On November 18th, I had the pleasure of joining the 8th Copenhagen FP&A Board — my fourth time attending. Each time, I walk away with new perspectives, but this session stood out for its blend of familiar faces and fresh voices. Alexander Schmit Pedersen, one of the recurring participants, delivered a thoughtful presentation on the FP&A Maturity Model, and I appreciated seeing how the discussions among attendees continue to evolve along with the profession.

The event, facilitated by FP&A Board founder Larysa Melnychuk, brought together finance leaders, practitioners, and business partners to explore what it truly means to progress toward a “leading stage” FP&A organisation. Supported by global sponsor EY, the session focused on trends, obstacles, and practical steps toward analytical transformation — all grounded in real-world experience.

The event was held in partnership with IWG and CFOPEOPLE, specialists in emergency financial recruitment.

The FP&A Maturity Model and the Reality of Transformation

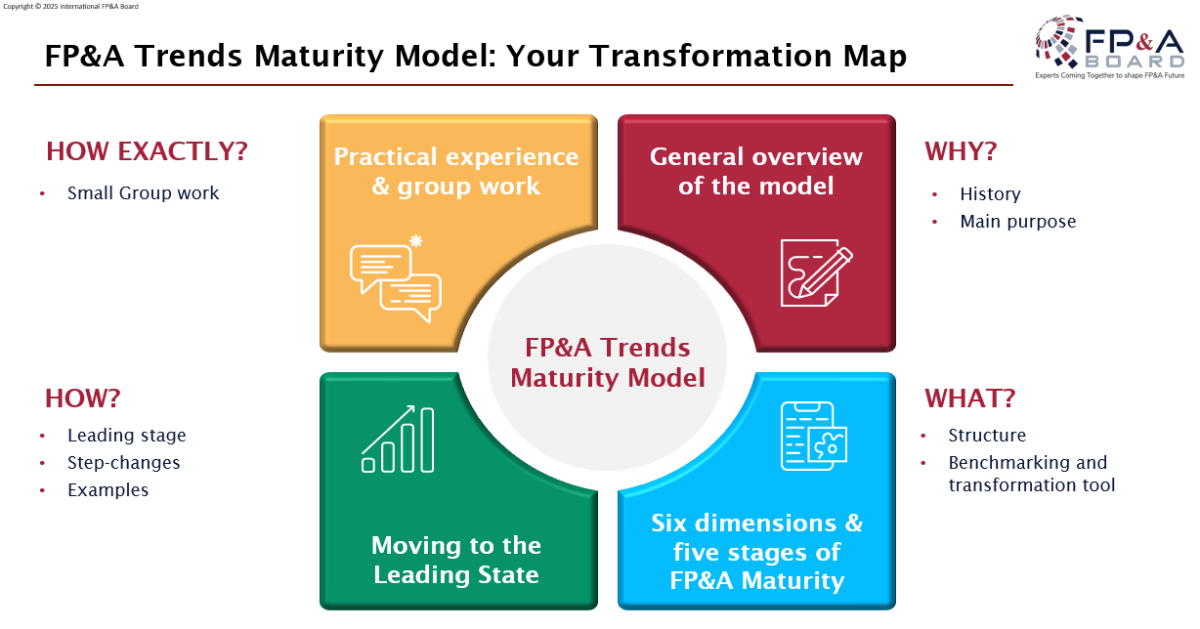

We began by examining the FP&A Trends Maturity Model and one of its central questions: What is the main obstacle to achieving FP&A maturity?

Despite the sophistication of tools and methodologies available today, the most common obstacles are surprisingly human:

• Politics

• Data issues

• Resistance to change

• Role clarity & skills

• Lack of proactivity

Figure 1

The model itself is designed to help organisations transition from fragmented, reactive analysis to integrated, predictive, and ultimately value-creating finance functions. But the discussions made one thing clear: no matter how advanced the model or analytics, progress depends on leadership — a theme that kept resurfacing throughout the day.

Planning for Uncertainty: The Role of Scenario Management

A recurring question during the session was whether it is even possible to plan for uncertainty. Scenario management, predictability gaps, and the balance between tools and skills took centre stage. Larysa posed a sharp, practical question:

“How quickly can you turn around a new scenario request?”

This became one of the most relevant discussion points of the day. It ties directly to a fundamental trade-off in FP&A: scope versus granularity.

From my own perspective, which I shared in the room, high-level business scenarios cannot be built with the same level of detail as bottom-up operational plans. If the aim is strategic agility, we must identify a few critical drivers and accept a lower level of granularity.

Conversely, when working with short-horizon planning in a narrow business area, extreme granularity may be both necessary and valuable. The turnaround time for scenarios must therefore reflect this trade-off. Not every scenario requires 100% precision; in many cases, reliability and directional insight are more important.

As one participant noted, 20% of drivers often account for 80% of the outcome.

The Purpose of Finance: Beyond Numbers

One insight I particularly appreciated was the idea that finance can take the role of both quality assurance and leadership in analytics. This role is not just about validating numbers — it is about shaping informed decision-making. One of the participants said during the session:

“Business partnering is not about pleasing stakeholders, but about securing the best possible decisions.”

This resonated deeply with me. This aligns with my approach in my own field, where I connect ESG with FP&A. When sustainable transformation is treated as a “nice to have” rather than a core driver of financial decision-making, organisations miss both value and risk signals.

That is why Andre Solberg Røysland's comment from EY stood out to me: net-zero targets and ESG commitments must become integrated into financial models, not appended as separate disclosures. True transformation requires that sustainability and finance speak the same language — through data, drivers, scenarios, and capital allocation.

Insights from the Group Work: Data Problems… or Culture Problems?

My group was assigned to discuss the theme “data challenges” as a barrier to reaching the leading maturity stage. Yet, within minutes, our conversation drifted toward leadership, involvement, and culture. We realised that many “data problems” are really symptoms of:

• unclear responsibilities,

• lack of shared understanding of drivers,

• siloed behaviours, and

• limited investment in capabilities.

We concluded that having the right strategy is not enough. To execute on it, organisations must:

• Involve people early

• Build skills

• Strengthen business partnering

• Agree on what “best in class” looks like

• Move away from seeking 100% accuracy and focus on reliability

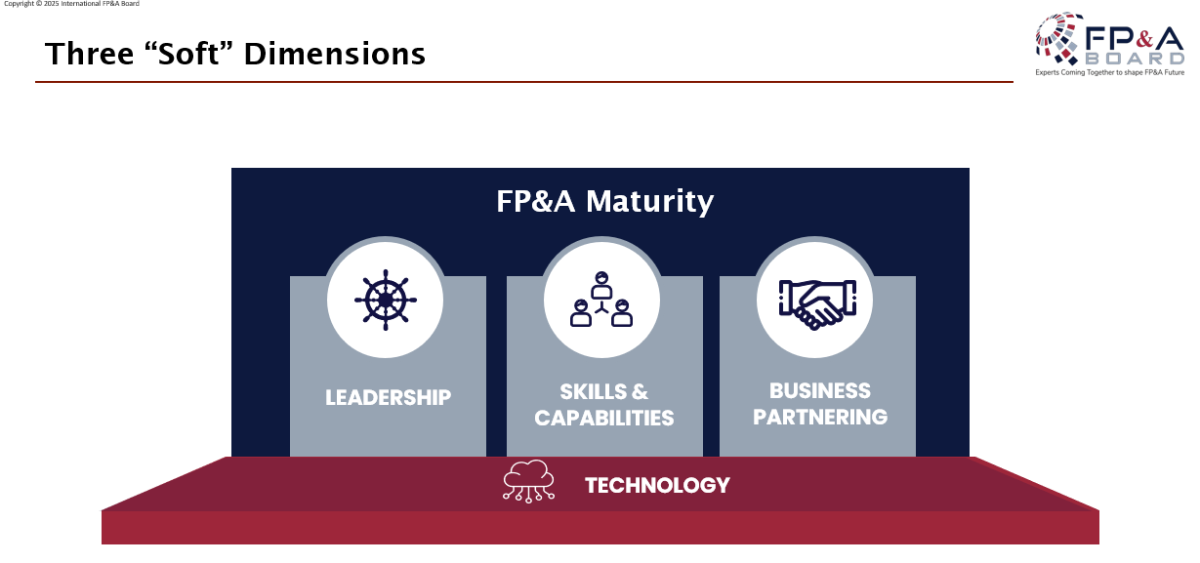

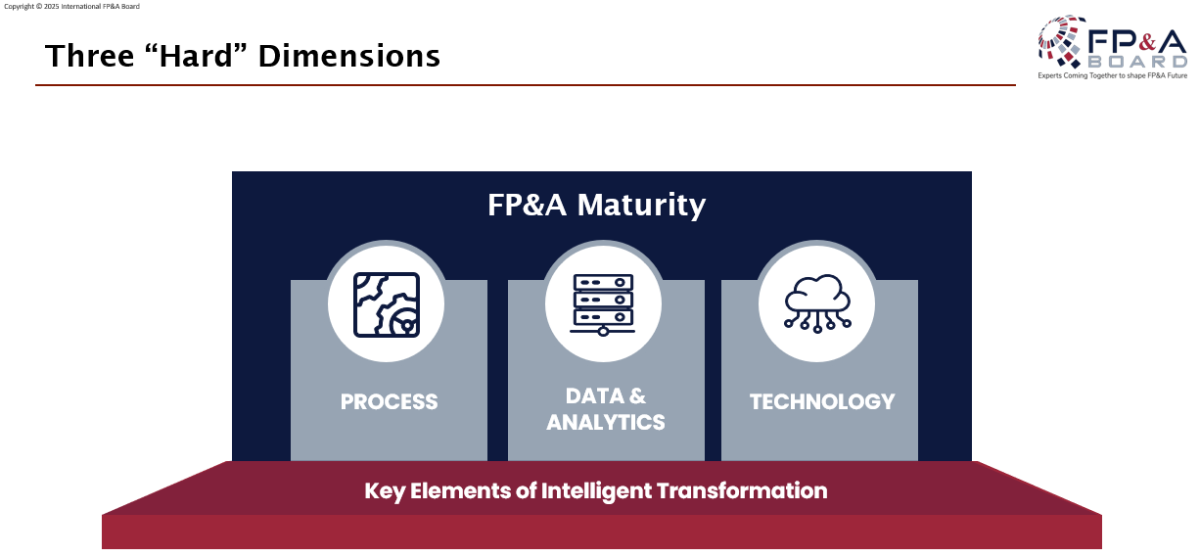

Interestingly, the maturity model itself divides capabilities into “soft” and “hard” elements.

Figure 2

Leadership, business partnering, and processes on one side, and data, analytics, and technology on the other. What we found in the discussion reinforced this: the soft elements are the true enablers of progress.

Figure 3

Personal Reflection: Leadership Determines Whether Transformation Happens

If I were to summarise my conclusion from the day in one sentence, it would be this:

We can build the best model in the world, but without leadership prioritising, driving, and investing in transformation, nothing will change.

Time and again during the meeting, the conversation returned to leadership. It is leadership that sets ambition levels, allocates resources, and builds the culture required for analytical transformation. And this applies equally to integrating sustainability into finance: tools matter, but leadership decides whether ESG becomes embedded in financial planning, or remains an isolated initiative with limited impact.

Final Thoughts

The 8th Copenhagen FP&A Board reaffirmed why I keep coming back. The mix of recurring and new participants creates an environment where ideas build on each other over time. There is no single template for achieving FP&A maturity, but there is a shared recognition that the journey is as much about people and leadership as it is about data and technology.

As FP&A continues to evolve, our role becomes increasingly strategic. We are not just forecasting numbers; we are shaping decisions, embedding new forms of value, and guiding our organisations through uncertainty. And that is a journey I look forward to continuing — both within the FP&A Board community and in my own work connecting ESG and finance.