Discover how FP&A professionals can lead digital transformation by integrating AI, Power BI, automation and continuous...

What happens when Finance stops polishing reports and starts helping decisions happen faster?

We earn trust when we help decisions happen faster. That’s been our focus: cut delays, simplify how we work, and keep attention on what really matters. Did we need more reports? No. We needed fewer loops.

Most FP&A teams sit on more data than they can absorb. The challenge isn’t access; it’s action. According to the 2025 FP&A Trends Survey, 46% of FP&A time is still spent on data collection and validation rather than analysis and insight. We’ve been there too, and we are fixing it.

Not long ago, our reports were built through manual exports, consolidations, and then emails with lengthy commentary. Now we are testing a few changes that make daily work easier. A reporting commentary automator is being developed, receivables appear earlier, and reports are shorter, so we can spend more time discussing what comes next instead of re-reading the past.

What Actually Changed

We stopped polishing reports and slides and started cutting the waiting time.

Commentary in real time.

We are testing an assistant that spots material variances and drafts text with clear routing and ownership. We kept it small on purpose. Extra features slowed us down. No shortcuts either; someone signs every draft. We lost a week once feeding it more data and learned the hard way that speed beats complexity.

Cash signals earlier.

One page. One set of definitions. Same conversation, just sooner. Once we agreed on the parameters, the focus shifted to reducing overdue amounts.

Narratives that explain, not repeat.

They are not perfect, but fast enough to start the right conversation. The machine drafts, people decide. That order needs to stay.

I still remember the first review when the assistant generated a summary of the month's volume results. It wasn’t perfect, but it was close enough to prove the point. The tone shifted from doubt to curiosity, and that’s when progress started to feel real.

We test for a fixed amount of time, keep what proves helpful, and shelve what doesn’t. Less commentary, more choices.

How We Run It

- Start small. Learn fast. Scale what helps.

- Use one glossary and end the “what do we mean by” debates.

- Track progress simply so we can see what’s moving.

- Be clear on ownership: who edits, who approves, who closes the loop.

- No frameworks. Just rhythm and discipline.

People and Capability

Every variance has a name next to it. If no one owns it, it doesn’t ship. Approvals need to be visible.

We are building a Digital Finance Community where people show quick demos, share prompts, and admit what went wrong. That’s where the learning sticks.

Technology only matters when people take responsibility for it. The future of Finance isn’t automatic; it’s human in the loop. What I learned at IESE and in practice is simple: good judgment still beats any model. Curiosity, context, and the courage to ask “why” keep us grounded. Tech makes it quick. People keep it right.

What We Are Seeing

More decisions are made in the room. Fewer follow-up emails. Receivables risks surface earlier, with less month-end noise.

Data issues keep showing up, and we deal with them one by one. Did everything so far work? No. Was it worth it? Absolutely. Simple tools, clear ownership, and constant fixes move faster than grand plans.

What’s Next

We are wrapping up the commentary pilot, tightening definitions, and tracking adoption. Each cycle concludes with a brief discussion on what remains, what has changed, and what still needs attention.

We’ve named owners for each initiative; there are no committees. We count minutes saved. Progress is shared and celebrated.

Why This Matters

Faster cycles give us time back: time to run scenarios, manage cash, and stop rewriting the same story. They also make Finance more useful in the room. When we bring clear signals and timely advice, people pay attention.

If I had to sum up what we have learned, it’s this:

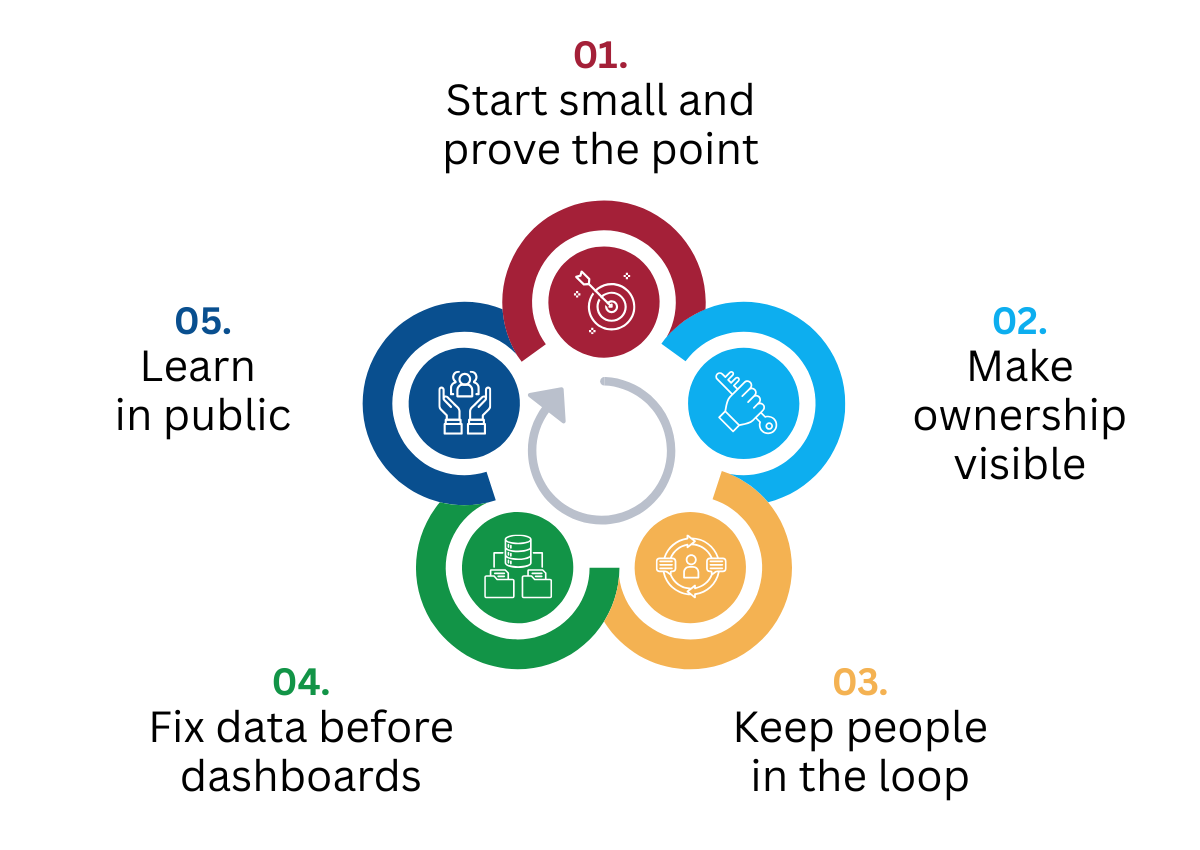

- Start small and prove the point.

- Make ownership visible.

- Keep people in the loop.

- Fix data before dashboards.

- Learn in public; it builds trust faster than presentations ever will.

Figure 1. The FP&A Decision Principles

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.