While FP&A professionals work in a field of numbers, language is a critical component of our profession. Far too often there is loose use of terminology in corporate finance. “Cash flow” is not actually cash, NPV is not “net” of anything, etc. This is problematic if applied finance is to be taken as a serious professional discipline. It took decades for the theory to become accepted and adopted in worldly application. It would be a heavy blow to see a reverse in this 60-year trend due to poor developer and end user communication. So, while our space has numerous new vocabulary entrants, not all of these new buzz words belong.

Take the word “predictive” as an example. The word “predictive” is an old standby to statisticians, but not to financial planning and analysis experts. A prediction is a statement about what will happen or may occur in the future. An estimate is an approximate calculation or judgment of a value, number or quantity. Historically, “predictive” is a term more aligned to statistically driven models such as those employing stochastic calculations and/or utilizing “big data”, a methodology and population set most FP&A pros never come near. In contrast to such purer statistical approaches, virtually all FP&A professionals use some form of statement line item deterministic modeling to produce output. In a deterministic model, there is no accounting for deviation or random walk. Therefore, deterministic models operate in a postulated framework; we “know” our assumptions to be true. Yet integrity tells us our line item answers are only approximate. We acknowledge this through proper terminology, hence the word “estimate”. And since finance is concerned with maximizing shareholder value, value is our end game. FP&A is, therefore, ultimately a valuation role. Fundamental valuation shies away from claiming to make any predictions whatsoever. More suitably, valuators “estimate” and “opine”. If your model is not largely statistically driven with statistical output, simply don’t use the word “predictive”.

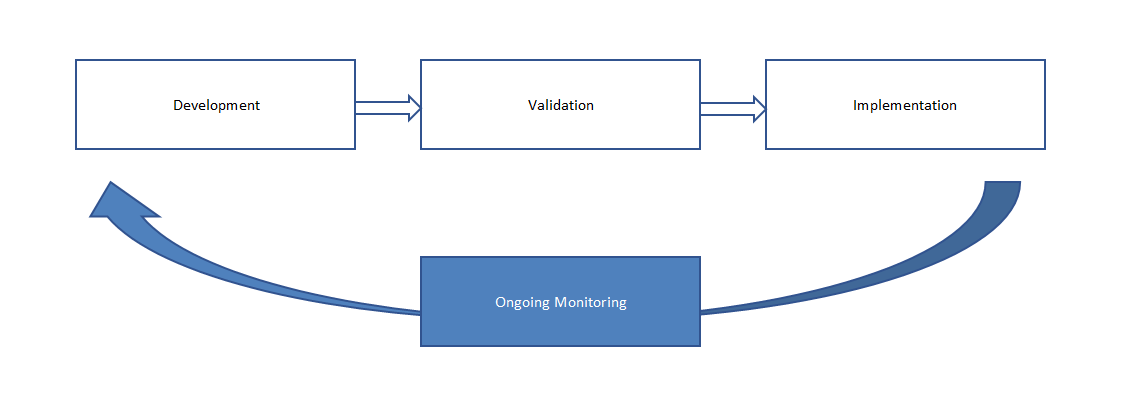

Companies forecast what is called a “current estimate”, not a “current prediction”. Current estimates are articulated to analysts, employees and shareholders. Predictions are not. Forecast models are intended to be populated, reviewed, adjusted as necessary and updated. Forecasts are an ongoing process, not a one-time guess. This is the very essence of modeling and an important distinction between what constitutes a model versus one-time analysis.

Good questions to ask yourself when updating your estimate are:

- Is my model back-tested periodically?

- What business conditions and/or data sources have changed?

- What external factors have changed affecting the model’s relevancy?

- Has the decision-making or regulatory environment adopted new rules and standards?

The FP&A field is dominated by finance and accounting professionals, not statisticians. Use the word “predictive” and you may ultimately lose your grip on your role and profession.

FP&A will become SP&A.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.