The first FP&A Board meeting in Brisbane was held this week and more than 25 FP&A professionals attended and discussed the latest trends and common challenges in Financial Planning and Analytics.

The first FP&A Board meeting in Brisbane was held this week and more than 25 FP&A professionals attended and discussed the latest trends and common challenges in Financial Planning and Analytics.

Apliqo – a Cubewise Company – is proud to be sponsoring such a high-quality forum where the most important challenges of FP&A related to people, process, technology, analytics and business partnering are debated.

A big thanks goes to Larysa Melnychuk, at FP&A Trends Group for creating such a unique community focused on FP&A and the opportunity for Apliqo to be associated with it.

We would like to share some of the insights from the event in a short summarized form. The topic of this board was “Modern Financial Planning and Analysis: Latest Trends”.

At the beginning all participant introduced themselves and explained their view about Latest Trends / Challenges. Below points provide a list of topics that were presented by the attendees (unweighted):

- Automation and Machine Learning

- Frequency

- Integration

- Transformation

- Forward Looking

- Agility

- Insights

- Partnership

- Ownership

- Churn and finding the right capabilities

- Humanity

- Innovation

- Empathy

- Emotional Intelligence

During the discussions it became clear that many organisations face challenges on the technical side to integrate successful FP&A processes with the required data and information. On the other hand, there are challenges in the organisation to move the organisation forward from the current status quo and establish better ways of partnering with and enabling the business stakeholders.

Figure 1: The Brisbane FP&A Board Participants

Maturity in FP&A in Brisbane

A short survey was done to understand the maturity in FP&A in Brisbane – here are the results:

How long is the average duration of your budgeting and planning process in months?

| 1 – 3 months | 4 – 6 months | More than 6 months |

| 13 | 10 | 2 |

| 52.0% | 40.0% | 8.0% |

How long is the average duration of your forecasting process?

| Less than 3 days | 3 – 7 days | More than 7 days |

| 5 | 10 | 10 |

| 20.0% | 40.0% | 40.0% |

Furthermore, the participants reported that 11 have a dedicated planning system, but only 3 attendees see that system as being flexible enough to cater for quick changes during the planning processes.

During the Board Meeting Kush de Alwis, CFO at City Beach Australia, shared his transformation experience to embed new finance processes in his organisation. Data integration was a key challenge to improve the efficiency. Another challenge was the introduction of data driven decision making processes.

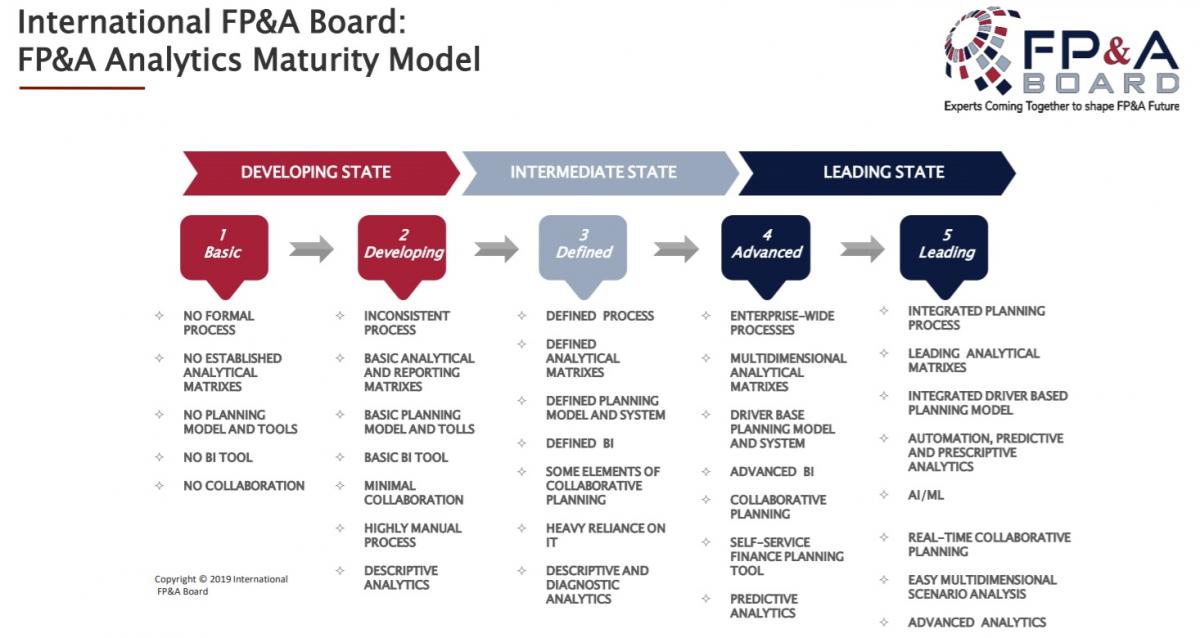

Analytics Maturity Model by FP&A Trends Group

Larysa shared with the Group the latest FP&A Analytics Maturity Model which was developed during the meetings around the globe.

Figure 2: The International FP&A Board Maturity Model

Afterwards during Group Workshops, the participants worked on following questions:

Where are your organizations placed on the FP&A Analytics Maturity Model?

Most of the organization rated themselves between Define and Advanced state. However, it became clear that organisations can be lagging in some areas but being in a higher state for most other topics.

What steps are needed to arrive to the Leading State?

Several milestones were presented by the groups. A common topic was the focus on steps with the highest impact for the organisation. Choosing, for example, the right level of data granularity is the foundation influencing any other development. With the transition to higher stages, it becomes also more important to develop the right skills in the teams.

Figure 3: Group Work During the Inaugural Brisbane FP&A Board

The event was hosted and sponsored by the global FP&A partners Apliqo and Michael Page.

You can also read more about the first Brisbane FP&A Board here.