In this article, the author explains how integrated modelling enables FP&A leaders to balance speed and...

Note: This article reflects conditions as of early September 2025. Given the pace of global developments, circumstances may have shifted significantly by the time you read this.

One of our clients looks after financial planning and accounting at a university. During a budgeting session with an academic department’s leadership, they struggled to explain why there weren’t enough funds available for additional overseas travel that year. For our client, the numbers on the spreadsheet were as clear as daylight. But for non-financial leaders, the message just didn’t land.

Today, this level of disconnect can be fatal to the financial agility organisations need to navigate today’s change and chaos. To resolve this, our client had to start thinking like someone who isn’t an accountant. Instead of using pounds and pennies to make the point, they used visuals to show how each student’s fee was allocated. By using a familiar frame of reference, our client made the budget situation clear for the team.

This shift didn’t only need better technology or more sophisticated modelling. It needed the accountant to speak human. It needed a people-centred solution to succeed.

Technology + Process + People

So although as I said in my previous article in this series, updated tools and processes are vital to enabling faster forecasting and budgeting to meet the speed of business today. If you don’t take your people along with you, even the most sophisticated integrated modelling systems are likely to fail. I’ve seen it happen.

There are several reasons for this. Let’s start with the example above: traditionally, we have built systems that make perfect sense within finance departments, but can be inaccessible to everyone else. But there are other factors at play, too.

People resist change because the way things have always been done feels safe. In context, your accounting team might feel threatened by including their non-financial colleagues in their domain. Or your operational managers might resent the perception that they need to do more work now, in an area they don’t particularly enjoy. And an already twitchy leadership, under pressure to meet targets, might prefer to retreat to increased control and more unilateral decision-making in challenging times. So, yes, there are a few balls to juggle or landmines to circumvent!

You need to support your new tools and processes with a change in how you work to optimise how information flows and stop making financial information unintelligible to ordinary people!

Free Your Financial Information

Traditional budgeting needs the world to change slowly enough for formal approval processes to keep pace, but today's reality demands that updates from the coalface reflect in the numbers as quickly as possible.

Agile organisations cultivate what I think of as financial intelligence networks. In these companies, information doesn’t only flow down through traditional hierarchies. Instead, the flow is two-way, with insights moving quickly and easily between the people who spot changes first, the systems that can respond to them quickly, and the people who need to take action.

If currency markets move overnight, your treasury team needs the freedom to adjust assumptions immediately, without being held up by multiple approvals. When operations spot a supply chain disruption, they should be able to act fast. Waiting for a monthly review kills the momentum and delays the remedy. And there is no point in marketing tracking the rapid change of customer demand, unless they can do something with that information at the same amount of speed.

I’m not suggesting you should abandon financial controls. Move them to the assumption level rather than managing every line item individually. Define the boundaries and parameters, then enable your people to work effectively within them.

Start Speaking Human

Please don’t try to train your non-financial managers to think like accountants to make financial information more accessible. The growing demand for "Finance for Non-Financial Managers" training makes me worried that this is the approach too many companies take. Better yet, spend your time and attention on making financial insights immediately useful to non-financial folk by transforming your finance teams from information gatekeepers into translators and facilitators.

My university travel budget example illustrates this perfectly. The financial data was absolutely accurate in the spreadsheet. But the understanding came from presenting the information in a way that reflected how the non-financial leadership team viewed their organisation.

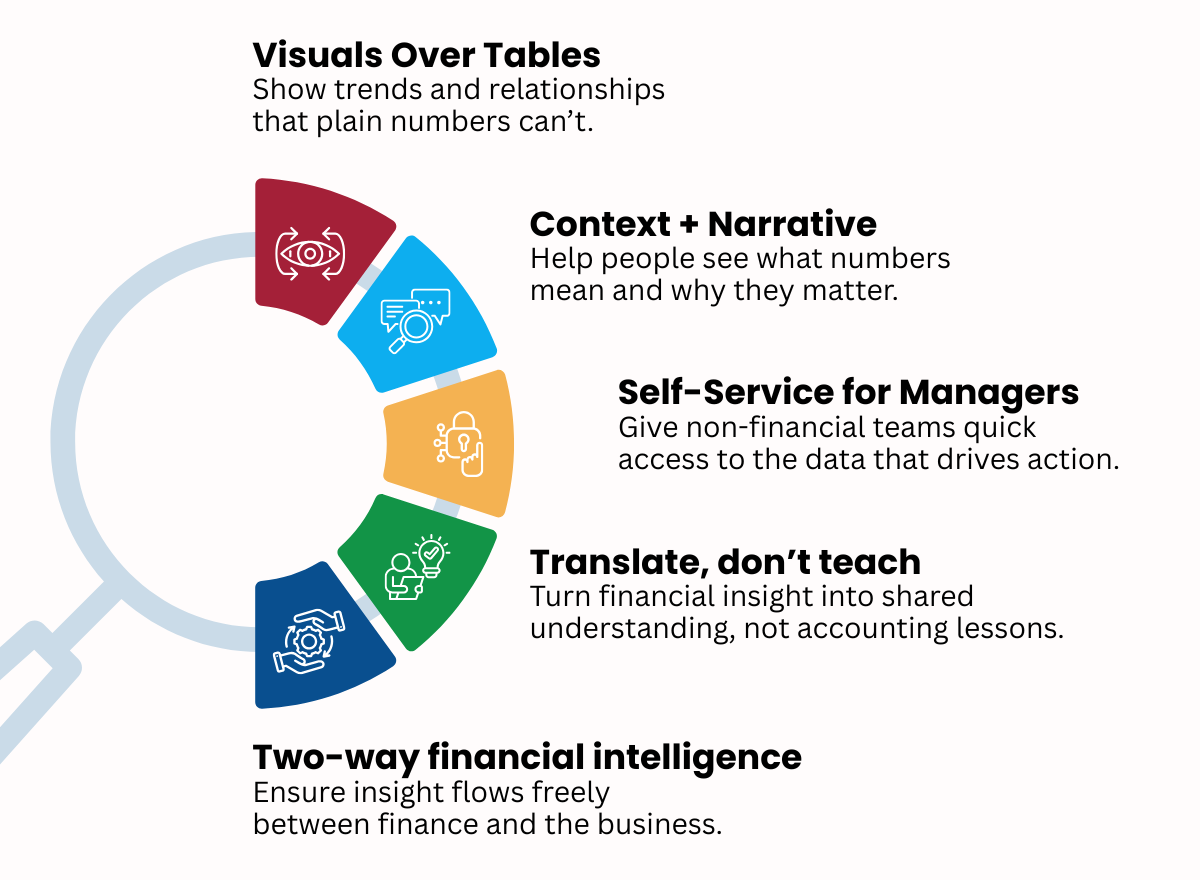

There are various ways you can make finance sound human. For instance, visual representations help people grasp trends and relationships that aren't obvious in numerical tables. Self-service tools allow managers to explore data relevant to their roles without needing finance support for every query. Most importantly, context and narrative help people understand what the numbers indicate, and also why those insights matter and what actions they suggest.

This is critical when you need departments to understand and respond to changing assumptions quickly, whether that's currency volatility, tariff impacts, or demand shifts. Furthermore, translating finance is vital when working with the scenario-based modelling I discussed in my previous article. Non-financial managers need to understand not just “what's the budget” but “here are three possible outcomes depending on how currency markets move” and what actions make sense under each scenario.

Important insight: If you, or any of your team, are concerned that this new way of working is going to threaten your jobs, this is one of the reasons it won’t. Accountants can continue to prove their strategic value to the business by effectively translating finance into human.

When the Agility Penny Drops

In my experience, a transformation like this doesn’t happen overnight. But after steady effort, there's often a tipping point when teams suddenly understand how their day-to-day decisions connect to financial outcomes, and start collaborating with finance. (Instead of thinking up ever more creative excuses for not completing their budgets.) This is a lot easier if finance are positioning themselves as translators and facilitators…

When departments understand their budgets and their assumptions, they can respond effectively and immediately. A classic example is the difference between the finance department unilaterally implementing a cut on a specific account, for instance, travel, and asking managers to reduce their budget where they can. In the first case, the forced cut is likely to be ignored or result in unintended consequences. But by putting the operational manager in the driver’s seat, they are empowered to trim the fat where they can. This means the cut is likely to actually happen, won’t have negative knock-on effects down the line, and your managers will be happy (or at least, less grumpy).

Even better, you will empower your people to identify discretionary spending that can be reduced, reallocate resources between priorities, and spot savings opportunities without waiting for top-down direction.

And they will be able to do it fast. Traditional approaches might require weeks to implement changes, but engaged organisations can respond within days.

Speed Wins

When last have you seen a company thrive by being slow?

Companies that can identify challenges and opportunities quickly and respond to them effectively consistently outperform those that can't. But this depends on having an engaged organisation that understands the financial implications of what they experience in their daily work.

Because when a crisis hits or an opportunity arises, successful pivots happen in organisations where a culture of agility already exists. Your planning process and culture either includes the people who identify changes first, or it doesn't. In an environment where response speed increasingly determines competitive outcomes, that choice shapes your organisation's strategic potential.

In this article series we've explored why traditional planning fails, how integrated modelling provides the technical solution, and here how cultural change enables it to work. But how do you know if it's actually driving the results you need? Just as you need new technical systems and working cultures for agile finance, you need to think in a new way about measuring your success. In our final article, we'll explore the frameworks that demonstrate whether your transformation is delivering real competitive advantage.

Key Takeaways for FP&A Leaders

1. Your best modelling system fails without buy-in. Address resistance to change and fear of losing control head-on rather than hoping these responses will just fade away.

2. Build two-way financial intelligence networks. Information needs to flow from the coalface to the numbers and back again, fast enough to actually matter.

3. Stop training non-financial managers to think like accountants. Instead, make finance speak human through visuals, context, and self-service tools they can actually use.

4. Speed wins when chaos hits. Engaged, already agile organisations that understand financial implications can pivot in days while competitors spend weeks updating traditional budgets.

5. Move controls to the assumption level, not line items. Define the boundaries clearly, then trust your people to work effectively within them.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.