in a pyramid: many analysts and managers, far fewer senior managers, and ultimately only one or two finance director roles. To progress, one must differentiate. I could continue to work hard advising the business, presenting well, and building strong relationships, and I was good at all of these. But if I’m being honest, there were others who outshone me. I am naturally reserved, particularly in boardroom settings. What I lacked was a clear, distinct USP.

Why Financial Planning and Analysis Changed Everything

The turning point came when I moved into FP&A.

In most large organisations, FP&A teams are relatively small. There is typically a central group function and, in larger businesses, divisional FP&A teams, too. I took on the role of FP&A Manager for the retail property portfolio, which immediately gave me exposure across an entire division rather than a single asset class. Following an organisational restructure, I moved into Group FP&A. Suddenly, I was working across retail, offices, leisure parks, and brownfield development sites. I coordinated the group budgeting process, chaired cross-divisional meetings, and listened to the commercial heads debate investment, disposals, development viability, and capital allocation. I also began working closely with Treasury, understanding debt structures, hedging strategies, and the timing of facilities relative to cash requirements. These are key skills in capital-intensive industries and an invaluable complement to commercial and operational finance experience.

When another restructure occurred, and a Senior Finance Manager role in Group FP&A became available, the outcome felt inevitable. I had become the obvious candidate.

Discovering the Importance of Systems

As interesting as Group FP&A is, its success ultimately depends on data and systems. Strong commercial insight means little if the underlying data is unreliable or the tools are inefficient.

By 2021, the budgeting and forecasting processes had become so cumbersome that they were having a tangible impact on business performance. Poor systems increased the burden on finance and created friction for commercial teams, limiting access to reliable information and distracting them from value-added decision-making.

When our CFO announced a finance transformation program in early 2022, placing FP&A processes at the top of the agenda, I jumped at the opportunity to get involved.

Leading a OneStream Implementation

We selected OneStream as our FP&A platform, a decision that surprised and intrigued me, as I had been an advocate of using property-specific software.

I was the natural in-house lead from a business perspective, working alongside external implementation specialists and the software vendor. My role was to design the financial models to be embedded in the system, translating business logic into something that could be codified technically. It was a steep learning curve, and we made mistakes.

The success of an implementation depends on everyone involved. A poor vendor or product means the project will never get off the ground. Weak implementation consultants are akin to having a bad builder on a redevelopment, while an inexperienced, under-resourced, or overstretched in-house team is like having a bad architect. No matter how good the product or builders are, the project will ultimately fail.

In hindsight, we focused too heavily on bespoke models, rather than first ensuring that core processes, consolidation, reconciliation, and data flows were robust and efficient. This experience taught me invaluable lessons about what drives success and failure in large-scale transformations. Two years later, despite the program’s challenges, I had developed deep, practical expertise in FP&A transformation and system implementation, exactly the kind of differentiated experience I had lacked earlier in my career.

The Step into the Head of FP&A

When a recruiter contacted me about a Head of Group FP&A role at a global law firm undergoing a complex OneStream implementation, the fit was immediately clear. Seventeen months in, the role has been deeply rewarding. We have rebuilt capability, strengthened the team, and accelerated progress. We are migrating to OneStream v9, bringing actuals reporting onto the platform, with a pathway to modernise our reporting infrastructure using Power BI.

Building a Differentiated Career in Finance

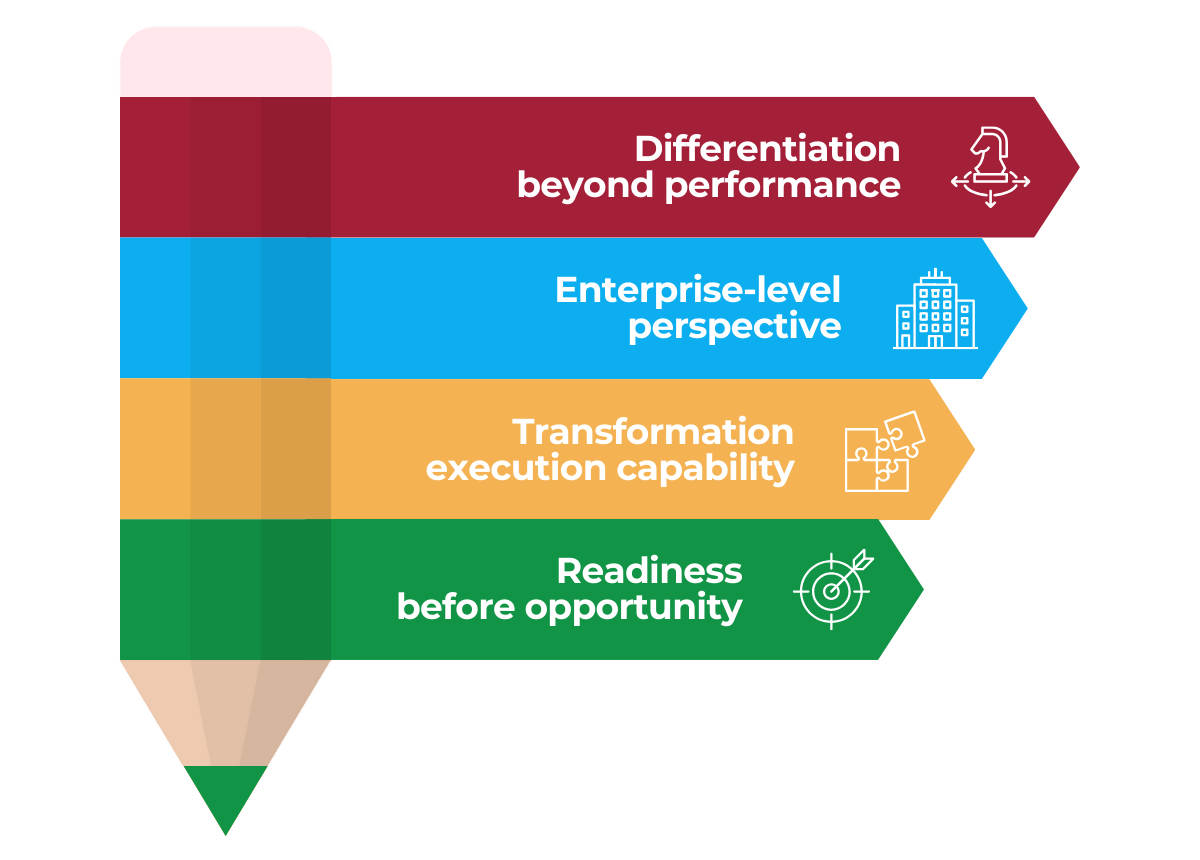

Becoming Head of FP&A has been the result of a series of intentional choices, each of which has helped me develop unique and valuable skills. The key lessons are clear:

Commercial finance is a great foundation, but differentiation is essential.

My early career provided rich experience in asset-level decision-making, stakeholder management, and commercial analysis. These capabilities formed a strong foundation, but they did not differentiate me in a competitive pool of managers vying for a small number of senior roles. Those who do progress usually bring something distinctive. The lesson: technical skill, commercial insight, and good relationships matter, but you need to identify and build a USP that sets you apart.FP&A is a career accelerator as it expands your scope.

Moving into FP&A proved pivotal, primarily because it expanded the scope of my work. My role provided insight across the full division and ultimately the group, including exposure to capital allocation, treasury, and strategic decision-making, areas outside the remit of asset-focused finance. This shift significantly influenced my career trajectory. The lesson: roles that broaden organisational understanding tend to deliver disproportionate career progression.Building systems and transformation expertise creates a unique, relevant, and highly impactful skillset.

Leading the OneStream implementation pushed me into a steep learning curve at the intersection of finance, data, modelling, and technology. Few finance leaders have hands-on experience delivering FP&A systems at scale. This experience became my true differentiator and directly enabled my move into a global Head of FP&A role. The lesson: in a world where finance is becoming more digital, combining FP&A expertise with systems and process transformation is one of the best ways to stand out.Opportunity and timing matter — but preparation matters more.

An organisational restructuring, a global pandemic that placed FP&A at the forefront of decision-making, and a transformation program all created sudden demand for the skills I was developing. These moments involved luck, but they only translated into career progression because I had already built the right capabilities. The lesson: you cannot control when opportunities arise, but you can control whether you are ready for them.

The Path Forward

Careers are journeys rather than linear paths. The Head of FP&A role is not an endpoint but a gateway to a CFO position, deeper specialisation in finance transformation, or broader commercial and strategic positions. For those in their early to mid-career, particularly those who feel stuck despite strong performance, there is an opportunity to move forward, as I have, by deliberately cultivating skills that sit at the intersection of commercial finance, strategic planning, and systems-driven change.

If you are analytically inclined, interested in financial modelling, strategy, and systems, and have the patience required for complex change programs, a similar path may resonate with you. If any of this strikes a chord, I’d love to hear from you.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.