Balancing centralised and decentralised FP&A models is key to improving efficiency, collaboration and business agility —...

In the first part, we looked at the key criteria for FP&A centralisation and explored two possible structural models, each with its own strengths and limitations. With this foundation in place, the focus now shifts to the practical side of the journey. The сentralisation approach considers how to move from concept to execution and what is needed to make the transition successful.

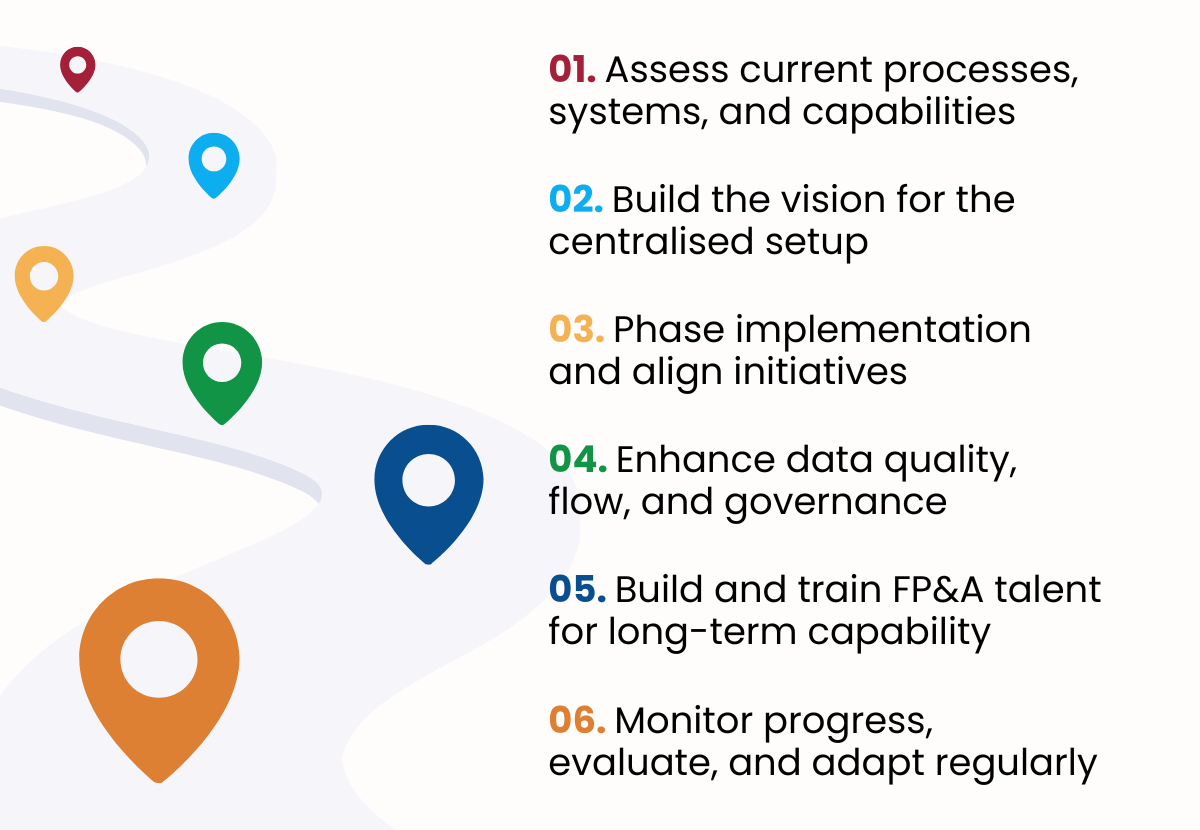

The Centralisation Approach: Implementation Steps

The process of FP&A centralisation can be complex, and possible solutions should be thoroughly thought through before the start, as well as their adjustments on the way should not be underestimated.

So, what could be the approach?

Of course, to start with, the assessment of the existing status is key, including understanding processes, systems, capabilities, and resource status.

The next step will be to build the vision for the future centralised FP&A set-up and validate related needs.

Now the work is to build the link between today and tomorrow. For this, there could be different models, and each organisation should select the most realistic and suitable one in their case.

The implementation can be phased, not only for better complexity management, but also considering parallel activities to prepare the next step. These activities could include the implementation of new technologies, streamlining of existing processes, standardisation of analytics, improvement of data quality, training of resources, etc.

It is also important to maintain flexibility and adaptability. Organisations should be prepared to adjust their approach based on evolving needs. This flexibility will help quickly respond to any unexpected challenges or opportunities that arise during the centralisation process.

The importance of Change Management in a centralisation project should not be underestimated. Centralisation requires significant changes in organisational structure, roles, and responsibilities. With this, there should be a high focus on effective communication, which can help to overcome the resistance and facilitate a smoother transition. Regular updates, feedback loops, and transparent reporting can foster trust and buy-in from all levels of the organisation.

Strong support from management and main stakeholders is also important. This will drive the mentality and culture change and support the acceptance of the centralisation. Also, getting the approvals for needed investments is critical in this case and can be accelerated if the executive team is on board with the project.

Leverage technology – modern tools utilisation is one of the key points for the successful centralisation, as using financial data from various sources and systems can be challenging, considering possible inconsistent formats and unreliable quality.

One of the important points during the centralisation process should be the improvement of the data flow, accuracy and consistency, as well as a robust data governance framework.

The above will help in further steps towards centralisation, such as the standardisation of analytics formats, processes, KPIs, and the main report structure.

Invest in training and talent management. It will provide development opportunities to FP&A professionals and will ensure that the teams are equipped with the skills needed for the centralised set up.

The centralisation process can also help to create an environment that encourages innovation within the FP&A team, including exploring new ideas, experimenting with different approaches, and sharing insights. This culture of innovation will drive continuous improvement and ensure the FP&A function remains agile and forward-thinking even after the main steps of the centralisation project are completed.

The process of centralisation should be under permanent monitoring and evaluation, which will help to adjust and adapt as needed. Establishing clear metrics and performance indicators to track progress and check the alignment with the goals is crucial.

There are, for sure, not only opportunities but also risks linked to the FP&A centralisation which need to be considered.

And while it is clear that the centralised model can bring enhanced efficiency, advanced analytics, agility, improved data quality, consistency, scalability, and a high level of service, some risks linked to this approach should be properly considered.

Some of Them are Listed Below:

1. Resistance to Change: Employees and stakeholders may resist the centralisation process due to concerns about impact on existing workflows, job security or changes in roles.

2. Transition Costs: The centralisation process requires additional investment in technology, training, and change management initiatives.

3. Data Security: Centralising sensitive financial data increases the risk of data breaches and requires robust security measures.

4. Loss of Local Insights/Specifics: Centralisation may lead to a loss of valuable local organisations' insights and knowledge, which can impact decision-making and business support.

5. Over-standardisation: Excessive standardisation can impact adaptation to changing business situations or moving focus areas.

All these risks could be avoided or minimised by the right corrective and proactive actions during the project.

Conclusion

With a clear vision for the future, a centralised FP&A function can play a pivotal role in driving organisational success and growth.

To achieve this vision, investing in the right technologies and talent is essential. By adopting modern software solutions and developing a culture of continuous learning and innovation, the centralised FP&A function can stay ahead of industry trends and deliver exceptional value to the organisation.

In essence, the journey towards a centralised FP&A function is a transformative process that requires detailed planning, strategic investments, and continuous improvement. By embracing these principles, organisations can unlock the full potential of their FP&A capabilities and drive sustainable growth and success in an increasingly complex and dynamic business environment.

Sources

Maturity Model: https://fpa-trends.com/maturity-model

International FP&A Board: https://fpa-trends.com/fpa-board

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.