In this article, you’ll explore why AI will transform, but not replace FP&A, and why human...

As we look ahead to 2026, finance is undergoing significant change due to technological acceleration, as well as a complete rethinking of how planning, analysis, and decision-making should function today. What are the emerging trends reshaping the FP&A landscape? How are forward-thinking organisations redesigning their planning processes and team structures to stay competitive? In what ways is AI disrupting the standard ways of working, and what does this mean for the FP&A skillset of the future?

These questions were asked and answered at the final 2025 FP&A Trends webinar, titled “Inside the Crystal Ball: Five Transformative Trends in FP&A for 2026 and Beyond.” The session explored the tectonic shifts that will define the future of Financial Planning and Analysis. From AI-powered agents and autonomous planning systems to the redefinition of the FP&A role itself, the discussion offered both inspiration and practical guidance.

In this report, we summarise key insights from the webinar, highlight audience perspectives through polling results, and unpack the five interconnected trends shaping the path to FP&A maturity.

Five Transformative Trends in FP&A

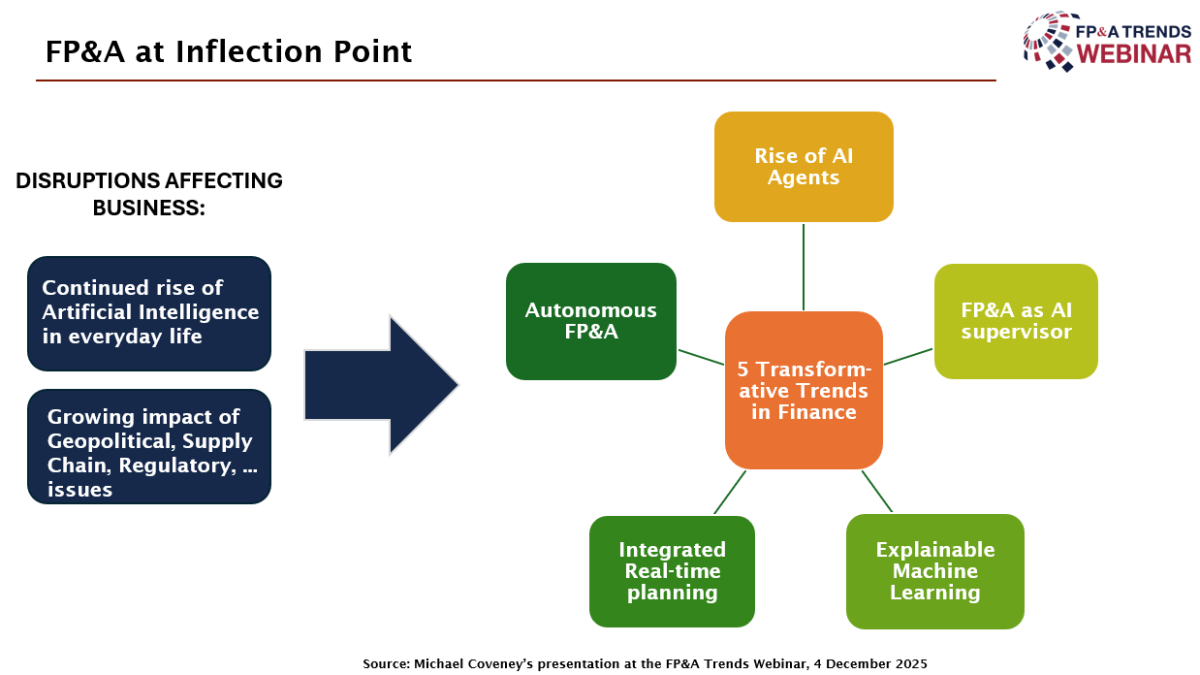

Michael Coveney, Analytics Thought Leader & Head of Research, FP&A Trends Group, opened the session by framing the urgency of change. In a world of constant disruption: from geopolitical shocks to AI breakthroughs, FP&A must evolve from reactive reporting to agile management.

Figure 1

Michael introduced five transformative trends that, while not yet mainstream, are rapidly being adopted by visionary organisations:

Rise of AI Agents: These next-generation tools go beyond automation, acting as real-time digital analysts that refresh forecasts, reconcile data, & surface insights without human input.

FP&A as AI Supervisor: As AI takes over routine tasks, FP&A professionals become the ethical stewards, ensuring AI outputs are accurate, ethical, and aligned to strategy.

Explainable Machine Learning: Transparency in AI models is essential. New tools now reveal their drivers, logic, and assumptions — no more black boxes.

Integrated Real-Time Planning: Planning shifts from periodic cycles to a continuous, live ecosystem linking finance, operations, and external data.

Autonomous FP&A: A self-updating system powered by AI that continually updates forecasts, detects shifts, and recommends actions in real-time.

Michael outlined a five-phase maturity model, beginning with foundational data and AI fluency, advancing through experimentation and integration, and culminating in true event-driven autonomous planning. His message was clear: transformation is no longer optional, it’s inevitable.

Poll Insight: How is AI Currently being Used within Your Finance/FP&A Function?

A majority of participants (58%) reported not using AI at all. This indicates a cautious stance towards AI across the profession, likely due to concerns about data governance, integration challenges, and trust in AI-generated insights. Meanwhile, 23% have begun using Generative AI, while 10% use Machine Learning, and another 10% use both. The relatively higher results for GenAI compared to ML suggest that accessibility and ease of experimentation lead to easier adoption.

From Early AI Wins to Future Momentum

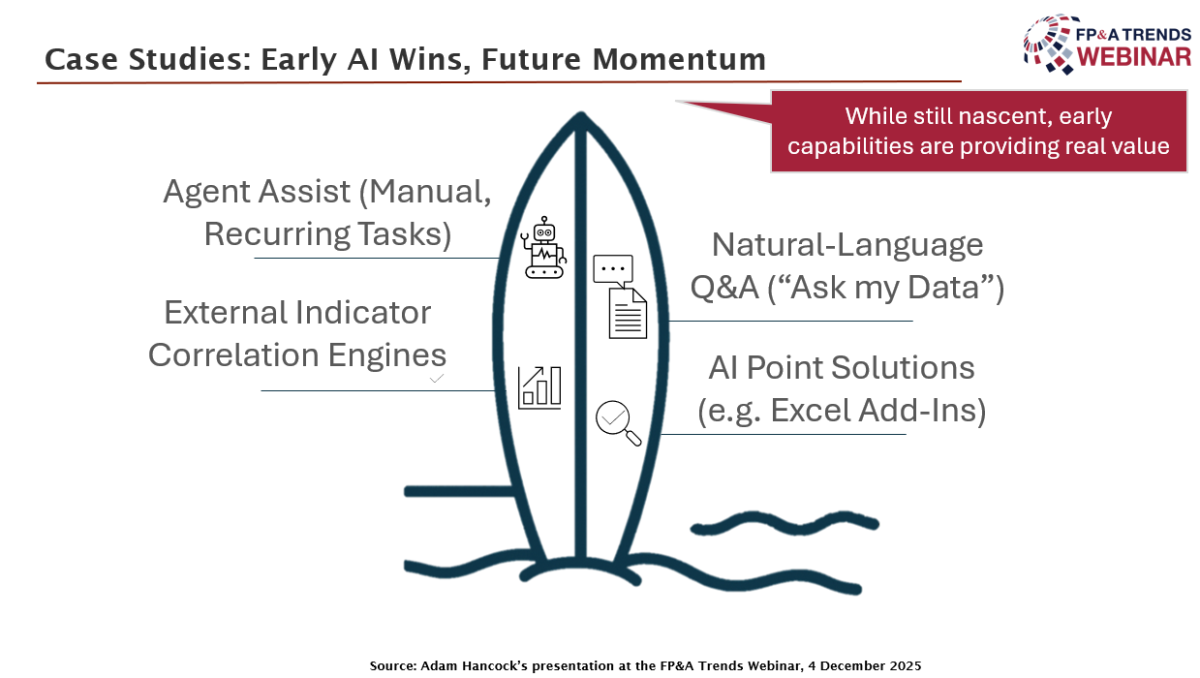

Adam Hancock, Vice President, FP&A, EBSCO Industries, Inc., brought theory into practice, sharing how EBSCO’s corporate FP&A team is harnessing AI to increase productivity and get new insights.

He described real-world applications, including:

Agent Assist (Manual, Recurring Tasks): for example, automating the transformation of long-form commentary into board-ready summaries using Generative AI. This has cut hours of manual effort into a few clicks.

Natural-Language Q&A (“Ask my Data”): Using secure GenAI environments to query financial and operational data, making insights accessible through conversational prompts.

External Indicator Correlation Engines: By scanning large external datasets, the AI identifies variables with the highest statistical relevance to internal metrics, automatically surfacing meaningful drivers.

AI Point Solutions (e.g. Excel Add-Ins): use of a web-based, Excel-native interface enhanced with AI-driven modelling capabilities. You still work in a familiar Excel environment, but this tool allows users to build fully integrated financial models simply by entering text prompts.

Figure 2

Adam compared the AI journey to riding a wave. As in AI adoption, we need to harness momentum. His team’s approach is pragmatic: they experiment in secure environments, start with clear use cases, and scale only when the results are trusted.

Poll Insight: Do You Trust AI-Generated Insights?

The second poll explored participants’ trust in AI-generated insights. While 70% said they trust AI only for low-risk tasks and 23% felt comfortable using it for most analytics, just 3% expressed near-complete trust. At the same time, 4% reported no trust at all. With over two-thirds of respondents being sceptical, the results highlight the importance of explainable insights, strong governance, and human oversight in building confidence in AI.

FP&A AI Agents and Embedding External Drivers into FP&A Forecasts

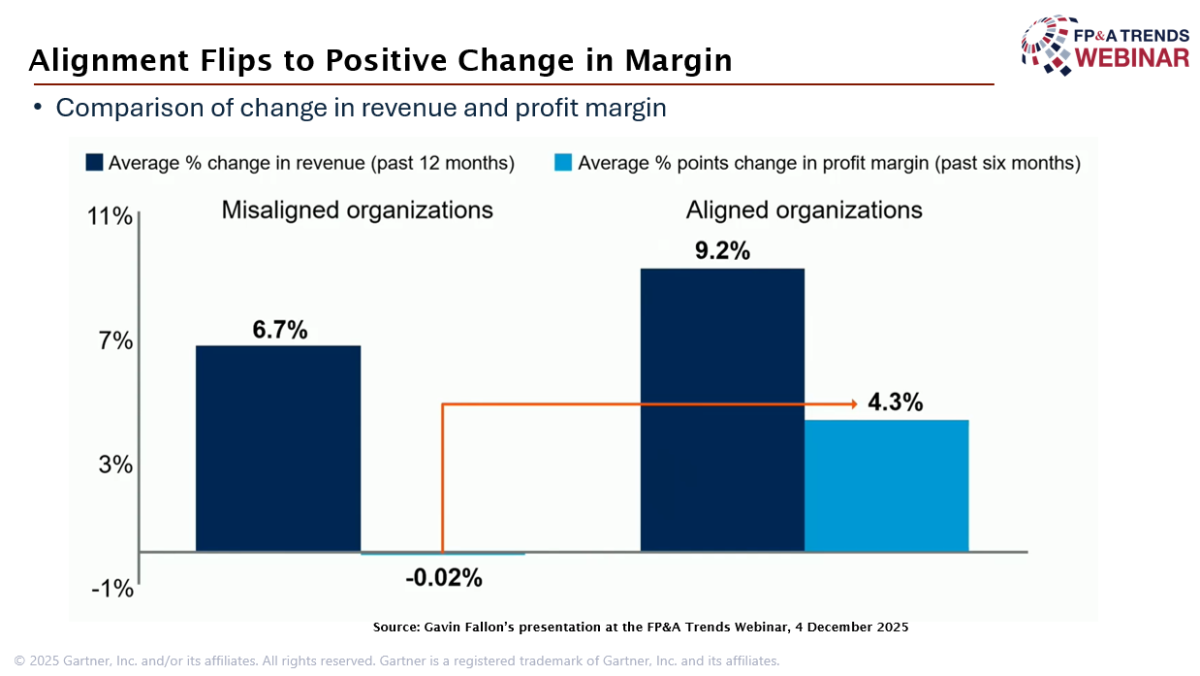

Gavin Fallon, SVP, Solutions, Board International, focused on one of the key trends of the future of FP&A: integrated real-time planning and the growing importance of external indicators. As he explained, this trend involves unifying planning across functions as well as enabling a distributed decision-making process where many actors rely on a single set of data.

Gavin noted that truly integrated planning is already showing measurable increases in both revenue and margins for aligned organisations, based on a Gartner report.

Figure 3

He demonstrated how important AI is for forecasting capabilities, especially through agent-driven approaches that embed predictive modelling.

Importantly, Gavin highlighted how organisations are beginning to build early warning systems, using real-time external data, such as market signals and macroeconomic indicators, to anticipate headwinds or tailwinds and inform decisions on inventory, market entry, or workforce planning.

This shift, he argued, is enabling finance teams to move beyond traditional forecasting and towards a continuous, data-enriched planning cycle. The integration of AI-powered discovery engines, correlation analysis, and hypothesis testing is giving rise to what Gavin described as The Architecture of Predictive, Market-Aware Planning, one that helps FP&A teams make faster, more informed strategic decisions.

Conclusion

The webinar confirmed that 2026 will be a pivotal year for AI-powered FP&A, driven by several converging factors:

AI Agents will automate routine processes and even complex analytical workflows.

Real-time data will replace batch updates, enabling continuous forecasting.

Planning platforms will evolve into intelligent ecosystems that blend internal and external signals.

FP&A roles will shift from data wrangling to orchestration, storytelling, and strategic influence.

The emphasis across all speakers was not just on tools, but on the transformation of how FP&A works, collaborates, and creates value.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.