In this article, discover how FP&A strategic business partnering helps finance professionals challenge assumptions, expand decision...

Margin expansion might look like a single line on the Profit and Loss (P&L), but anyone who has ever owned it knows it is never just a finance target. I have attended numerous forecast reviews over the years, and they all start to feel the same. Numbers go up on the screen. Leaders ask a few questions. We re-forecast. And before long, we are right back where we started.

That is when I realised the real problem is not the rhythm of the process. It is that so many people across the business do not see how their everyday decisions impact the P&L.

When It Stopped Being Just a Number

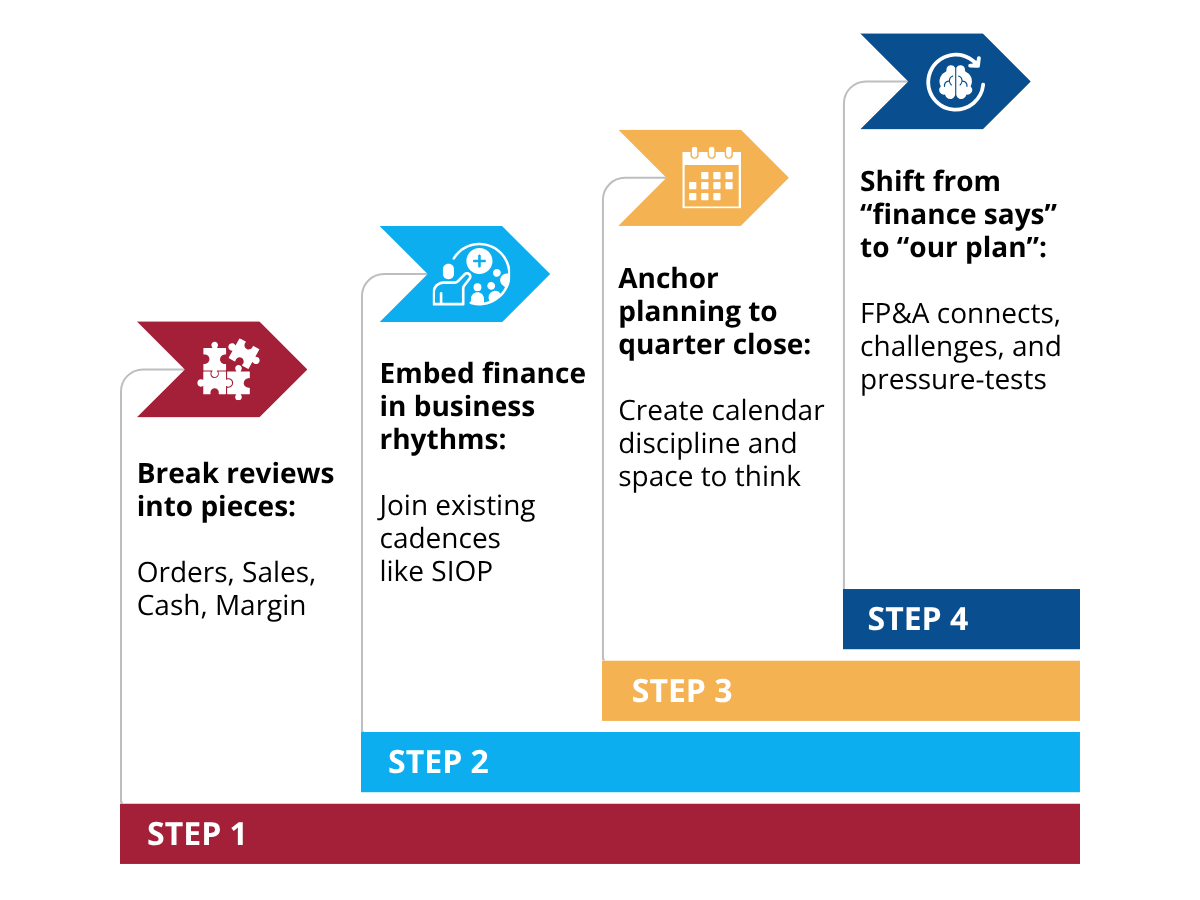

One budget season really brought this home for me. Everything felt disjointed. The reviews were lengthy, conversations kept jumping from one topic to another, and we never seemed to get to a clear picture. I finally decided to slow everything down. Instead of running through the budget in one big session, I broke it into four smaller ones: orders, sales, cash, and margin.

The margin session was particularly insightful.

We took it piece by piece. Price first, with a commercial walking through their assumptions. Then, sourcing brought their deflationary outlook. Product management explained the mix changes they were planning. Ops laid out their productivity ideas.

For the first time, everyone could see how those pieces fit together or clashed. You could literally feel the room shift. People leaned in. Heads started nodding. Even the Supply Chain leader quietly admitted,

“Oh, so that’s why my productivity target feels impossible.”

It changed the tone of the entire session. People who had never considered themselves “finance people” suddenly realised how their decisions affected the whole picture.

From that moment, forecasting stopped feeling like a finance chore. It became a way to teach and to show the team the story behind the numbers.

Turning Chaos into Rhythm

Once people understood their impact, everything changed. Forecasting stopped being about chasing variances and started being about making choices that actually stick. One of the most powerful shifts was aligning FP&A with the rhythms the business already lived by. Operations had a rolling SIOP cadence, so finance joined those sessions. That meant the long-range plan flowed naturally into the budget, and the budget flowed into the forecast. No one was starting from scratch.

I also became obsessed with calendar discipline. During one cycle, I mapped every single planning step against quarter close. That created breathing room we never had before. Reviews became sharper. Leaders came prepared. And for once, we had time to think instead of firefighting.

But the biggest shift was ownership. Planning cannot sit in finance alone. Sales owns bookings. Ops owns throughput. Sourcing owns costs. FP&A connects the dots and calls out when the story does not add up. When people feel true ownership, the conversation shifts from “finance says” to “this is our plan, and finance helped us pressure-test it.”

Margin expansion is not a number finance delivers. It is a mirror we hold up so everyone can see how their choices stack up. That is when finance stops being the scorekeeper and starts being the coach.

When It Finally Comes Together

What I loved most about that margin session was not the mechanics; it was what happened in the room. You could see lightbulbs going off. The commercial started asking how discounts would affect sourcing’s savings targets. Ops wanted to know how their throughput goals were tied to the mix assumptions. Leaders began to connect their wins with each other’s challenges. Suddenly, forecasting was no longer about justifying numbers. It became about making better decisions together.

I have seen this same moment in other industries as well. In manufacturing, missing a throughput target by even one per cent can wipe out millions of dollars in expected margin. In healthcare, reimbursement lags make even clean forecasts look messy. In retail, one discount campaign can undo weeks of pricing work.

Context is everything. And FP&A is the team that sees across all of it.

Looking Ahead

The future of FP&A is not about producing more versions or prettier dashboards. It is about helping the business see itself clearly and act faster. The FP&A leader of the future will not be measured by how many forecasts they deliver. They will be measured by how well they turn numbers into insight and insight into action.

They will have to be part teacher, part challenger, part storyteller. They will need courage to say no when another re-forecast will not change the decision, and the judgment to slow things down when everyone else is rushing ahead. Forecasting should be a compass that points the business in the right direction, not a treadmill that keeps everyone running in circles.

So the next time someone asks for another version, the most powerful response might not be to send them new numbers. It might be to ask them a simple question:

“Do you see how your decision shows up in the P&L?”

When the business can answer that question without finance in the room, that is when you know you have done your job. That is when FP&A stops reporting the story and starts shaping it.

What FP&A Leaders Can Do

- We need to help teams understand how their choices impact the P&L statement. Once they grasp this, they start to take ownership, leading to margin expansion.

- Reviews should feel like conversations, not audits. The goal is to show the impact of decisions, not catch mistakes.

- Stick to a rhythm. A clear calendar stops the firefighting and gives space to actually think.

- Plan side by side with operations. Forecasts land better when they follow the beat of the business.

- A forecast only matters if it leads to a better decision for the business owners. Otherwise, it’s just math.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.