In this article, discover how Agentic AI is revolutionising FP&A by automating forecasting, budgeting, and variance...

Are finance professionals ready to move into the era of Agentic AI? Digital workers evolve from tools to our intelligent collaborators, and FP&A must shift from operational support to AI orchestration. The future of finance lies human-AI collaboration, where culture, skills, and mindset are as critical as the technology itself.

In the latest FP&A Trends webinar, experts from TMF Group, Clyde & Co, and Wolters Kluwer CCH Tagetik examined how FP&A roles are being redefined. From foundational concepts to practical applications, the session provided a forward-looking yet grounded view of how to prepare for the agentic era. This report summarizes the key messages and takeaways.

Agentic AI in FP&A: Mindset, Culture, and Capability

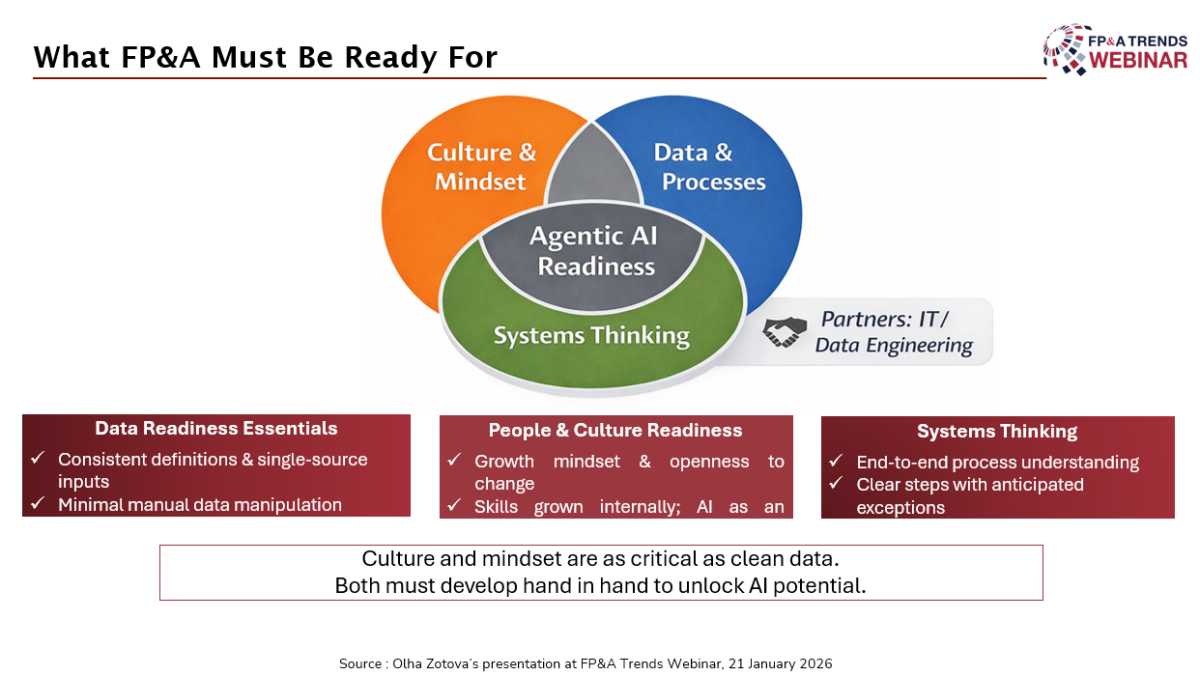

Olha Zotova, Market Finance Director for Western Europe at TMF Group, opened the discussion and stated that success with Agentic AI starts not with perfect data, but with people. Clean and structured data are necessary, but culture and mindset are equally important for adoption.

Olha outlined three pillars for AI-ready FP&A:

- Data readiness essentials: Consistent definitions & single-source inputs and minimal manual data manipulation

- People & Culture Readiness: Growth mindset & openness to change and skills grown internally; AI as an enabler

- Systems thinking: End-to-end process understanding and clear steps with anticipated exceptions

Figure 1

Olha described to us the “hybrid model”, where human professionals own and manage digital agents. Each agent must have an accountable owner. FP&A teams must “start small, learn fast, and later on scale what works.” Pilot initiatives should focus on routine, rules-based tasks that are well-understood.

Olha stressed the importance of freeing up capacity, so that teams can “play with AI”, experiment and iterate. We also need to celebrate early wins to have the motivation to move forward.

“The biggest challenge isn’t technology, it’s resistance to change,” she concluded.

Poll Insight: What is Currently the Biggest Barrier to Adopting AI Agents in FP&A?

Data quality and structure were the leading challenges, which were selected by 35% of participants. Organisational culture and mindset followed closely at 27%, demonstrating that human readiness remains nearly as significant as technical foundations. Skills and capability gaps within FP&A teams accounted for 19% of responses, and technology limitations ranked last at 18%. These results strongly reinforce Olha’s message that successful adoption of AI agents depends not only on systems and data, but equally on cultural readiness.

Agentic AI – Is it for Everyone ?

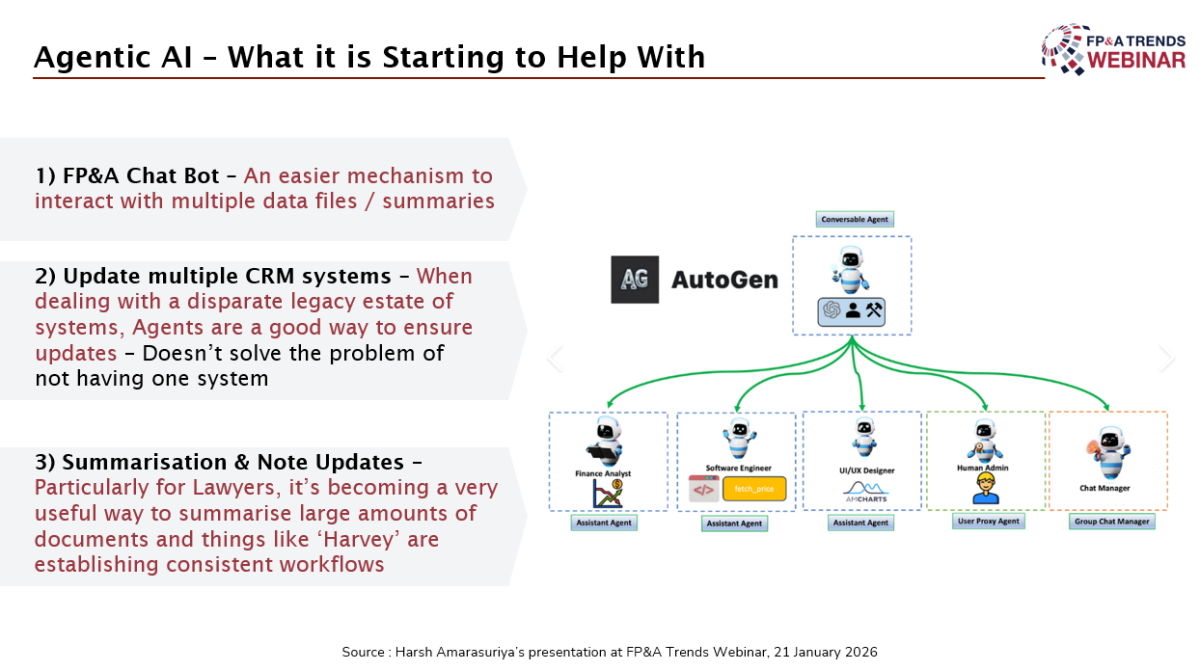

Harsh Amarasuriya, Global Head of FP&A, Finance Transformation, Data Strategy at Clyde & Co, brought in practical, real-world examples to the discussion, outlining how his team is already deploying Agentic AI. Examples included:

- An FP&A chatbot that answers recurring internal questions, reducing workload on analysts.

- Data updates across CRM systems, easing integration across disparate platforms.

- Automated document summarisation, used effectively in legal operations.

Figure 2

However, he warned against over-relying on technology without addressing underlying process inefficiencies.

“AI doesn’t fix broken processes, it amplifies them,” he noted.

Harsh highlighted the importance of aligning AI initiatives with clear business pain points, and establishing robust KPIs to track impact: error rates, customer value, and process volume.

Also, he challenged the notion of obsolescence in skills:

“We’re not replacing skills, we’re redistributing focus.”

Handling of data will reduce, but interpretation, storytelling, and decision-making will become even more important.

Poll Insight: Which FP&A Activity is Most Likely to be Delegated to AI Agents First in Your Organisation?

In the second poll, respondents shared that data validation and reconciliation are most likely to be delegated to AI agents first, with 46% selecting this option. Management reporting and commentary followed at 23%, while 20% selected forecasting and scenario modelling. Only 11% saw business partner Q&A and on demand insights as the initial use case. Together, these results clearly show that adoption will begin with routine, repeatable activities.

Agentic AI in Finance: Unlocking Role-Specific Value for FP&A

Dominic Nguyen, FP&A Technology Advisor at Wolters Kluwer CCH Tagetik, offered us a strategic overview of how Agentic AI is transforming FP&A. He stated that the debate around whether to adopt AI is over: AI is here to stay, and early adopters are already realising measurable benefits.

Dominic highlighted the growing pressures on CFOs to keep pace with data volumes and process complexity, advocating AI as a lever for enterprise-wide planning, faster reporting, and improved data quality. He explored how objective and generative AI are supporting FP&A teams through natural language interfaces, enabling users to build dashboards, generate commentary, and run scenario analyses with minimal technical knowledge.

Key use cases included anomaly detection, predictive planning, and executive reporting, with AI agents embedded in familiar tools like Excel to reduce the learning curve. He shared a compelling example of a leading automotive company using AI for auto-mapping and sales forecasting, significantly enhancing speed and strategic agility.

Dominic closed by reaffirming AI’s role in augmenting, not replacing, human judgment, ultimately freeing finance professionals to focus on what matters most: insight, impact, and balance in their work. The destination is clear: higher productivity through intelligent augmentation.

Conclusion

Agentic AI offers FP&A teams a compelling opportunity to unlock quick wins: through bots, automation, and always-available “digital junior workers” that can execute routine tasks at speed. But while the promise is real, success depends on more than just plugging in new tools.

Readiness for AI agents goes beyond technology. It requires a strong foundation: reliable data, consistent definitions, and minimal manual manipulation. Just as critically, it demands a shift in culture and mindset. Teams must feel safe to experiment, fail, learn, and iterate, because real transformation is never linear.

To truly realise the value of agentic AI, FP&A leaders must create space for exploration. That means freeing up capacity by automating existing work where possible, so that professionals have the time and confidence to build, test, and govern these new digital collaborators.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.