In this blog series, the author provides a comprehensive approach to the design, construction, roll-out and...

Driver-based planning and forecasting is generally considered a more modern approach to forecasting, where key drivers and correlation linkages are created and used to forecast performance. For FP&A teams, it enables a more analytical conversation about why results moved, not just what happened. The benefit of this approach is that it helps focus performance management/variance analysis on the drivers that were missed, why they were missed, and how they can be corrected. It also enables scenario planning, allowing users to run scenarios quickly and efficiently, as well as a rolling forecast.

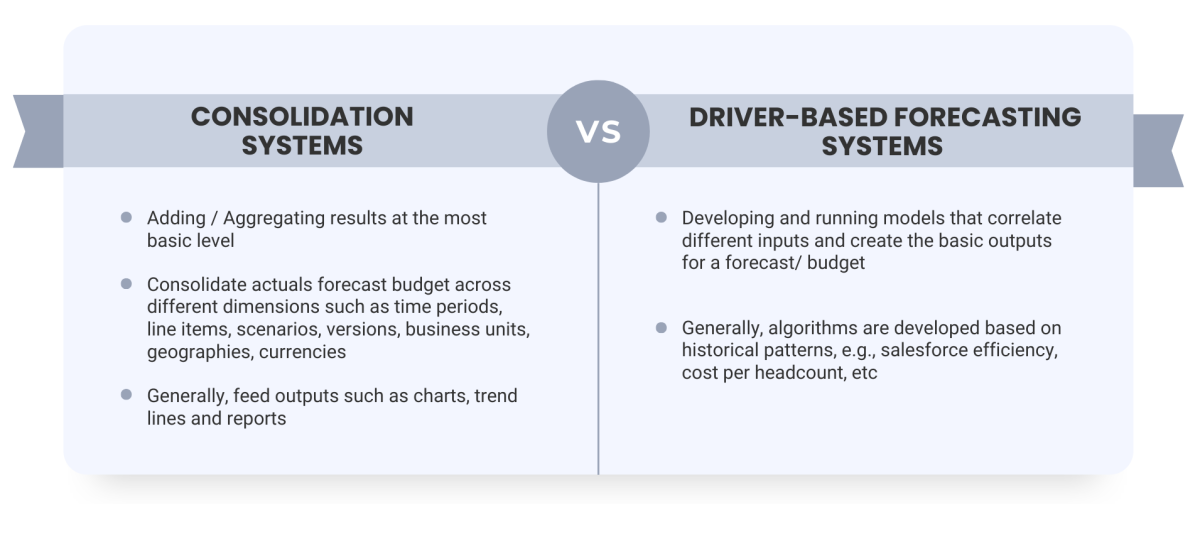

Consolidation Systems vs Driver-Based Forecasting

In general, an organisation should consider planning and forecasting as having two basic areas – Consolidation and Modelling.

Most reasonably sized companies have Consolidation systems to consolidate or add up Actuals, Plans and Forecasts. This is done in several different views – for example, by division, country, currency, P&L, balance sheet, and cash flow line items, as well as years, months, and versions. These can be considered dimensions of the planning platform and are very useful for analysing trends and obtaining multiple views of the information. Quite a few organisations assume that because they have a consolidation system, they can run different scenarios within it. However, collecting a scenario is different from creating and modelling one.

Modelling, or what we think of as driver-based forecasting, is typically done in Excel or in a planning system. When done in Excel, the challenge is that the model and its underlying assumptions are not transparent to stakeholders and are dependent on the person running the model. Modelling done in a planning system makes it easily accessible and transparent. However, even using a system for modelling can lead to multiple issues, such as excessive standardisation and manual work required to pull the data into a system.

In Figure 1, this comparison helps illustrate why many FP&A teams incorrectly assume consolidation platforms can “run” scenarios, when in reality consolidation only aggregates outputs — it does not generate them.

Figure 1. Consolidation vs Driver-Based Forecasting

Basic Principles of Driver-Based Forecasting

At its simplest, driver-based forecasting involves

identifying a few key independent variables (drivers). E.g., new client acquisition, no of salespeople, marketing spend, inflation, GDP growth

building a model that links these variables to key outcomes such as sales, balances, revenue components, costs

consolidating these outputs to create a comprehensive budget/ forecast

quickly repeatable – e.g., a monthly/ quarterly rolling forecast

For FP&A, the art lies in choosing a few but material drivers that leadership can understand, challenge, and influence.

Complexity of Large Organisations and Multiplicity of Models

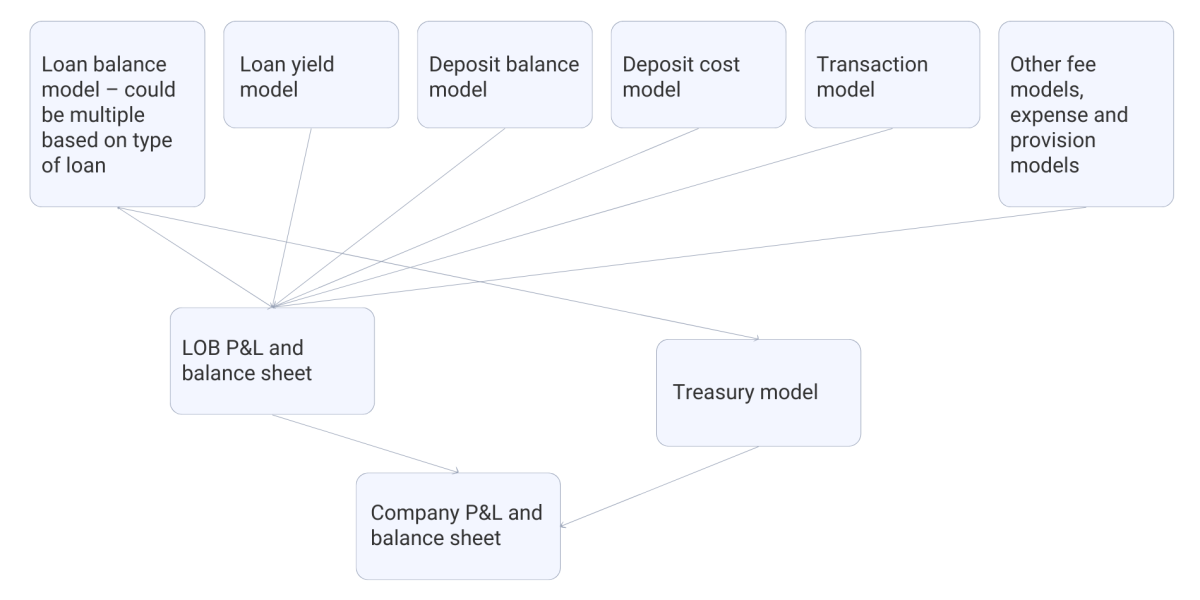

The larger the organisation and the more diverse its product set, the more complex its planning models become. Taking the previous example, the output of one model serves as the input to another model, which is used to generate additional outputs.

For example, in the case of banking, you could have a model to forecast loan balances. Larger organisations would have different types of loans, which could have different models or algorithms. For example, a standard C&I loan is modelled differently from a Commercial real estate loan, and even more differently than consumer loans, such as mortgages, credit cards, and student loans. In the next model, the output of the loan balance model is used in conjunction with the loan yield model to forecast interest income. The Treasury also uses the loan balance to develop Asset-Liability forecasts.

Figure 2 illustrates how driver-based forecasting in large organisations operates as a chain of linked models, where one output becomes the next model’s input.

Figure 2. Example of the Interconnected Model Ecosystem in Driver-Based Forecasting

To add another level of complexity, a forecast model may sometimes differ from a Budget model. During a forecast, the pipeline is known with better certainty, whereas in a budget or longer-term forecasting horizon, the drivers could be more high-level. For example, in a Forecast, the new client generation can be estimated using pipeline reports, whereas in a budget or long-term plan, you might have to forecast new client generation differently.

For FP&A leaders, this means that driver-based forecasting is rarely “one model.” It is a connected ecosystem of models that must remain understandable and governable.

Common Pitfalls in Driver-Based Forecasting

Too Much Complexity in Trying to Please Everyone

When building a driver-based system, one of the primary challenges is balancing the needs of all stakeholders and model creators. As this happens, too many variables and too much customisation are built, which makes the models difficult to maintain.Additionally, the tendency is to build incredibly detailed models and attempt to link too many systems. When this happens, the chance of failure increases exponentially. Different stakeholders have different needs for data – e.g., a business unit manager would like to have transparency into their forecast P&L. What needs to be assessed is how material that is and what decisions it drives.

Another example of this is when a forecast is missed; the question from leadership can be, 'Why did we not consider a certain factor?' The downstream effect of this is that more detailed models are built with increasing complexity and sometimes unnecessary details.

Offline Reliance on Excel

When the people who have to use the model in the system don’t fully understand the model because they didn’t create it or don’t like its workings they will look to do the work offline in Excel and then retrofit it to the model. Sometimes the model is too high-level, and the person doing the modelling believes more detail is needed. In such cases, they will model offline in Excel and then input the results into the model.A classic example of this is expense forecasting, where you might have a high-level mode and the person inputting believes in forecasting at a person-level.

Challenges with Running Scenarios Quickly

Once all the models are created, there is sometimes no clear link between the driver that’s changing and the driver in the model. For example, you might be asked to run a scenario for lower GDP growth. However, not all the models are likely linked to GDP growth.The second example is that the scenario is quite complex and cannot be run as easily as by changing one input. For example, if the assumption is to incorporate a Fed rate change, some part of that change could be done formulaically. However, what the model might not be able to do is measure other correlated areas, such as expense constraints and higher provision costs.

Evolving Business and Models

Business models continue to evolve over time, leading to the need for model changes. Businesses expand or commit to M&A, which can necessitate changes and updates to their models. Additionally, some of the underlying/connected systems may change, which means the driver-based models need to adapt as well. A fair amount of the planning systems need a fair amount of technical expertise to change the model.

Practical Suggestions to Improve Driver-Based Forecasting

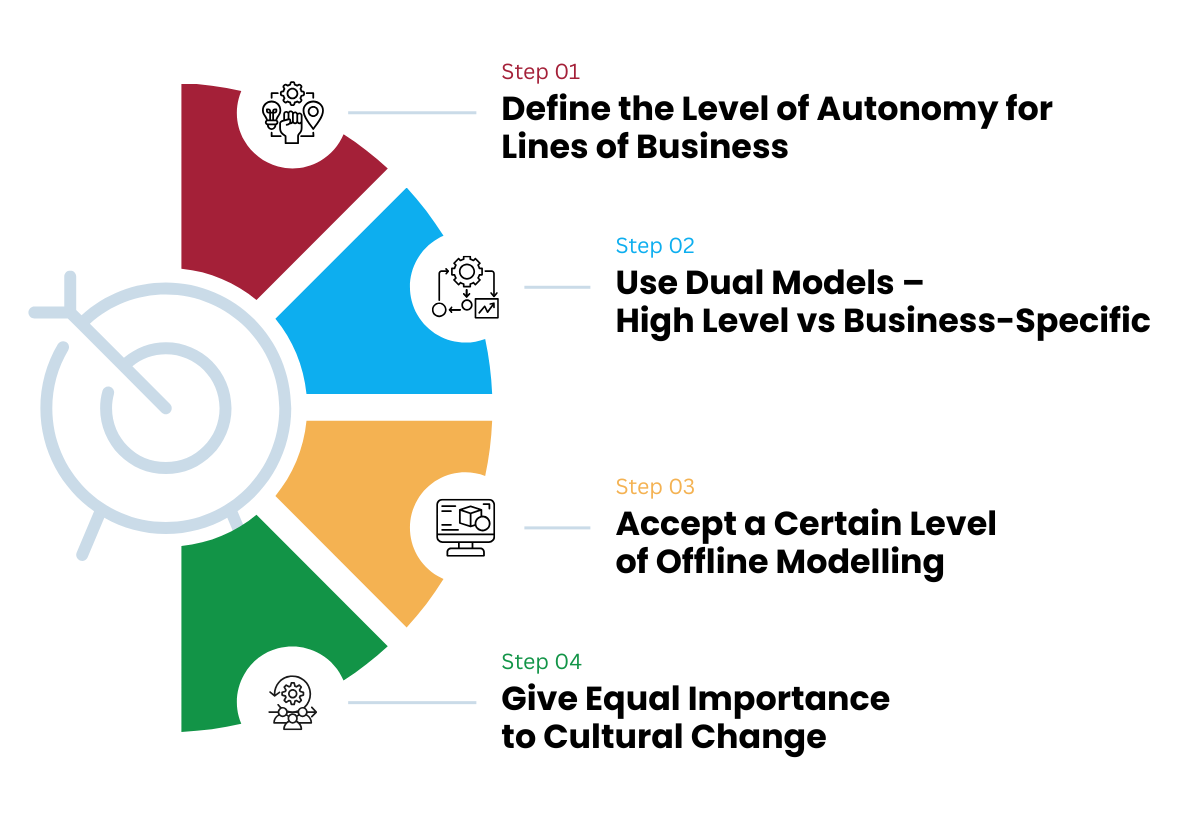

Define the Level of Autonomy for Lines of Business

The first decision to be made should be what level of autonomy should be given to the Lines of Business. It should mirror what happens in the business. This dictates what the role of the centre is – is the centre more of a consolidator and reader of trends, or is it closer to the first line of defence? Obviously, the bigger the company, the farther the centre tends to be to facilitate quick decision-making. If there is more autonomy in the LOB models built, they should be more detailed. On the other hand, if they are more tailored to the centre, they can be more high-level.Throughout my career, my preference has been to have more independence and autonomy at lower levels. Revenues and business lines are managed at the unit level and require a high degree of support to meet the organisation's objectives.

Use Dual Models – High Level vs Business-Specific

My preference is to build dual models. One set is high-level and works for the centre, and another set is detailed and works for the LOBs. This helps meet two different priorities. However, this approach does need the detailed lower-level models to be linked as much as possible to the high-level model and populated regularly. Any differences can be kept in a separate line. This approach also enables FP&A to balance multiple priorities.Accept a Certain Level of Offline Modelling

Another approach would be to keep the bare minimum in higher-level models/ consolidation systems, allowing LOBs to create and maintain their own models. LOBs can do this in two separate ways. They can either maintain separate offline Excel models.Alternatively, they can use a part of a standard platform to create their own model linked to different data sources of their own choosing. While using this approach, it is critical that the planning tool used is highly customisable and easy to use, so that any modeller can use and program it easily. This was the approach at one of my earliest companies, where we were allowed to use a standard planning tool to create our own model, with minimal submission requirements for certain lines and dimensions, to the corporate headquarters. This gives a fair amount of autonomy to the LOBs.

Give Equal Importance to Cultural Change

It's crucial for Corporate FP&A and the CFO not to underestimate the cultural change that implementing a transparent, driver-based forecasting system entails. It allows transparency and enables insights and data at multiple levels of the organisation.

In the initial phases of implementation, it's essential to drive the cultural aspect through regular communication. Managers need to understand that driver-based forecasting is not just a new tool but a new way of discussing performance, accountability, and trade-offs.

In conclusion, while implementing a driver-based forecasting system is not an easy task, the benefits far outweigh the challenges. It's essential not to change course in the middle, as that creates even more challenges. A practical approach, such as having two sets of models or giving more independence to the LOBs, can help alleviate some of the challenges.

For FP&A leaders, the real success factor is not the model itself but how effectively the organisation adopts and uses it.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.